Earnings summaries and quarterly performance for Pathfinder Bancorp.

Executive leadership at Pathfinder Bancorp.

JA

James A. Dowd

Detailed

Chief Executive Officer

CEO

JF

Joseph F. Serbun

Detailed

Chief Credit Officer

JP

Joseph P. McManus

Detailed

Chief Information Officer

JK

Justin K. Bigham

Detailed

Chief Financial Officer

RG

Robert G. Butkowski

Detailed

Chief Operating Officer

RG

Ronald G. Tascarella

Detailed

Chief Lending Officer

WD

William D. O’Brien

Detailed

Chief Risk Officer and Corporate Secretary

Board of directors at Pathfinder Bancorp.

AC

Adam C. Gagas

Detailed

Director

DA

David A. Ayoub

Detailed

Director

EA

Eric Allyn

Detailed

Director

JF

John F. Sharkey, III

Detailed

Director

JP

John P. Funiciello

Detailed

Director

L"

Lloyd "Buddy" Stemple

Detailed

Director

MC

Meghan Crawford-Hamlin

Detailed

Director

ML

Melanie Littlejohn

Detailed

Director

TS

Tony Scavuzzo

Detailed

Director

WA

William A. Barclay

Detailed

Chairman of the Board

Research analysts covering Pathfinder Bancorp.

Recent press releases and 8-K filings for PBHC.

Pathfinder Bancorp, Inc. Reports Q4 and Full Year 2025 Net Loss Driven by Credit Loss Provision

