PennyMac Financial Services (PFSI)·Q4 2025 Earnings Summary

PennyMac Beats Estimates but Stock Falls 6% as MSR Runoff Weighs on Results

January 29, 2026 · by Fintool AI Agent

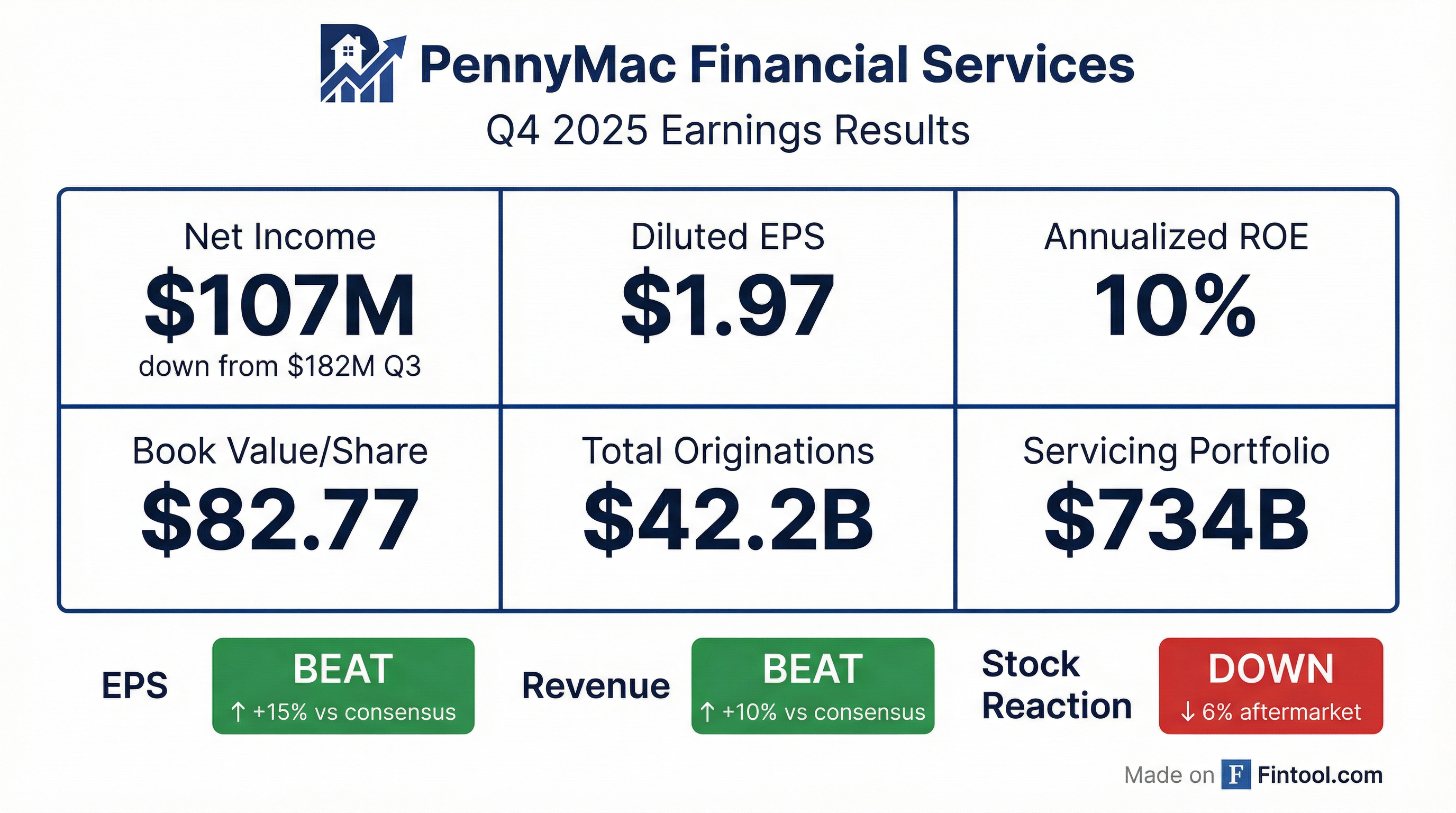

PennyMac Financial Services (PFSI) delivered a beat on both EPS and revenue in Q4 2025 but saw its stock drop approximately 6% in aftermarket trading. The culprit: increased MSR runoff that significantly outpaced production-related income growth, driving a 41% sequential decline in net income from Q3's $182 million to $107 million.

