PEOPLES FINANCIAL CORP /MS/ (PFBX)·Q4 2025 Earnings Summary

Peoples Financial Q4 Earnings Drop 53% as Interest Income Declines

January 29, 2026 · by Fintool AI Agent

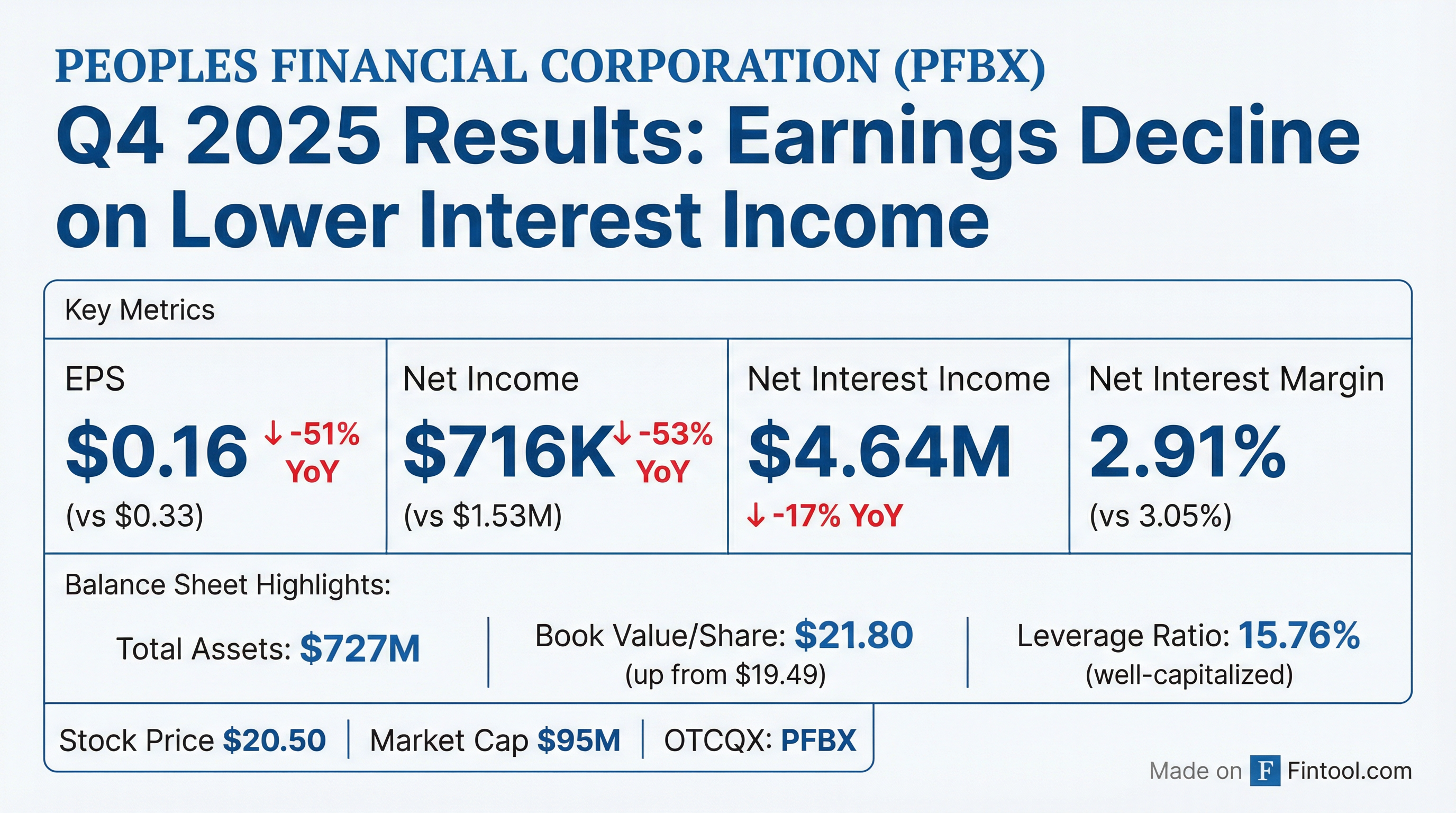

Peoples Financial Corporation (OTCQX: PFBX), the Mississippi Gulf Coast regional bank holding company, reported fourth quarter 2025 earnings that showed a significant decline from the prior year as lower interest income weighed on results. The company also announced an extension of its stock repurchase program and set its 2026 annual meeting date.

