Alpine Income Property Trust (PINE)·Q4 2025 Earnings Summary

Alpine Income Property Trust Delivers 23% AFFO Growth, Raises Dividend, Stock Hits 52-Week High

February 5, 2026 · by Fintool AI Agent

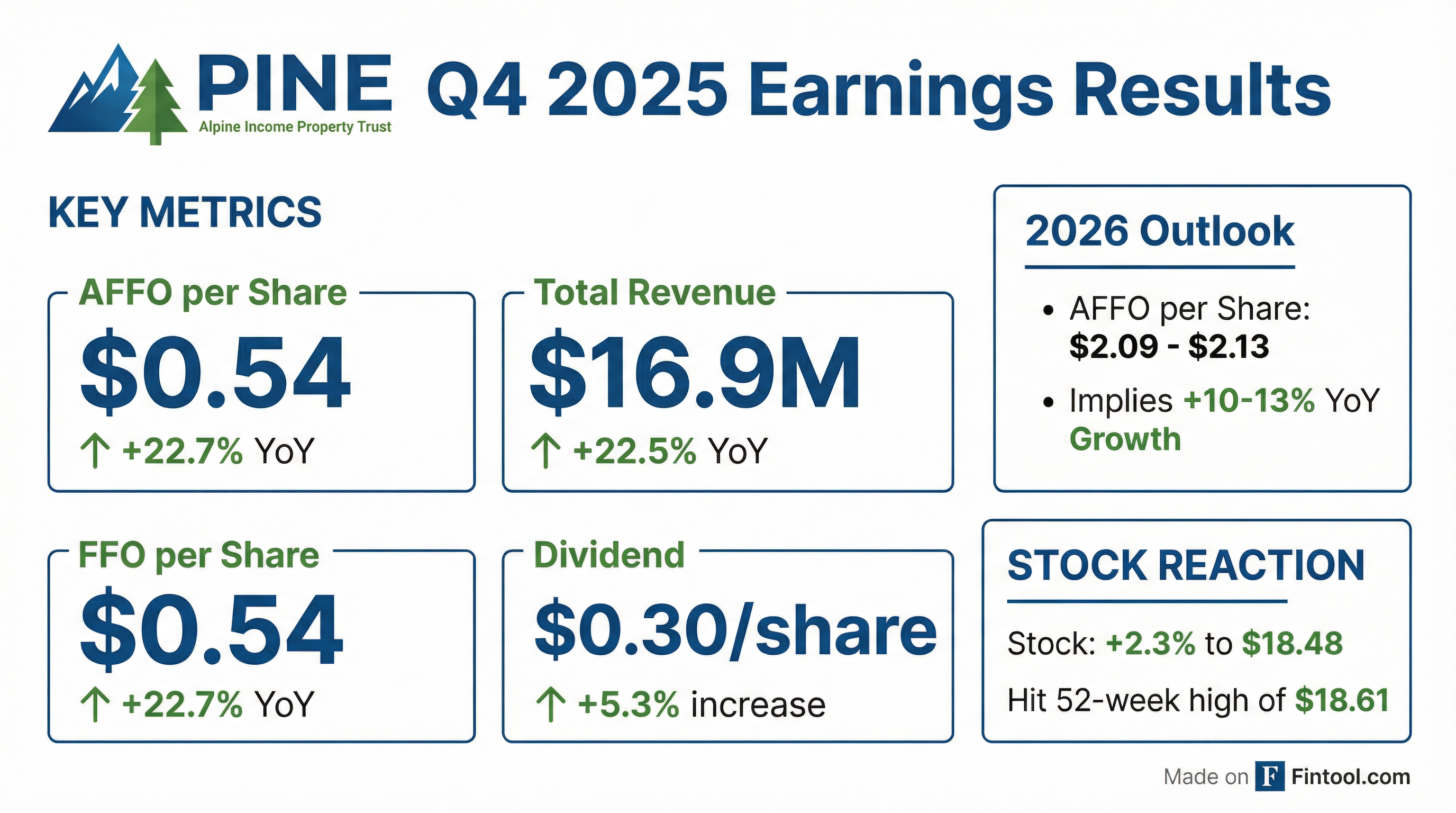

Alpine Income Property Trust (NYSE: PINE) reported Q4 2025 results that demonstrated the payoff from record investment activity, with AFFO per share surging 22.7% year-over-year to $0.54. The net lease REIT raised its quarterly dividend by 5.3% and issued 2026 guidance projecting sector-leading growth. Shares hit a 52-week high of $18.61 intraday, closing up 2.3% at $18.48.

