Earnings summaries and quarterly performance for PennyMac Financial Services.

Executive leadership at PennyMac Financial Services.

David A. Spector

Chairman and Chief Executive Officer

Abbie Tidmore

Senior Managing Director and Chief Revenue Officer

Daniel S. Perotti

Senior Managing Director and Chief Financial Officer

Derek W. Stark

Senior Managing Director, Chief Legal Officer and Secretary

Doug Jones

President and Chief Mortgage Banking Officer

James Follette

Senior Managing Director and Chief Digital Officer

Mark Elbaum

Senior Managing Director and Chief Capital Markets Officer

Board of directors at PennyMac Financial Services.

Anne D. McCallion

Director

Farhad Nanji

Director

Jeffrey A. Perlowitz

Independent Lead Director

Jonathon S. Jacobson

Director

Joseph Mazzella

Director

Lisa M. Shalett

Director

Patrick Kinsella

Director

Sunil Chandra

Director

Theodore W. Tozer

Director

Research analysts who have asked questions during PennyMac Financial Services earnings calls.

Bose George

Keefe, Bruyette & Woods

7 questions for PFSI

Crispin Love

Piper Sandler

7 questions for PFSI

Douglas Harter

UBS

6 questions for PFSI

Eric Hagen

BTIG

6 questions for PFSI

Ryan Shelley

Bank of America

5 questions for PFSI

Trevor Cranston

Citizens JMP

5 questions for PFSI

Michael Kaye

Wells Fargo & Company

4 questions for PFSI

Mark DeVries

Deutsche Bank

3 questions for PFSI

Terry Ma

Barclays

3 questions for PFSI

Derek Sommers

Jefferies

2 questions for PFSI

Shanna Chee

Barclays

2 questions for PFSI

Brian Fiorino

Wedbush Securities

1 question for PFSI

Doug Harter

UBS Group AG

1 question for PFSI

Gengxuan Qiu

Barclays

1 question for PFSI

Sienna Chu

Barclays

1 question for PFSI

Recent press releases and 8-K filings for PFSI.

- PennyMac Financial Services announced a definitive agreement to acquire Cenlar Capital’s subservicing business for an upfront payment of $172.5 million and up to $85 million in contingent consideration.

- This acquisition is expected to add approximately $740 billion in unpaid principal balance and about two million loans, expanding PennyMac's servicing portfolio to over $1 trillion and positioning it as the second-largest mortgage servicer in the U.S..

- The transaction is anticipated to close in the second half of 2026, pending regulatory approvals.

- TipRanks’ Spark maintains a Neutral with a Hold rating for PFSI, with a $115 target, citing risks such as negative operating cash flow, elevated leverage, and competitive margin pressure.

- PennyMac Financial Services, Inc. (Pennymac) has entered into a definitive agreement to acquire the subservicing business of Cenlar Capital Corporation (Cenlar).

- The acquisition is an all-cash transaction for an upfront purchase price of $172.5 million and up to $85 million of contingent consideration payable over three years.

- This transaction is expected to add up to $740 billion in unpaid principal balance (UPB) and 2 million loans to Pennymac's servicing portfolio, bringing its total portfolio to over $1 trillion in UPB.

- The transaction is expected to close in the second half of 2026 and is anticipated to be slightly dilutive to earnings in 2026 and 2027, with earnings accretion expected in 2028, reaching a normalized post-integration contribution to EPS of $2.00 annually.

- PennyMac Financial Services (Pennymac) has entered into a definitive agreement to acquire the subservicing business of Cenlar Capital Corporation (Cenlar).

- The acquisition is an all-cash transaction for an upfront purchase price of $172.5 million and up to $85 million in contingent consideration payable over three years.

- This transaction is expected to add up to $740 billion in unpaid principal balance (UPB) of mortgage loan subservicing and 2 million loans to Pennymac's portfolio, bringing its total portfolio to over $1 trillion in UPB.

- Upon completion, Pennymac is projected to become the second largest mortgage servicer overall and one of the largest subservicers in the U.S..

- The transaction is expected to close in the second half of 2026.

- The Law Offices of Frank R. Cruz announced a securities fraud investigation into PennyMac Financial Services, Inc. (PFSI) for possible violations of federal securities laws.

- This investigation follows the release of PennyMac's Q4 and full year 2025 financial results on January 29, 2026, where the company reported revenue of $538.01 million and earnings per share of $1.96, both missing consensus estimates.

- PennyMac's 10% return on equity (ROE) also missed its previous guidance of high-teens to low 20s.

- Following these announcements, PennyMac's stock price fell $49.78, or 33.25%, to close at $99.92 per share on January 30, 2026.

