Earnings summaries and quarterly performance for PARK NATIONAL CORP /OH/.

Executive leadership at PARK NATIONAL CORP /OH/.

Board of directors at PARK NATIONAL CORP /OH/.

BM

Byrd Miller III

Detailed

Director

DD

Daniel DeLawder

Detailed

Director

DA

Donna Alvarado

Detailed

Director

FB

Frederic Bertley

Detailed

Director

JJ

Jason Judd

Detailed

Director

KM

Karen Morrison

Detailed

Director

KG

Kelly Gratz

Detailed

Director

LZ

Leon Zazworsky

Detailed

Lead Independent Director

RO

Robert O'Neill

Detailed

Director

TM

Timothy McLain

Detailed

Director

WE

William Englefield IV

Detailed

Director

Research analysts covering PARK NATIONAL CORP /OH/.

Recent press releases and 8-K filings for PRK.

Park National Corporation Completes Acquisition and Announces New CEO

PRK

M&A

CEO Change

Earnings

- Park National Corporation (PRK) completed its acquisition of First Citizens Bancshares, Inc. on February 1, 2026, adding $2.6 billion in assets and increasing PRK's total assets to over $10 billion. This transaction is projected to be 15% accretive to 2026E EPS and slightly accretive to tangible book value.

- For the year ended December 31, 2025, PRK reported strong profitability with a return on average assets of 1.78% and a return on average tangible common equity of 15.76%.

- Matthew R. Miller assumed the role of CEO of Park and Park National Bank in January 2026, succeeding David L. Trautman.

- As of December 31, 2025, the company maintained robust capital ratios, including a Common Equity Tier 1 (CET1) ratio of 14.0%.

Feb 9, 2026, 1:00 PM

Park National Corporation Completes Merger with First Citizens Bancshares

PRK

M&A

Board Change

- Park National Corporation successfully completed its all-stock merger transaction with First Citizens Bancshares, Inc. on February 1, 2026.

- As of December 31, 2025, the combined company has pro forma total assets of $12.6 billion, deposits of $10.5 billion, and loans of $9.6 billion.

- The merger extends Park's presence into Tennessee, resulting in more than 100 branches across Ohio, Kentucky, North Carolina, South Carolina, and Tennessee.

- Jeffrey D. Agee, former CEO and Chairman of First Citizens, joined Park's Board of Directors and will lead the new Tennessee Region of Park.

Feb 2, 2026, 1:00 PM

Park National Corporation Reports 2025 Results, Increases Dividend, and Provides Merger Update

