PARKS AMERICA (PRKA)·Q1 2026 Earnings Summary

Parks! America Q1 FY2026: Revenue Jumps 18% as Texas Park Turnaround Delivers

February 6, 2026 · by Fintool AI Agent

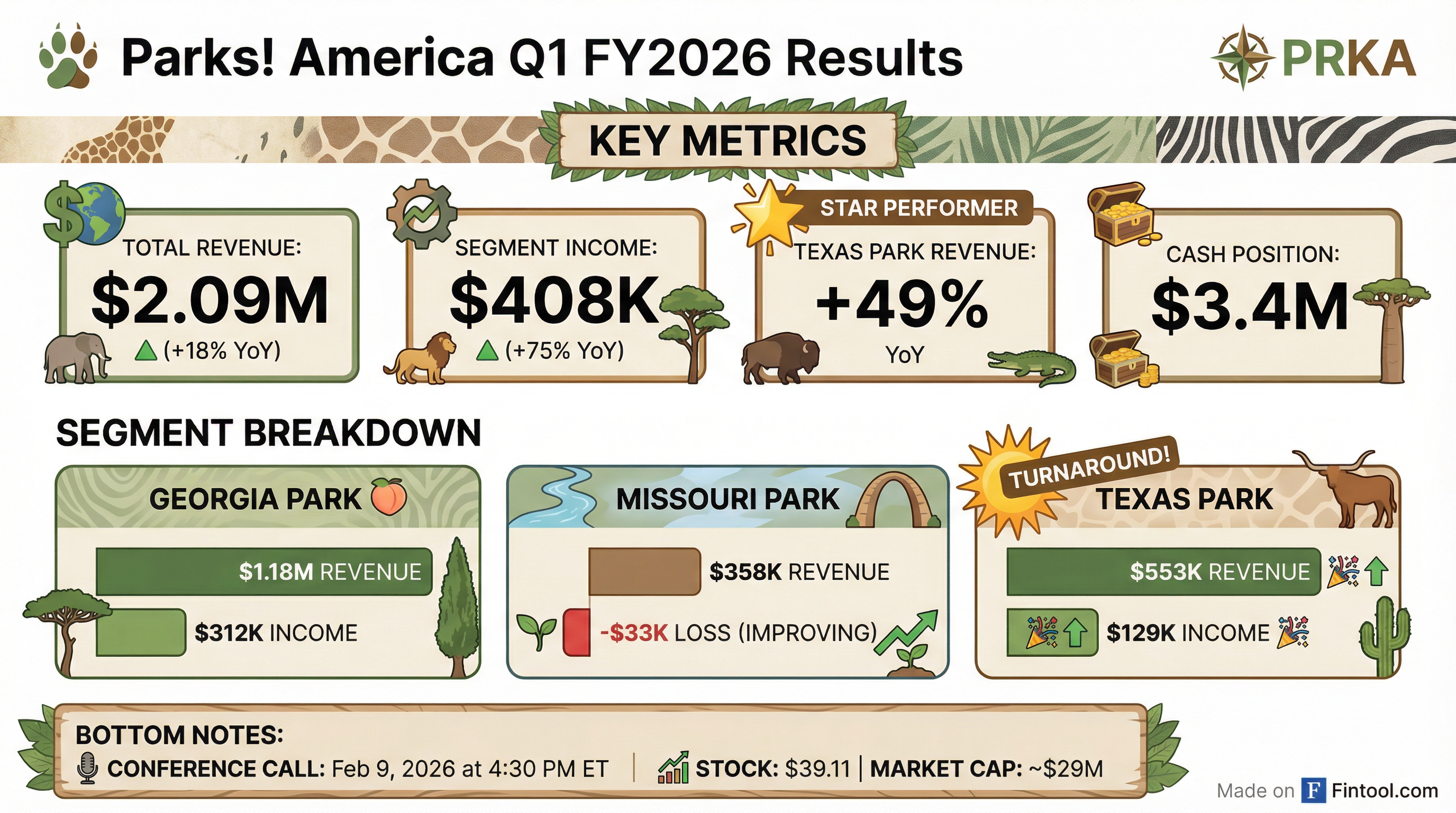

Parks! America (OTCQX: PRKA), the regional safari park operator, reported Q1 fiscal 2026 results showing strong operational momentum across all three locations. Total revenue grew 18% year-over-year to $2.09M, while consolidated segment income surged 75% to $408K . The Texas Park completed a notable turnaround, swinging from a $52K loss in Q1 FY2025 to $129K profit this quarter .

