PULTEGROUP INC/MI/ (PHM)·Q4 2025 Earnings Summary

PulteGroup Q4 2025: Revenue Beats as EPS Misses on One-Time Charges

January 29, 2026 · by Fintool AI Agent

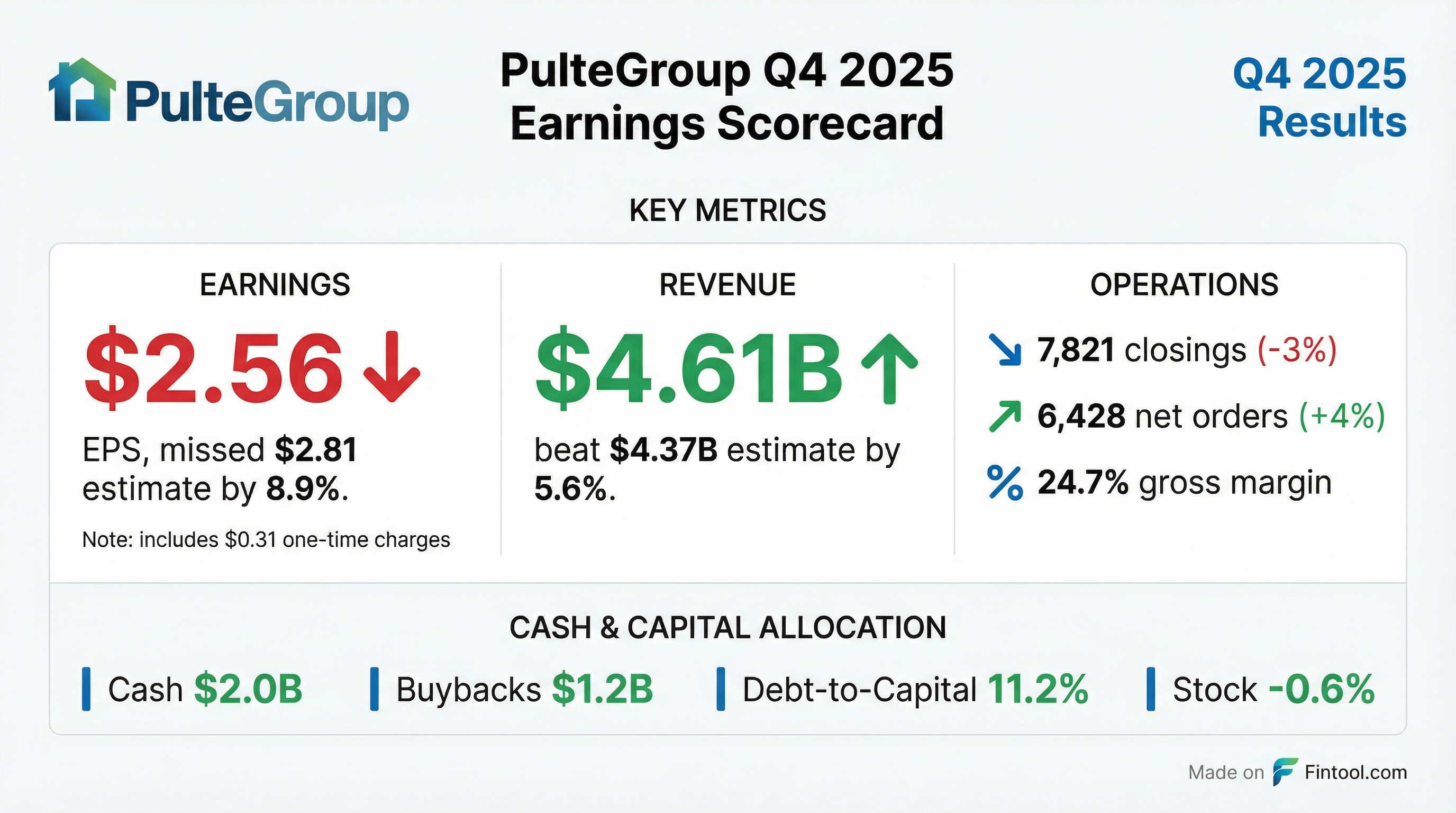

PulteGroup (PHM) reported Q4 2025 results with a revenue beat offset by an EPS miss driven by one-time charges. The homebuilder generated $4.61 billion in total revenues, beating consensus by 5.6%, while EPS of $2.56 missed estimates by 8.9% primarily due to an $81 million charge related to the intended divestiture of manufacturing assets.

Net new orders rose 4% year-over-year to 6,428 homes, a positive signal despite what CEO Ryan Marshall called "lagging consumer confidence" weighing on homebuyer demand.

Did PulteGroup Beat Earnings?