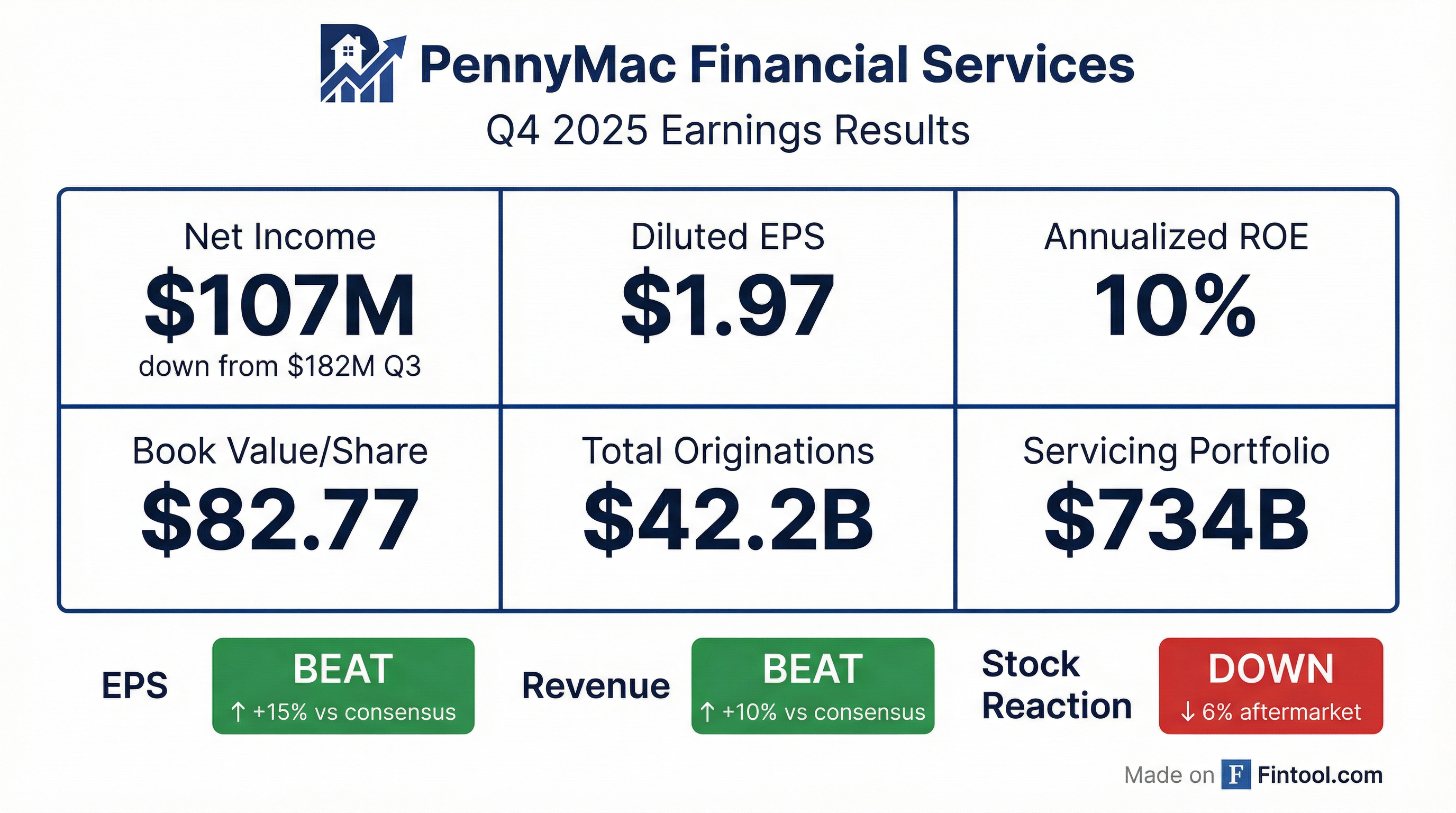

- PennyMac Financial Services reported net income of $107 million and diluted EPS of $1.97 for Q4 2025, with an annualized return on equity of 10%. For the full year 2025, the company achieved an annual return on equity of 12%, with net income growing 61% year-over-year.

- The Production Segment generated $127 million in pretax income in Q4 2025, contributing to $370 million for the full year 2025, an increase of 19% year-over-year. Total loan acquisitions and originations in Q4 2025 were $42.2 billion.

- The Servicing Segment reported $37 million in pretax income for Q4 2025, with full-year 2025 pretax income reaching $325 million, up 58% year-over-year. The total servicing portfolio UPB grew to $734 billion as of December 31, 2025, representing a 10% year-over-year increase.