PRK

Earnings

Dividends

M&A

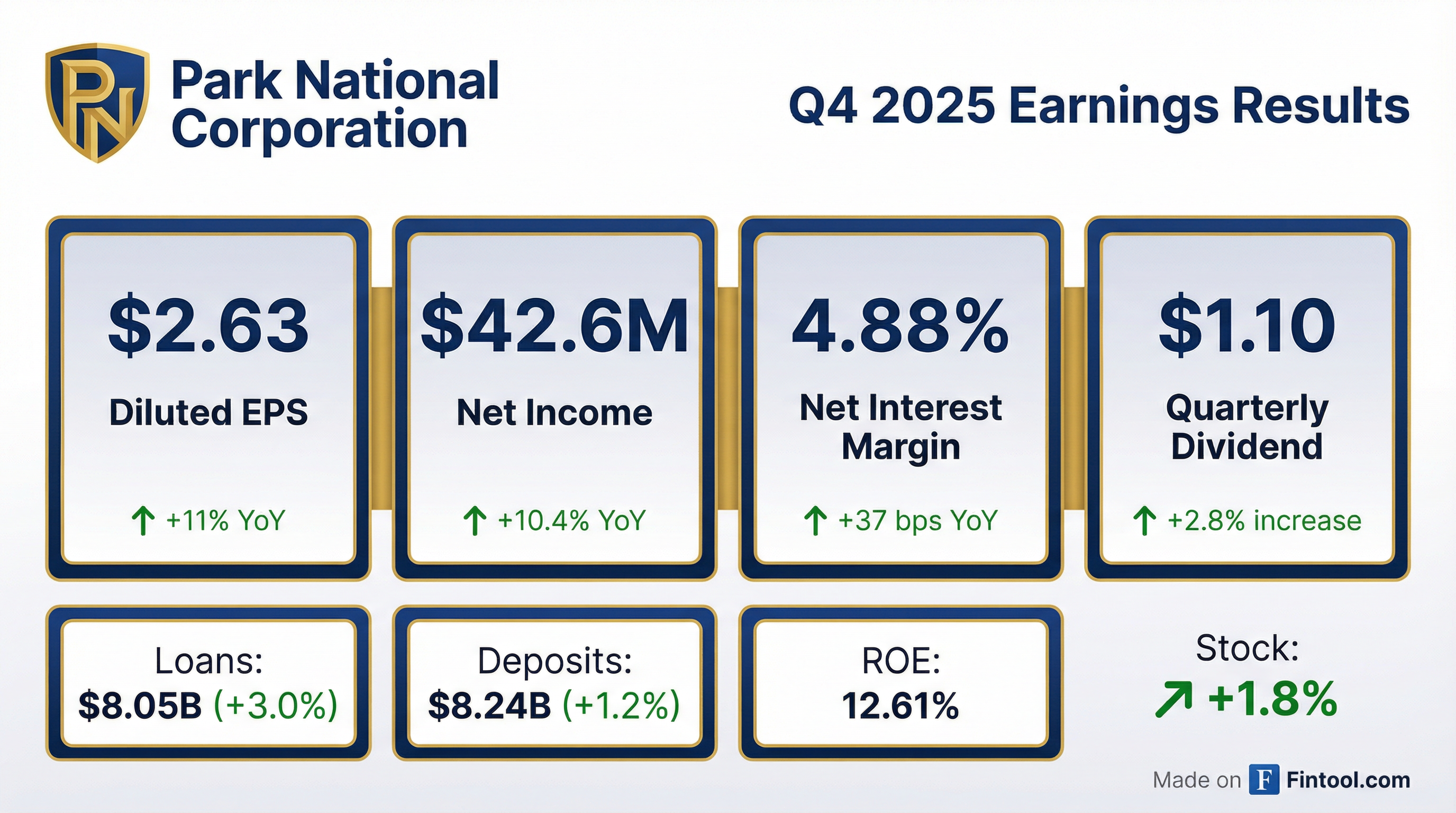

- Park National Corporation reported net income of $42.6 million for the fourth quarter of 2025, a 10.4% increase from the fourth quarter of 2024, and $180.1 million for the full year 2025, an 18.9% increase from 2024.

- Diluted net income per common share was $2.63 for the fourth quarter of 2025 and $11.11 for the full year 2025.

- The board of directors declared a quarterly cash dividend of $1.10 per common share, payable on March 10, 2026, to common shareholders of record as of February 20, 2026.

- The merger with First Citizens Bancshares, Inc. is expected to close on February 1, 2026, following approval by First Citizens' shareholders and regulatory bodies.

Jan 26, 2026, 9:15 PM

Park National Corporation Reports Strong Q3 2025 Results and Announces Acquisition

PRK

Earnings

Dividends

M&A

- Park National Corporation reported net income of $47.2 million for Q3 2025, a 23.4% increase from Q3 2024, with diluted earnings per common share of $2.92. For the first nine months of 2025, net income was $137.4 million, up 21.8% from the same period in 2024, with diluted EPS of $8.48.

- The company's board declared a quarterly cash dividend of $1.07 per common share and a special one-time dividend of $1.25 per common share, both payable on December 10, 2025.

- Park announced the acquisition of First Citizens Bancshares, Inc. for approximately $317.3 million, a transaction expected to be 15% accretive to 2026 earnings per share and slightly accretive to tangible book value per share. The acquisition is anticipated to be completed in Q1 2026 and will contribute to Park crossing $10 billion in total assets in Q1 2026.

