Earnings summaries and quarterly performance for PEOPLES FINANCIAL SERVICES.

Executive leadership at PEOPLES FINANCIAL SERVICES.

Gerard Champi

Chief Executive Officer

Amy Vieney

Chief Human Resource Officer

James Bone Jr.

Chief Financial Officer

James Chiaro

Chief Investment Services Officer

Jeffrey Drobins

Chief Lending Officer

John Anderson III

Chief Operating Officer

Mary Griffin Cummings

General Counsel

Neal Koplin

Chief Banking Officer

Stephanie Westington

Chief Accounting Officer

Susan Hubble

Chief Information Officer

Thomas Tulaney

President

Timothy Kirtley

Chief Risk Officer and Corporate Secretary

Board of directors at PEOPLES FINANCIAL SERVICES.

Elisa Ramirez

Director

James Nicholas

Director

Joseph Coccia

Director

Joseph DeNaples

Director

Joseph Wright Jr.

Director

Kathleen McCarthy Lambert

Director

Keith Eckel

Director

Louis DeNaples Sr.

Vice Chairman of the Board

Richard Lochen Jr.

Director

Ronald Kukuchka

Director

Sandra Bodnyk

Director

Thomas Melone

Director

William Aubrey II

Chairman of the Board

William Bracey

Director

William Conaboy

Director

Research analysts covering PEOPLES FINANCIAL SERVICES.

Recent press releases and 8-K filings for PFIS.

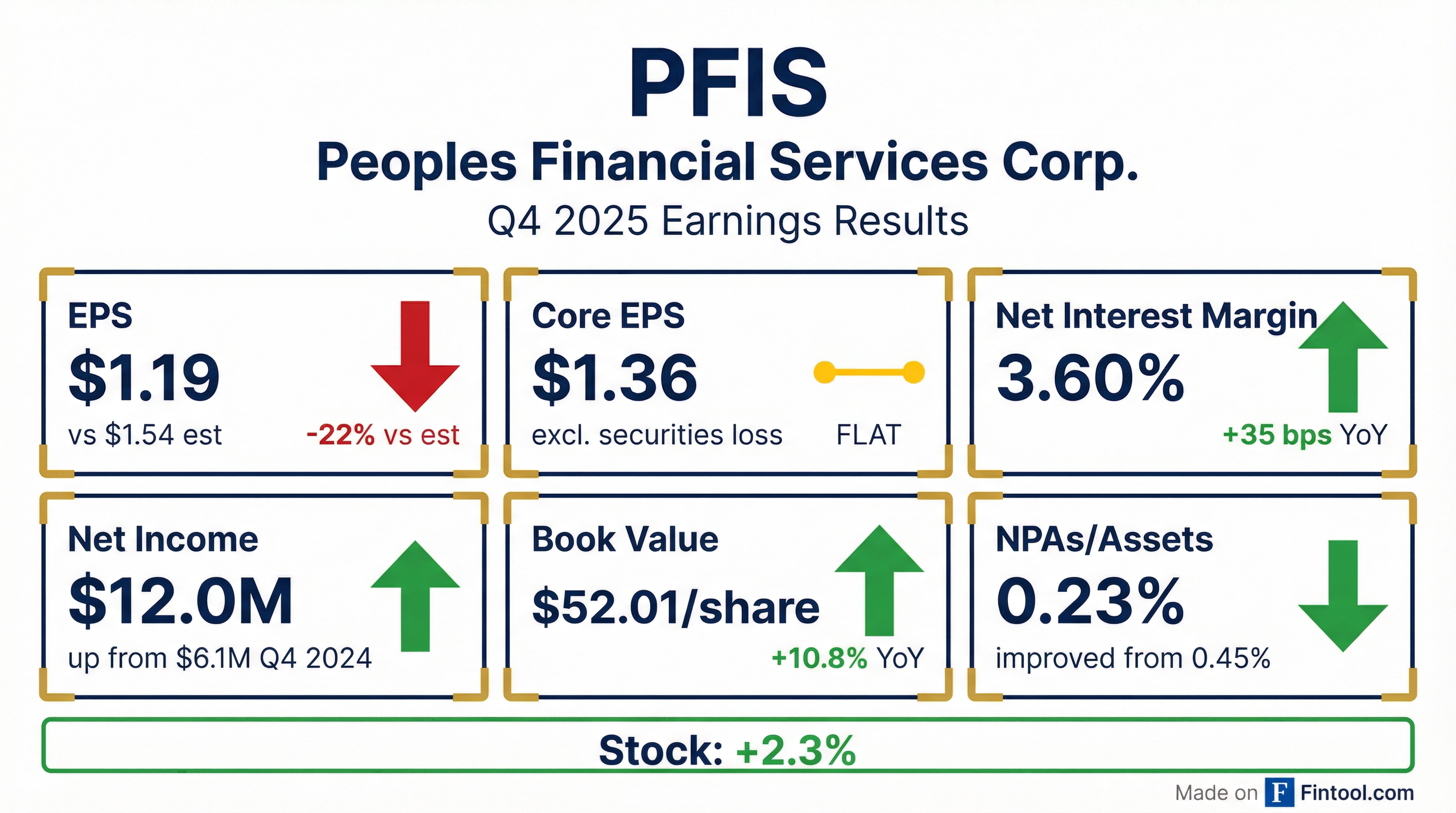

- Peoples Financial Services Corp. reported net income of $12.0 million, or $1.19 per diluted share, for the three months ended December 31, 2025, and $59.2 million, or $5.88 per diluted share, for the full year ended December 31, 2025.

