Earnings summaries and quarterly performance for PROGRESSIVE CORP/OH/.

Executive leadership at PROGRESSIVE CORP/OH/.

Susan Patricia Griffith

President and Chief Executive Officer

Carl G. Joyce

Vice President and Chief Accounting Officer

John Murphy

Claims President

John P. Sauerland

Vice President and Chief Financial Officer

Karen B. Bailo

Commercial Lines President

Patrick K. Callahan

Personal Lines President

Board of directors at PROGRESSIVE CORP/OH/.

Barbara R. Snyder

Director

Charles A. Davis

Director

Devin C. Johnson

Director

Jeffrey D. Kelly

Director

Kahina Van Dyke

Director

Lawton W. Fitt

Chairperson of the Board

Pamela J. Craig

Director

Philip Bleser

Director

Roger N. Farah

Director

Stuart B. Burgdoerfer

Director

Research analysts who have asked questions during PROGRESSIVE CORP/OH/ earnings calls.

David Motemaden

Evercore ISI

6 questions for PGR

C. Gregory Peters

Raymond James

5 questions for PGR

Elyse Greenspan

Wells Fargo

5 questions for PGR

Michael Zaremski

BMO Capital Markets

4 questions for PGR

Alex Scott

Barclays PLC

3 questions for PGR

Jian Huang

Morgan Stanley

3 questions for PGR

Jimmy Bhullar

JPMorgan Chase & Co.

3 questions for PGR

Josh Shanker

Bank of America

3 questions for PGR

Joshua Shanker

Bank of America Merrill Lynch

3 questions for PGR

Andrew Andersen

Jefferies

2 questions for PGR

Bob Huang

Morgan Stanley

2 questions for PGR

Brian Meredith

UBS

2 questions for PGR

Jamminder Bhullar

JPMorgan Chase & Co.

2 questions for PGR

Meyer Shields

Keefe, Bruyette & Woods

2 questions for PGR

Michael Phillips

Oppenheimer & Co. Inc.

2 questions for PGR

Mike Zaremski

BMO Capital Markets

2 questions for PGR

Paul Newsome

Piper Sandler Companies

2 questions for PGR

Robert Cox

The Goldman Sachs Group, Inc.

2 questions for PGR

Ryan Tunis

Cantor Fitzgerald

2 questions for PGR

Tracy Benguigui

Wolfe Research

2 questions for PGR

Hristian Getsov

Wells Fargo

1 question for PGR

Katie Sakys

Autonomous Research

1 question for PGR

Recent press releases and 8-K filings for PGR.

- $5 billion one-time dividend announced for auto policyholders, averaging $100 per vehicle across 49 million vehicles, to be paid this summer.

- Eligibility limited to customers with a Private Passenger Auto Voluntary Preferred policy in force as of December 31, 2025.

- Dividend enabled by stronger-than-expected underwriting performance, investment gains, and industry trends such as lower repair costs and fewer collisions.

- Accompanies 10% rate cuts in 40 states, estimated to save customers $4.6 billion annually.

- In 2025, reported $132.3 billion in total revenue and $12.9 billion in net income, with the auto segment swinging from a $2.7 billion underwriting loss in 2024 to a $4.6 billion underwriting gain in 2025.

- Net premiums written totaled $6,735 million in January 2026 (up 4% YoY); net income was $1,163 million, diluted EPS was $1.98, and the combined ratio was 84.4%.

- Total policies in force grew 10% YoY to 38.875 million, including 37.686 million personal lines policies (up 10%) and 1.189 million commercial lines policies (up 4%) as of January 31, 2026.

- Total investments were $91,815 million, shareholders’ equity was $31,191 million, and the debt-to-total capital ratio stood at 18.1% as of January 31, 2026.

- The company will hold its Q4 2025 investor conference call on March 3, 2026, and plans to release February results on March 18, 2026.

