Earnings summaries and quarterly performance for PENTAIR.

Executive leadership at PENTAIR.

John Stauch

Chief Executive Officer

De'Mon Wiggins

Executive Vice President and President, Flow

Heather Hausmann

Executive Vice President, Chief Information Officer and Chief Information Security Officer

Jennifer Hensley

Senior Vice President, Chief Accounting Officer and Controller

Jerome Pedretti

Executive Vice President and Chief Executive Officer, Pool

Lance Bonner

Executive Vice President, General Counsel and Secretary

Nicholas Brazis

Senior Vice President, Finance

Robert Fishman

Executive Vice President, Chief Financial Officer and Chief Accounting Officer

Board of directors at PENTAIR.

Billie Williamson

Director

David A. Jones

Chair of the Board

Gregory Knight

Director

Melissa Barra

Director

Michael Speetzen

Director

Mona Abutaleb Stephenson

Director

T. Michael Glenn

Director

Theodore Harris

Director

Tracey Doi

Director

Research analysts who have asked questions during PENTAIR earnings calls.

Andrew Krill

Deutsche Bank

8 questions for PNR

Deane Dray

RBC Capital Markets

8 questions for PNR

Jeffrey Hammond

KeyBanc Capital Markets

8 questions for PNR

Julian Mitchell

Barclays Investment Bank

8 questions for PNR

Nigel Coe

Wolfe Research, LLC

7 questions for PNR

Joseph Giordano

TD Cowen

6 questions for PNR

Steve Tusa

JPMorgan Chase & Co.

6 questions for PNR

Brett Linzey

Mizuho Securities

5 questions for PNR

Nathan Jones

Stifel, Nicolaus & Company, Incorporated

5 questions for PNR

Saree Boroditsky

Jefferies

5 questions for PNR

Andrew Buscaglia

BNP Paribas

4 questions for PNR

Andrew Kaplowitz

Citigroup

4 questions for PNR

Andy Kaplowitz

Citigroup Inc.

4 questions for PNR

Brian Lee

Goldman Sachs Group, Inc.

4 questions for PNR

Mike Halloran

Robert W. Baird & Co. Incorporated

4 questions for PNR

Scott Graham

Seaport Research Partners

4 questions for PNR

Brian Blair

Oppenheimer & Co. Inc.

3 questions for PNR

Bryan Blair

Oppenheimer

3 questions for PNR

Damian Karas

UBS

3 questions for PNR

C. Stephen Tusa

JPMorgan Chase & Co.

2 questions for PNR

Michael Halloran

Baird

2 questions for PNR

Nathan Jones

Stifel

2 questions for PNR

Nick Cash

Goldman Sachs Group, Inc.

2 questions for PNR

Adam Farley

Stifel Financial Corp.

1 question for PNR

Nick Ash

Goldman Sachs Group, Inc.

1 question for PNR

Recent press releases and 8-K filings for PNR.

- Pentair outlines a strategy targeting mid-single-digit organic revenue growth and 100 bps annual margin expansion to reach 28% ROS by 2028, excluding potential uplift from U.S. residential recovery.

- The Flow & Water Solutions segment delivered $225 million operating income in FY 2025, and plans to drive high incremental margins via next-gen pump innovations, IoT-enabled aftermarket services, and commercial/infrastructure growth platforms.

- Pentair Pool achieved 8% annual growth and 600 bps margin expansion over the past six years, leveraging its leading brand, extensive dealer network, and pool connectivity to capture share and address labor constraints.

- The Pentair Business System, including 80/20 SKU rationalization, has structurally reduced fixed costs, exited Quad 4 offerings, and refocused capacity on Quad 1 customers, supporting durable earnings leverage and ~100% free cash flow conversion.

- A strong cash flow profile and investment-grade balance sheet underpin disciplined capital allocation—organic investments in high-return platforms, accretive M&A, 50th consecutive year of dividend raises, and opportunistic share buybacks.

- Pentair expects mid-single-digit organic revenue growth and ~100 bps annual margin expansion, targeting 28% return on sales by 2028.

- In its base case, Pentair targets mid-single-digit revenue growth, high-single-digit adjusted operating income growth, low-double-digit EPS compounding, and ~100% free cash flow conversion, with additional upside from residential recovery and breakthrough innovations.

- The company prioritizes organic investments, dividend growth (50th consecutive year), and disciplined M&A/share buybacks, while maintaining an investment-grade balance sheet (≤2.5 x net leverage cap).

- Strategic use of its Pentair business system (80/20, SIOP, make-buy) has delivered structural cost reductions, portfolio simplification (6,500 SKUs cut), and improved returns, supporting a high-teens ROIC through cycles.

- Growth is expected to be balanced across Flow, Water Quality, Commercial, and Pool segments, generating approximately $2.7 billion of cumulative cash through 2028 for reinvestment and shareholder returns.

