PEOPLES FINANCIAL SERVICES (PFIS)·Q4 2025 Earnings Summary

Peoples Financial Q4 Miss Overshadowed by NIM Expansion, Stock Rises 2%

January 30, 2026 · by Fintool AI Agent

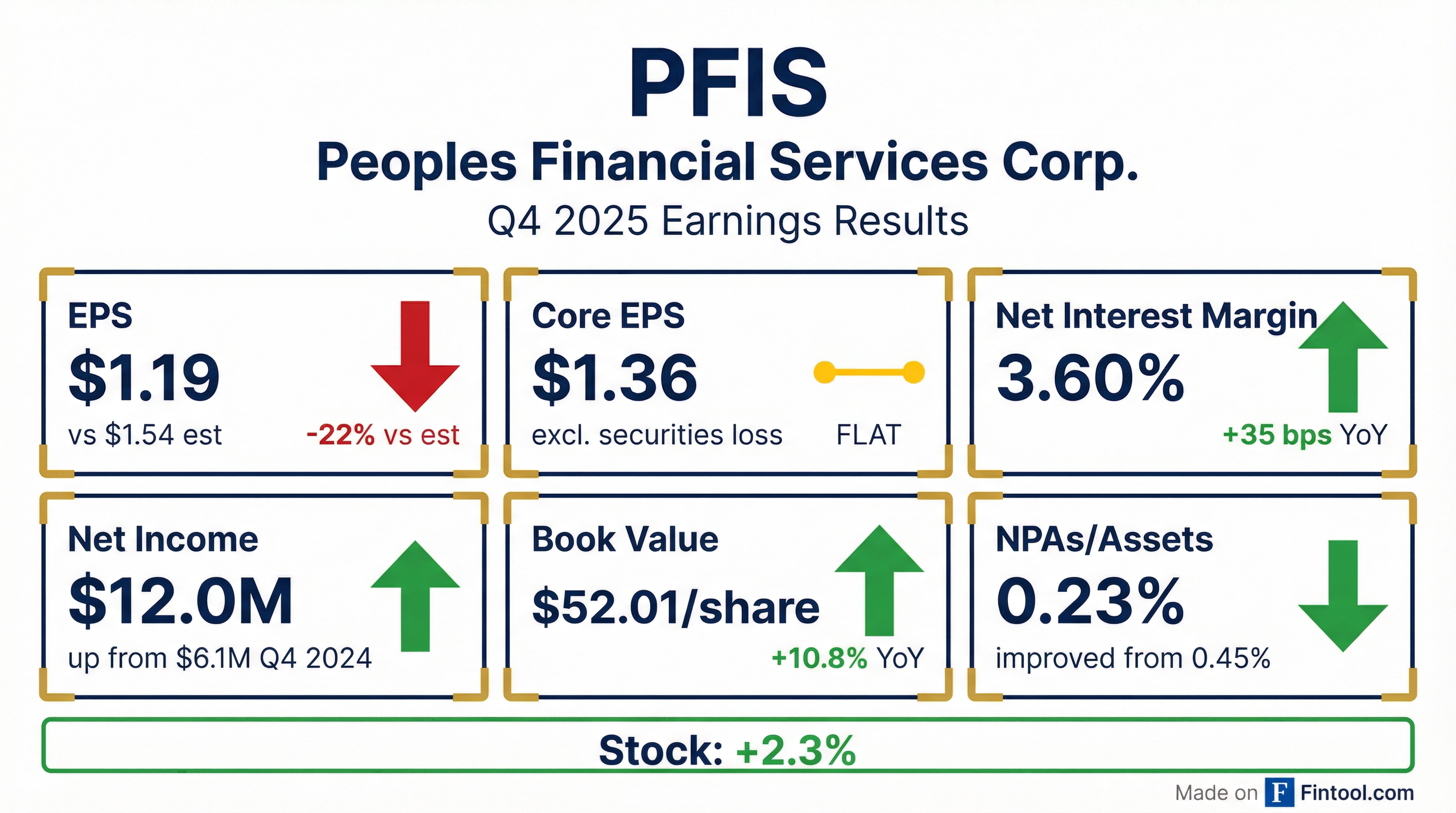

Peoples Financial Services Corp. (NASDAQ: PFIS) reported Q4 2025 earnings that missed consensus estimates on both EPS and revenue, but the stock rose 2.3% as investors looked past a one-time securities loss to focus on margin expansion and improved credit quality.

