Earnings summaries and quarterly performance for PROSPERITY BANCSHARES.

Executive leadership at PROSPERITY BANCSHARES.

David Zalman

Senior Chairman and Chief Executive Officer

Asylbek Osmonov

Chief Financial Officer

Charlotte M. Rasche

Executive Vice President and General Counsel

Edward Z. Safady

Vice Chairman

H. E. Timanus, Jr.

Chairman of the Board

J. Mays Davenport

Executive Vice President and Director of Corporate Strategy

Kevin J. Hanigan

President and Chief Operating Officer

Randy Hester

Executive Vice President and Chief Lending Officer

Robert J. Dowdell

Executive Vice President

Board of directors at PROSPERITY BANCSHARES.

Harrison Stafford II

Director

Ileana Blanco

Director

Jack Lord

Director

James A. Bouligny

Presiding Director

Laura Murillo

Director

Leah Henderson

Director

Ned S. Holmes

Director

Perry Mueller, Jr.

Director

Robert Steelhammer

Director

W. R. Collier

Director

William T. Luedke IV

Director

Research analysts who have asked questions during PROSPERITY BANCSHARES earnings calls.

Catherine Mealor

Keefe, Bruyette & Woods

9 questions for PB

Manan Gosalia

Morgan Stanley

9 questions for PB

Peter Winter

D.A. Davidson

9 questions for PB

Jon Arfstrom

RBC Capital Markets

8 questions for PB

Michael Rose

Raymond James Financial, Inc.

7 questions for PB

Eric Dray

Bank of America

4 questions for PB

Stephen Scouten

Piper Sandler & Co.

4 questions for PB

David Chiaverini

Wedbush Securities Inc.

2 questions for PB

Ebrahim Poonawala

Bank of America Securities

2 questions for PB

Janet Lee

TD Cowen

2 questions for PB

Jared Shaw

Barclays

2 questions for PB

Matt Olney

Stephens Inc.

2 questions for PB

Bill Carcache

Wolfe Research, LLC

1 question for PB

Dave Rochester

Cantor Fitzgerald

1 question for PB

David Rochester

Compass Point

1 question for PB

Jonathan Rau

Barclays

1 question for PB

Recent press releases and 8-K filings for PB.

- Prosperity Bancshares, Inc. completed its merger with Southwest Bancshares, Inc., effective February 1, 2026.

- As part of the merger, Prosperity issued 4,095,397 shares of its common stock to the former shareholders and award holders of Southwest.

- Southwest's wholly owned subsidiary, Texas Partners Bank, which operates eleven banking offices in Central Texas, will continue to operate under its current name until operational integration in November 2026.

- Following the merger, Prosperity Bancshares, Inc. reported $38.463 billion in assets as of December 31, 2025, and operates 301 full-service banking locations as of January 30, 2026.

- Key personnel from Texas Partners Bank, including Brent Given and Tom Moreno, will join Prosperity Bank in senior management roles, and Gene Dawson, Jr. from Southwest has joined the Board of Directors of Prosperity Bank.

- Prosperity Bancshares, Inc. completed its merger with Southwest Bancshares, Inc. and its wholly owned subsidiary, Texas Partners Bank, effective February 1, 2026.

- As part of the merger, Prosperity issued 4,095,397 shares of its common stock to former shareholders and award holders of Southwest.

- Key management from Texas Partners Bank will join Prosperity Bank in senior roles, and Gene Dawson, Jr., Interim Chairman, President and Chief Executive Officer of Southwest, has joined the Board of Directors of Prosperity Bank.

- The operational integration of Texas Partners Bank locations is scheduled for November 2026, after which customers can use any Prosperity Bank full-service banking center.

- Prosperity Bancshares, Inc. entered into an Agreement and Plan of Merger with Stellar Bancorp, Inc. on January 27, 2026.

- Under the agreement, Stellar will merge with and into Prosperity, and Stellar Bank will merge into Prosperity Bank.

- Each share of Stellar Common Stock will be converted into the right to receive 0.3803 shares of Prosperity Common Stock and $11.36 in cash.

- The merger, which was unanimously approved by the boards of both companies, is subject to customary conditions, including Stellar shareholder approval and required regulatory approvals.

- Stellar will be required to pay a $78 million termination fee under certain circumstances.