- Progressive reported net premiums written of $6.735 billion (up 4%) and net premiums earned of $6.921 billion (up 5%) for January 2026 vs. January 2025.

- The company achieved net income of $1.163 billion, or $1.98 per share, representing a 4% increase year-over-year.

- The combined ratio was 84.4, a 0.3-point rise from 84.1 in January 2025.

- Total policies in force rose 10% to 38.875 million, with growth across personal and commercial lines.

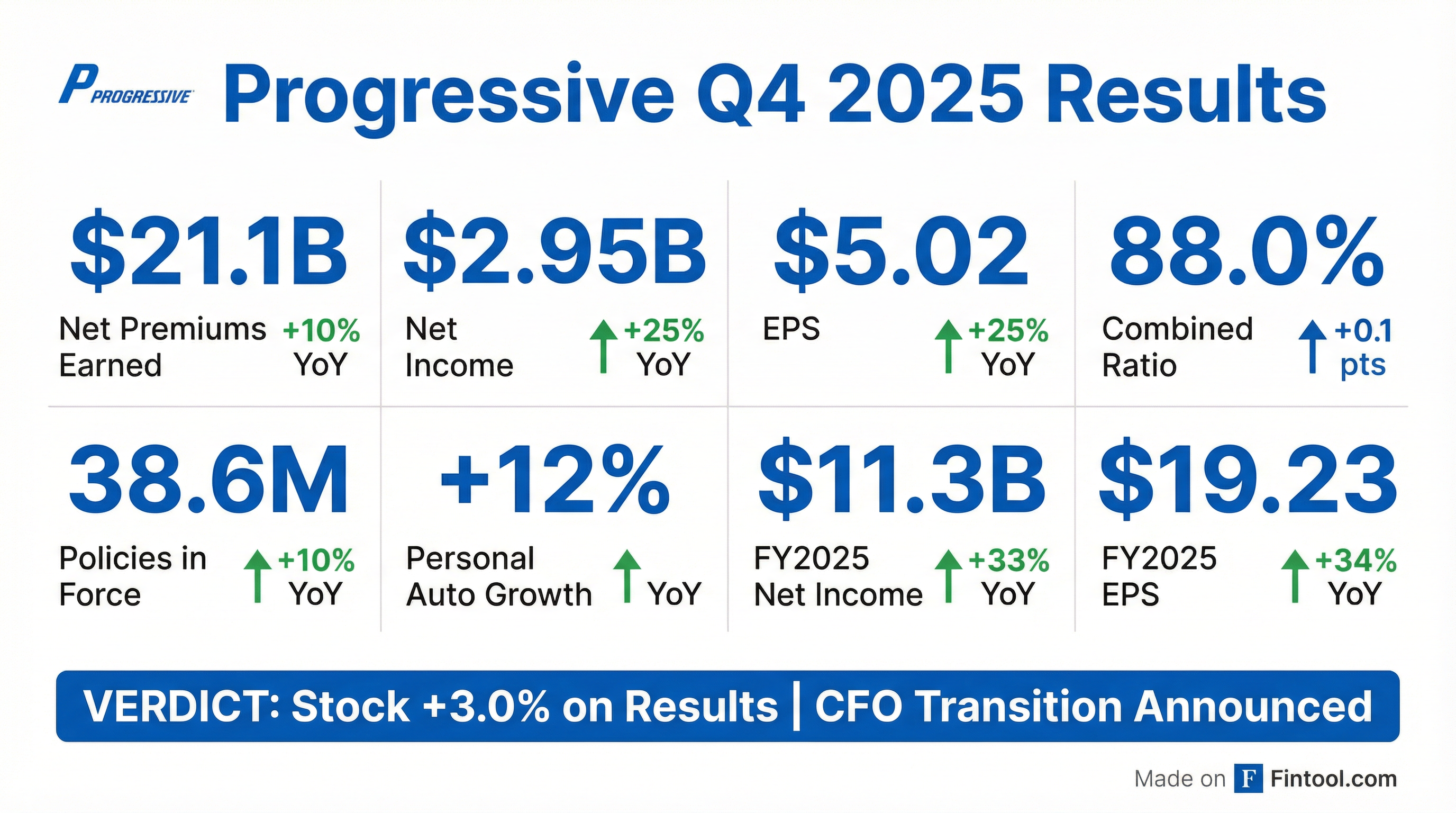

- Net premiums earned in Q4 2025 totaled $21.093 billion (up 10% YoY), with net income of $2.951 billion (up 25%) and a combined ratio of 88.0.

- For December 2025, net premiums written were $6.313 billion (up 6%), and net income was $1.147 billion (up 22%), with a combined ratio of 87.1.

- CFO John P. Sauerland will retire on July 3, 2026, and Andrew J. Quigg is expected to succeed him.

- John Sauerland, Progressive’s CFO since April 2015, will retire on July 3, 2026, after 35 years with the company; Andrew Quigg, CSO since 2018, is expected to succeed him

- Progressive closed 2025 with full-year net income near $11.3 billion and a companywide combined ratio of about 87.4

- Full-year net premiums written (NPW) reached about $83.2 billion, up 12%, driven by 19% growth in the direct channel and 11% in the agency channel

- In Q4 2025, NPW were about $21.1 billion, the combined ratio was 88, and December net income was roughly $1.15 billion, up 22% year-over-year

- Net premiums written rose 8% year-over-year to $19.508 billion in Q4 2025.

- Net premiums earned climbed 10% to $21.093 billion in the quarter.

- Net income increased 25% to $2.951 billion, driving EPS of $5.02, up 25%.

- Combined ratio was 88.0, marginally above last year’s 87.9 points, and policies in force grew 10% to 38.6 million.

- November 2025: Net premiums written of $6,193 million (+11%), net premiums earned of $6,894 million (+14%), net income of $958 million and EPS of $1.63 (–5%).

