Earnings summaries and quarterly performance for Alpine Income Property Trust.

Executive leadership at Alpine Income Property Trust.

John P. Albright

President and Chief Executive Officer

Daniel E. Smith

Senior Vice President, General Counsel and Corporate Secretary

Lisa M. Vorakoun

Senior Vice President and Chief Accounting Officer

Philip R. Mays

Senior Vice President, Chief Financial Officer and Treasurer

Steven R. Greathouse

Senior Vice President and Chief Investment Officer

Board of directors at Alpine Income Property Trust.

Research analysts who have asked questions during Alpine Income Property Trust earnings calls.

John Massocca

B. Riley Financial

6 questions for PINE

Craig Kucera

Lucid Capital Markets

5 questions for PINE

Gaurav Mehta

Alliance Global Partners

5 questions for PINE

Michael Goldsmith

UBS

5 questions for PINE

R.J. Milligan

Raymond James

5 questions for PINE

Matthew Erdner

JonesTrading Institutional Services

4 questions for PINE

Rob Stevenson

Janney Montgomery Scott

4 questions for PINE

Alex Fagan

Robert W. Baird & Co. Incorporated

3 questions for PINE

Wesley Golladay

Robert W. Baird & Co.

3 questions for PINE

Barry Oxford

Colliers

2 questions for PINE

Robert Stevenson

Janney Montgomery Scott LLC

2 questions for PINE

Kathryn Graves

UBS

1 question for PINE

Recent press releases and 8-K filings for PINE.