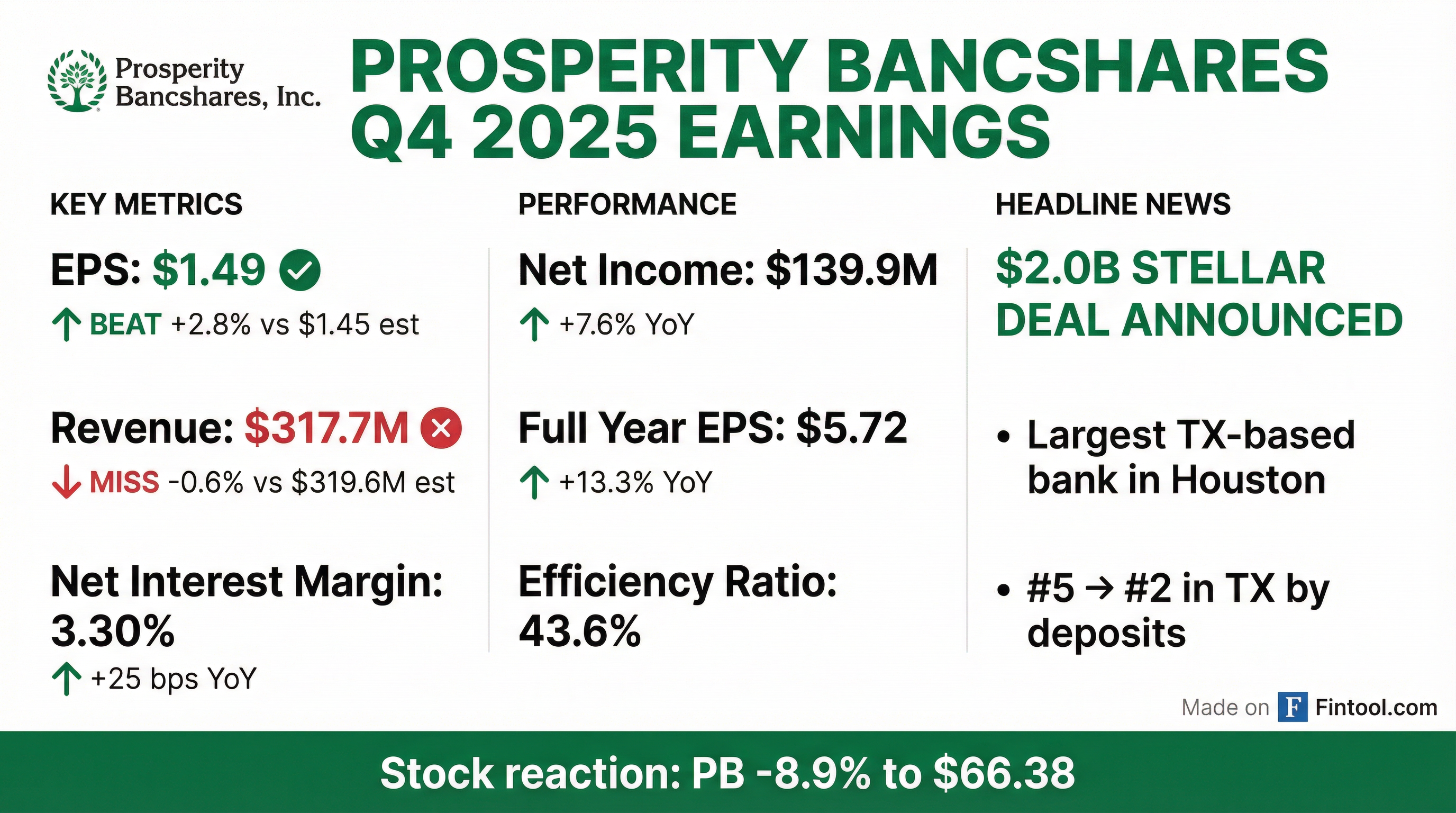

- Prosperity Bancshares reported net income of $543 million and $5.72 net income per diluted common share for the full year ended December 31, 2025, representing increases of 13.2% and 13.3% respectively, compared to 2024. For the fourth quarter of 2025, net income was $139.9 million, a 7.6% increase over the same period in 2024.

- The company completed its merger with American Bank on January 1, 2026, and expects its merger with Southwest Bancshares (Texas Partners Bank) to be effective February 1, 2026. Discussions also highlighted the acquisition of Stellar Bancorp, with an estimated $2.20 EPS run rate for Stellar based on Q4 2025 performance.

- Operational metrics showed improvement, with the net interest margin (tax equivalent) rising to 3.3% in Q4 2025 from 3.05% in Q4 2024, and the efficiency ratio improving to 43.7%. Deposits increased by $700 million to $28.4 billion at December 31, 2025, while loans (excluding warehouse purchase program loans) were $20.5 billion.

- In terms of capital deployment, Prosperity Bancshares repurchased approximately $157 million or 2.34 million shares of its common stock during 2025 at an average price of $67.04 , and has another 5% approved for 2026.

- Prosperity Bancshares reported net income of $139.9 million for the three months ending December 31, 2025, an increase of $9.8 million or 7.6% compared to the same period in 2024, with an annualized return on average assets of 1.49% and an efficiency ratio of 43.6%.

- The company's net interest margin on a tax equivalent basis was 3.30% for Q4 2025, an increase from 3.05% in Q4 2024 and 3.24% in Q3 2025, with a projected standalone margin of around 3.50% for 2026.

- Prosperity Bancshares completed its merger with American Bank on January 1, 2026, expects the merger with Southwest Bancshares (parent of Texas Partners Bank) to be effective February 1, 2026, and announced the acquisition of Stellar Bancorp.