- Pentair expects mid-single-digit revenue growth, ~100 bps margin expansion, and low-double-digit EPS growth through 2028, targeting 28% ROS by 2028 on a base-case excluding housing recovery and breakthrough innovations.

- The Pentair Business System and 80/20 program have permanently reset the cost base, yielding sustained incremental margins, ~100% free cash flow conversion, and supporting ~$2.7 billion of cumulative cash generation to 2028.

- Pool and Commercial Water Solutions are identified as best-in-class businesses with clear growth and margin expansion paths, while Flow & Water Quality Management focus on complexity reduction and productivity to drive future margin gains.

- Capital allocation is prioritized as organic growth, dividend increases (50 consecutive years of raises), and disciplined opportunistic M&A and share buybacks, underpinned by an investment-grade balance sheet.

- A unified strategy across 12 water businesses will leverage innovation, digital solutions, and AI to address evolving water challenges and expand the total addressable market.

- Pentair is hosting an Investor Day in New York City today from 9:30 a.m. to 12 p.m. ET, featuring presentations by CEO John Stauch and CFO Nick Brazis.

- The company is reiterating its 2026 guidance and unveiling new long-term financial targets through fiscal 2028.

- CEO John Stauch highlighted trends in water scarcity and infrastructure modernization, and outlined plans for sales growth, margin expansion, adjusted EPS growth, and stronger free cash flow on a multi-decade value creation runway.

- In 2025, Pentair generated approximately $4.2 billion in revenue and trades under the ticker PNR.

- Nick Brazis succeeds Bob Fishman as CFO effective March 1, 2026; De’Mon Wiggins now leads both Flow and Water Solutions segments.

- For FY 2026 Pentair guides flat pool volumes with 2–3 points of price, Water Solutions up low-single digits, and Flow up high-single digits with ~100 bps margin expansion.

- Emphasis on a balanced guide across Move, Improve, and Enjoy segments, each contributing roughly equally to incremental EBITDA.

- Leverage reduced to 1.4× net debt/EBITDA; recent bolt-on acquisitions include Gulf Stream and Hydra-Stop; future M&A to prioritize ROIC enhancement.

- Pentair guided full-year 2026 with flat Pool volumes (assuming no residential recovery), 2–3% pricing to offset inflation, high-single-digit growth in Flow, low-single-digit growth in Water Solutions, and ~100 bp system-wide margin expansion, with each segment contributing equally to incremental EBITDA

- CFO Bob Fishman will retire effective March 1, 2026, and Nick Brazis is appointed as incoming CFO

- Demand remains strong in commercial (buildings, healthcare, data centers) and industrial markets driven by recurring-revenue solutions, while residential end markets are flat

- Ongoing transformation program targeting >26% corporate margins, delivering approximately $70 million annually in productivity gains, with further opportunities beyond 2026

- Pentair CFO Bob Fishman will retire on March 1, with Nick Brazis named incoming CFO after a two-year overlap in preparation for the transition.

- De’Mon Wiggins is now leading both the Flow and Water Solutions segments, targeting synergies in residential/commercial filtration and growth in industrial and convenience-store markets.

- 2026 guidance calls for flat pool volumes offset by 2–3% pricing, Water Solutions growth in the low single digits, Flow growth in the high single digits with ~100 bps margin expansion, and balanced EBITDA contributions across all segments.

- Capital allocation remains disciplined: net debt/EBITDA delevered from ~2.5× post-Manitowoc to 1.4× at end-2025, with bolt-on M&A (Gulf Stream, Hydra-Stop), share buybacks, and light CapEx.