Did Parks! America Beat Expectations?

As a small-cap OTC company with no Wall Street analyst coverage, Parks! America does not have consensus estimates to compare against. However, the results represent a significant improvement versus the prior year:

Important context on the bottom line: Q1 FY2025's pretax income of $277K included a one-time gain of $567K from "Contested proxy and related matters" — a legal/governance recovery that inflated last year's earnings . Excluding this non-recurring item, Q1 FY2025 would have shown an underlying pretax loss of ~$290K. The Q1 FY2026 loss of $46K represents a ~$245K improvement in core operations .

What Changed From Last Quarter?

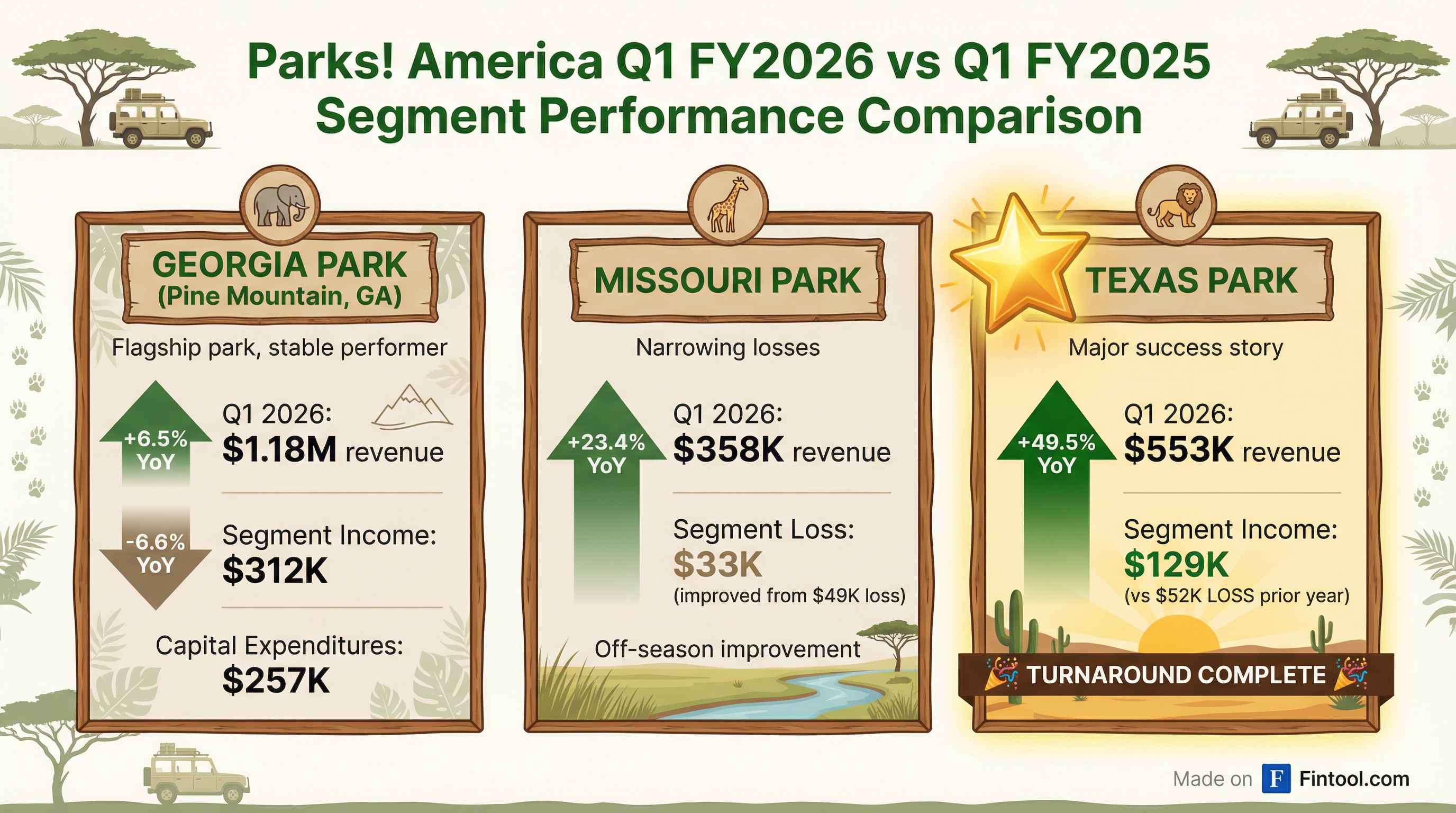

Texas Park Turnaround Complete: The biggest story this quarter is the Texas Park's dramatic improvement. Revenue jumped 49% YoY to $553K, and the park swung from a $52K loss to $129K profit — a $181K improvement . This builds on Q4 FY2025 momentum when Texas generated $189K segment income vs. a $29K loss the prior year .

Missouri Narrowing Losses: Missouri Park reduced its segment loss from $49K to $33K while growing revenue 23% to $358K . The winter off-season remains challenging for this location, but improvement is evident.

Georgia Steady but Mixed: The flagship Georgia Park grew revenue 6.5% to $1.18M but saw segment income decline 6.6% to $312K . Higher personnel and advertising costs offset revenue gains.

Segment Breakdown

Key expense drivers:

- Advertising & marketing increased significantly to $243K vs. $124K prior year (+96%) — the company is investing in visitor acquisition

- Personnel costs rose 5% to $673K

- Cost of goods sold increased with higher volumes to $276K vs. $252K

How Did the Stock React?

PRKA shares traded at $39.11 with minimal volume (32 shares) on the day of the earnings release. The stock has been stable around the $39 level since late January 2026. Key context:

The stock trades on the OTCQX with very limited liquidity. The 52-week low of $0.38 reflects a stock split adjustment; the actual trading range has been much tighter. Shares have appreciated meaningfully over the past year as operating performance improved.

Balance Sheet Highlights

Cash declined $455K in the quarter, primarily funding capital expenditures of $305K and covering the seasonal operating loss. This is typical for Q1, which falls in the lower-traffic winter period.

Capital Expenditures by Park:

- Georgia: $257K (down from $496K prior year)

- Missouri: $22K

- Texas: $26K

Forward Catalysts

-

Spring/Summer Season Approaching: Q2-Q4 are seasonally stronger periods for safari parks. Management's Q4 FY2025 results showed consolidated revenue of $3.2M and segment income of $1.37M , demonstrating the business's seasonality.

-

Texas Momentum: If the Texas Park maintains its trajectory, it could contribute meaningfully to full-year results after years of underperformance.

-

Conference Call: Management will host a conference call on Monday, February 9, 2026 at 4:30 PM ET . Investors can email questions to [email protected].

Risks and Considerations

- Seasonality: Q1 is the weakest quarter; results should be viewed in context of full fiscal year trends

- Liquidity: Very low trading volume makes entry/exit challenging for institutional investors

- No Guidance: Company does not provide forward guidance or have analyst coverage

- Georgia Margin Pressure: Higher advertising spend compressed Georgia Park profitability despite revenue growth

- Interest Expense: $49K interest expense remains a drag on profitability

The Bottom Line

Parks! America delivered a solid Q1 FY2026, with the headline story being the Texas Park's successful turnaround. Revenue growth of 18% and segment income growth of 75% demonstrate improving operational execution across the three-park portfolio. While the company reported a small pretax loss, this reflects seasonality and is a significant improvement from adjusted prior-year performance when stripping out one-time proxy contest gains.

The upcoming spring and summer season will be the true test of whether momentum can continue. With $3.4M in cash and modest capex needs, the balance sheet appears adequate to fund operations.