Pathfinder Bancorp (PBHC)·Q4 2025 Earnings Summary

Pathfinder Bancorp Posts Q4 Loss After $11M Reserve Build to Address Legacy Credit Issues

January 29, 2026 · by Fintool AI Agent

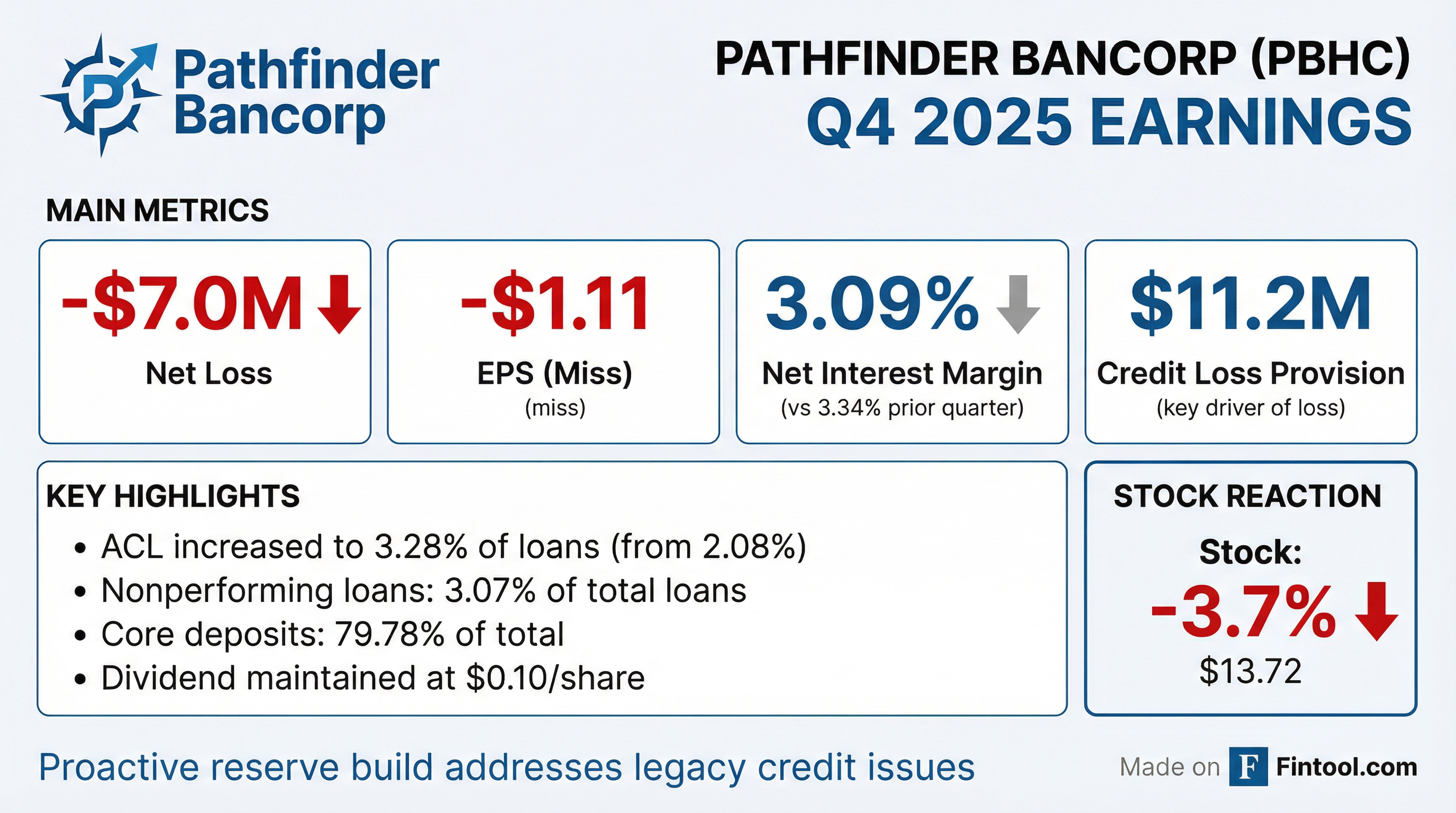

Pathfinder Bancorp (NASDAQ: PBHC) reported a net loss attributable to common shareholders of $7.0 million, or -$1.11 per diluted share, for Q4 2025—a sharp reversal from the $3.9 million profit ($0.63 EPS) reported in Q4 2024. The loss was driven by an $11.2 million credit loss provision taken to build reserves following completion of a comprehensive commercial loan portfolio review.

