Earnings summaries and quarterly performance for PARKS AMERICA.

Executive leadership at PARKS AMERICA.

Board of directors at PARKS AMERICA.

Research analysts who have asked questions during PARKS AMERICA earnings calls.

Recent press releases and 8-K filings for PRKA.

Parks! America, Inc. Reports First Quarter Fiscal 2026 Financial Results

PRKA

Earnings

Profit Warning

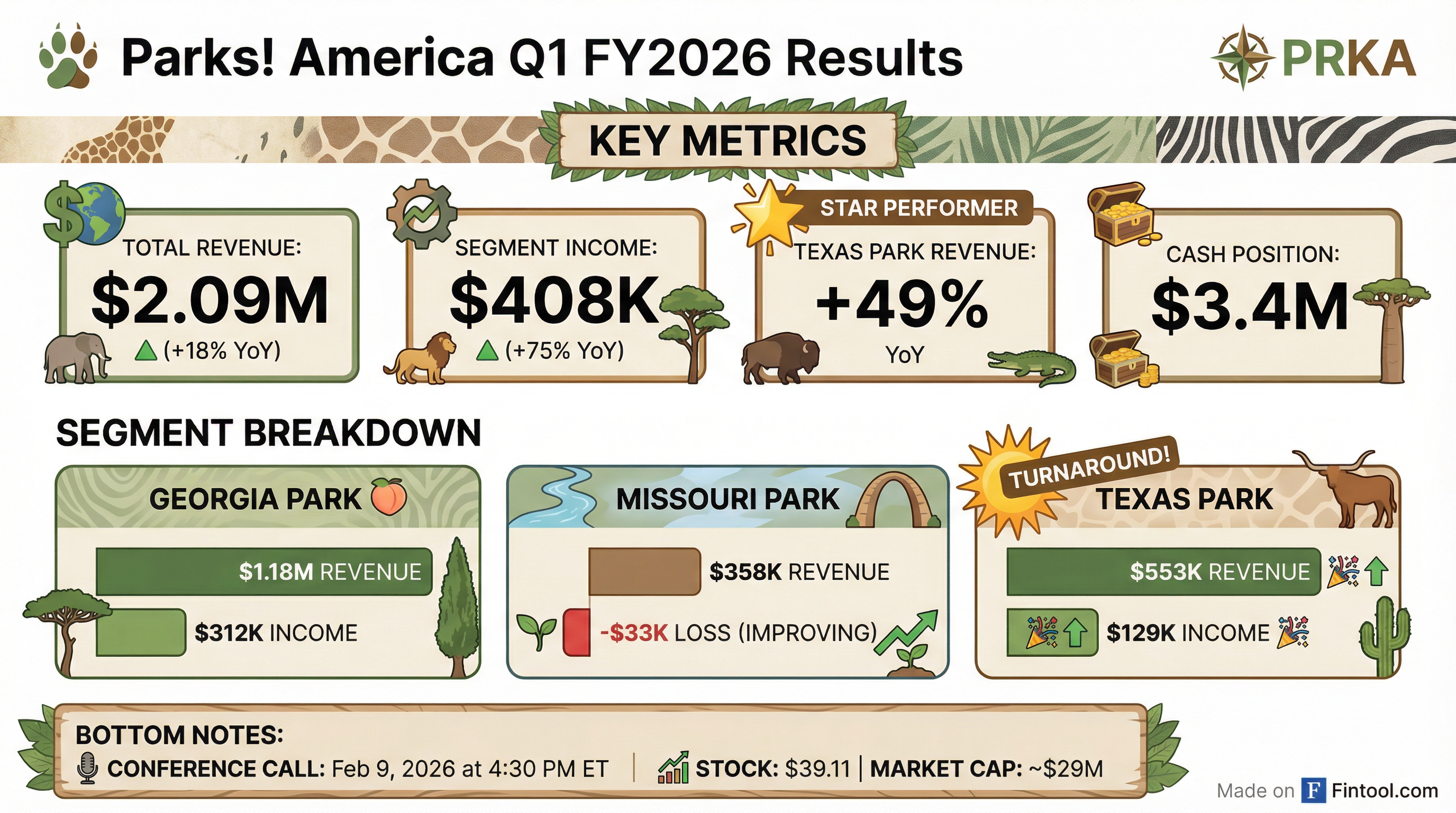

- Parks! America, Inc. reported total revenue of $2,093,398 for the first fiscal quarter ended December 28, 2025, an increase compared to $1,770,458 in the prior year period.

- For the 13 weeks ended December 28, 2025, the company recorded a loss before income taxes of $(45,561), a decline from an income of $276,941 in the same period of the previous year.

- Consolidated segment income increased to $407,727 for the quarter ended December 28, 2025, up from $232,719 in the prior year.

- As of December 28, 2025, total assets were $19,208,517, and total cash & short-term investments amounted to $3,421,972.

19 hours ago

Parks! America Reports Q1 Fiscal 2026 Financial Results

PRKA

Earnings

New Projects/Investments

- Parks! America, Inc. announced its financial results for the first fiscal quarter ended December 28, 2025, on February 6, 2026.

- The company reported a consolidated total revenue of $2,093,398 for Q1 fiscal 2026, an increase from $1,770,458 in the prior year period.

- Consolidated segment income for the quarter was $407,727, up from $232,719 in the first fiscal quarter of the prior year.

- Parks! America, Inc. reported a loss before income taxes of ($45,561) for Q1 fiscal 2026, compared to an income of $276,941 for the same period in the prior year.

- Total capital expenditures for the quarter ended December 28, 2025, were $304,853, a decrease from $601,476 in the prior year period.