PBHC

Earnings

Profit Warning

Dividends

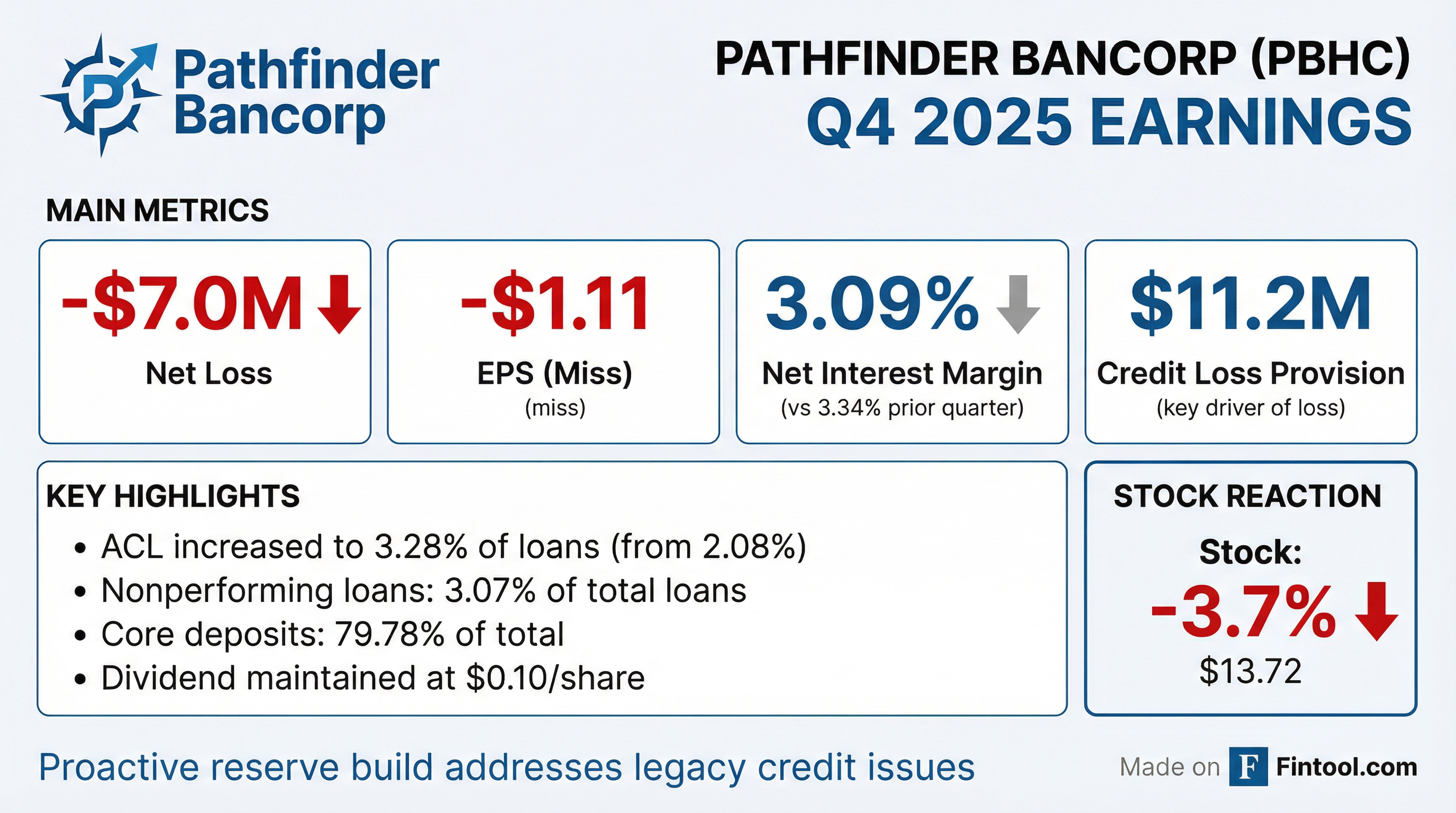

- Pathfinder Bancorp, Inc. reported a net loss attributable to common shareholders of $7.0 million, or $1.11 per diluted share, for the fourth quarter of 2025, and a net loss of $3.4 million, or $0.54 per diluted share, for the full year 2025.

- This loss was primarily due to an $11.2 million credit loss provision expense in Q4 2025, which increased the Allowance for Credit Losses (ACL) to $29.4 million, or 3.28% of loans, at December 31, 2025, following a comprehensive commercial loan review.

- Deposits totaled $1.18 billion at December 31, 2025, with core deposits expanding to 79.78% of total deposits.

- The company declared a quarterly cash dividend of $0.10 per share, payable on February 6, 2026, resulting in an annualized dividend yield of 2.83% as of December 31, 2025.

Jan 29, 2026, 9:22 PM

Pathfinder Bancorp Announces Fourth Quarter and Full Year 2025 Financial Results

PBHC

Earnings

Profit Warning

Dividends

- Pathfinder Bancorp reported a net loss attributable to common shareholders of $7.0 million, or $1.11 per diluted share, for the fourth quarter of 2025, and a net loss of $3.4 million, or $0.54 per diluted share, for the full year 2025.

- The net loss was primarily due to an $11.2 million credit loss provision expense in the fourth quarter of 2025, which increased the allowance for credit losses (ACL) by $10.8 million to $29.4 million, or 3.28% of loans, at December 31, 2025, following a comprehensive review of the commercial loan portfolio.

- Nonperforming loans increased to $27.6 million at December 31, 2025, compared to $22.1 million on December 31, 2024.

- Total loans were $896.7 million and deposits totaled $1.18 billion at December 31, 2025, with core deposits expanding to 79.78% of total deposits.

- The company declared a quarterly cash dividend of $0.10 per share, payable on February 6, 2026, which represented an annualized dividend yield of 2.83% as of December 31, 2025.

Jan 29, 2026, 9:18 PM

Pathfinder Bancorp, Inc. Announces Third Quarter 2025 Results

PBHC

Earnings

Dividends

- Pathfinder Bancorp, Inc. reported net income attributable to common shareholders of $626,000, or $0.10 per diluted share, for the third quarter of 2025, a significant increase from $31,000 (less than $0.01 per diluted share) in the second quarter of 2025 and a net loss of $4.6 million ($0.75 per share) in the third quarter of 2024.

- The company's net interest income was $11.6 million and the net interest margin (NIM) was 3.34% in Q3 2025, up from $10.8 million and 3.11% in the linked quarter.

- Nonperforming loans increased to $23.3 million, representing 2.59% of total loans at September 30, 2025, compared to $11.7 million (1.28%) in the prior quarter, primarily due to two commercial relationships. Provision expense for credit losses was $3.5 million in Q3 2025.

- Total deposits grew to $1.23 billion at September 30, 2025, with core deposits reaching $960.1 million, or 78.37% of total deposits.

- The Board of Directors declared a cash dividend of $0.10 per share on September 29, 2025, payable on November 7, 2025.

Oct 30, 2025, 8:10 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more