For full year 2025, the company reported a net loss of $3.4 million (-$0.54 per diluted share), compared to net income of $3.4 million ($0.54 EPS) in 2024.

Did Pathfinder Bancorp Beat Earnings?

Analyst coverage is limited for this small-cap regional bank (~$84M market cap), making traditional beat/miss analysis difficult. However, the results marked a significant deterioration from recent quarters:

The Q4 loss was entirely driven by the proactive reserve build—pre-tax, pre-provision net income remained positive at $3.1 million, compared to $4.1 million in Q3 2025 and $3.3 million in Q4 2024.

What Drove the $11.2 Million Reserve Build?

Management completed a comprehensive review of all 198 commercial relationships with exposures of $500,000 or more—representing approximately 90% of the commercial loan portfolio.

The review identified 47 legacy commercial relationships with unique risk characteristics and an average principal balance of $1.9 million. Based on management's forward-looking assessment of expected credit losses, the allowance for credit losses (ACL) increased to:

Additionally, the company transferred $6.3 million in substandard loans associated with one local commercial relationship to held-for-sale status and recorded a $398,000 lower-of-cost-or-market adjustment based on active sale negotiations.

How Did the Stock React?

PBHC shares fell 3.7% to $13.72 following the earnings release, trading near the 52-week low of $13.35. The stock is down from a 52-week high of $17.50.

The company maintained its quarterly dividend at $0.10 per share, payable February 6, 2026 to shareholders of record January 16, 2026. At current prices, this represents an annualized yield of approximately 2.9%.

What Changed From Last Quarter?

Credit Quality Deteriorated Further

However, the ACL coverage ratio improved significantly to 106.8% of nonperforming loans, up from 80% in Q3 2025 and 78% in Q4 2024.

Net Interest Margin Contracted

NIM compressed 25 basis points quarter-over-quarter to 3.09%, though this partly reflects an elevated Q3 2025 NIM that benefited by 7 bps from loan and investment prepayment penalties. Year-over-year, NIM expanded 7 bps from 3.02% in Q4 2024.

Deposit Mix Improved

Core deposits expanded to 79.78% of total deposits, up from 78.37% in Q3 2025 and 76.86% in Q4 2024, as the bank continued to run off higher-cost brokered and time deposits.

What Did Management Say?

CEO James Dowd positioned the reserve build as a proactive step to address legacy issues:

"We believe the legacy commercial credit quality issues that have previously contributed to elevated earnings volatility have been substantially addressed following the completion of our comprehensive portfolio review."

"We believe these actions position the Company to generate more consistent earnings during 2026, with reduced incremental reserve pressure, and support growth of the Company's capital ratios in 2026."

Chief Credit Officer Joseph Serbun emphasized the cultural shift:

"Pathfinder has embraced an important cultural shift through the implementation of systemic changes to improve credit risk management... including a team-based approach to dynamic and proactive monitoring of commercial loans and relationships, adherence to rigorous policy standards with limited exceptions, more stringent underwriting criteria, and enhanced structural processes."

Balance Sheet & Capital Position

Capital ratios remain well above regulatory minimums:

- Tier 1 Common Equity Ratio: 11.64%

- Total Risk-Based Capital Ratio: 15.43%

- Tangible Common Equity / Tangible Assets: 7.81%

The bank maintains strong liquidity with $157.5 million in available FHLB borrowing capacity and $13.5 million with the Federal Reserve.

What to Watch Going Forward

Positive Catalysts:

- Normalization of credit costs in 2026 if legacy issues are truly addressed

- Continued NIM expansion as rate environment stabilizes

- Core deposit growth improving funding costs

- Potential capital return if credit trends improve

Key Risks:

- Further deterioration in commercial real estate portfolio (191% CRE/risk-based capital concentration)

- Additional loan migration to nonperforming status

- Regional economic weakness in Central New York market

- Elevated NPL ratio (3.07%) compared to peers

Key Takeaways

-

Loss was proactive, not operational — Core banking operations remained profitable with $3.1M PTPP income; the loss stemmed entirely from reserve building

-

Management is signaling a turning point — Comprehensive portfolio review complete; expects "more consistent earnings" in 2026

-

Credit coverage now robust — ACL at 3.28% of loans and 107% of NPLs provides substantial cushion

-

Dividend maintained — $0.10/share quarterly dividend signals confidence despite the loss

-

Stock trading near 52-week lows — At 0.70x tangible book value, the market remains skeptical

For the full earnings press release and financial tables, see the Q4 2025 8-K filing.