19 hours ago

Parks! America Authorizes Share Repurchase Program

PRKA

Share Buyback

- Parks! America, Inc. announced on December 17, 2025, that its Board of Directors authorized a share repurchase program.

- The program allows the company to repurchase up to the lesser of 75,000 shares (representing 9.95% of shares outstanding) or $3 million of its common stock.

- Repurchases will be funded using the Company’s cash on hand, and the program is discretionary, meaning it can be suspended or discontinued at any time.

Dec 17, 2025, 9:10 PM

Parks! America Authorizes Share Repurchase Program

PRKA

Share Buyback

- Parks! America, Inc. (OTCQX: PRKA) announced on December 17, 2025, that its Board of Directors has authorized a share repurchase program.

- The program allows the Company to repurchase up to the lesser of 75,000 shares (representing 9.95% of shares outstanding) or $3 million of its common stock.

- Payment for shares repurchased under the program will be funded using the Company’s cash on hand.

Dec 17, 2025, 9:05 PM

Parks America Discusses Q4 2025 Park Performance and Strategic Initiatives

PRKA

Earnings

Revenue Acceleration/Inflection

Demand Weakening

- Texas Park demonstrated significant year-over-year revenue growth, driven by increased attendance and ticket prices, and is projected to become the second biggest park in terms of EBITDA contribution for fiscal year 2026. The property was last appraised at $14,000 per acre for 450 acres, totaling $6 million-$6.5 million.

- Missouri Park experienced a 14% increase in attendance but only a 7.5% increase in revenue, primarily due to seasonality, the elimination of some food services, and value-conscious consumers in its market.

- Georgia Park managed to limit its revenue decline to 1% despite a 10% drop in attendance, thanks to improved per capita spending and dynamic pricing strategies.

- The company sold approximately 50 acres of non-essential land in Georgia for about $150,000.

Dec 15, 2025, 9:30 PM

Parks! America Discusses Q4 2025 Park Performance and Growth Strategies

PRKA

Earnings

New Projects/Investments

Revenue Acceleration/Inflection

- Parks! America reported varied Q4 2025 park performance: Texas park revenue significantly increased year-over-year due to higher attendance and ticket prices, despite free attendance promotions earlier in the year. The Missouri park saw attendance up 14% but revenue only increased 7.5%, attributed to seasonality, reduced food services, and value-conscious consumers. The Georgia park's attendance was down 10%, but revenue only decreased 1%, driven by dynamic pricing and strong per-capita spending, particularly in gift shop sales.

- The company sold approximately 50 acres of non-essential land in Georgia for about $150,000 to a management employee, noting the land had no utility to the company. Management incentives for General Managers are based on achieving EBITDA greater than 20% of non-cash assets and limiting CapEx to less than one-third of EBITDA.

- Future growth strategies include hiring additional corporate staff for marketing and events, focusing on small events, social media, and animal encounters, which are expected to be profitable. The President anticipates Texas will be the second-largest park in terms of earnings contribution in fiscal year 2026, surpassing Missouri. The Texas property was last appraised at $14,000 per acre for 450 acres, totaling $6 million-$6.5 million, with a $2.5 million loan.

Dec 15, 2025, 9:30 PM

Parks America Reports Q4 2025 Earnings and Operational Updates

PRKA

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- The Texas park experienced a significant year-over-year revenue increase, primarily driven by ticket revenue from higher attendance and ticket price increases, and is projected to become the company's second-largest contributor to earnings in fiscal year 2026.

- Missouri park attendance rose by 14%, but revenue only increased by 7.5%, attributed to seasonality, the elimination of food service, and value-conscious consumers in its market.

- The Georgia park saw its revenue decrease by only 1% despite a 10% drop in attendance, due to strong per capita spending (e.g., gift shop sales were up) and dynamic pricing strategies.

- Parks America sold approximately 50 acres of non-essential land in Georgia for about $150,000.

- Management incentives are linked to achieving EBITDA greater than 20% of non-cash assets and maintaining CapEx below one-third of EBITDA, with future growth efforts focused on events, social media, and animal encounters.

Dec 15, 2025, 9:30 PM

Parks! America, Inc. Reports Q4 and Full Year Fiscal Year 2025 Financial Results

PRKA

Earnings

Revenue Acceleration/Inflection

- Parks! America, Inc. (PRKA) announced its financial results for the fourth fiscal quarter and full fiscal year ended September 28, 2025.

- For the fourth fiscal quarter ended September 28, 2025, the company reported consolidated total revenue of $3,223,176 and income before income taxes of $887,531.

- For the full fiscal year ended September 28, 2025, consolidated total revenue was $10,471,575, with income before income taxes of $1,920,309.

- Management will host a conference call on December 15, 2025, at 4:30 PM ET to discuss these results.

Dec 12, 2025, 9:20 PM

Parks! America, Inc. Reports Q4 and Full Year Fiscal 2025 Financial Results

PRKA

Earnings

Revenue Acceleration/Inflection

- Parks! America, Inc. reported a significant increase in income before income taxes for the fourth fiscal quarter ended September 28, 2025, reaching $887,531, up from $252,312 in the prior year's fourth quarter.

- Total revenue for Q4 fiscal 2025 grew to $3,223,176, compared to $2,607,691 in Q4 fiscal 2024.

- For the full fiscal year ended September 28, 2025, the company achieved total revenue of $10,471,575, an increase from $9,912,260 in fiscal year 2024.

- The company turned around its full fiscal year performance, reporting income before income taxes of $1,920,309 for fiscal year 2025, a substantial improvement from a loss of $(1,479,797) in fiscal year 2024.

Dec 12, 2025, 9:10 PM

Quarterly earnings call transcripts for PARKS AMERICA.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more