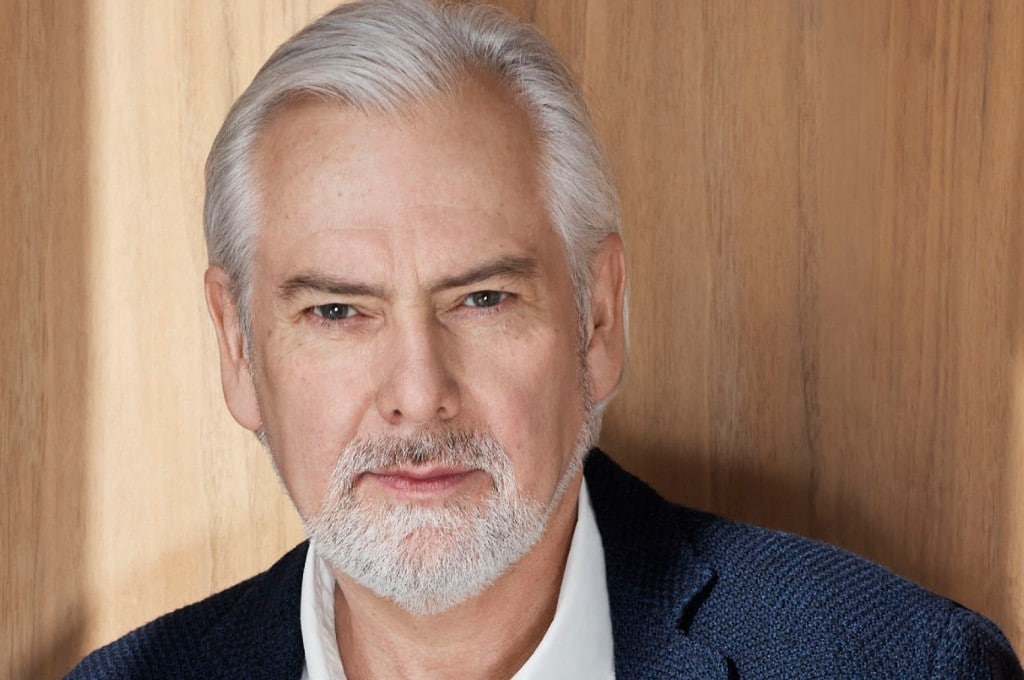

Jacek Olczak

About Jacek Olczak

CEO of Philip Morris International (PMI) since May 2021; previously COO (2018–May 2021) and CFO (2012–2017). Age 60. He has been a PMI director since 2021 and serves on the Science & Technology Committee . 2024 pay-for-performance outcomes were strong: the company’s annual incentive plan was certified at 130% of target on objective/strategic metrics , the 2022–2024 PSU cycle paid at 170% , and three‑year adjusted diluted EPS CAGR excluding currency was 12.2% . PMI reported 2024 smoke‑free net revenue growth of 16.7% ex-currency and total adjusted organic net revenue growth of 9.8% .

Past Roles

| Organization | Role | Years | Strategic impact |

|---|---|---|---|

| Philip Morris International | Chief Executive Officer | May 2021–present | Leads transformation toward smoke‑free portfolio; oversaw integration of Swedish Match; drove 2024 outperformance on adjusted OI and operating cash flow targets . |

| Philip Morris International | Chief Operating Officer | 2018–May 2021 | Advanced consumer‑centric and digitalized engagement; optimized manufacturing; supported multi‑market IQOS rollout . |

| Philip Morris International | Chief Financial Officer | 2012–2017 | Financial stewardship during early transformation stage . |

| Philip Morris International | GM/Regional leadership (Poland, Germany, EU Region) | 1993–Jan 2018 | Built execution capabilities across key European markets and EU region . |

External Roles

- Prior to PMI, worked for BDO Binder (dates not disclosed) .

Board Governance and Service

- Director since 2021; member, Science & Technology Committee .

- The Chairman is non‑executive (A. Calantzopoulos); an empowered Lead Independent Director (L. Hook) presides over executive sessions and sits on all committees, mitigating dual‑role risks from a CEO/director structure .

- All nominees (including Olczak) attended at least 80% of 2024 Board/committee meetings; Board held 6 regular meetings in 2024 .

- As a full‑time employee, he receives no director fees .

- Independence: management directors (CEO/Chair) are not independent; all other standing committees (Audit & Risk; Compensation; Nominating & Governance) consist solely of independent directors .

Fixed Compensation

| Item | 2022 | 2023 | 2024 |

|---|---|---|---|

| Base Salary ($) | 1,461,248 | 1,649,458 | 1,706,594 |

| 2024 Board‑decision base salary reference ($) | — | — | 1,718,705 (CHF‑converted at decision date) |

| Target Cash Incentive (% of base) | — | — | 200% |

| Actual Cash Incentive (% of base) | — | — | 351% |

Notes: Salary figures reflect CHF→USD translations per proxy methodology; 2024 “reference” vs “paid” differ due to FX conventions .

Performance Compensation

Annual Incentive Plan (2024 performance certification)

| Measure | Target | Actual | Weight | Perf. rating | Weighted rating |

|---|---|---|---|---|---|

| Share of Top 30 OI markets with growing/stable share | 15–17 | 18 | 15% | 105 | 16 |

| Smoke‑Free shipment volume (bn sticks‑eq.) | 153.4–158.0 | 156.5 | 15% | 100 | 15 |

| Adjusted Net Revenues (organic YoY) | 7.5–8.5% | 9.8% | 20% | 147 | 29 |

| Adjusted Operating Income (organic YoY) | 8.4–9.7% | 14.9% | 15% | 150 | 23 |

| Operating Cash Flow ($bn) | 9.8–10.2 | 12.2 | 20% | 150 | 30 |

| Strategic initiatives | 100% | 110% | 15% | 110 | 17 |

| Total | — | — | 100% | — | 129% (rounded to 130%) |

Long‑Term Equity (structure and 2024/2025 awards)

- Vehicle mix: 60% PSUs, 40% RSUs; no stock options used .

- PSU metrics/weights: Relative TSR (40%), currency‑neutral adjusted diluted EPS CAGR (30%), Sustainability Index (30%) .

- 2022–2024 PSU cycle payout: 170% (rounded) .

| Grant | PSU target (% salary) | RSU target (% salary) | Actual award (% salary) PSUs | Actual award (% salary) RSUs | Target PSUs (#) | RSUs (#) | Vest date |

|---|---|---|---|---|---|---|---|

| 2024 grant (Feb 8, 2024) | 360% | 240% | 432% | 288% | 80,150 | 53,440 | Feb 17, 2027 (PSUs 0–200% on certification; RSUs cliff) |

| 2025 grant (Feb 6, 2025) | — | — | — | — | 66,900 (PSUs) | 44,600 (RSUs) | Feb 16, 2028 (subject to plan conditions) |

Additional disclosure: 2024 PSUs maximum value at 200% = $14,057,348 .

Vesting and near‑term supply considerations

- 2022 grants vested Feb 19, 2025 at 170% PSU factor; for Olczak: 86,938 PSUs; 34,100 RSUs vested same date .

- 2023 grants vest Feb 18, 2026; 2024 grants vest Feb 17, 2027 .

Equity Ownership & Alignment

| Metric | Value |

|---|---|

| Beneficial ownership (Mar 14, 2025) | 401,106 shares (each director/NEO <1% of outstanding) |

| Shares outstanding (record date) | 1,556,488,205 |

| Unvested RSUs at 12/31/2024 | 53,440 (2024), 48,280 (2023), 34,100 (2022) |

| Unearned PSUs at 12/31/2024 | 160,300 (2024), 144,820 (2023) |

| Market value references (12/31/2024 close $120.35) | See per‑grant valuations in Outstanding Equity Awards table |

| Ownership guideline | 10× base salary for CEO (salary grade 28) |

| Compliance | All NEOs compliant as of Dec 31, 2024 |

| Hedging/pledging | Prohibited for directors/executives |

| Post‑termination holding (accelerated vest) | 12‑month holding period on shares |

Notes: Dividend equivalents are paid quarterly on RSUs and at vesting on earned PSUs .

Employment Terms

- Contract/severance: No special CEO employment contract disclosed; broad policy bars severance for voluntary termination (adopted 2023) .

- Change‑in‑Control (CIC): Double‑trigger under 2017/2022 plans; if awards are not replaced, RSUs vest in full and PSUs settle based on actual (if >½ cycle elapsed/determinable) or target performance; if replaced, full vest on qualifying termination within two years .

- Estimated CIC value (as of 12/31/2024): Unvested PSUs $24,515,295; unvested RSUs $16,345,937; completed 2024 IC $3,317,116; total $44,178,348 (pricing at $120.35) .

- Clawback policy: Board‑approved SEC‑compliant recovery policy adopted Sept 13, 2023; Committee oversees administration .

- Perquisites: Company car/driver services eligibility; 2024 car‑related reported at $26,314; no incremental personal aircraft cost reported .

- Pension: Present value of accumulated benefits at 12/31/2024 – Pension Fund CHF‑based plan $14,713,016; IC Pension $1,232,504; Supplemental $10,213,670; credited service 35.00/18.92/16.00 years; purchased 15.67 years with own funds .

Say‑on‑Pay, Shareholder Feedback, Peer Benchmarking

- Say‑on‑Pay approval: 92.88% support in 2024 (up from 70.00% in 2022 and 73.95% in 2023) following outreach and program adjustments .

- Peer group: 19 global CPG/healthcare peers (incl. MO, KO, PEP, PG, UN, BAT, JTI, etc.) used for benchmarking and PSU TSR comparisons; Committee does not target a specific market percentile for pay .

- Independent consultant: FW Cook advises Compensation Committee; assessed as independent .

Performance & Track Record (select indicators)

- 2024 outcomes vs targets: Adjusted net revenues +9.8% organic; adjusted OI +14.9% organic; OCF $12.2bn; all above‑target; smoke‑free shipment volume on target .

- PSU 2022–2024 payout drivers: TSR at 95th percentile of peer group (200% factor); adjusted diluted EPS CAGR ex‑FX 12.2% (200% factor); Sustainability Index aggregate 89% .

- 2024 smoke‑free and total growth: Smoke‑free net revenues +16.7% ex‑currency; total adjusted net revenues +9.8% organic .

Director Compensation (as director)

- Not applicable: full‑time employees receive no director compensation; non‑employee director program is separate .

Compensation Structure Analysis

- High at‑risk mix: CEO target equity 600% of salary (at 60/40 PSU/RSU); no options (reduces leverage, dilution) .

- Annual plan refined to align with shareholders: currency effects now flow through OCF target; smoke‑free volume metric broadened beyond HTU; 2024 company rating 130% .

- Long‑term program emphasizes TSR and currency‑neutral EPS CAGR plus Sustainability Index; Committee retained discretion for unusual events and relative tobacco TSR modifier .

Risk Indicators & Red Flags

- Hedging/pledging prohibited; robust ownership/holding and clawback policies in place .

- Related party transactions: none disclosed for Olczak; single immaterial related‑person case disclosed for another officer’s family member .

- Section 16 compliance: proxy notes two late Form 4s in 2024 for other individuals; none attributed to Olczak .

Upcoming Vesting Calendar (supply watch)

| Grant | Instrument | Shares | Vest date | Notes |

|---|---|---|---|---|

| 2023 | RSU | 48,280 | Feb 18, 2026 | Cliff vest, dividend equivalents during vesting |

| 2023 | PSU (target) | 144,820 | Feb 18, 2026 | 0–200% based on 2023–2025 metrics |

| 2024 | RSU | 53,440 | Feb 17, 2027 | Cliff vest |

| 2024 | PSU (target) | 80,150 | Feb 17, 2027 | 0–200% based on 2024–2026 metrics |

| 2025 | RSU | 44,600 | Feb 16, 2028 | Cliff vest (subject to plan) |

| 2025 | PSU (target) | 66,900 | Feb 16, 2028 | 0–200% based on 2025–2027 metrics |

Investment Implications

- Alignment: CEO pay is heavily at‑risk and tied to multi‑year TSR and currency‑neutral EPS growth, with sustainability components; 2022–2024 PSU paid at 170%, consistent with strong TSR/EPS performance .

- Retention/selling pressure: Large scheduled RSU/PSU vests in 2026–2028 create potential supply windows; anti‑hedging/pledging and 12‑month post‑acceleration hold reduce adverse optics, but monitor 30‑day windows around Feb vesting dates .

- Governance: CEO is a non‑independent director; mitigants include a non‑executive Chair and a strong Lead Independent Director overseeing executive sessions and all committees .

- CIC economics: Equity is the main driver; at 12/31/2024 prices, estimated CIC value ~$44.2m for CEO—principally unvested PSUs/RSUs under a double‑trigger regime (shareholder‑friendly vs. single‑trigger) .

- Pay support: Say‑on‑pay rebounded to 92.88% in 2024 after investor engagement and plan refinements (currency treatment, metrics), reducing headline governance risk .