- For the year ending December 31, 2025, Prosperity Bancshares repurchased approximately $157 million, or 2.34 million shares of its common stock at an average weighted price of $67.04.

- The company projects combined earnings of $7.34 per share for 2027, anticipating significant franchise value enhancement and a 17% return on average tangible capital in 2027.

- Prosperity Bancshares reported net income of $543 million and diluted EPS of $5.72 for the full year 2025, marking increases of 13.2% and 13.3% respectively compared to 2024. For the fourth quarter of 2025, net income was $139.9 million, a 7.6% increase from the same period in 2024.

- The net interest margin (NIM) on a tax equivalent basis for Q4 2025 was 3.3%, up from 3.05% in Q4 2024 and 3.24% in Q3 2025.

- As of December 31, 2025, loans (excluding warehouse purchase program loans) stood at $20.5 billion, while deposits reached $28.4 billion, an increase of $700 million from September 30, 2025. Nonperforming assets totaled $150 million.

- Prosperity Bancshares completed its merger with American Bank on January 1, 2026, and anticipates the merger with Southwest Bancshares (Texas Partners Bank) to be effective on February 1, 2026. Additionally, the company announced the acquisition of Stellar Bancorp.

- Management projects a combined EPS of $7.34 per share for 2027, with an expected 17% return on average tangible capital. Non-interest expense for Q1 2026 is forecast to be between $172 million and $176 million, in addition to $30 million to $33 million in one-time merger-related charges.

- Prosperity Bancshares reported net income of $139.9 million and diluted earnings per share of $1.49 for the three months ended December 31, 2025.

- As of December 31, 2025, the company's assets totaled $38.5 billion, with total loans at $21.8 billion and deposits reaching $28.5 billion.

- The net interest margin for Q4 2025 increased 25 basis points to 3.30% compared to the fourth quarter of 2024.

- The company declared a cash dividend of $0.60 for the first quarter 2026 and approved a 2026 Stock Repurchase Program covering up to 5% of outstanding common stock.

- Prosperity Bancshares announced the signing of a definitive merger agreement to acquire Stellar Bancorp, Inc. on January 28, 2026, completed the acquisition of American Bank Holding Corporation on January 1, 2026, and received regulatory approvals for the pending acquisition of Southwest Bancshares, Inc..

- Prosperity Bancshares has agreed to acquire Stellar Bancorp in a cash-and-stock deal valued at approximately $2.0 billion, or $39.08 per Stellar share, representing a 19.8–20% premium. The transaction is expected to close in the second quarter of 2026.

- The acquisition will create the second-largest Texas-headquartered bank by deposits with over 330 branches, significantly expanding Prosperity’s footprint in Houston, Beaumont, and Dallas.

- Stellar's CEO, Robert Franklin, will join Prosperity as vice chairman.

- As of December 31, 2025, Prosperity had approximately $38.5 billion in assets and Stellar had approximately $10.8 billion in assets.

- Prosperity Bancshares reported net income of $139.9 million and diluted earnings per share of $1.49 for the fourth quarter of 2025. For the full year 2025, net income increased by 13.2% to $542.8 million and diluted EPS increased by 13.3% to $5.72 compared to 2024.

- The company announced the signing of a definitive merger agreement to acquire Stellar Bancorp, Inc., which reported $10.807 billion in total assets as of December 31, 2025, for an approximate total consideration of $2.002 billion.

- Prosperity Bancshares completed the acquisition of American Bank Holding Corporation on January 1, 2026, and received all necessary approvals for the pending acquisition of Southwest Bancshares, Inc., which is expected to be effective on February 1, 2026.

- During the fourth quarter of 2025, the company repurchased 2.0 million shares of common stock for $137.2 million, and approved a 2026 Stock Repurchase Program covering up to 5% of outstanding common stock.

- Prosperity Bancshares reported net income of $139.9 million and diluted earnings per share of $1.49 for the fourth quarter ended December 31, 2025. For the full year 2025, net income was $542.8 million, an increase of 13.2%, and diluted EPS was $5.72, up 13.3% compared to 2024.

- The company completed the acquisition of American Bank Holding Corporation on January 1, 2026, received regulatory and shareholder approvals for the pending acquisition of Southwest Bancshares, Inc. (expected effective February 1, 2026), and announced a definitive merger agreement to acquire Stellar Bancorp, Inc..

- Deposits increased by $700.4 million during the fourth quarter of 2025, and the fourth quarter net interest margin rose 25 basis points to 3.30% compared to the same period in 2024.

- Prosperity Bancshares repurchased 2.0 million shares of common stock for $137.2 million during the fourth quarter of 2025 and approved a 2026 Stock Repurchase Program for up to 5% of outstanding common stock.

Fintool News

In-depth analysis and coverage of PROSPERITY BANCSHARES.

Quarterly earnings call transcripts for PROSPERITY BANCSHARES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more