PARK NATIONAL CORP /OH/ (PRK)·Q4 2025 Earnings Summary

Park National Posts Record Earnings, Raises Dividend Ahead of First Citizens Merger

January 26, 2026 · by Fintool AI Agent

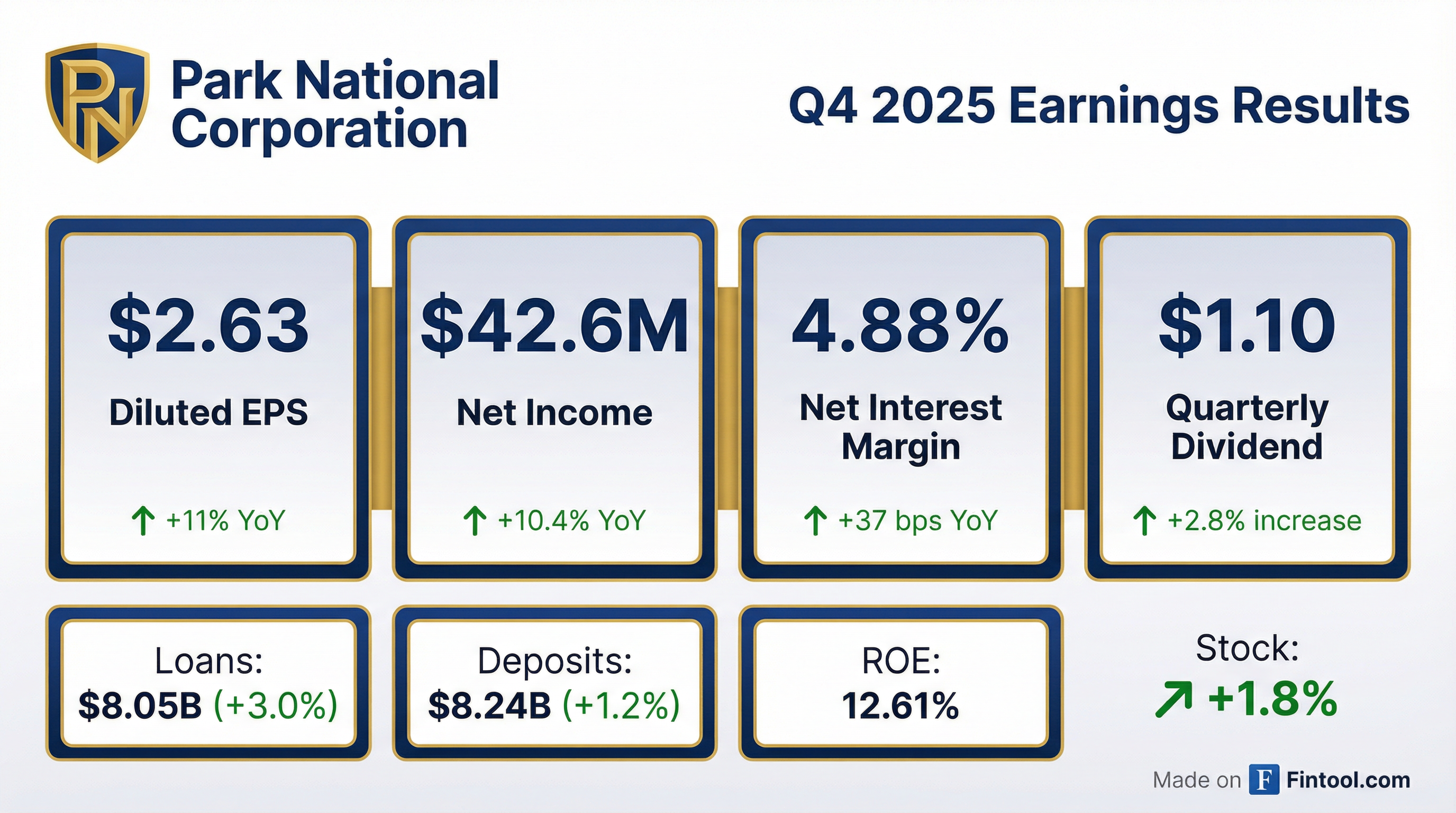

Park National Corporation (NYSE: PRK) delivered another strong quarter, posting Q4 2025 net income of $42.6 million—a 10.4% increase year-over-year—while raising its quarterly dividend to a record $1.10 per share . The Newark, Ohio-based regional bank capped off a record year with full-year net income of $180.1 million (+18.9% YoY) as it prepares to close its acquisition of First Citizens Bancshares on February 1, 2026 .