- Fourth-quarter earnings were impacted by a $2.2 million pre-tax loss on the sale of available-for-sale investment securities as part of a strategic portfolio repositioning, which is expected to strengthen the balance sheet and recover the after-tax loss within approximately 10 months.

- The company's full-year 2025 net income significantly increased due to a full year of combined operations following the FNCB merger in July 2024, which contributed to higher net interest income and a lower provision for credit losses.

- At December 31, 2025, total assets reached $5.3 billion, total loans increased to $4.1 billion, and total deposits grew to $4.4 billion.

- Asset quality improved, with non-performing assets to total assets decreasing to 0.23% at December 31, 2025, from 0.45% at December 31, 2024, largely due to an $11.7 million decrease in nonaccrual loans.

- Peoples Financial Services Corp. reported net income of $12.0 million, or $1.19 per diluted share, for the three months ended December 31, 2025, and $59.2 million, or $5.88 per diluted share, for the full year 2025.

- Full-year 2025 net income significantly increased from $8.5 million in 2024, primarily due to a full year of combined operations following the FNCB merger on July 1, 2024, and a reduction in the provision for credit losses.

- Fourth quarter 2025 net income was negatively impacted by a $2.2 million pre-tax loss from a strategic repositioning of available-for-sale investment securities.

- Key financial metrics for Q4 2025 included a Return on Average Assets (ROAA) of 0.92% and a Net Interest Margin (NIM) of 3.60%.

- At December 31, 2025, total assets reached $5.3 billion, with total loans at $4.1 billion and deposits at $4.4 billion. Non-performing assets to total assets improved to 0.23%.

- Peoples Financial Services Corp. (PFIS) completed a repositioning of a portion of its investment securities portfolio on December 23, 2025.

- The company sold approximately $78.6 million of lower-yielding U.S. treasury bonds with a weighted average yield of 1.18%.

- The sale resulted in a realized after-tax loss of approximately $1.85 million, which will be recognized during the fourth quarter of 2025.

- Net proceeds of approximately $76.1 million were used to purchase higher-yielding investment securities, including U.S. agency mortgage-backed securities and discounted tax-exempt municipal bonds, with an average book yield of approximately 4.67%.

- This repositioning is estimated to improve interest income from the securities portfolio by approximately $2.8 million over the next 12 months, and the company expects to recover the after-tax loss in approximately 10 months.

- Peoples Financial Services Corp. reported net income of $15.2 million, or $1.51 per diluted share, for the three months ended September 30, 2025.

- For Q3 2025, the company's Return on Average Assets (ROAA) was 1.19%, Return on Average Tangible Common Equity (ROATCE) was 15.2%, and the efficiency ratio was 56.5%.

- As of September 30, 2025, the company held $4.3 billion in total deposits and $4.0 billion in total loans.

- The tangible book value per share increased to $40.43 as of September 30, 2025.

- Peoples Financial Services Corp. declared a fourth quarter cash dividend of $0.6175 per share.

- The dividend is payable on December 15, 2025, to shareholders of record as of November 28, 2025.

- The company, which operates 39 full-service community banking offices, also noted the consummation of its merger with FNCB Bancorp, Inc. on July 1, 2024.

- Peoples Financial Services Corp. reported net income of $15.2 million, or $1.51 per diluted share, for the three months ended September 30, 2025, a significant improvement from a net loss of $4.3 million, or $0.43 per diluted share, in the same period of 2024.

- For the nine months ended September 30, 2025, net income was $47.2 million, or $4.69 per diluted share, compared to $2.4 million, or $0.30 per diluted share, for the comparable period of 2024, primarily due to higher net interest income and noninterest income, and a lower provision for credit losses.

- The company's Return on average assets (ROAA) was 1.19% and Return on average equity (ROAE) was 12.02% for the three months ended September 30, 2025.

- As of September 30, 2025, total assets were $5.2 billion, loans were $4.0 billion, and deposits were $4.3 billion. Nonperforming assets decreased to $16.8 million, or 0.42% of loans, net, and foreclosed assets, from $23.0 million or 0.58% at December 31, 2024.

- Peoples Financial Services Corp. reported net income of $15.2 million, or $1.51 per diluted share, for the three months ended September 30, 2025, a significant increase from a net loss of $4.3 million, or $0.43 per diluted share, in Q3 2024.

- For the nine months ended September 30, 2025, net income was $47.2 million, or $4.69 per diluted share, compared to $2.4 million, or $0.30 per diluted share, for the comparable period of 2024.

- The company's Return on Average Assets (ROAA) was 1.19% and Return on Average Equity (ROAE) was 12.02% for Q3 2025.

- As of September 30, 2025, total assets stood at $5.2 billion, with total loans at $4.0 billion and total deposits at $4.3 billion.

- Book value per common share rose to $50.95 and tangible book value per common share increased to $40.43 at September 30, 2025, with the company maintaining a well capitalized position.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more