Earnings summaries and quarterly performance for Philip Morris International.

Executive leadership at Philip Morris International.

Jacek Olczak

Group CEO PMI

Emmanuel Babeau

Group Chief Financial Officer

Frederic de Wilde

CEO PMI International

Reginaldo Dobrowolski

Group Controller

Stacey Kennedy

CEO PMI U.S.

Stefano Volpetti

Chief Global Growth Officer

Yann Guerin

Group Chief Legal Officer

Board of directors at Philip Morris International.

André Calantzopoulos

Chairman of the Board

Bonin Bough

Director

Dessi Temperley

Director

Kalpana Morparia

Director

Lisa Hook

Lead Independent Director

Michel Combes

Director

Robert Polet

Director

Shlomo Yanai

Director

Victoria Harker

Director

Werner Geissler

Director

Research analysts who have asked questions during Philip Morris International earnings calls.

Bonnie Herzog

Goldman Sachs

8 questions for PM

Eric Serotta

Morgan Stanley

7 questions for PM

Faham Baig

UBS Group

6 questions for PM

Damian McNeela

Deutsche Numis

4 questions for PM

Matt Smith

Bank of America

4 questions for PM

Gaurav Jain

Barclays

3 questions for PM

Matthew Smith

Analyst

3 questions for PM

Gerald Pascarelli

Needham & Company

2 questions for PM

Mirza Faham Baig

UBS

2 questions for PM

Priya Ohri-Gupta

Barclays Capital

2 questions for PM

Callum Elliott

Bernstein

1 question for PM

Philip Spain

JPMorgan Chase & Co.

1 question for PM

Recent press releases and 8-K filings for PM.

- The Board declared a regular quarterly dividend of $1.47 per share, payable April 13, 2026, to shareholders of record as of March 19, 2026 (ex-dividend date March 19, 2026).