- As of September 30, 2025, Park's total assets were $9.9 billion, with total loans increasing 2.2% and deposits increasing 2.3% during the first nine months of 2025. The allowance for credit losses as a percentage of period-end loans was 1.15%.

Oct 27, 2025, 8:05 PM

Park National Corporation to Acquire First Citizens Bancshares, Inc.

PRK

M&A

Board Change

New Projects/Investments

- Park National Corporation (PRK) and First Citizens Bancshares, Inc. (FIZN) have signed a definitive merger agreement, under which FIZN will merge with and into Park in an all-stock transaction.

- The transaction is valued at approximately $317.3 million, with FIZN shareholders receiving 0.52 shares of Park common stock for each FIZN share, implying a per share price of $82.96 based on Park's October 24, 2025 closing price.

- As of September 30, 2025, the combined company is projected to have pro forma total assets of $12.5 billion, deposits of $10.5 billion, and loans of $9.6 billion.

- The merger is anticipated to be approximately 15% accretive to 2026 earnings per share and slightly accretive to tangible book value per share, with completion expected in the first quarter of 2026.

- First Citizens' CEO, Jeff Agee, will lead the new Tennessee Region of Park National Bank, and one FIZN director will join Park's Board of Directors.

Oct 27, 2025, 8:01 PM

Park National Corporation Reports Q3 and Nine-Month 2025 Financial Results

PRK

Earnings

Dividends

- Park National Corporation reported a 23.4 percent increase in net income to $47.2 million for the third quarter of 2025, with diluted earnings per common share rising to $2.92.

- For the first nine months of 2025, net income increased 21.8 percent to $137.4 million, and diluted earnings per common share reached $8.48.

- The board of directors declared a quarterly cash dividend of $1.07 per common share and a special one-time dividend of $1.25 per common share, both payable on December 10, 2025.

- Total loans increased 2.2 percent during the first nine months of 2025, and reported period-end deposits grew 2.3 percent in the same period.

Oct 27, 2025, 8:00 PM

Park National Corp Reports Q1 2025 Financial and Strategic Highlights

PRK

Earnings

M&A

- Financial Performance: Q1 2025 highlights include a net income of $42.2M and an improved net interest margin of 4.62%, with substantial growth in book value and loans, reflecting strong capital ratios and balance sheet management.

- Geographic Expansion & Leadership: The company emphasizes its diversified regional footprint across Ohio, North Carolina, and Kentucky, strengthened by experienced management and ongoing branch consolidation and market acquisitions.

- Strategic M&A & Growth Initiatives: Park National is strategically managing balance sheet growth below $10B while investing in people, processes, and technology to meet enhanced regulatory expectations, including partnering with third-party advisors for M&A readiness.

May 19, 2025, 12:00 AM

Park National Corp Reports Q1 2025 Financial Results

PRK

Earnings

Dividends

- Q1 2025 results showed a net income of $42.2 million, a 19.8% increase from Q1 2024, with diluted EPS rising to $2.60 from $2.17.

- The board declared a quarterly cash dividend of $1.07 per common share, payable on June 10, 2025, to shareholders as of May 16, 2025.

Apr 25, 2025, 12:00 AM

Park National Corp Q4 2024 Investor Presentation Overview

PRK

Earnings

- The document is an 8‑K investor presentation for Park National Corp filed on March 10, 2025, detailing Q4 2024 financial results and risk disclosures.

- It highlights key financial metrics including a net income of $38.6M, an improved net interest margin of 4.51%, and strong capital ratios (Total Shareholders’ Equity to Total Assets of 12.69% and Tangible Equity to Tangible Assets of 11.21%).

- The presentation also emphasizes a diversified revenue base, a balanced loan portfolio, and prudent management of credit losses, all underpinned by comprehensive forward‑looking statements.

Mar 10, 2025, 12:00 AM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more