Did Alpine Income Property Trust Beat Earnings?

PINE's Q4 2025 results reflected the full impact of its record $277.7 million investment year:

For the full year, AFFO per share grew 8.6% to $1.89 from $1.74 in 2024.

CEO Commentary: "We delivered a strong finish to 2025, growing AFFO per share by 22.7% in the fourth quarter and 8.6% for the full year compared to the comparable prior year periods," said John P. Albright, President and CEO.

What Did Management Guide for 2026?

PINE issued robust 2026 guidance that projects continued sector-leading growth:

The 11.6% AFFO growth at the midpoint significantly outpaces the net lease peer average of approximately 4-5%.

How Did the Stock React?

PINE shares rallied on the results, hitting a fresh 52-week high:

- Day's Performance: +2.3% to $18.48

- 52-Week High: $18.61 (intraday)

- 52-Week Low: $13.10

- Year-to-Date (from Dec 31): +10.5% (from $16.72)

The stock now trades at an 8.5x 2026E AFFO multiple based on guidance midpoint, the lowest in the net lease sector versus peers averaging 13.0x.

What Changed From Last Quarter?

Dividend Increase

The Board authorized a 5.3% increase to the quarterly dividend, raising it from $0.285 to $0.300 per share. This marks a 50% cumulative increase since the beginning of 2020.

At the new dividend rate:

- Annualized Dividend: $1.20 per share

- Dividend Yield: 6.5% (at current price)

- AFFO Payout Ratio: ~58% (based on 2026 guidance midpoint)

Credit Facility Refinancing

On February 4, 2026, PINE entered into an Amended and Restated Credit Agreement providing:

- $250M senior unsecured revolving credit facility

- $100M term loan maturing 2029

- $100M term loan maturing 2031

This refinancing extends the debt maturity profile significantly from the prior facility.

Capital Raising Activity

- Issued $50M of 8.00% Series A Preferred Stock in November 2025

- Issued 618,757 common shares via ATM for net proceeds of $10.4M

- Repurchased 546,390 shares at average price of $16.07

How Strong is the Portfolio?

PINE's portfolio metrics remain healthy as of December 31, 2025:

Top Tenants by ABR

Notable: Lowe's, Dick's Sporting Goods, and Walmart are now all within the top 5 tenants, collectively representing 29% of ABR. Walgreens has fallen to the 9th largest tenant at just 4% of ABR with only 5 remaining locations.

The company notes it has a "low basis" of $157 per square foot, roughly half the peer average, providing margin of safety.

What About the Commercial Loan Portfolio?

PINE's commercial lending strategy continues to complement its property portfolio:

Interest income from commercial loans reached $4.0M in Q4, up from $2.2M in Q4 2024, reflecting the significant portfolio growth.

Balance Sheet & Leverage

The company has utilized interest rate swaps to fix SOFR on $300M of debt at weighted average rates of 2.05-3.32%.

Investment Activity Recap

Full Year 2025 Investments

- Total Investment Volume: $277.7M (record)

- Property Acquisitions: $100.6M (13 properties)

- Commercial Loan Originations: $177.0M (15 loans)

- Weighted Avg Initial Yield: 10.3%

Full Year 2025 Dispositions

- Total Disposition Volume: $82.8M

- Operating Properties: $67.4M (17 properties)

- Vacant Properties: $5.3M (3 properties)

- Commercial Loans: $10.0M (1 loan)

- Weighted Avg Exit Cap Rate (Operating): 8.0%

The positive spread between investment yields (~10.3%) and exit cap rates (~8.0%) drove the AFFO accretion.