What Did Peoples Financial Report?

Source: Company 8-K filing

The quarterly decline stemmed primarily from lower interest income on securities, overnight fed funds, and loans as the company saw decreases in balances, yields, and rates. Total interest income fell by $1.07 million year-over-year, while interest expense declined by only $134,000.

How Did the Stock React?

PFBX shares traded at $20.50 following the earnings release, relatively unchanged from recent levels. The stock is thinly traded on the OTCQX Best Market with a market capitalization of approximately $95 million. The shares have traded in a narrow range of $19.00 to $22.54 over the past year, reflecting the bank's stable but modest performance profile.

What Changed From Last Quarter?

The Q4 decline continues a challenging year for Peoples Financial. Full year 2025 net income totaled $3.91 million compared to $21.70 million in 2024, though the 2024 figure included a one-time $15.19 million tax benefit from the reversal of the company's valuation allowance on deferred tax assets.

*2024 included $15.19M one-time tax benefit; **Adjusted ROA excluding discrete item

The efficiency ratio deteriorated to 83% from 73%, indicating the bank is spending more to generate each dollar of revenue—a concerning trend for profitability. Net interest margin compressed to 2.91% from 3.05%.

What Happened to Deposits?

One of the most significant developments was a substantial decline in deposits. Total deposits fell $116.3 million (16.1%) to $604.4 million from $720.7 million at year-end 2024.

Management attributed this to losing several large public fund deposits through competitive bid processes, where the accounts were awarded to other local banks. This reflects the intense competition for deposits in a higher rate environment.

Source: Company 8-K filing

Why Did Book Value Increase?

Despite the earnings decline, shareholders' equity improved by $10.7 million to $100.7 million. Two factors drove this:

- Retained earnings of $3.91 million in 2025

- Reduced unrealized securities losses — the available-for-sale portfolio's unrealized losses decreased by $9.1 million (from $38.0M to $28.9M) as rates moderated

The bank noted these unrealized losses relate to interest rate movements, not credit deterioration, and the company does not anticipate selling affected securities that would realize these losses.

What Did Management Say?

"The Bank's leadership remains committed to maintaining high-quality assets. We are closely monitoring economic conditions and staying vigilant for any potential changes in interest rates."

— Chevis C. Swetman, Chairman, President and CEO

Management emphasized the bank's strong liquidity position and well-capitalized balance sheet. The leverage ratio of 15.76% significantly exceeds the 5% threshold for "well-capitalized" status under regulatory requirements.

What About Capital Returns?

The board of directors extended the company's stock repurchase program, originally set to expire on December 31, 2025, with no new expiration date. The program authorizes repurchases of up to the lesser of $750,000 or 40,000 shares.

With 4,617,466 shares outstanding, the repurchase authorization represents approximately 0.9% of shares outstanding. Repurchased shares will be retired.

What's Next for PFBX?

Key Dates:

- Annual Meeting: April 22, 2026

- Q1 2026 Earnings: Expected late April 2026

Watch List:

- Deposit stabilization: Can the bank retain existing deposits and attract new ones after losing public fund accounts?

- Interest rate trajectory: The bank's net interest margin depends heavily on rate movements

- Efficiency improvement: The 83% efficiency ratio needs to trend lower to restore profitability

Asset Quality Snapshot

Source: Company 8-K filing

Asset quality remains relatively stable with no loans past due 90+ days and a modest allowance coverage ratio. Net charge-offs increased modestly but remain at de minimis levels relative to the loan portfolio.

Company Background

Founded in 1896, Peoples Financial Corporation operates The Peoples Bank with 18 facilities along the Mississippi Gulf Coast in Hancock, Harrison, Jackson, and Stone counties. With $727 million in total assets, the bank offers retail and commercial banking services plus trust and investment services established in 1936.

Data sourced from Peoples Financial Corporation 8-K filed January 29, 2026. PFBX trades on the OTCQX Best Market. No analyst coverage available for beat/miss comparison.