Earnings summaries and quarterly performance for Pioneer Bancorp, Inc./MD.

Executive leadership at Pioneer Bancorp, Inc./MD.

Thomas L. Amell

President and Chief Executive Officer

James E. Murphy

Executive Vice President and Chief Credit Officer

Jesse Tomczak

Executive Vice President and Chief Banking Officer

Kelli Arnold

Executive Vice President and Chief Strategy & Innovations Officer

Patrick J. Hughes

Executive Vice President and Chief Financial Officer

Susan M. Hollister

Executive Vice President and Chief Human Resources Officer; Corporate Secretary

Thomas Signor

Executive Vice President and Chief Administrative Officer

Board of directors at Pioneer Bancorp, Inc./MD.

Research analysts covering Pioneer Bancorp, Inc./MD.

Recent press releases and 8-K filings for PBFS.

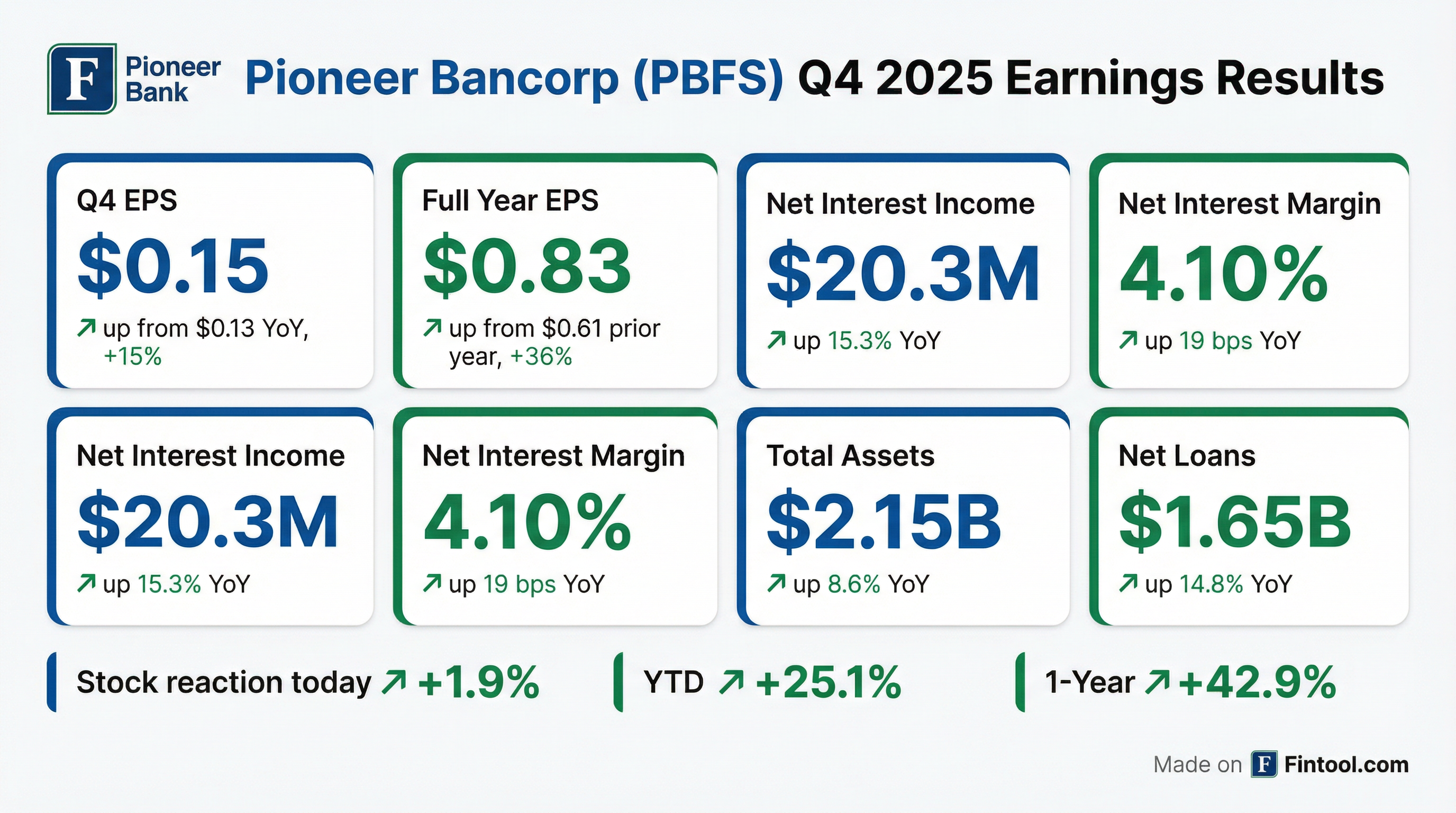

- Net income for Pioneer Bancorp, Inc. (PBFS) was $3.7 million for the three months ended December 31, 2025, and $20.3 million for the calendar year ended December 31, 2025, resulting in diluted EPS of $0.15 and $0.83, respectively.

- The company experienced strong balance sheet growth, with net loans receivable increasing by 14.8% to $1.65 billion and deposits growing by 9.6% to $1.74 billion at December 31, 2025, compared to December 31, 2024.

- Net interest income for the three months ended December 31, 2025, rose by 15.3% to $20.3 million, and the net interest margin improved by 19 basis points to 4.10%.

- Pioneer Bancorp, Inc. launched its broker-dealer subsidiary, Pioneer Capital Markets, Inc., on January 2, 2026, and completed the acquisition of Brown Financial Management Group during the fourth quarter of 2025, as part of its strategy to diversify products and services.

- Pioneer Bancorp, Inc. (PBFS) announced the adoption of a second stock repurchase program on December 17, 2025.

- The new program authorizes the repurchase of up to approximately 5% of its outstanding common stock, or 1,254,027 shares.

- The company has completed its initial stock repurchase program, under which it repurchased 1,298,883 shares at an average price of $11.83 per share.

- The new repurchase program has no expiration date and allows for repurchases at management's discretion.

- Pioneer Bancorp, Inc. reported net income of $4.3 million and $0.18 per basic and diluted share for the third quarter ended September 30, 2025. For the nine months ended September 30, 2025, net income was $16.5 million and $0.67 per basic and diluted share.

- Net loans receivable increased to $1.61 billion and deposits grew to $1.90 billion as of September 30, 2025, representing increases of 12.5% and 19.5% respectively, from December 31, 2024.

- Net interest income for the three months ended September 30, 2025, was $20.2 million, up 12.9% from the prior year, with a net interest margin of 4.16%.

- The company completed the acquisition of Brown Financial Management Group, LLC on October 28, 2025, adding $73 million of assets under management.

- Pioneer repurchased 463,126 shares of its common stock during the three months ended September 30, 2025, at an average price of $12.82 per share. As of September 30, 2025, 28,333 shares remained available for repurchase under the program.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more