The Pennsylvania-based regional bank posted net income of $12.0 million, or $1.19 per diluted share, compared to $6.1 million, or $0.61 per share, in Q4 2024. Excluding a $2.2 million pre-tax loss ($1.8 million after-tax) from strategic securities repositioning, core EPS was $1.36.

Did Peoples Financial Beat Earnings?

No — PFIS missed on both EPS and revenue, but the market shrugged it off.

*Values retrieved from S&P Global

The miss was driven by the strategic decision to sell $78.6 million of low-yielding U.S. Treasury bonds (1.18% weighted average yield) and reinvest in higher-yielding securities averaging 4.67%. Management expects to recover the after-tax loss within approximately 10 months.

What Drove the Results?

Net Interest Margin Expansion — The Bright Spot

Net interest margin (FTE) expanded 35 basis points year-over-year to 3.60%, the key metric that likely drove the positive stock reaction.

The margin expansion was driven by a combination of stable asset yields and sharply lower funding costs following the Fed's 75 basis points of rate cuts in 2025.

Credit Quality Improvement

Nonperforming assets improved significantly, addressing a key concern following the FNCB merger:

Nonperforming assets fell from $23.0 million to $12.1 million, driven by an $11.7 million decrease in nonaccrual loans following resolution of several large commercial credit relationships.

What Did Management Say?

CEO Gerard Champi struck a confident tone despite the headline miss:

"We delivered solid full-year results in 2025, with net income of $59.2 million driven by strong net interest income and a lower provision for credit losses... While fourth-quarter earnings were impacted by a strategic $2.2 million pre-tax loss related to the repositioning of our available-for-sale securities portfolio, this action strengthens our balance sheet and positions us well for future periods."

Key forward-looking commentary:

- Securities repositioning expected to recover the loss within ~10 months

- Focus on disciplined growth, operating efficiency, and long-term shareholder value

- FNCB merger integration largely complete with synergies flowing through

How Did the Stock React?

PFIS rose 2.3% on earnings day, closing at $52.10 on above-average volume.

The positive reaction despite the miss suggests:

- Expectations may have been low heading into the print

- Investors viewed the securities loss as one-time and value-accretive long-term

- NIM expansion and credit quality improvement were the more important signals

What Changed From Last Quarter?

The sequential decline in profitability was almost entirely attributable to the securities repositioning loss. Excluding that, operating trends remained solid with continued NIM expansion.

Full Year 2025 vs. 2024

The year-over-year transformation is stark, reflecting the full integration of the FNCB merger:

FY 2024 was distorted by $16.2 million in acquisition-related expenses and a $14.3 million Day 1 provision for acquired loans. Normalizing for these items, the underlying business improved materially.

Balance Sheet Highlights

Loan growth was modest at 1.8% for the year, but accelerated to 5.0% annualized in Q4 2025.

Capital & Liquidity

The bank maintained its well-capitalized position with ample liquidity:

- Cash & Equivalents: $269.0 million (up from $135.9 million YoY)

- Available Borrowing Capacity: $1.0 billion at FHLB + $349 million at Fed Discount Window

- Uninsured Deposits: 34.3% of total deposits ($1.5B), with $494M collateralized by FHLB letters of credit

- Dividends Declared: $2.47 per share for FY 2025 (4.7% yield at current price)

Key Risks and Concerns

- Rate Sensitivity: NIM benefited from lower funding costs, but further Fed cuts could pressure asset yields

- Commercial Real Estate Concentration: CRE loans represent $2.33 billion of the $4.07 billion loan portfolio

- Geographic Concentration: Operations primarily in northeastern Pennsylvania with 40 branches

- Integration Execution: While FNCB integration is largely complete, continued focus on efficiency and system integration required

Forward Catalysts

- Q1 2026 Earnings: ~April 2026 — Look for securities repositioning payback and continued NIM trends

- Dividend: $0.6175 quarterly dividend maintained

- Fed Policy: Further rate cuts could pressure NIM but support credit quality

- M&A: With FNCB integration complete, potential for additional consolidation in fragmented PA market

Peoples Financial Services Corp. is the bank holding company for Peoples Security Bank and Trust Company, serving retail and commercial customers through 40 branches across Pennsylvania, New Jersey, and New York.

Related Links: