Palantir Technologies (PLTR)·Q4 2025 Earnings Summary

Palantir Crushes Q4 on 137% U.S. Commercial Surge, Raises FY26 Guide 15% Above Street

February 2, 2026 · by Fintool AI Agent

Palantir Technologies (PLTR) delivered a blowout Q4 2025, beating on both revenue and earnings while issuing FY 2026 guidance that "crushed consensus expectations" in CEO Alex Karp's words. The stock jumped 7.6% in after-hours trading to $159.08, recovering from a sharp 17.5% decline heading into the print.

U.S. commercial revenue growth of 137% year-over-year stole the show, while the company's "Rule of 40" score hit 127%—a metric Karp called "incredible." With GAAP operating margins at 41% and adjusted operating margins at 57%, Palantir continues to demonstrate rare operating leverage at hypergrowth rates.

Did Palantir Beat Earnings?

Yes—and extended its streak to 9 consecutive quarters of beats.

Revenue growth of 70% year-over-year significantly outpaced the 63% growth Wall Street had modeled. The beat was driven by exceptional U.S. performance—total U.S. revenue grew 93% YoY to $1.076B, now representing 76% of total revenue.

What Did Management Guide?

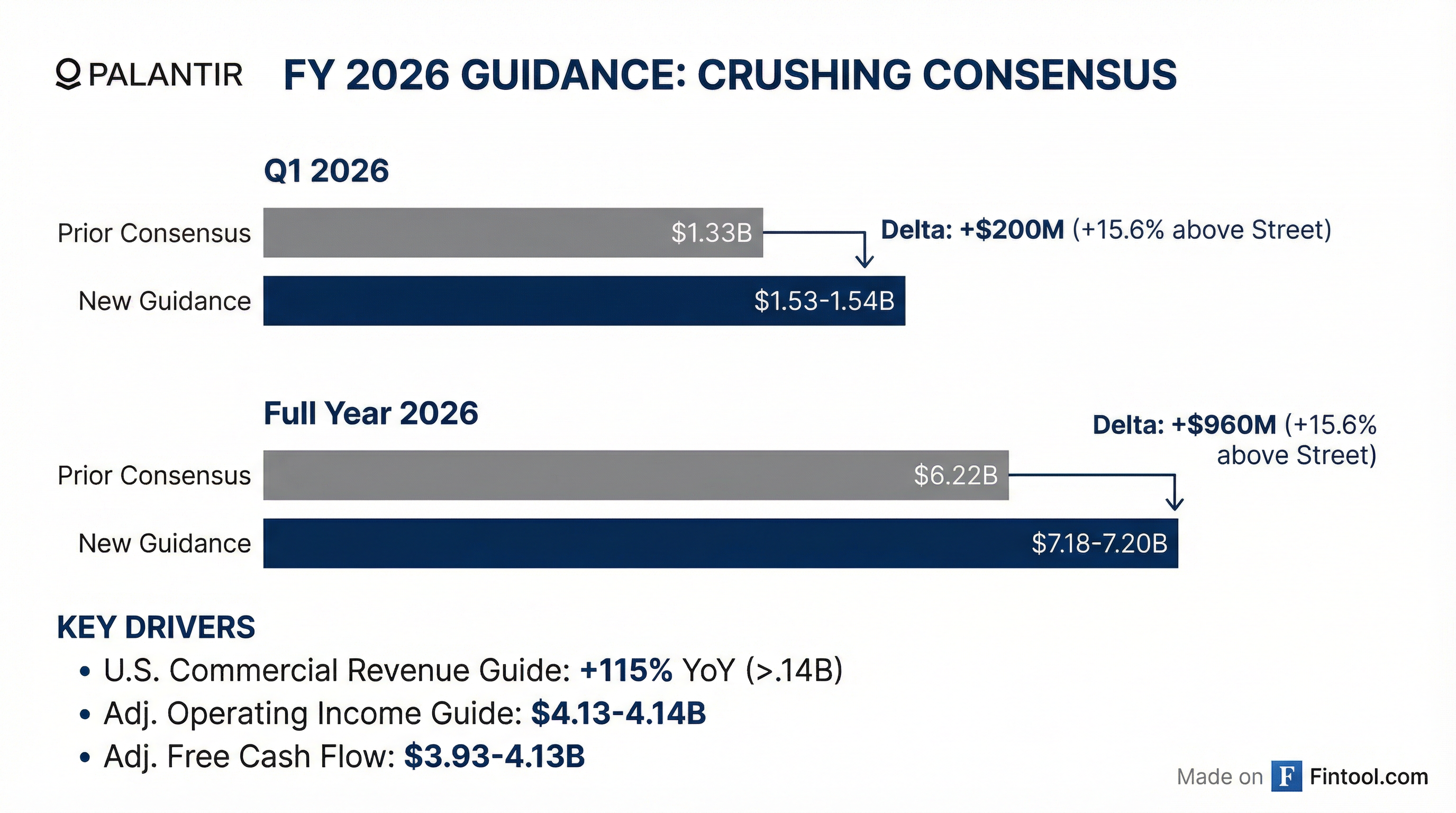

Guidance was the real story—Palantir raised expectations roughly 15% above Street estimates across the board.

The 61% revenue growth guide for FY 2026 is remarkable for a company of Palantir's scale. For context, Q4 2025's 70% growth rate accelerated from Q3's 56% growth. Management expects GAAP operating income and net income "in each quarter of this year."

What Changed From Last Quarter?

Several metrics accelerated meaningfully:

Acceleration in Key Growth Rates:

Contract Momentum:

- Total Contract Value (TCV) hit a record $4.262B, up 138% YoY

- U.S. Commercial TCV reached $1.344B, up 67% YoY

- U.S. Commercial Remaining Deal Value (RDV) grew to $4.38B, up 145% YoY

Deal Flow:

- 180 deals ≥$1M (vs. 104 in Q3 2024)

- 84 deals ≥$5M

- 61 deals ≥$10M

SaaS Metrics:

- Net dollar retention hit 139% in Q4 2025

- Billings surged to $1.489B, up 91% YoY from $779M in Q4 2024

- Total RPO reached $4.21B (Short-term: $1.62B, Long-term: $2.59B)

How Did the Stock React?

Palantir shares rallied 7.6% in after-hours trading to $159.08, bouncing sharply from recent weakness.

Pre-Earnings Context:

- Stock had fallen 17.5% over the past month heading into earnings

- Down 29% from November 2025 peak

- Traded at 142x forward earnings—third highest multiple in S&P 500

Historical Earnings Reactions: Based on Palantir's 1.545 beta, the stock typically moves 8-12% on earnings surprises. The 7.6% after-hours move is within this range but suggests investors were anticipating a beat—the upside was in the guidance raise.

Q&A Highlights

On International Business & European Rearmament:

When asked about potential acceleration in international markets due to European rearmament, Karp was candid about priorities:

"Palantir is in a unique position where we really don't have the bandwidth to do anything that's difficult outside of America... The demand in the U.S. is so great."

He noted that allies face a structural challenge: "Can they understand the delta in a way that allows them to make a decision that might go against the narrow economics of their own country?" The result is stark adoption divergence—broad adoption in the U.S., Israel, and Middle East, but "lack of adoption in Canada, Northern Europe, and in Europe in general."

On Commercial Go-to-Market (Bank of America):

Management emphasized that the go-to-market strategy centers on delivering demonstrable value quickly:

"Our whole commercial go-to-market strategy is showing and actually delivering value impact to our customers directly as quickly as possible... We closed 61 deals over $10 million. That's because of the impact that we're delivering."

Karp noted the shift in customer conversations: "Two years ago it was 'I've heard you're kind of this weird thing that might be able to make it work.' Now it's 'I've heard you made this work. What do I need to do to make this accelerate?'"

On Reindustrialization & ShipOS Expansion (Wedbush):

When asked about expanding beyond shipbuilding, Shyam Sankar highlighted broad demand:

"Reindustrialization is something we've been talking about for the better part of two or three years now... People are asking us to help with all sorts of different weapon systems: fighters, bombers, surface vessels, drones, weapons themselves, munitions."

The strategy spans "from the factory floor to the foxhole"—integrating production and sustainment with battlefield operations.

On Budget Capture:

Karp noted that growth isn't coming from customer count expansion but from deepening relationships: "What you will see is inexplicable growth in revenue but not inexplicable growth in customers. Customers that are serious are putting a lot of their most important problems in our hands."

Key Financial Metrics

What's Driving the U.S. Commercial Surge?

CEO Alex Karp called it "one of the truly iconic performances in the history of corporate performance or technology" and positioned Palantir as "an N of 1":

"At the beginning of last year, we were guiding to roughly in the 30%, which would be a stellar performance for a company. At the end of the year, we grew our company almost 20% in one quarter. If you were a company sitting in continental Europe or in any other similarly situated country and you grew your whole company 20% and you had a rule of 50, you would be one of the premier companies in your nation, if not in your continent."

On the "N of 1" positioning:

"With a Rule of 127 and 70% aggregate growth, 93% growth in the U.S., you really have to look at this—the numbers speak volumes that we are in an N of one category of our own, and we are doing things unlike any other company has done."

AIP (Artificial Intelligence Platform) Momentum:

- The AI-powered platform continues to be the primary driver of U.S. commercial acceleration

- Commercial customer count grew 34% YoY and 5% QoQ

- Average deal sizes expanding—61 deals over $10M vs. lower figures historically

Customer Testimonials:

Thomas Cavanagh Construction executive on going all-in with Palantir:

"We've gone all-in so much so that every other software must justify its existence, and so far they haven't been able to. 97% of our employees use Foundry every day; Foundry is our operating system... The ontology is the secret weapon. Nothing else comes close."