The quarter capped a strong full year, with 2025 delivering 61% year-over-year net income growth and a 12% return on equity. But investors appear focused on the sequential deterioration and what it signals for the rate environment ahead.

Did PennyMac Beat Earnings?

Yes — PennyMac beat on both lines:

*Values retrieved from S&P Global

The GAAP diluted EPS came in at $1.97, with net income of $107 million. Annualized ROE was 10%, while operating ROE also came in at 10%.

Key Q4 2025 metrics:

What Drove the Sequential Decline?

Management attributed the results to increased runoff of mortgage servicing rights, which outpaced production-related income growth.

Servicing Segment Dynamics:

- Servicing pretax income: $37 million (down from $157 million in Q3)

- MSR fair value changes and hedging results netted to just $1 million impact

- Realization of MSR cash flows jumped 32% from prior quarter as lower mortgage rates drove higher prepayment activity

- Actual CPR (prepayment rate) on owned portfolio surged to 13.0% from 8.6% in Q3

Production Segment Performance:

- Production pretax income: $127 million

- Total loan acquisitions/originations: $42.2 billion

- Revenue per fallout-adjusted lock: 78 bps (down from 86 bps in Q3)

- Consumer direct lock volume: $7.4 billion (up from $6.0 billion in Q3)

The company also sold $24 billion in UPB of low note-rate Ginnie Mae MSRs, with the servicing transfer completed after quarter-end.

How Did the Stock React?

Stock Reaction Summary:

Despite the aftermarket drop, PFSI remains up significantly over the past year, having more than doubled from its 52-week low near $86.

What Did Management Guide?

Management provided directional guidance for operating ROE:

"We expect PFSI's operating return on equity to move into the mid to high teens later in the year."

January 2026 Update: CEO David Spector noted that early Q1 trends are encouraging:

"January has been a good month. For a month that historically has been very slow coming out of the holidays, we've had a good production month. We're seeing nice increases in production."

Total volumes in January have been consistent with Q4, but with a mix shift toward higher-margin direct lending channels, driving expectations for Q1 production segment income to be higher than Q4.

Market Outlook:

The 2026 forecast shows refinance volume expected to grow 60% to $0.8 trillion, which would benefit PennyMac's consumer direct recapture strategy.

What Changed From Last Quarter?

Key Sequential Changes (Q3 → Q4 2025):

The servicing-related income (excluding valuation changes) was actually stable. The dramatic swing came from production segment profitability and the impact of MSR valuation-related items.

Full Year 2025 Highlights

Despite the weak Q4, full year 2025 was a strong year for PennyMac:

Production Segment Full Year:

- Pretax income: $370 million (up 19% Y/Y)

Servicing Segment Full Year:

- Pretax income: $325 million (up 58% Y/Y)

Market Position & Competitive Moat

PennyMac maintained its strong market position:

The company serviced 2.8 million customers as of quarter-end.

Technology Investments: The Vesta Transformation

PennyMac highlighted its investment in Vesta, a new loan origination system on track for full implementation across consumer direct in Q1 2026:

"This operational velocity has a direct financial impact, with a corresponding 25% decrease in our operational costs to originate, creating another lever in our pricing strategy."

When asked about Vesta benefits, CEO Spector confirmed it's both cost reduction AND capacity building:

"Throughout 2026... we're going to see more and more deployment of AI tools and AI agents that's really going to have a meaningful effect on our ability to originate a loan as inexpensive as anyone else in the industry, as quickly as anyone in the industry."

Balance Sheet & Liquidity

The hedge ratio increased from 85-90% last quarter to near 100%, providing greater protection if rates decline further.

Recapture Opportunity

PennyMac highlighted significant upside from refinance recapture as rates decline:

Total UPB of Loans with Note Rates >5%: $312B total, of which $209B have rates above 6%

Recapture Progress: Management noted recapture rates are improving, with upside potential from current levels. Key strategies include:

- Shifting focus from closed-end seconds to conventional recapture

- Targeted AI investments to drive higher recapture rates

- Deeper servicing integrations to anticipate borrower needs with real-time data

"Our customer relationships are our most important asset, and we are driving strategies to retain those customers for life."

Q&A Highlights: What Analysts Asked

On Capacity & Competition (Terry Ma, Barclays): When asked what went wrong with recapture despite preparations, CEO David Spector acknowledged:

"The competitive environment for refinances was, quite frankly, stronger than what I've seen historically in an interest rate decline... We're accelerating our move on to Vesta... we have to have capacity in place to deal with a 50-75 basis point rally in less than a week."

On Whether This Is a Structural Industry Change (Bose George, KBW):

"I'm not ready to declare it a structural change in the industry. The administration and others have been warning us for well over a year that they're going to be pulling levers to reduce rates. So I think it gave people the nod that they needed to have capacity in place."

On GSE Competition (Bose George, KBW): Spector noted that the GSE cash windows are driving conventional correspondent competition:

"On the conventional side, it was generally the cash windows. And I think that's going to be the story for 2026. With the announcement coming out of Washington, D.C., the GSEs are going to be very active."

On Trigger Lead Regulation: A competitive headwind is set to ease:

"At the top of the list [of runoff we didn't recapture] was broker originators. And I generally think that they're going to be hard-pressed to duplicate that once this trigger [lead] law comes into place."

The trigger lead regulation takes effect at the end of Q1 2026.

On Capacity for Future Rate Rallies (Trevor Cranston, Citizens JMP):

"There's no one driving for more capacity in this company more so than me... It is my stated goal to not be in this position where we're saying to you that we had amortization that exceeded the recapture necessary to balance it. And that's something that... is going to be achieved long before the end of the year."

On FHA Delinquencies (Shanna Chee, Barclays): FHA 60+ delinquencies rose to 7.5% from 5.9% sequentially. CFO Dan Perotti explained:

"The FHA did change its policy around modifications during the latter half of the year, moving from allowing streamlined modifications that required no trial payments to requiring trial payments. Really what that is going to result in is a bit of a lag in terms of loans that had been delinquent getting those modifications implemented."

On Buyback Authorization (Eric Hagen, BTIG):

"We have a little over $200 million of buyback available. And it's something that... we utilized ever so briefly in Q3. And it's something that we look at on a regular basis."

Key Risks & Watch Items

- Interest Rate Sensitivity: Higher rates drove MSR runoff that outpaced production, pressuring near-term results

- Production Margin Compression: Revenue per lock declined to 78 bps from 86 bps Q/Q due to higher competition

- Delinquency Trends: 60+ day delinquency on owned portfolio rose to 4.2% from 3.4%, consistent with seasonal trends

- Reliance on PMT: Continued dependence on PennyMac Mortgage Investment Trust for fulfillment volume

Forward Catalysts

- Rate Cuts: Fed easing would accelerate refinance activity and recapture opportunity

- Vesta Rollout: Full implementation in Q1 2026 with continued AI efficiency gains throughout the year

- Trigger Lead Regulation: Takes effect end of Q1 2026, reducing broker competition for recapture

- Market Growth: Industry forecasting $2.3-2.4T origination market in 2026

- Operating Leverage: Management targeting mid-to-high teens ROE by mid-2026

The Bottom Line

PennyMac delivered a solid beat on estimates and capped 2025 with 61% net income growth and 12% ROE. However, the Q4 sequential decline — driven by MSR runoff outpacing production in an unexpectedly competitive refinance market — spooked investors, sending shares down ~6% aftermarket.

Management was candid that the competitive environment for refinances was "stronger than I've seen historically" and that the industry had built capacity in anticipation of rate declines. But they're responding aggressively: accelerating Vesta deployment, building capacity for "flash rallies," and benefiting from the trigger lead regulation taking effect in Q1.

The setup for 2026 looks constructive: a forecasted $2.3-2.4 trillion origination market, $312 billion in above-5% rate loans primed for refinancing, efficiency gains from Vesta, and a hedge ratio now at ~100%. January is off to a good start with a favorable mix shift toward higher-margin direct lending. Management's goal to reach mid-to-high teens ROE by mid-2026 — and their stated commitment to never again have amortization exceed recapture — will be the key proof points to watch.