- Year-to-date Nov 30, 2025: Net premiums written of $76,861 million (+12%), net premiums earned of $74,540 million (+16%), net income of $10,161 million and diluted EPS of $17.28.

- Performance metrics: November combined ratio was 87.1%, while the year-to-date combined ratio stood at 87.5%.

- Dividend declaration: Board approved a $13.50 annual common share dividend and a $0.10 quarterly common share dividend, both payable January 8, 2026.

- Net premiums written rose 11% to $6.193 billion in November 2025

- Net premiums earned increased 14% to $6.894 billion

- Net income was $958 million, down 5% year-over-year, or $1.63 EPS

- Combined ratio widened 1.5 points to 87.1%

- Total policies in force grew 11% to 38.414 million companywide

- $13.50 annual dividend for 2025, tripling last year’s $4.50 payout, alongside the regular $0.10 quarterly dividend.

- Payable on January 8, 2026 to shareholders of record as of January 2, 2026.

- Total dividend commitment of $7.9 billion based on 586.4 million shares outstanding.

- Board cited the company’s strong capital position and robust profitability (net margin 12.58%, EBITDA margin 16.55%, ROE 35.77%).

- Annual meeting set for May 8, 2026 with record date March 13, 2026.

- Net premiums written for October 2025 were $7.002 billion (up 6% YoY), net income was $846 million (up 107% YoY), and the combined ratio was 89.7%

- Year-to-date through October 31, 2025, net premiums written reached $70.668 billion (up 12% YoY), with net income of $9.203 billion (up 41% YoY) and a combined ratio of 87.5%

- Policies in force as of October 31, 2025 grew 12% YoY to 38.379 million

- Progressive will release November results on December 17, 2025, before market open

Fintool News

In-depth analysis and coverage of PROGRESSIVE CORP/OH/.

Quarterly earnings call transcripts for PROGRESSIVE CORP/OH/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more