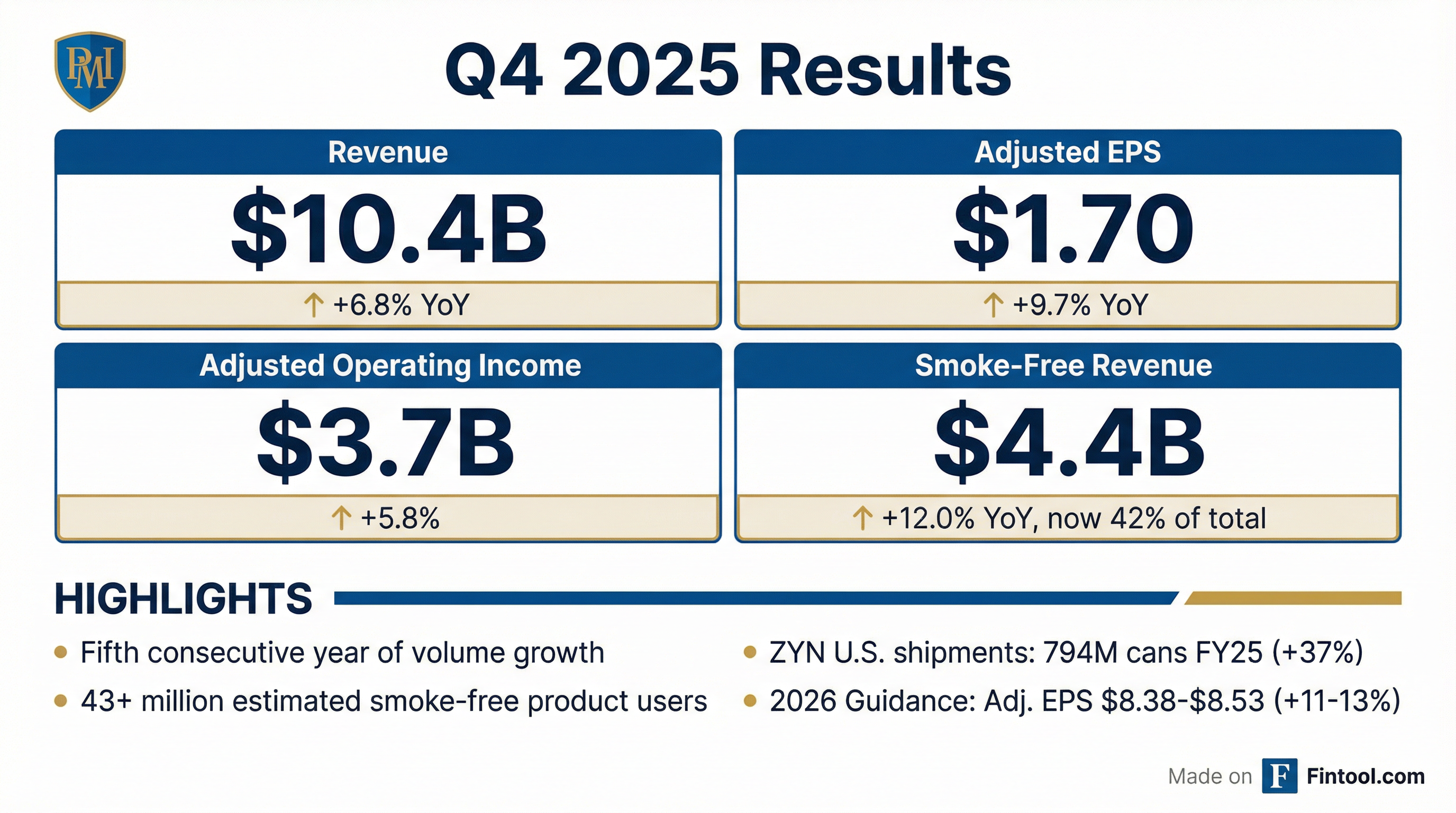

- Smoke-free products accounted for 41.5% of PMI’s full-year 2025 net revenues and were used by over 43 million adult consumers as of December 31, 2025.

- Since 2008, PMI has invested over $16 billion in developing smoke-free products and secured the first-ever FDA marketing and Modified Risk Tobacco Product authorizations for its and Swedish Match’s offerings.

- PMI’s smoke-free transformation now delivers >40% of revenues and gross profit, with presence in 106 markets and three regions exceeding 50% smoke-free revenue, collectively driving 75% of operating income

- Reaffirmed 2026–2028 growth guidance: high single-digit to low-teens smoke-free volume growth, 6–8% organic revenue growth, 8–10% operating income growth, and 9–11% EPS (ex-FX) growth

- Multi-category strategy drives faster momentum, as markets with >1 smoke-free category record >15% in-market sales growth versus 10% with single-category presence

- Built extensive smoke-free infrastructure: 1.5 million points of sale, 8,000 brand retail outlets, and 500 million consumer interactions via experiential touchpoints

- PMI reconfirmed its 2026–2028 growth algorithm, targeting high single-digit to low-teen smoke-free volume growth, 6%–8% organic revenue growth, 8%–10% operating income growth, and 9%–11% adjusted EPS growth.

- Over 40% of revenues and gross profit now come from smoke-free products, with $17 billion in smoke-free revenues and 180 billion heatsticks sold across 106 markets as of Q4 2025.

- Three of four regions exceeded 50% smoke-free revenue penetration, representing 75% of operating income, surpassing PMI’s 2025 target of presence in 100 markets.

- Markets where PMI offers >1 smoke-free product see >15% in-market sales growth versus 10% where only one category is available, underscoring the multi-category strategy’s impact.

- The smoke-free transformation is driving sustained volume growth, margin expansion, and accelerating free cash flow, with leverage declining and a framework for durable double-digit EPS growth.

- At CAGNY 2026, PMI highlighted over 40% of its revenues and gross profit now derive from smoke-free products; the business generated $17 billion in smoke-free revenue and is present in 106 markets, targeting two-thirds of revenues from smoke-free by 2030.

- PMI’s 2026–2028 growth algorithm calls for high-single to low-teen smoke-free volume growth to offset combustible declines, driving 6–8% organic revenue growth, 8–10% operating income growth, and 9–11% EPS growth ex-Forex.

- Smoke-free products deliver 2.5× the revenue and 2.6× the gross profit per unit of combustible cigarettes, with smoke-free gross margins approaching 70%, boosting smoke-free share of group gross profit from 22% to 43% over five years.