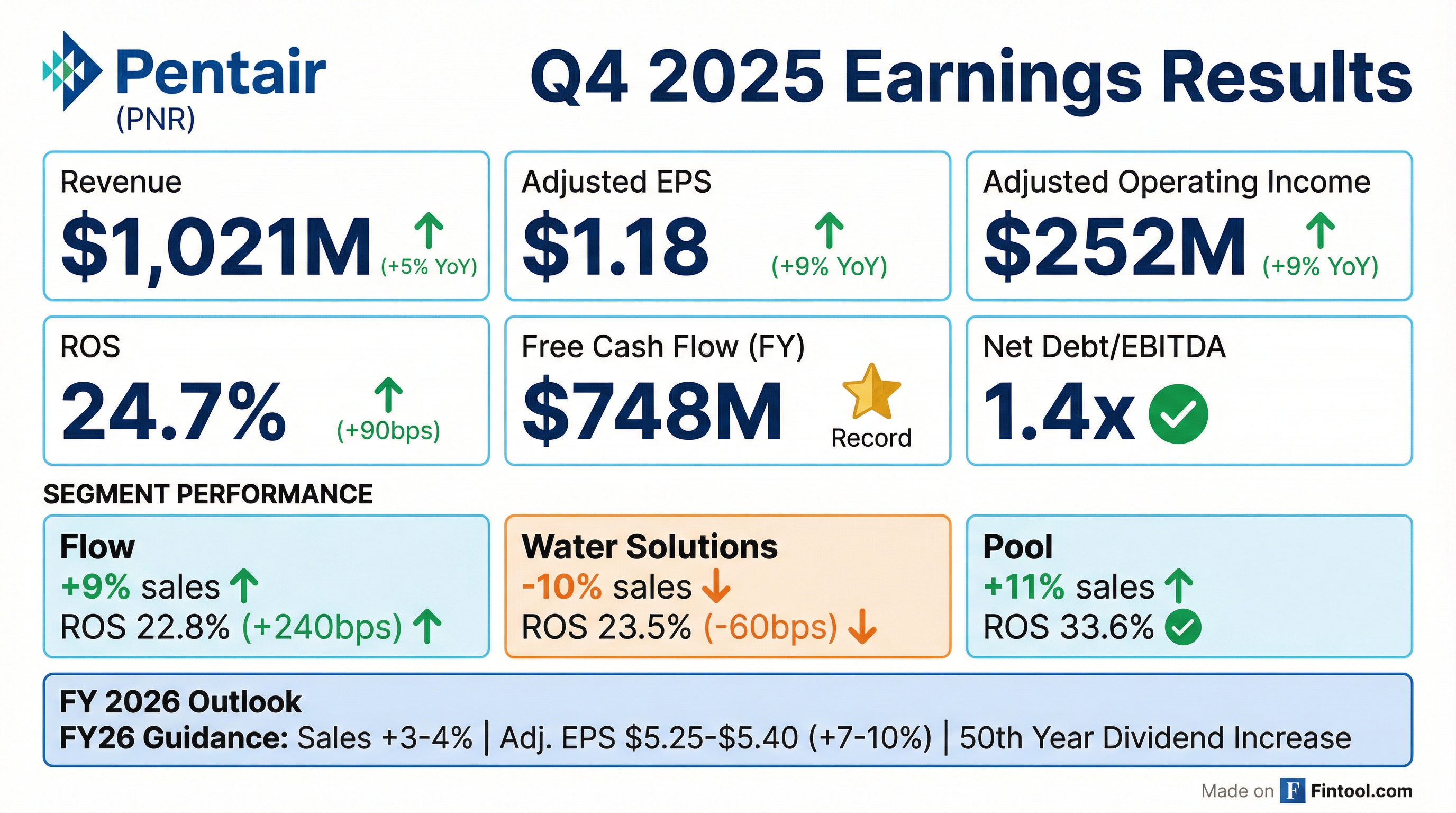

- Pentair delivered 5% sales growth to $1,021 M, 9% adjusted operating income growth to $252 M, a 90 bps expansion in ROS to 24.7%, and 9% higher adjusted EPS of $1.18 in Q4 2025.

- Growth was led by Pool (+11%) and Flow (+9%), with core sales up 4% year-over-year.

- Updated FY 2026 guidance: total sales expected to rise 3–4% to $4,280–4,330 M, and adjusted EPS of $5.25–5.40 (up 7–10%).

- Generated $748 M of free cash flow in FY 2025, repurchased $225 M of shares, maintained a 50th consecutive annual dividend increase, and ended the year with net debt/EBITDA of 1.4×.

- Delivered 5% sales growth, 9% adjusted operating profit increase, ROS expanded to 24.7%, and adjusted EPS of $1.18, marking the 15th consecutive quarter of margin expansion.

- Generated record free cash flow of $748 million, returned $225 million to shareholders via share repurchases, and authorized a new $1 billion buyback program.

- Announced CFO transition: Nick Brazis named incoming CFO, succeeding Bob Fishman after six years and 24 quarters of service.

- Issued 2026 outlook: 3%–4% sales growth, 5%–8% adjusted operating income growth, and adjusted EPS guidance of $5.25–$5.40.

- Effective Q1 2026, combined residential Flow and Water Solutions businesses under one leadership to drive channel synergies and operational scale.

- In Q4, Pentair delivered 5% sales growth, 24.7% ROS, and $1.18 adjusted EPS, marking the 15th consecutive quarter of margin expansion.

- For FY 2025, the company posted $4.18 billion in sales (+2%), $4.92 adjusted EPS (+14%), and a record $748 million in free cash flow.

- Nick Brazis has been named incoming CFO, succeeding Bob Perkis as part of a management transition.

- The 2026 outlook calls for 3–4% sales growth and $5.25–$5.40 adjusted EPS, an ~8% increase at midpoint, with a target ROS of ~26%.

Quarterly earnings call transcripts for PENTAIR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more