Earnings summaries and quarterly performance for IMPINJ.

Executive leadership at IMPINJ.

Board of directors at IMPINJ.

Research analysts who have asked questions during IMPINJ earnings calls.

Troy Jensen

Cantor Fitzgerald

6 questions for PI

Christopher Rolland

Susquehanna Financial Group

4 questions for PI

Guy Hardwick

Freedom Capital Markets

4 questions for PI

Harsh Kumar

Piper Sandler & Co.

4 questions for PI

James Ricchiuti

Needham & Company, LLC

4 questions for PI

Scott Searle

ROTH MKM

4 questions for PI

Ezra Weener

Jefferies LLC

2 questions for PI

Harsh V. Kumar

Piper Sandler

2 questions for PI

James Andrew Ricchiuti

Needham & Company

2 questions for PI

Natalia Winkler

UBS

2 questions for PI

Scott Wallace Searle

ROTH Capital Partners

2 questions for PI

Blayne Curtis

Jefferies Financial Group

1 question for PI

Dylan Oliver

Susquehanna Financial Group

1 question for PI

Dylan Olivier

Susquehanna International Group

1 question for PI

Ezra Ma

Jefferies

1 question for PI

Mark Lipacis

Evercore ISI

1 question for PI

Recent press releases and 8-K filings for PI.

