Earnings summaries and quarterly performance for PULTEGROUP INC/MI/.

Executive leadership at PULTEGROUP INC/MI/.

Ryan R. Marshall

President and Chief Executive Officer

James L. Ossowski

Executive Vice President and Chief Financial Officer

Kevin A. Henry

Executive Vice President and Chief People Officer

Matthew Koart

Executive Vice President and Chief Operating Officer

Todd N. Sheldon

Executive Vice President, General Counsel and Corporate Secretary

Board of directors at PULTEGROUP INC/MI/.

André J. Hawaux

Director

Brian P. Anderson

Director

Bryce Blair

Director

Cheryl W. Grisé

Director

John R. Peshkin

Director

Kristen Actis-Grande

Director

Lila Snyder

Director

Scott F. Powers

Director

Thomas J. Folliard

Non-Executive Chairman of the Board

Research analysts who have asked questions during PULTEGROUP INC/MI/ earnings calls.

John Lovallo

UBS Group AG

8 questions for PHM

Michael Rehaut

JPMorgan Chase & Co.

8 questions for PHM

Stephen Kim

Evercore ISI

8 questions for PHM

Alan Ratner

Zelman & Associates

7 questions for PHM

Anthony Pettinari

Citigroup Inc.

6 questions for PHM

Kenneth Zener

Seaport Research Partners

6 questions for PHM

Sam Reid

Wells Fargo

5 questions for PHM

Matthew Bouley

Barclays PLC

4 questions for PHM

Matthew Bouley

Barclays

4 questions for PHM

Carl Reichardt

BTIG, LLC

3 questions for PHM

Jay McCanless

Wedbush Securities

3 questions for PHM

Michael Dahl

RBC Capital Markets

3 questions for PHM

Mike Dahl

RBC Capital Markets

3 questions for PHM

Rafe Jadrosich

Bank of America

3 questions for PHM

Susan Maklari

Goldman Sachs Group Inc.

3 questions for PHM

Trevor Allinson

Wolfe Research, LLC

2 questions for PHM

Truman Patterson

Wolfe Research

2 questions for PHM

Buck Horne

Raymond James Financial, Inc.

1 question for PHM

Christopher Kalata

RBC Capital Markets

1 question for PHM

Ivy Lynne Zelman

Zelman & Associates

1 question for PHM

Paul Przybylski

Wolfe Research, LLC

1 question for PHM

Rafe Chadrosic

Bank of America

1 question for PHM

Richard Reid

Wells Fargo & Company

1 question for PHM

Recent press releases and 8-K filings for PHM.

- On February 20, 2026, PulteGroup completed a public offering of $800 million aggregate principal amount of senior unsecured notes: $400 million 4.250% notes due 2031 and $400 million 4.900% notes due 2036.

- The notes were issued under an Indenture dated February 5, 2026, as supplemented on February 20, 2026, and are unconditionally guaranteed on a senior basis by the Company’s U.S. subsidiaries.

- The 2031 notes mature on March 1, 2031, and the 2036 notes mature on March 1, 2036, with interest payable semi-annually on March 1 and September 1, beginning September 1, 2026.

- Prior to their respective par call dates, the notes are redeemable at a make-whole redemption price; at or after par call dates, they may be redeemed at 100% of principal plus accrued interest.

- In the event of a change of control, PulteGroup must offer to repurchase the notes at 101% of principal plus accrued interest.

- PulteGroup priced an $800 million underwritten offering of senior unsecured notes: $400 million 4.25% notes due March 1, 2031 and $400 million 4.90% notes due March 1, 2036 at a 99.658% public offering price for the 2031 tranche.

- Net proceeds will repay senior notes maturing in March 2026 and redeem $337.3 million of 5.00% notes due 2027 (redeemed March 13, 2026).

- Management aims to stagger and extend maturities, lower interest costs and maintain financial flexibility with any remaining proceeds available for general corporate purposes.

- Analysts hold a “Buy” rating with a $152 price target and Spark AI labels PulteGroup “Outperform,” citing robust margins and liquidity against housing affordability and regional demand risks.

- PulteGroup priced an $800 million underwritten public offering of senior unsecured notes, consisting of $400 million 4.250% notes due March 1, 2031 (priced at 99.658%, yield 4.326%) and $400 million 4.900% notes due March 1, 2036 (priced at 99.038%, yield 5.023%).

- The offering is expected to close on or about February 20, 2026, subject to customary closing conditions.

- Net proceeds will be used to repay $251.9 million principal of 5.500% senior notes due March 2026 and redeem $337.3 million principal of 5.000% senior notes due January 2027 (including premiums and accrued interest); remaining proceeds for general corporate purposes.