Did Park National Beat Earnings?

Yes—on an adjusted basis. Park National reported diluted EPS of $2.63 for Q4 2025, up 11% from $2.37 in Q4 2024 . On an adjusted basis (excluding merger costs and one-time items), diluted EPS was $2.93, beating consensus estimates of $2.74 by approximately 7% .

The gap between GAAP and adjusted EPS reflects $1.6 million in merger-related expenses for the First Citizens acquisition, a $1.0 million foundation contribution, and $989,000 in restructuring costs .

What Drove the Strong Results?

Net interest margin expansion was the primary driver. Park's NIM expanded to 4.88% in Q4 2025, up 37 basis points from 4.51% a year earlier . This expansion came from:

- Loan yield improvement – Yield on loans rose to 6.34% (+13 bps YoY)

- Funding cost decline – Cost of interest-bearing deposits fell to 1.61% (-29 bps YoY) as the rate environment normalized

- Reduced borrowings – Interest expense on borrowings dropped 90% to $268,000 after the company redeemed $190 million of subordinated debt in September 2025

How Did the Stock React?

Shares rose approximately 1.8% on the day of the release, trading at $161.34 as of January 26, 2026. The stock has pulled back from its 52-week high of $179.48, but remains well above the 52-week low of $137.97.

The muted reaction likely reflects that much of the good news was expected—Park has beaten or met estimates in most recent quarters, and the First Citizens merger timeline was already known.

What Changed From Last Quarter?

The dividend got raised. Park National declared a quarterly cash dividend of $1.10 per share, up from $1.07 in Q3 2025—a 2.8% increase . The company also declared a special dividend of $1.25 per share in Q3 2025 (paid in Q4), bringing total 2025 dividends to $5.53 per share .

Credit quality remains solid. Nonperforming loans fell to 0.86% of total loans, down from 1.13% in Q3 2025 . Net charge-offs were just 0.13% annualized, well below historical averages .

Loan growth continued. Total loans reached $8.05 billion, up 3.0% from December 2024, driven primarily by commercial loan growth of 5.9% .

What Did Management Say?

"Our performance reflects the hard work and dedication our associates demonstrate in service to others. With earnings and dividends at their highest levels, we're delivering solid value for our fellow shareholders." — David Trautman, Chairman

"Our loan and deposit growth demonstrate the strength of our relationships and the trust our customers place in us. Looking ahead to the expected closing of First Citizens Bancshares, Inc. on February 1, 2026, we're energized by the opportunities the partnership will create." — Matthew Miller, CEO & President

First Citizens Merger Update

The merger is on track to close February 1, 2026. First Citizens Bancshares shareholders approved the deal on January 21, 2026, and all regulatory approvals have been obtained .

Key details:

- Regulatory clearance: OCC approved the Bank Merger; Federal Reserve Bank of Cleveland granted waiver

- Structure: First Citizens will merge into Park, with First Citizens National Bank merging into The Park National Bank

- Expected close: February 1, 2026

Full Year 2025 Summary

Forward Catalysts & Risks

Catalysts:

- First Citizens integration – Potential cost synergies and expanded footprint once the merger closes

- Rate environment – Further Fed cuts could support deposit repricing and NIM stability

- Dividend growth – Track record suggests continued increases with strong earnings

Risks:

- Merger execution – Integration of First Citizens operations could create near-term noise

- Commercial real estate – Bank has concentration in CRE loans that could face headwinds

- Competitive pressures – Regional banking consolidation continues

Key Takeaways

- Record year – Full-year 2025 net income of $180.1M and EPS of $11.11 were all-time highs

- Dividend raised – Quarterly dividend up 2.8% to $1.10; total 2025 payout of $5.53/share

- Margin expansion – NIM hit 4.88%, the highest in recent history, driven by funding cost declines

- Credit quality stable – NPLs at 0.86% of loans; net charge-offs just 0.08% for the year

- Merger imminent – First Citizens deal expected to close February 1, 2026

For more details, read the full 8-K filing or explore Park National's company page.