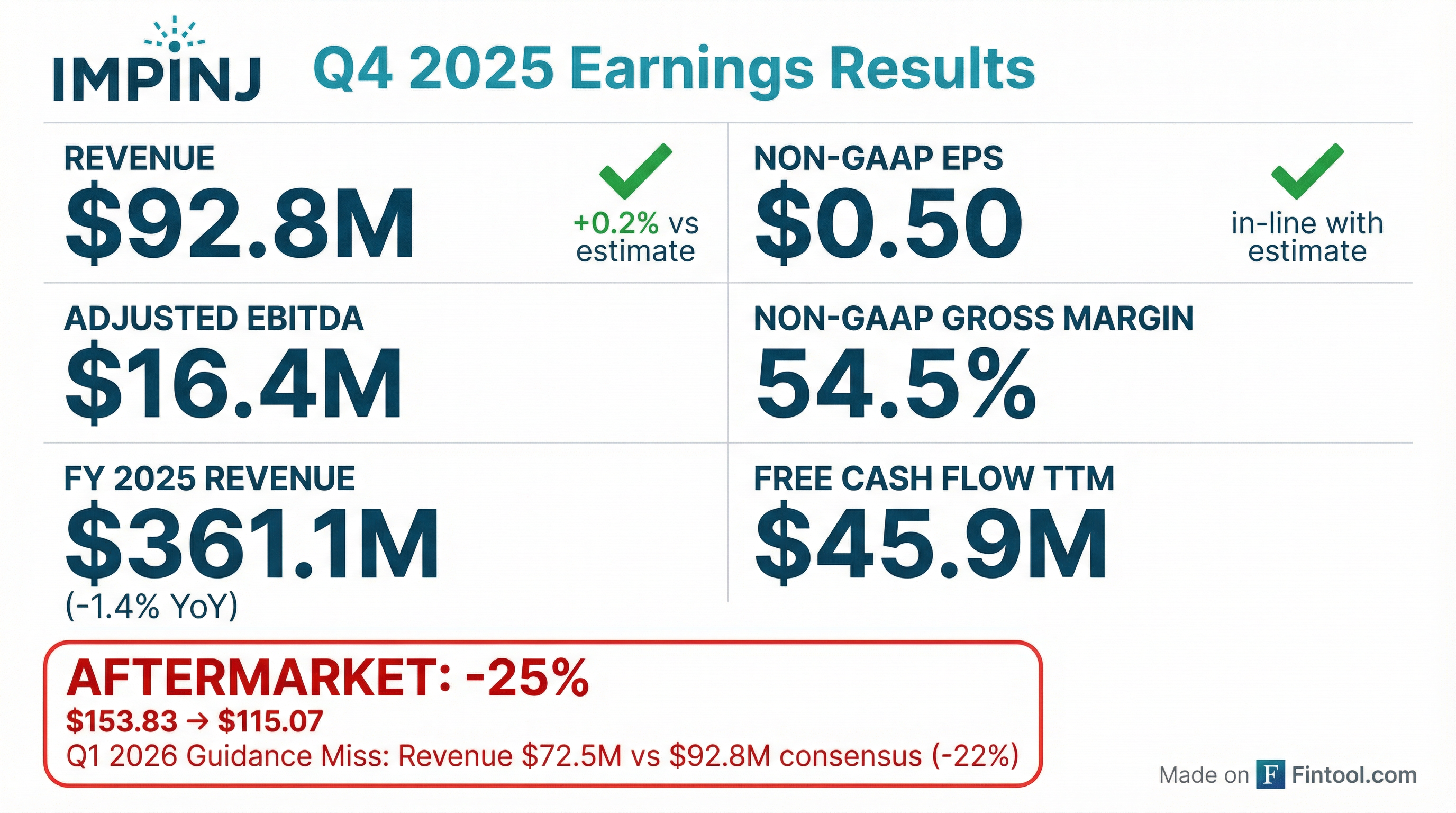

- Impinj reported Q4 2025 revenue of $92.8 million and full-year 2025 revenue of $361.1 million, marking a 1% year-over-year decline for the full year. The company achieved record Adjusted EBITDA of $69.6 million for 2025 and ended the year with record cash, cash equivalents, and investments of $279.1 million.

- For Q1 2026, Impinj expects revenue between $71 million and $74 million and non-GAAP net income between $2.5 million and $4 million, or $0.08 to $0.13 per share.

- The anticipated sequential decline in Q1 2026 revenue is primarily attributed to lower Endpoint IC volumes due to channel inventory reductions by logistics partners (estimated $5 million impact per week of burn down), annual price reductions (estimated $2 million impact), and retail weakness.

- The company is also transitioning to a custom-built Endpoint IC for a significant North American supply chain and logistics end user, which is currently in production and is expected to cause a temporary dip in orders as partners reduce prior product inventory.

- Despite Q1 headwinds, Impinj expects conditions to improve, with Endpoint IC demand for apparel normalizing by Q2 2026, general merchandise growing, and food rollouts expanding, driven by strategic initiatives like Gen2X and a focus on enterprise solutions.

- Impinj reported Q4 2025 revenue of $92.8 million and full-year 2025 revenue of $361.1 million, achieving a record Adjusted EBITDA of $69.6 million for 2025.

- For Q1 2026, the company expects revenue between $71 million and $74 million and Adjusted EBITDA between $1.2 million and $2.7 million, attributing the sequential decline to order timing, ongoing retailer inventory burn down, and product transitions.

- A custom-built endpoint IC for a major North American supply chain and logistics customer is now in production and expected to be fully adopted in 2026, which is anticipated to improve inventory visibility and drive future volumes.

- Despite Q1 headwinds, Impinj anticipates apparel demand to normalize as early as Q2 2026 and expects overall industry endpoint IC volumes to rebound in 2026, driven by growth vectors and the company's solutions focus, including Gen2X as a key market share driver.

- Impinj reported Q4 2025 revenue of $92.8 million and full-year 2025 revenue of $361.1 million, achieving record Adjusted EBITDA of $69.6 million for the year.

- For Q1 2026, the company expects revenue between $71 million and $74 million and non-GAAP diluted earnings per share between $0.08 and $0.13.

- The anticipated sequential decline in Q1 2026 revenue is primarily attributed to inventory burn down in supply chain and logistics (with an estimated $5 million per week impact) and retail weakness, alongside annual Endpoint IC price reductions.

- Impinj expects conditions to improve after Q1 2026, with Endpoint IC demand for apparel normalizing as soon as Q2 2026 and a custom Endpoint IC for a major logistics customer fully switching over this year.

- Impinj reported annual revenue of $361.1 million for 2025.

- For Q4 2025, the company achieved total revenue of $168.0 million, consisting of $75.2 million from Endpoint ICs and $92.8 million from Systems. The company also reported a Non-GAAP Gross Margin of 54.5%, Adjusted EBITDA of $16.4 million, and Non-GAAP EPS of $0.50 for the quarter.

- As of December 31, 2025, Impinj had sold over 150 billion endpoint ICs , and held $279.1 million in cash and investments with $45.9 million in TTM free cash flow.

- Impinj, Inc. reported Q4 2025 revenue of $92.8 million and non-GAAP net income of $15.6 million, or $0.50 per diluted share.

- For the full year 2025, the company achieved revenue of $361.1 million and non-GAAP net income of $64.2 million, or $2.11 per diluted share.

- The company provided a Q1 2026 financial outlook, projecting revenue between $71.0 million and $74.0 million and non-GAAP net income per diluted share between $0.08 and $0.13.

- CEO Chris Diorio stated that 2025 was a transition year for Impinj, exiting the year with record adjusted EBITDA and cash.