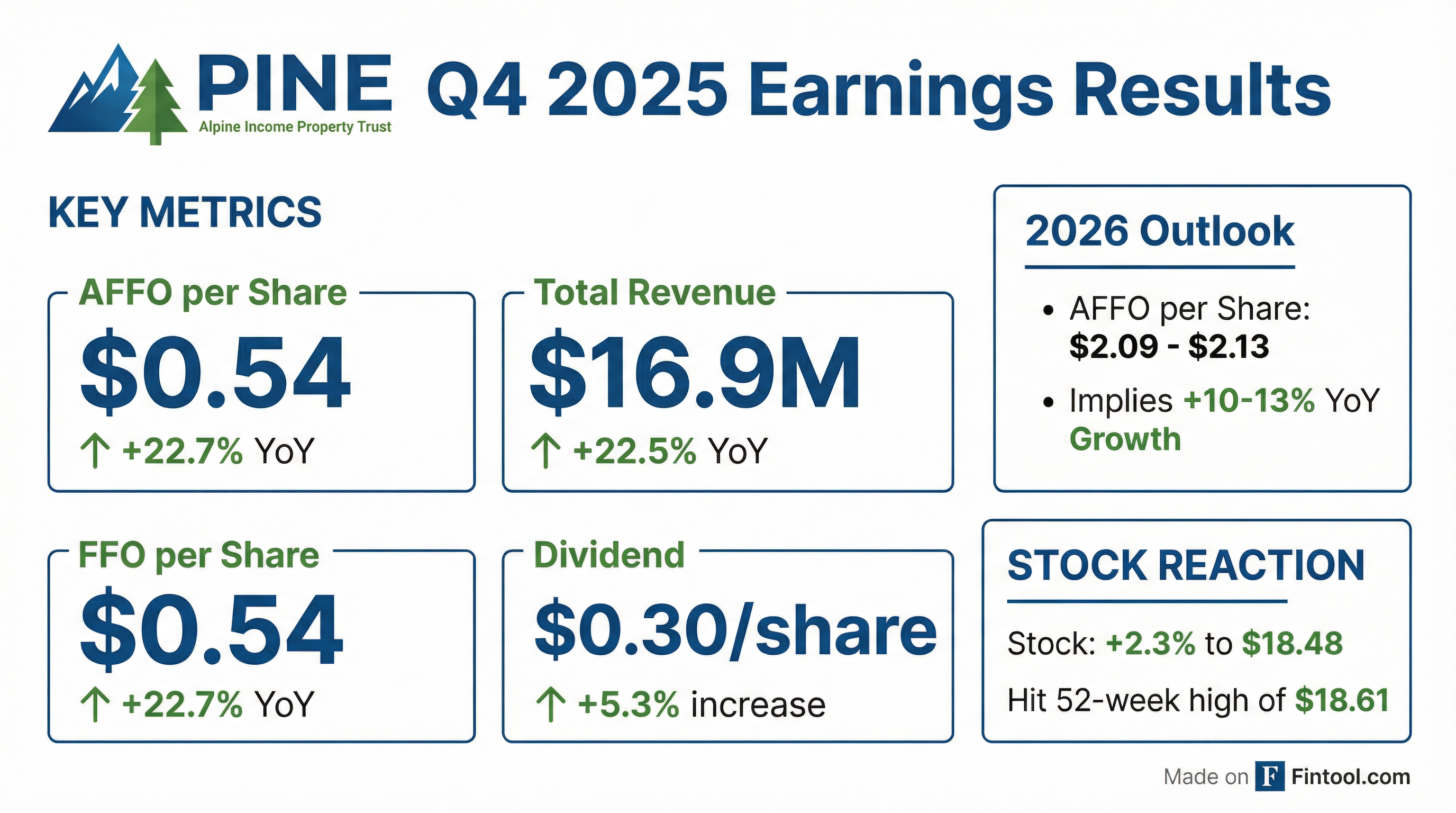

- Alpine Income Property Trust reported strong Q4 2025 results, with 22.7% growth in AFFO per common share, contributing to 8.6% AFFO per common share growth for the full year 2025, driven by a record $277.7 million in annual investments.

- The company completed significant capital market activities, including issuing $50 million of Series A Preferred Stock and establishing a new $450 million unsecured credit facility, which helped reduce net debt to pro forma Adjusted EBITDA to 6.7 times at year-end 2025.

- Alpine increased its quarterly common dividend by 5.3% to $0.30 per share, effective Q1 2026, representing a 56% AFFO payout ratio for Q4 2025.

- For 2026, the company provided initial guidance of $2.07-$2.11 for FFO per diluted common share and $2.09-$2.13 for AFFO per diluted common share, with anticipated investment volume of $70 million-$100 million and disposition volume of $30 million-$60 million.

- Alpine Income Property Trust reported a strong fourth quarter and full year 2025, with AFFO per common share growing 22.7% for Q4 and 8.6% for the full year.

- The company achieved a record annual investment volume of $277.7 million for 2025, including $142.1 million in Q4, comprising property acquisitions and commercial loan originations.

- For 2026, Alpine provided initial earnings guidance of $2.07-$2.11 for FFO per diluted common share and $2.09-$2.13 for AFFO per diluted common share.

- The board increased the quarterly common dividend by 5.3% to $0.30 per share beginning in the first quarter of 2026, representing a 56% AFFO payout ratio for the fourth quarter of 2025.

- The net commercial loan portfolio grew to approximately $129.8 million by year-end 2025 and is targeted to run at approximately 20% of total undepreciated asset value.

- Alpine Income Property Trust reported strong financial results for Q4 and full-year 2025, with AFFO per common share growing 22.7% in Q4 to $0.54 and 8.6% for the full year to $1.89. The company achieved a record $277.7 million in total investments for 2025.

- The company significantly increased its net commercial loan portfolio to approximately $129.8 million by year-end 2025, originating $177 million in loans during the year, and targets this portfolio to reach approximately 20% of total undepreciated asset value.

- Capital market activities included issuing $50 million of new Series A preferred stock and raising $18.3 million through common and Series A preferred ATM programs. The company also closed a new unsecured credit facility, refinancing its prior debt and improving pricing.

- For 2026, Alpine provided initial guidance of $2.07-$2.11 for FFO and $2.09-$2.13 for AFFO per diluted share, alongside an increase in its quarterly common dividend by 5.3% to $0.30 per share beginning in Q1 2026.

- Alpine Income Property Trust reported Adjusted Funds From Operations (AFFO) per diluted share of $0.54 for Q4 2025.

- The company projects 11.6% year-over-year AFFO per share growth for 2026E compared to 2025E.

- PINE issued $50 million of new Series A Preferred Stock with an 8% coupon in November 2025 to fund growth.