- For 2025, PennyMac's market share was 19.4% in Correspondent Production, 5.5% in Broker Direct, 1.3% in Consumer Direct, and 5.0% in Loan Servicing.

- As of December 31, 2025, the company maintained a strong balance sheet with $4.6 billion in total liquidity and a Total Debt-to-Equity ratio of 3.6x.

- PFSI reported net income of $107 million or $1.97 per share for Q4 2025, with a 10% annualized return on equity. For the full year 2025, net income was up 61% from 2024, achieving a 12% return on equity.

- The company is accelerating the full implementation of its new Vesta loan origination system in Q1 2026, which is expected to drive 50% efficiency gains for loan officers and a 25% decrease in operational costs to originate.

- PFSI anticipates its operating return on equity to increase to the mid to high teens later in 2026, supported by strategic actions to enhance production income and higher recapture rates.

- The servicing portfolio reached $734 billion in unpaid principal balance by quarter-end, and the company's hedge ratio is now near 100%.

- PFSI declared a Q4 common share dividend of $0.30 per share and has over $200 million remaining in its share buyback authorization.

- PennyMac Financial Services (PFSI) reported net income of $107 million and $1.97 per share for Q4 2025, resulting in a 10% annualized return on equity. For the full year 2025, net income increased 61% and pretax income rose 38% from 2024, with a 12% return on equity.

- The company experienced a 32% increase in MSR cash flow realization due to higher prepayment speeds, which was not fully offset by production segment income growth in Q4 2025 due to competitive dynamics. Production segment pretax income was $127 million, up slightly from the prior quarter, with total acquisition and origination volumes increasing 16% to $42 billion UPB.

- PFSI is implementing its new Vesta loan origination system across its consumer direct channel in Q1 2026, aiming for 50% efficiency gains for loan officers and a 25% reduction in operational costs to originate. This is expected to drive operating return on equity into the mid to high teens later in 2026.

- The servicing portfolio grew to $734 billion UPB by year-end, and the company sold approximately $24 billion in low note-rate government MSRs to unlock capital for reinvestment. PFSI also has over $200 million in buyback authorization available.

- PennyMac Financial Services Inc. (PFSI) reported net income of $107 million, or $1.97 per share, for Q4 2025, resulting in an annualized return on equity (ROE) of 10%. For the full year 2025, the company achieved pretax income growth of 38% and net income growth of 61% compared to 2024, with a 12% ROE and 11% growth in book value per share.

- The company experienced significantly higher-than-expected market prepayment speeds in Q4 2025, which led to an increased realization of MSR cash flows and accelerated runoff of its servicing asset. While the production segment's pretax income increased slightly to $127 million, it did not fully offset the MSR runoff due to competitive dynamics in the origination market.

- PFSI is on track to fully implement Vesta, a new AI-enabled loan origination system, across its consumer direct channel in Q1 2026. This technology is expected to deliver 50% efficiency gains for loan officers, reduce loan processing time by approximately 25%, and decrease operational costs to originate by 25%.

- Management anticipates that PFSI's operating ROE will ramp throughout 2026, starting in the lower double digits and moving into the mid to high teens later in the year, driven by strategic actions and technology improvements. The company also sees potential for issuing additional unsecured debt in 2026 and beyond, while maintaining its non-funding debt-to-equity ratio around 1.5x.

- PennyMac Financial Services, Inc. reported net income of $106.8 million, or $1.97 per diluted share, on total net revenues of $538.0 million for the fourth quarter of 2025.

- For the full year 2025, the company achieved net income of $501.1 million on total net revenue of $2.0 billion, representing a return on equity of 12 percent.

- The Production segment's pretax income was $127.3 million and the Servicing segment's pretax income was $37.3 million in Q4 2025. Total loan acquisitions and originations reached $42.2 billion in unpaid principal balance (UPB), and the servicing portfolio grew to $733.6 billion in UPB by December 31, 2025.

- The Board of Directors declared a fourth quarter cash dividend of $0.30 per share.

- PennyMac Financial Services, Inc. (PFSI) reported net income of $106.8 million and diluted earnings per share of $1.97 for the fourth quarter of 2025, on total net revenues of $538.0 million.

- For the full year 2025, PFSI achieved net income of $501.1 million and total net revenue of $2.0 billion, delivering a 12 percent return on equity and 11 percent growth in book value per share to $82.77.

- The company's operational performance for 2025 included total loan production of $145.5 billion in UPB, a 25 percent increase from 2024, and its servicing portfolio grew to $733.6 billion in UPB by year-end.

- PFSI's Board of Directors declared a cash dividend of $0.30 per share for the fourth quarter of 2025.

Quarterly earnings call transcripts for PennyMac Financial Services.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more