- Impinj expects Q4 2025 revenue near the high end of $90-$93 million and Adjusted EBITDA above the midpoint of $15.4-$16.9 million, with non-GAAP gross margin increasing by more than 125 basis points sequentially. This preliminary update was announced on January 14, 2026.

- The company licensed its Gen2X technology to EM Microelectronic, establishing a second source for Gen2X-enabled endpoint ICs, with the M800 (which carries Gen2X) being the volume runner in Q4 2025 and driving gross margin accretion.

- Impinj is seeing significant traction in the food market, with Kroger and Walmart implementing RAIN RFID tagging for perishable items, leading to substantial time savings in inventory management. The company expects modest volumes from the Walmart program in H1 2026, accelerating in H2 2026.

- Impinj has achieved the bottom end of its long-term operating margin (19%) and gross margin (almost 55%) targets at approximately $360 million in revenue, despite these targets not originally contemplating the food market. The company is also focused on refinancing its convertible debt to reduce coupon and dilution.

- Impinj expects fourth quarter 2025 revenue near the high end of its prior guidance of $90-$93 million and Adjusted EBITDA above the midpoint of its prior guidance of $15.4-$16.9 million. Additionally, non-GAAP gross margin increased by more than 125 basis points sequentially.

- Impinj licensed its Gen2X technology to EM Microelectronic, which will serve as a second source of silicon supply for Gen2X-enabled endpoint ICs, with an immaterial financial impact expected for 2026.

- As of September 2025 trailing 12 months, Impinj achieved a gross margin of almost 55% and an operating margin of 19% on approximately $360 million in revenue, reaching the lower end of its long-term targets without the anticipated revenue scale.

- The second North American supply chain and logistics end user reached 100% penetration in North America in Q3 2025. The food market, with Kroger and Walmart adopting tagging, is expected to see modest volumes in the second half of 2026.

- Impinj announced preliminary Q4 2025 revenue is expected near the high end of $90 million-$93 million, with Adjusted EBITDA above the midpoint of $15.4 million-$16.9 million, and non-GAAP gross margin increasing by over 125 basis points sequentially.

- Impinj licensed its Gen2X technology to EM Microelectronic, a strategic partner and second source for Gen2X-enabled endpoint ICs, though financial impact is expected to be immaterial to the 2026 P&L. Gen2X is a key competitive differentiator, improving readability and reducing inventory time and labor costs.

- The M800 was the volume runner in Q4 2025, driving gross margin accretion, and is expected to continue ramping in 2026. The company also highlighted strong adoption in food (Kroger, Walmart) and the emergence of RAIN RFID reading in mobile devices.

- Impinj has achieved the bottom end of its long-term operating margin (19%) and gross margin (almost 55%) targets with $360 million in revenue, ahead of the originally anticipated revenue scale of $500 million-$750 million.

- Impinj expects preliminary fourth-quarter 2025 revenue to be near the high end of its prior guidance of $90.0 to $93.0 million.

- Preliminary adjusted EBITDA for the fourth quarter of 2025 is anticipated to be above the midpoint of its prior guidance of $15.4 to $16.9 million.

- Impinj's CEO and CFO are participating in the 28th Annual Needham Growth Conference on January 14, 2026.

- The company will release its full financial results for the fourth quarter and full year 2025 on February 5, 2026.

- The RAIN industry experienced substantial growth, with a unit CAGR of 28% since 2010, reaching 52.8 billion units in 2024, an increase of 8 billion from the prior year, driven by retail apparel and expanding into logistics, general merchandise, and item-level food.

- Impinj's platform, featuring Gen2X capabilities in its M800 ICs and R700 readers, provides a competitive advantage by enhancing read performance and supporting advanced retail use cases as customers move towards 100% tagging.

- The company is expanding into new verticals, with item-level food identified as the largest RAIN market opportunity, alongside continued penetration in Walmart's general merchandise programs and 100% domestic penetration achieved by a major logistics provider in Q3.

- Impinj expects a gross margin uplift of an additional 300 basis points from the full deployment of its M800 chip, with over 100 basis points of accretion anticipated in Q4 as the M800 becomes the volume runner.

- Impinj refinanced $190 million of its convertible debt, issuing new 0% convertibles and repurchasing 1 1/8% convertibles, to reduce coupon, decrease dilution, and strategically split maturities of its total $287 million convertible debt.

Fintool News

In-depth analysis and coverage of IMPINJ.

Quarterly earnings call transcripts for IMPINJ.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more