- The annualized dividend yield for Q4 2025 was 6.8%, and the quarterly dividend was raised by 5.3% in Q1 2026.

- As of December 31, 2025, the portfolio maintained a 99.5% occupancy rate and 51% of Annualized Base Rent (ABR) from investment-grade rated tenants.

- Alpine Income Property Trust reported Adjusted Funds From Operations (AFFO) per diluted share of $0.54 for Q4 2025 and $1.89 for the full year 2025, reflecting a 22.7% increase in Q4 and an 8.6% increase for the full year compared to the comparable prior year periods.

- The company announced a 5.3% increase in its quarterly common stock dividend, raising it to $0.300 per share for Q1 2026, payable on March 31, 2026.

- For the full year 2025, PINE completed a record $277.7 million in total investments and executed $82.8 million of select dispositions.

- The 2026 outlook projects AFFO Attributable to Common Stockholders per Diluted Share to be between $2.09 and $2.13, with anticipated investment volume of $70 to $100 million and disposition volume of $30 to $60 million.

- Subsequent to year-end, on February 4, 2026, the company entered into an Amended and Restated Credit Agreement, establishing a $250 million senior unsecured revolving credit facility and two unsecured term loans totaling $200 million.

- Alpine Income Property Trust (PINE) closed a $450 million unsecured credit facility on February 4, 2026, which was used to effectively retire all the Company’s prior unsecured debt.

- The new Credit Facility is comprised of a $250 million revolving credit facility due February 2030, a $100 million term loan due February 2029, and a $100 million term loan due February 2031.

- Borrowings under the new facility are 10 to 15 basis points lower compared to the Company’s prior unsecured debt.

- Initial fixed interest rates are approximately 3.5% for both the 2029 Term Loan and the 2031 Term Loan, and approximately 4.8% for $100 million outstanding under the Revolving Credit Facility.

- The Credit Facility includes an accordion feature that allows total borrowings to be increased to $750 million.

- Alpine Income Property Trust, Inc. (NYSE: PINE) acquired a 6,529-square foot retail property in downtown Aspen, Colorado on January 20, 2026.

- The acquisition was for $10.0 million at an initial cap rate of 8.5% with 1.25% annual escalators.

- The property is structured as a 50-year absolute triple net master lease with an established commercial real estate firm.

- Alpine Income Property Trust reported record annual investment activity of $277.7 million for the full year 2025, alongside $82.8 million in dispositions.

- For the fourth quarter of 2025, investment activity totaled $142.1 million, and disposition activity was $48.4 million.

- As of December 31, 2025, the company's property portfolio was 99.4% occupied with a weighted average remaining lease term of 8.4 years, and 51% of annualized base rent was attributable to investment grade rated tenants.

- Alpine Income Property Trust, Inc. is offering up to $35,000,000 of its 8.00% Series A Cumulative Redeemable Preferred Stock, with a par value of $0.01 per share, which will be listed on the NYSE.

- In conjunction with this offering, the Operating Partnership's agreement was amended to authorize an additional 1,458,334 of its 8.00% Series A Cumulative Redeemable Preferred Units, bringing the total authorized to 3,758,334 units, each with a liquidation preference of $25.00.

- The company's Manager will waive a portion of the Base Management Fee, reducing the rate on the net cash proceeds from the Series A Preferred Stock issuance to 0.75% per annum (0.1875% per fiscal quarter) from the standard 1.50% per annum (0.375% per fiscal quarter).

- The Series A Preferred Stock cannot be sold above a "Series A Maximum Price," defined as $25.00 plus accrued and unpaid dividends, with a formula for adjustments through November 12, 2029.

- Alpine Income Property Trust (PINE) announced on November 12, 2025, the acquisition of a 131,039-square-foot property net leased to Sam’s Club in Houston, Texas.

- The tenant, Sam’s Club, is a subsidiary of Walmart, which holds an AA credit rating.

- This acquisition makes Walmart the Company’s fifth largest tenant as of the acquisition date.

- The property is located in a dense infill market in Houston, Texas, where Sam's Club has operated for nearly 25 years.

Quarterly earnings call transcripts for Alpine Income Property Trust.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more