Revenue: Beat by 5.6% — Total revenues of $4.61 billion exceeded consensus of $4.37 billion. Home sale revenues were $4.48 billion, down 5% year-over-year due to 3% fewer closings and 1% lower average selling prices.

EPS: Missed by 8.9% — Reported EPS of $2.56 missed the $2.81 consensus estimate. However, reported earnings included several notable items:

Excluding these items, adjusted EPS would be approximately $2.88, largely in line with consensus.

Historical Context: The EPS miss marks the first sub-$3.00 quarter in Q4 since 2023, though this comparison is skewed by Q4 2024's $4.43 EPS which included a $255 million insurance benefit.

What Changed From Last Quarter?

Gross Margin Compression Continues: Home sale gross margin declined to 24.7% from 26.4% in Q3 2025, though 80 basis points of this decline is attributable to land impairment charges. The underlying margin erosion reflects ongoing pricing pressure in the housing market.

Incentives Rising: Current period incentives reached 9.9% of home sale revenues, up meaningfully from 7.2% a year ago and 8.9% in Q3 2025. This escalating incentive spend, primarily through mortgage rate buydowns, is a key driver of gross margin pressure and signals continued buyer resistance at current price points.

*Values from S&P Global

Order Momentum Improved: Net new orders of 6,428 homes (+4% YoY) represents an improvement after declines in recent quarters. The order value of $3.5 billion was flat year-over-year despite the volume increase, suggesting some price concessions.

Backlog Shrinking: Ending backlog of 8,495 homes ($5.3B value) is down 16% in units and 19% in value versus Q4 2024's 10,153 homes ($6.5B). This reflects the industry-wide trend of faster turn times and less forward visibility.

Spec Strategy Shift: Total specs declined 18% YoY to 7,216 homes, with finished specs at ~2,000 units. Management has matched starts to sales for "the last 4-5 months" and is targeting a return to 60%+ build-to-order mix. Current cycle times of ~100 days (some markets in the 70s) enable more flexible BTO production.

How Did the Stock React?

PHM shares rallied +3.6% to $127.74 following the earnings call, after initially closing down 0.5% at $123.27 on the release day. The post-call strength suggests investors were encouraged by management's detailed guidance and cautiously optimistic spring selling outlook.

Recent Stock Performance:

- 52-week high: $142.11

- 52-week low: $88.07

- Current: $127.74 (up 3.6% post-earnings)

- 50-day avg: $123.65

The rally suggests the market looked through one-time charges and focused on the unchanged FY 2026 guidance, pristine balance sheet, and management's comment that early January demand followed "expected seasonal increase" patterns.

What Did Management Say?

CEO Ryan Marshall's commentary struck a cautiously optimistic tone, acknowledging headwinds while highlighting operational discipline:

"PulteGroup's fourth quarter and full year financial results reflect our balanced and disciplined approach to the business as we continue to successfully navigate today's continuously shifting market dynamics."

On Demand Environment:

"While lower interest rates and more favorable pricing dynamics have worked to improve the overall affordability of new homes relative to a year ago, lagging consumer confidence continued to weigh on homebuyer demand in the quarter."

On Strategy:

"Given these market dynamics, we remain focused on intelligently turning our assets, generating strong cash flows, and further developing a land pipeline that can routinely support community count growth of 3% to 5% annually."

What Did Management Guide?

PulteGroup provided detailed guidance for Q1 2026 and full year 2026:

Q1 2026 Guidance:

Full Year 2026 Guidance:

Guidance Implications: The midpoint of FY 2026 closings guidance (28,750 homes) would represent a decline of ~3% versus FY 2025's 29,572 closings. Gross margin guidance of 24.5%-25.0% is roughly flat with Q4 2025's 24.7% but below FY 2025's 26.3% full-year margin, signaling continued pricing pressure into 2026.

Regional Performance: Where Is PulteGroup Winning?

Key Takeaway: Florida and Southeast are driving growth, with Florida closings up 7% and orders up 13%. Within Florida, Fort Myers, Naples, Palm Beach, Vero Beach, Fort Lauderdale, and Orlando are outperforming, while Tampa and Jacksonville remain "stable but not as good."

The West region saw significant weakness with closings down 20% YoY, reflecting affordability challenges and tech employment softness. CEO Marshall called out Colorado as "more challenged" given its expensive market conditions similar to Texas's post-COVID correction.

Management noted some signs of "bottoming" in Dallas and San Antonio, though improvements are "likely the result of pricing actions" to find clearing prices.

Buyer Segment Mix: Who Is Buying?

PulteGroup's diversified buyer approach spans three distinct segments with different economics:

Segment Dynamics:

- First-Time Buyers represent the largest addressable market but are most sensitive to interest rates and monthly payments. PulteGroup uses spec-production and mortgage rate buydowns to capture this segment.