Johnson Controls on AI transformation:

"It is really incredible to see that you can transform a 140-year-old company with the power of AI."

Lear demonstrated at DevCon how they grew from 100 users and 4 use cases to 16,000 users and 280 use cases.

Deal Velocity Examples:

- A utility company expanded from $7M ACV in Q1 2025 to $31M ACV by year-end

- An energy company expanded from $4M ACV in Q1 2025 to over $20M ACV by year-end

- A healthcare company signed a $96M deal after two bootcamps

- An engineering services company signed an $80M deal after a series of demos

Government Tailwinds: U.S. government revenue grew 66% YoY to $570M, supported by strong demand from the Trump administration.

Key Strategic Announcements

Palantir announced several major initiatives alongside Q4 results:

Government & Defense:

- ShipOS with U.S. Navy: Deploying Foundry and AIP across America's maritime industrial base. Secretary of the Navy John Phelan called it "a new way of doing business that puts Palantir's cutting-edge tools in the hands of decision-makers at every level."

- American Tech Fellowship for Veterans (ATF-V): Expanding the 12-week AI training program exclusively for veterans, active-duty service members, and reservists

- Submarine Industrial Base Fellowship: An 8-week course launching later this month to upskill users at suppliers and shipyards to build their own AI applications—"unleashing the profound domain expertise to accelerate the delivery of one of our military's most important capabilities"

Commercial Partnerships:

- Accenture Partnership: Deploying forward deployed engineers alongside 2,000+ Palantir-skilled Accenture professionals to accelerate AIP deployment across healthcare, telecom, manufacturing, consumer goods, and financial services

- HD Hyundai Expansion: Largest and longest partnership in Korea, scaling Foundry and AIP across shipbuilding, refineries, construction equipment, robotics, and electric systems

Product Innovation:

- Hivemind Framework: Now lets AI "develop novel solutions to emergent challenges and identify hidden opportunities." Palantir used Hivemind to generate bespoke AIP demos for prospects based only on public information—CTOs were "blown away" by the fit.

- AIFD (AI-First Development): Now capable of powering complex SAP ERP migrations from ECC to S4—"years of work now done in as little as 2 weeks."

- Maven: Usage at all-time highs, supporting simultaneous real-world events across combatant commands. Rolling out to all combatant commands and more networks this fiscal year.

- OSDK: Serves over 1 billion API Gateway requests per week from customer-built applications.

- Warp Speed/ShipOS: Reduced planning at one shipbuilder from 160 hours to 10 minutes; cut material review at a shipyard from weeks to less than an hour. Notably, one customer was able to add a third shift because AI made more work "shovel-ready and executable"—Shyam Sankar highlighted this as "Jevons Paradox in action" proving AI creates jobs.

DevCon 4 Announcements:

- Chain Reaction: New platform for AI infrastructure targeting energy producers, grid operators, and data centers

- Gotham Suite: Kairos (planning/sync matrices), Nexus (command relationships), Workbench (collections/fires/BDA)—integrated capabilities that "turn battlefield complexity into lethality"

Balance Sheet & Cash Flow

Palantir ended the quarter with substantial financial flexibility:

The company generated $2.13B in operating cash flow for FY 2025 and guided to $3.93-4.13B in adjusted free cash flow for FY 2026—nearly doubling year-over-year.

Risks & Concerns

Despite the blowout quarter, investors should monitor:

-

Valuation: At 142x forward earnings pre-report, Palantir remains one of the most expensive stocks in the S&P 500

-

Government Concentration: U.S. government still represents ~41% of total revenue; policy changes could impact growth

-

Stock-Based Compensation: SBC of $196M in Q4 (~14% of revenue) remains elevated, though down from $282M in Q4 2024

-

Competitive Threats: Concerns about AI potentially displacing established software firms weighed on the sector pre-earnings

What to Watch Going Forward

Q1 2026 Earnings (Expected May 2026):

- Revenue guidance: $1.532-1.536B

- Adj. operating income: $870-874M

- U.S. commercial trajectory—can 100%+ growth sustain?

Full Year 2026:

- Can Palantir deliver on 61% revenue growth at scale?

- International growth remains a question mark—only 7% QoQ growth outside U.S.

- Watch for further expansion of government contracts under current administration

The Bottom Line

Palantir delivered exactly what bulls hoped for: accelerating growth, expanding margins, and guidance that demolishes consensus. The 137% U.S. commercial revenue growth and 127% Rule of 40 score validate the company's AI-first positioning. At these valuation levels, the stock needs to keep delivering—and Q4 suggests it can.

The market's initial reaction (+7.6% after-hours) reflects a strong beat but also suggests some upside was priced in given the recent pullback. With FY 2026 guidance now 15% above prior consensus, analyst estimate revisions should be substantial.

Note: Values marked with an asterisk () are retrieved from S&P Global.*