- J.P. Morgan Securities LLC, BofA Securities, Inc., Truist Securities, Inc., U.S. Bancorp Investments, Inc., and other firms are serving as joint book-running managers.

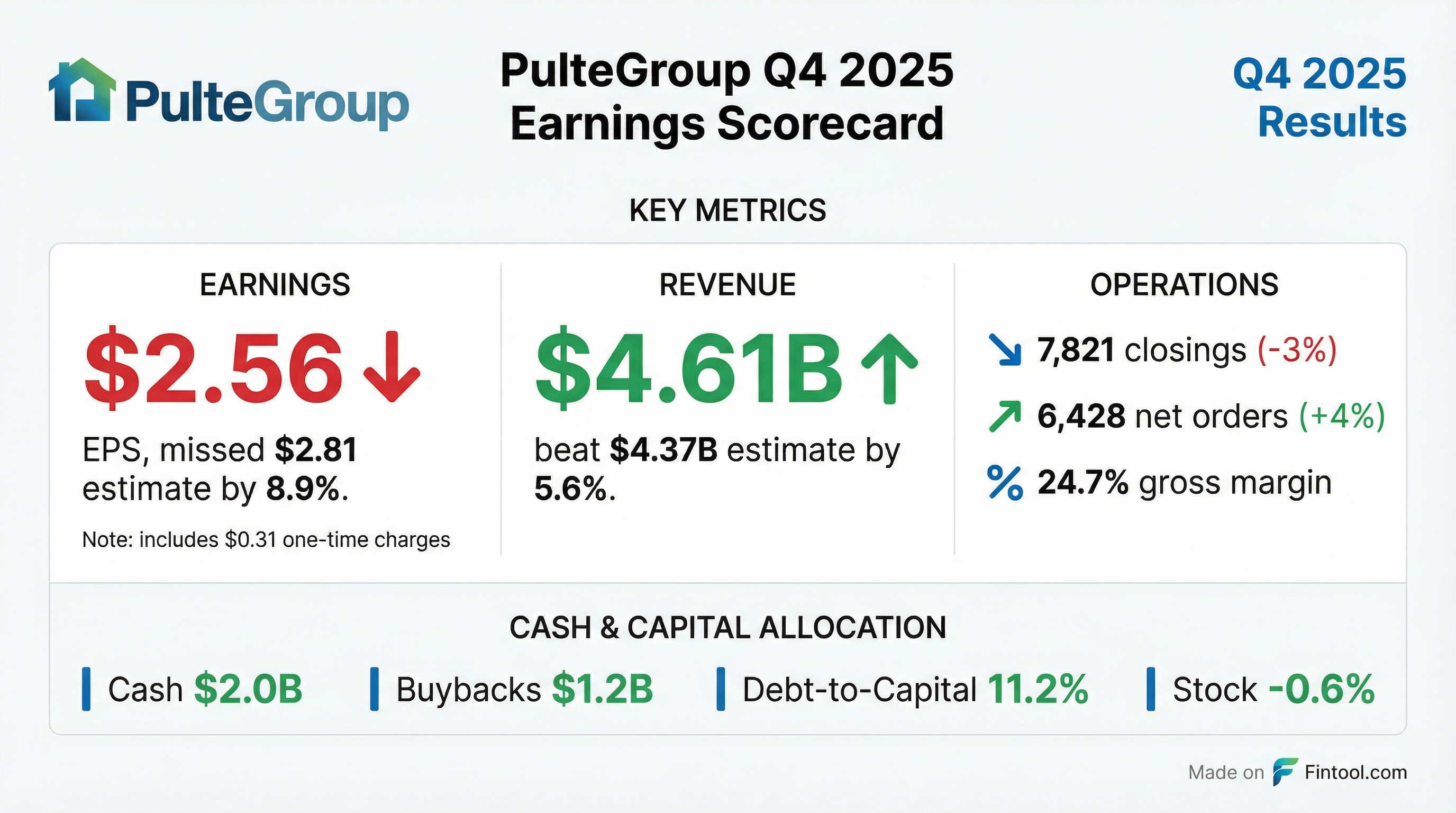

- Home sale revenues of $4.5 billion (-5% YoY), 7,821 homes closed (-3%), and $573,000 average sales price (-1%) in Q4 2025.

- Gross margin of 24.7% (including $35 million of land impairments) and incentives at 9.9% of sales versus 7.2% in Q4 2024.