- Move-Up Buyers generate higher margins through lot premiums and customization options. This experienced buyer segment can afford to select lot and home options.

- Active Adult via the Del Webb brand commands the most pricing power as these buyers are the most financially capable with the highest percentage of cash buyers. Management confirmed Del Webb is trending toward the 25% volume target, up from 22-24% currently, driven by new community openings.

Capital Allocation: Buybacks and Balance Sheet

PulteGroup maintained its aggressive capital return program while preserving financial flexibility:

Q4 2025:

- Share repurchases: $300 million (2.4 million shares)

Full Year 2025:

- Share repurchases: $1.2 billion (10.6 million shares, 5.2% of shares outstanding)

- Average repurchase price: $112.76 per share

Balance Sheet Highlights (Dec 31, 2025):

The company is effectively debt-free on a net basis, with cash exceeding total debt. This provides substantial optionality for opportunistic land purchases if market conditions deteriorate further.

Land Investment: PulteGroup invested $5.2 billion in land acquisition and development during 2025, including $1.4 billion in Q4. The company controls approximately 235,000 lots, with 57% held via options and 43% owned outright. Management targets 70% optioned lots long-term to enhance ROIC and mitigate market risk.

Full Year 2025 Summary

Financial Services Segment

The mortgage business showed weakness reflecting lower homebuilding volumes:

Q&A Highlights: What Analysts Asked

The earnings call Q&A covered several key topics that shed light on management's thinking:

On Build-to-Order Strategy: Management emphasized a strategic shift back toward built-to-order (BTO) production, targeting 60%+ BTO vs 40% spec (currently inverted). CEO Ryan Marshall noted BTO homes generate "hundreds of basis points" higher gross margins due to lot premiums and option revenue.

"Ideally, what we're really endeavoring to do is to move back more into a built-to-order builder where 60+% of our sales are built-to-order, 40% are spec."

On Forward Commitments for BTO: The financial services team has developed forward rate lock programs for BTO homes, enabled by faster 100-day cycle times. Rates are within ~50 bps of spec offers, in the low-to-mid 5% range.

On ICG Divestiture Rationale: Management explained the off-site manufacturing exit as a capital allocation decision, not a rejection of innovation:

"We really believe in the innovation that we got out of ICG. We believe we'll continue to benefit from that innovation. But it comes down to what's the best allocation of our resources. Both time, money, and focus is probably the short answer."

On 2026 Margin Bridge: CFO Jim Ossowski detailed the FY 2026 gross margin outlook components:

- ASP: Flat year-over-year

- House costs (sticks & bricks): Flat to slightly down

- Land costs: Up 7-8% (already locked in)

- Incentives: Expected to remain elevated

On Labor and Materials: Some tailwinds emerging with "a little bit of help on the lumber side" and labor availability improving. The guidance incorporates potential tariff impacts.

On Florida Submarket Performance: CEO Marshall highlighted Florida's 14% YoY order growth with particular strength in Fort Myers, Naples, Palm Beach, Vero Beach, Fort Lauderdale, and Orlando. Tampa and Jacksonville were described as "stable but not as good as the others."

On West Region Challenges: The West region's struggles stem from affordability (highest home prices nationally) combined with tech sector employment weakness. Colorado was specifically cited as "more challenged."

On Land Deal Renegotiations: While some opportunities exist to renegotiate land deal pricing and timing, management noted these benefits will flow to FY 2027-2028 closings, not 2026.

Forward Catalysts and Risks

Potential Catalysts:

- Improved affordability setup — Mortgage rates ~100 bps lower YoY, wages up 4%, and new home prices reset lower through incentives. CEO Marshall called this "a much better position heading into the 2026 spring selling season."

- Early January demand tracking seasonally — "The first few weeks of January have also demonstrated the expected seasonal increase in demand as we move from December into the start of the new year."

- Community count growth of 3-5% provides volume upside

- Strong balance sheet enables opportunistic M&A or land purchases

- Florida inventory "generally stable to improving modestly"

Key Risks:

- Consumer confidence critical — "Consumer confidence will be a critical component to determining just how strong buyer demand will be in the months to come."

- Gross margin pressure may persist as incentives remain elevated

- Land cost inflation of 7-8% already locked in for 2026

- West region and Texas demand remain sluggish

Links

- PulteGroup Company Profile

- Q4 2025 Earnings Call Transcript

- Q4 2025 8-K Filing

- Q3 2025 Earnings Review

This analysis is based on PulteGroup's Q4 2025 8-K filing, earnings presentation slides, and earnings call transcript published January 29, 2026.