- In 2025, PMI achieved a record 40%+ operating income margin, generated over $12 billion in annual operating cash flow, aims to reduce net debt/EBITDA to around 2× by end-2026, and maintained a 75% payout ratio with a 9% dividend increase.

- PMI’s smoke-free business achieved $17 billion in net revenues across 106 markets in 2025, with 43 markets deriving over 30% of adjusted net revenues from smoke-free products.

- Smoke-free products accounted for 19% of global nicotine industry volumes (ex-China) in 2025, growing at a 10% CAGR from 2022–2025, while combustible volumes (81% share) declined at a 2% CAGR.

- For 2026–28, PMI targets a high-single to low-teens SFP volume CAGR, 6–8% organic net revenue CAGR, and 9–11% currency-neutral adjusted EPS CAGR.

- PMI expects $45 billion in operating cash flow over 2026–28, average annual capex of $1.3–1.5 billion, and aims for net debt/EBITDA near 2.0× by end-2026, supporting its progressive dividend policy.

- Group CEO Jacek Olczak and CFO Emmanuel Babeau will present at the 2026 Consumer Analyst Group of New York Conference on February 18, 2026, at approximately 10:00 a.m. ET.

- Reaffirmed full-year 2026 reported diluted EPS guidance of $7.87 to $8.02 per share.

- Adjusted diluted EPS guidance of $8.38 to $8.53 per share, implying 11.1%–13.1% growth versus $7.54 in 2025.

- Excluding a $0.27 currency tailwind, adjusted EPS at constant rates is forecast at $8.11 to $8.26, or 7.5%–9.5% growth.

- At the 2026 CAGNY conference, PMI said its smoke-free products now contribute over 40% of revenues and gross profit, driving sustained volume growth, margin expansion, and accelerating free cash flow.

- Management cited declining leverage and a new capital-allocation framework to support durable double-digit EPS growth and faster shareholder returns.

- PMI reaffirmed its full-year 2026 reported diluted EPS guidance of $7.87–$8.02 and adjusted EPS guidance of $8.38–$8.53.

- Excluding a $0.27 per share favorable currency impact, adjusted EPS is projected to grow 7.5%–9.5% to a range of $8.11–$8.26.

- PMI’s CEO Jacek Olczak and CFO Emmanuel Babeau presented at the 2026 CAGNY conference

- Reaffirmed 2026 full-year reported diluted EPS guidance of $7.87–$8.02 per share

- Forecasted 2026 adjusted diluted EPS of $8.38–$8.53, reflecting 11.1%–13.1% growth over 2025

- Adjusted EPS excluding currency headwinds projects $8.11–$8.26, or 7.5%–9.5% growth vs. 2025

- PMI forecasts 11–13% adjusted EPS growth for 2026, underscoring confidence in its smoke-free strategy.

- Its smoke-free segment now represents 42% of revenue (≈$17 billion) with profitability having doubled over the past five years.

- Smoke-free volumes rose 12.8% in 2025; IQOS shipments grew 11%, while Zyn pouch volumes increased 19% in the latest quarter.

- Total smoke-free unit shipments reached 179 billion in 2025 (IQOS: 155 billion), with in-market IQOS sales up 12% in Q4 and 10.5% for the full year.

- PMI reiterated multi-year targets through 2028: 6–8% organic net revenue CAGR, 8–10% operating income CAGR and 9–11% adjusted EPS CAGR; cigarette volumes declined 1.5% in 2025.

- Q4 net revenue was $10.4 billion (+3.7% organic) with adj. diluted EPS of $1.70 (+9.0%); for FY 2025, net revenues reached $40.6 billion (+6.5% organic) and adj. diluted EPS was $7.54 (+14.2%).

- Smoke-free products accounted for 41.5% of net revenues in 2025; e-vapor shipments grew 102% and heated tobacco units volumes rose 11% year-over-year.

- Adjusted operating income was $16.4 billion (+10.6% organic) in FY 2025, with adjusted operating margin expanding to 40.4%.

- Achieved 3-year volume and EPS CAGR targets in two years; renewed 2026–28 growth targets and expect accelerating cash flow from 2026 to support shareholder returns.

Quarterly earnings call transcripts for Philip Morris International.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more