- Net income of $502 million (EPS $2.56) versus $913 million (EPS $4.43) in Q4 2024; full-year 2025 net income of $2.2 billion (EPS $11.12).

- Strong liquidity with $2 billion cash, net debt-to-capital of -3%, and 235,000 lots under control at year-end.

- 2026 guidance: Q1 closings of 5,700–6,100 homes, full-year closings of 28,500–29,000 homes, ASP of $550,000–560,000, and gross margins of 24.5–25.0%.

- Q4 home sale revenues of $4.5 billion (-5% y/y) on 7,821 closings (-3% y/y) with an average selling price of $573,000 (-1% y/y).

- Q4 gross margin of 24.7% versus 27.5% last year, including $35 million of land impairments (80 bps) and incentives of 9.9% of home sale price (7.2% LY).

- Q4 net income of $502 million or $2.56 per share, down from $913 million or $4.43 PS in Q4 2024; FY 2025 net income of $2.2 billion or $11.12 PS.

- Year-end liquidity and capital allocation: $2 billion cash, net debt-to-capital of -3% ; repurchased 10.6 million shares for $1.2 billion in 2025, with $983 million remaining authorization.

- 2026 guidance: 28,500–29,000 home closings; ASP of $550,000–$560,000; gross margin 24.5%–25.0%; SG&A 9.5%–9.7% of revenue; tax rate ~24.5%.

- Reported net income of $502 million, or $2.56 per share, in Q4 2025.

- Home sale revenues declined 5% to $4.5 billion; Q4 closings were 7,821 homes (-3% YoY) with an average sales price of $573,000.

- Q4 home sale gross margin contracted to 24.7% from 27.5% a year ago; incentives rose to 9.9% of revenues (vs. 7.2% in Q4 2024).

- Issued Q1 2026 guidance for 5,700–6,100 closings, 24.5–25.0% gross margin, and average sales price of $550–560K.

- Returned capital with repurchases of 2.4 million shares for $300 million in Q4 (10.6 million shares/$1.2 billion full-year) and ended 2025 with $2.0 billion cash and an 11.2% debt-to-capital ratio.

- PulteGroup closed 2025 with home sale revenues of $16.7 billion, gross/operating margins of 26.3%/16.9%, net income of $2.2 billion, and cash flow from operations of $1.9 billion.

- In Q4 2025, the company delivered $4.5 billion in home sale revenues on 7,821 closings and reported a 24.7% gross margin (including $35 million of land impairments).

- For 2026, PulteGroup guides to 28,500–29,000 home closings, an average sales price of $550,000–$560,000, gross margins of 24.5%–25.0%, and SG&A of 9.5%–9.7% of revenue.

- The balance sheet remains strong with $2 billion of cash, a net debt-to-capital ratio of –3%, and 235,000 lots under control; the company also plans to divest its off-site manufacturing operations, recording an $81 million charge in Q4.

- PulteGroup reported net income of $502 million, or $2.56 per diluted share, in Q4 2025, compared with $913 million, or $4.43 per share, in Q4 2024.

- Q4 home sale revenues were $4.48 billion from 7,821 closings at an average selling price of $573,000, down 5% and 1%, respectively, year-over-year.

- Net new orders increased 4% to 6,428 homes with a value of $3.5 billion, and the ending backlog was 8,495 homes valued at $5.3 billion.

- The Company repurchased 2.4 million shares for $300 million in Q4, ended the quarter with $2.0 billion of cash, and maintained a debt-to-capital ratio of 11.2%.

- $502 million net income, or $2.56 EPS in Q4 2025

- $4.5 billion home sale revenues from 7,821 closings; average sales price of $573,000

- 6,428 net new orders (+4% YoY) valued at $3.5 billion

- Home sale gross margin of 24.7%, down from 27.5%, including $35 million of land impairment charges

- Invested $1.4 billion in land acquisition and repurchased $300 million of common shares

- PulteGroup reported TTM ended 9/30/25 ROE of 21%, land & development spend of $5.3 B, cash from operations of $1.7 B, and returned $1.4 B to shareholders.

- It operates 968 active communities across 26 states (47 markets), has delivered ~30 K homes TTM, with ASP $569 K and home sales gross margin 27%.

- The strategy emphasizes disciplined land underwriting (42% owned, 58% optioned lots), integrated design/build processes, and data-driven market segmentation for risk-adjusted returns.

- The balance sheet remains strong with $1.5 B cash, $12.8 B equity and an 11.2% debt-to-capital ratio as of 9/30/25.

Quarterly earnings call transcripts for PULTEGROUP INC/MI/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more