Earnings summaries and quarterly performance for PEOPLES FINANCIAL CORP /MS/.

Research analysts covering PEOPLES FINANCIAL CORP /MS/.

Recent press releases and 8-K filings for PFBX.

Peoples Financial Corporation Reports Q4 and Full-Year 2025 Results and Extends Share Repurchase Program

PFBX

Earnings

Share Buyback

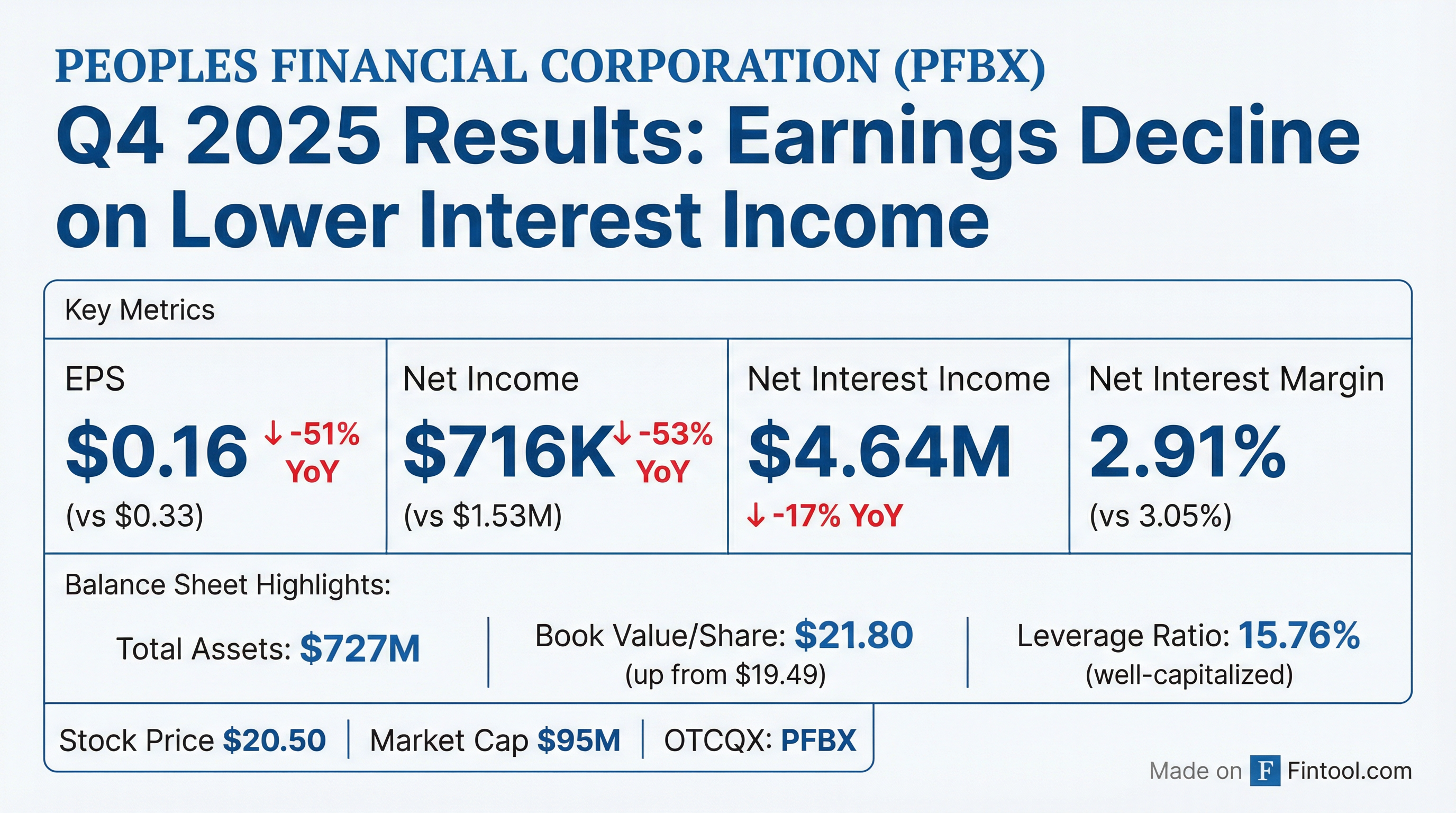

- Peoples Financial Corporation reported net income of $716,000 and earnings per weighted average common share of $0.16 for Q4 2025, a decrease from $1,528,000 and $0.33, respectively, in Q4 2024. For the full year 2025, net income decreased to $3,911,000 ($0.85 EPS) from $21,703,000 ($4.66 EPS) in 2024, with the 2024 figure including a $15,194,000 tax benefit.

- The company's board of directors approved an extension of its stock repurchase program with no expiration date, authorizing the repurchase of up to the lesser of $750,000 or 40,000 shares of common stock.

- Total shareholders' equity increased by $10,666,000 to $100,667,000 at December 31, 2025, from $90,001,000 at December 31, 2024, partially due to twelve-month earnings and a $9,077,000 decrease in unrealized losses on securities.

- Total deposits decreased by $116,301,000 to $604,429,000 as of December 31, 2025, from $720,730,000 as of December 31, 2024, mainly due to the loss of several large public fund deposits.

- Key performance ratios for the year ended December 31, 2025, included a return on average assets of 0.50% (compared to 2.65% in 2024, which included a discrete item) and an efficiency ratio of 83% (compared to 73% in 2024).

Jan 29, 2026, 3:47 PM

Peoples Financial Corporation Reports Fourth Quarter and Full Year 2025 Results

PFBX

Earnings

Share Buyback

- Peoples Financial Corporation reported net income of $716,000 and earnings per weighted average common share of $0.16 for the fourth quarter of 2025, a decrease from $1,528,000 and $0.33, respectively, in the fourth quarter of 2024. This decrease was attributed to lower interest income on securities, overnight fed funds, and loans due to decreased balances, yields, and rates.

- For the full year ended December 31, 2025, net income was $3,911,000 ($0.85 EPS), significantly lower than $21,703,000 ($4.66 EPS) for the year ended 2024, primarily due to a $15,194,000 tax benefit recorded in the third quarter of 2024 from the reversal of a valuation allowance on deferred tax assets.

- The Company's board of directors approved an extension of its stock repurchase program with no expiration date, authorizing the repurchase of up to the lesser of $750,000 or 40,000 shares of outstanding common stock.

- Total shareholders' equity increased by $10,666,000 to $100,667,000 at December 31, 2025, from $90,001,000 at December 31, 2024, partially due to twelve-month earnings and a $9,077,000 decrease in unrealized losses on securities. Conversely, total deposits decreased by $116,301,000 to $604,429,000 as of December 31, 2025, mainly due to the loss of several large public fund deposits.

Jan 29, 2026, 3:25 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more