Key Risks to Monitor

- Leverage: Net Debt / Pro Forma EBITDA of 6.7x is elevated versus peers

- Interest Rate Sensitivity: While $300M is hedged, $78M remains floating rate

- Tenant Concentration: Top 2 tenants (Lowe's + Dick's) represent 22% of ABR

- Small Market Cap: ~$262M market cap limits institutional interest

- External Management: Managed externally by CTO Realty Growth, which owns ~15.4%

Valuation vs. Peers

PINE trades at a significant discount to peers despite projecting the highest AFFO growth in the sector and maintaining the lowest payout ratio.

Q&A Highlights: What Did Management Say?

The earnings call Q&A provided valuable color on PINE's strategy and outlook:

Commercial Loan Portfolio Strategy

Why cap the loan portfolio at 20%? CEO John Albright explained the rationale:

"It's really not wanting to flip the script, if you will, as far as our primary source of the business, which is the net lease properties... This business has been fantastic. It gets us in deeper into developer relationships and tenant relationships, and it provides us a source of future net lease investments. And it's very much complementary, but don't want it to be a distraction."

Remaining runway: CFO Phil Mays noted that with 20% of total undepreciated assets (~$770M) as the target, and $130M outstanding at year-end, there's approximately $25-30M of additional capacity.

Long-term commitment: Albright confirmed the 20% allocation is a permanent part of PINE's strategy: "We fully intend them [loans that burn off] to be refilled."

Walgreens Exit Progress

Management is continuing to reduce Walgreens exposure methodically:

"There's definitely a little more to do, and we're now actively on selling an additional Walgreens now... Now that we've gotten it way down the list, is not as sort of super focused on it. We just want to take our time and find the right buyers and not just sell it just to sell it."

Walgreens now represents just 4% of ABR with only 5 remaining locations, down from a much larger historical concentration.

Q4 Run-Rate AFFO

RJ Milligan of Raymond James asked about non-recurring items in Q4. CFO Mays provided important context:

"There's several one-time items in there... a little over $300,000 for the quarter. That's primarily the management fees that are going away, and also a prepayment penalty we got from one of the loans that paid off early... The $0.54, if you take it down for all those items, are probably $0.50, $0.51 on a run rate at the end of the quarter."

Dividend Increase Rationale

The 5.3% dividend increase was driven by taxable income growth. CFO Mays explained:

"When you think about the loan portfolio, there's no depreciation that goes with that. So, even though it's 20% of total assets and the properties make up more, there is no kind of tax cover or depreciation to go with it, so it does help drive taxable income up."

Investment Pipeline Outlook

On the commercial loan pipeline:

"We're really pleased with the pipeline... We're talking about more kind of grocery-anchored development and also investment-grade credit development with terrific tenants and new relationships... So, we're very excited as we continue to work on the pipeline."

Cap Rate Expectations

Management provided color on their investment approach:

"On the more investment grade properties that we've been looking at, they'll be lower than what we just did on that acquisition in Aspen... On cap rate direction, certainly for quality properties, it's still very tight. But a lot of the investments we made in the past five years... we'll look at really strong real estate, very strong MSAs, and maybe have a shorter lease duration, where the likelihood of a tenant renewing is very high because the rental rates they're paying are very, very low, so they're almost like covered land plays."

Why Lower Investment Volume Guidance?

When asked about the $70-100M acquisition guidance (vs. $100.6M in 2025), Albright explained the conservative approach:

"We just want to be real careful on curating a super strong portfolio and not being forced into some more commodity assets."

Austin Loan Update

The Q&A provided additional detail on PINE's largest commercial loan exposure:

- Phase 1: Lot sales have begun, with repayments going first to the senior participation sold to a third party

- Phase 2 Funding: Expected late Q1/early Q2 2026

- Participation Structure: The senior participation has a constant 10% rate and "hyper amortizes" (gets repaid first)

- Future Participation Sales: Likely another $10-20M to be sold from Phase 2, potentially reducing PINE's net hold to approximately half of the total commitment

Related Links: