Earnings summaries and quarterly performance for PFH.

Research analysts covering PFH.

Recent press releases and 8-K filings for PFH.

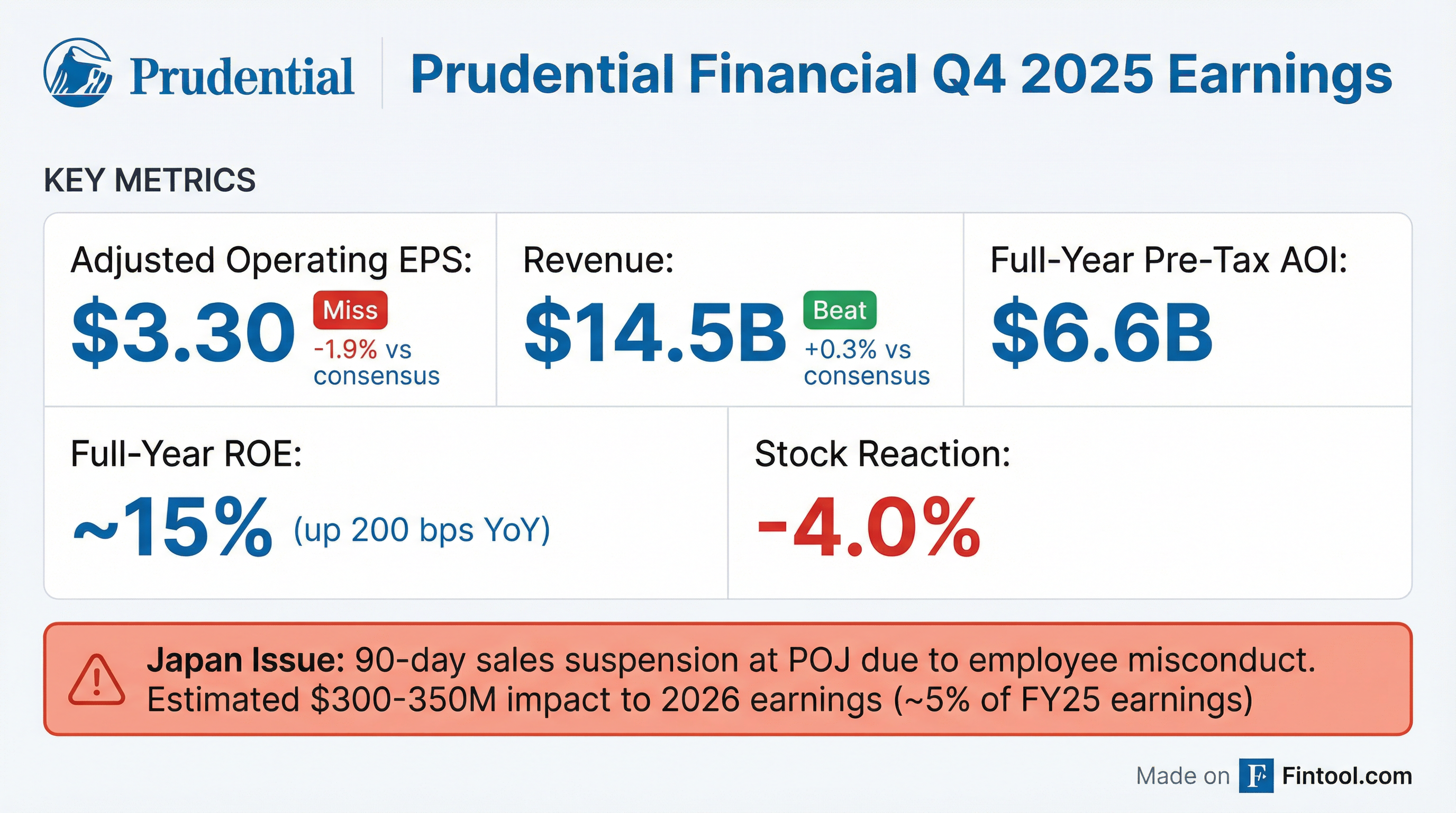

Prudential Financial Reports Q4 2025 Results and Addresses Japan Misconduct

PFH

Earnings

Profit Warning

Legal Proceedings

- Prudential Financial (PFH) announced a 90-day voluntary halt on new sales at Prudential of Japan (POJ) due to employee misconduct, with the possibility of extending this period.

- The POJ issue is projected to impact 2026 pre-tax adjusted operating income by $300 million-$350 million, equivalent to approximately 5% of 2025 PFI earnings. This estimate includes $150 million-$180 million from the sales suspension, $70 million in one-time costs, and $80 million from lower earnings due to a gradual sales ramp-up.

- For the full year 2025, the company reported pre-tax adjusted operating income of $6.6 billion, or $14.43 per share, and an adjusted operating return on equity of approximately 15%.

- Prudential returned nearly $3 billion to shareholders in 2025 through dividends and buybacks, and the board authorized up to $1 billion in share repurchases for 2026, increasing the common stock dividend for the 18th consecutive year.

- The financial impact from the POJ issue could lead to the company achieving the low end of its 5%-8% intermediate EPS growth target for the 2024-2027 period.

2 days ago

PFH Announces Q4 2025 Results and Addresses Japan Business Misconduct

PFH

Guidance Update

Legal Proceedings

Share Buyback

- Prudential Financial (PFH) reported full-year 2025 pretax adjusted operating income of $6.6 billion and an adjusted operating return on equity of approximately 15%.

- The company announced a voluntary 90-day halt on new sales at Prudential of Japan (POJ) due to employee misconduct, expecting an impact on 2026 pre-tax adjusted operating income of $300 million-$350 million. This includes $70 million in one-time costs, primarily for customer reimbursement.

- The POJ issue could lead to the company's intermediate EPS growth target (2024-2027) reaching the low end of the 5%-8% range.

- PFH authorized share repurchases of up to $1 billion in 2026 and increased its common stock dividend for the 18th consecutive year, having returned nearly $3 billion to shareholders in 2025 through dividends and buybacks.

2 days ago

Prudential Financial Addresses Japan Misconduct and Provides 2026 Financial Outlook

PFH

Legal Proceedings

Guidance Update

Share Buyback

- Prudential Financial's Japan business (POJ) is addressing employee misconduct issues, leading to a voluntary 90-day halt of new sales at POJ, with the possibility of extension.

- The company anticipates a $300 million-$350 million impact on 2026 pre-tax adjusted operating income due to the POJ issues, which includes costs from the sales suspension, one-time expenses for customer reimbursement, and lower earnings from a gradual sales ramp-up. This could lead to the intermediate EPS growth target reaching the low end of the 5%-8% range by 2027.

- The Board has authorized share repurchases of up to $1 billion in 2026 and increased the common stock dividend for the 18th consecutive year.

- For 2025, the company reported strong sales across several segments, including $40 billion in Retirement Strategies, over $600 million in Group Insurance (up 11% year-over-year), and $955 million in Individual Life (up 5% over prior year).

2 days ago

PFH Reports Q4 2025 Adjusted Operating Income and Provides 2026 Outlook

PFH

Earnings

Guidance Update

Share Buyback

- PFH reported Q4 2025 pre-tax adjusted operating income of $1,505 million and after-tax adjusted operating income per share of $3.30.

- Individual Life sales in Q4 2025 were primarily driven by Universal Life at $269 million.

- Private credit exposure reached $82 billion, representing 21% of invested assets as of December 31, 2025, with 84% classified as Investment Grade.

- For 2026, the company expects a Corporate & Other Operating Loss of $1.65 billion and has authorized a $1 billion share repurchase program.

2 days ago

Prudential Financial Reports Record Q3 2025 Adjusted Operating Income and Strong Business Growth

PFH

Earnings

Guidance Update

M&A

- Prudential Financial (PFH) reported a strong Q3 2025, with pretax adjusted operating income of $1.9 billion, or $4.26 per share, marking a record high up 28% from the prior year quarter. The year-to-date adjusted operating return on equity was over 15%.

- PGIM's assets under management increased 5% to $1.5 trillion, driven by $2.4 billion in total net inflows, despite outflows from Jennison. The company expects to realize approximately $100 million in annual run-rate savings by the end of 2026 and anticipates over 200 basis points of margin expansion in 2026, targeting a 25% to 30% margin.

- The company saw strong sales momentum across its businesses, with Individual Retirement delivering over $3 billion in sales for the seventh consecutive quarter and Institutional Retirement sales exceeding $6 billion, including a $2.3 billion jumbo pension risk transfer. Individual Life sales were up 20% to $253 million, and year-to-date Group Insurance sales increased 14% to $555 million.

- PFH completed the sale of its PGIM Taiwan business and is evolving to a unified asset manager model in PGIM. The company continues to manage headwinds from legacy variable annuity runoff, which has an estimated $10 to $15 million adjusted operating income impact per quarter , and higher-than-expected surrenders in Japan, though stabilization is noted.

Oct 30, 2025, 3:00 PM

PFH Reports Q3 2025 Financial Results and Strategic Updates

PFH

Earnings

M&A

- PFH reported Adjusted Operating Income Per Share of $4.26 for Q3 2025 and $11.13 year-to-date 2025.

- The company's Pre-Tax Adjusted Operating Income for Q3 2025 was $1,947 million, with significant contributions from U.S. Businesses ($1,149 million), International Businesses ($881 million), and PGIM ($244 million).

- PGIM recorded positive total net flows of $2.4 billion in Q3 2025.

- PFH completed the sale of its PGIM Taiwan business during the quarter.

Oct 30, 2025, 3:00 PM

Prudential Financial Reports Record Q3 2025 Operating Income and Strategic Progress

PFH

Earnings

Guidance Update

New Projects/Investments

- Prudential Financial (PFH) reported a record high pretax adjusted operating income of $1.9 billion, or $4.26 per share, for Q3 2025, reflecting a 28% increase from the prior year quarter and a year-to-date adjusted operating return on equity over 15%.

- The company experienced strong business performance, including positive net inflows of $2.4 billion in PGIM , over $6 billion in Institutional Retirement sales (which included a $2.3 billion jumbo pension risk transfer) , and over $3 billion in Individual Retirement sales for the seventh consecutive quarter.

- Strategic actions included the sale of the PGIM Taiwan business and a PGIM reorganization that is expected to generate approximately $100 million in annual run-rate savings by the end of 2026, leading to over 200 basis points of margin expansion in 2026.

- PFH's capital position remains strong with $3.9 billion in cash and liquid assets , and the board approved an Economic Solvency Ratio (ESR) operating target of 150%, which Prudential of Japan and Gibraltar Life currently exceed.

Oct 30, 2025, 3:00 PM

Quarterly earnings call transcripts for PFH.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more