Earnings summaries and quarterly performance for Phillips 66.

Research analysts who have asked questions during Phillips 66 earnings calls.

Manav Gupta

UBS Group

8 questions for PSX

Neil Mehta

Goldman Sachs

8 questions for PSX

Jason Gabelman

TD Cowen

7 questions for PSX

Matthew Blair

Tudor, Pickering, Holt & Co.

6 questions for PSX

Paul Cheng

Scotiabank

6 questions for PSX

Ryan Todd

Simmons Energy

6 questions for PSX

Theresa Chen

Barclays PLC

6 questions for PSX

Jean Ann Salisbury

Bank of America

4 questions for PSX

Douglas George Blyth Leggate

Wolfe Research

3 questions for PSX

Doug Leggate

Wolfe Research

3 questions for PSX

John Royall

JPMorgan Chase & Co.

3 questions for PSX

Phillip Jungwirth

BMO Capital Markets

3 questions for PSX

Roger Read

Wells Fargo & Company

3 questions for PSX

Douglas Leggate

Wolfe Research

2 questions for PSX

Joseph Laetsch

Morgan Stanley

2 questions for PSX

Justin Jenkins

Raymond James

2 questions for PSX

Lloyd Byrne

Jefferies LLC

2 questions for PSX

Sam Margolin

Wells Fargo & Company

2 questions for PSX

Stephen Richardson

Evercore ISI

2 questions for PSX

Steve Richardson

Evercore

2 questions for PSX

Joe Laetsch

Morgan Stanley

1 question for PSX

Theresa Chinn

Barclays

1 question for PSX

Recent press releases and 8-K filings for PSX.

- Phillips 66 delivered strong Q4 and full-year 2025 results, achieving record safety performance, high refinery utilization with record clean product yields, and midstream adjusted EBITDA of ~$1 billion in Q4, up 40% since 2022.

- Refining controllable cost was $5.96/barrel in Q4 (excluding Los Angeles idling costs items would be ~$5.50/barrel); company targets $5.50/barrel by end-2027 and idled the 135 kbd Los Angeles refinery to optimize the asset base.

- Midstream segment targets a run-rate $4.5 billion adjusted EBITDA by year-end 2027 via organic expansions (Permian gas plants every 12–18 months, Iron Mesa online early 2027) and pipeline growth (Coastal Bend +125 kbd by late 2026).

- Portfolio optimization included acquiring the remaining 50% of the WRB JV (boosting heavy crude exposure by 40%), selling a 65% stake in the Germany/Austria retail business, and idling the Los Angeles refinery to streamline operations and enhance returns.

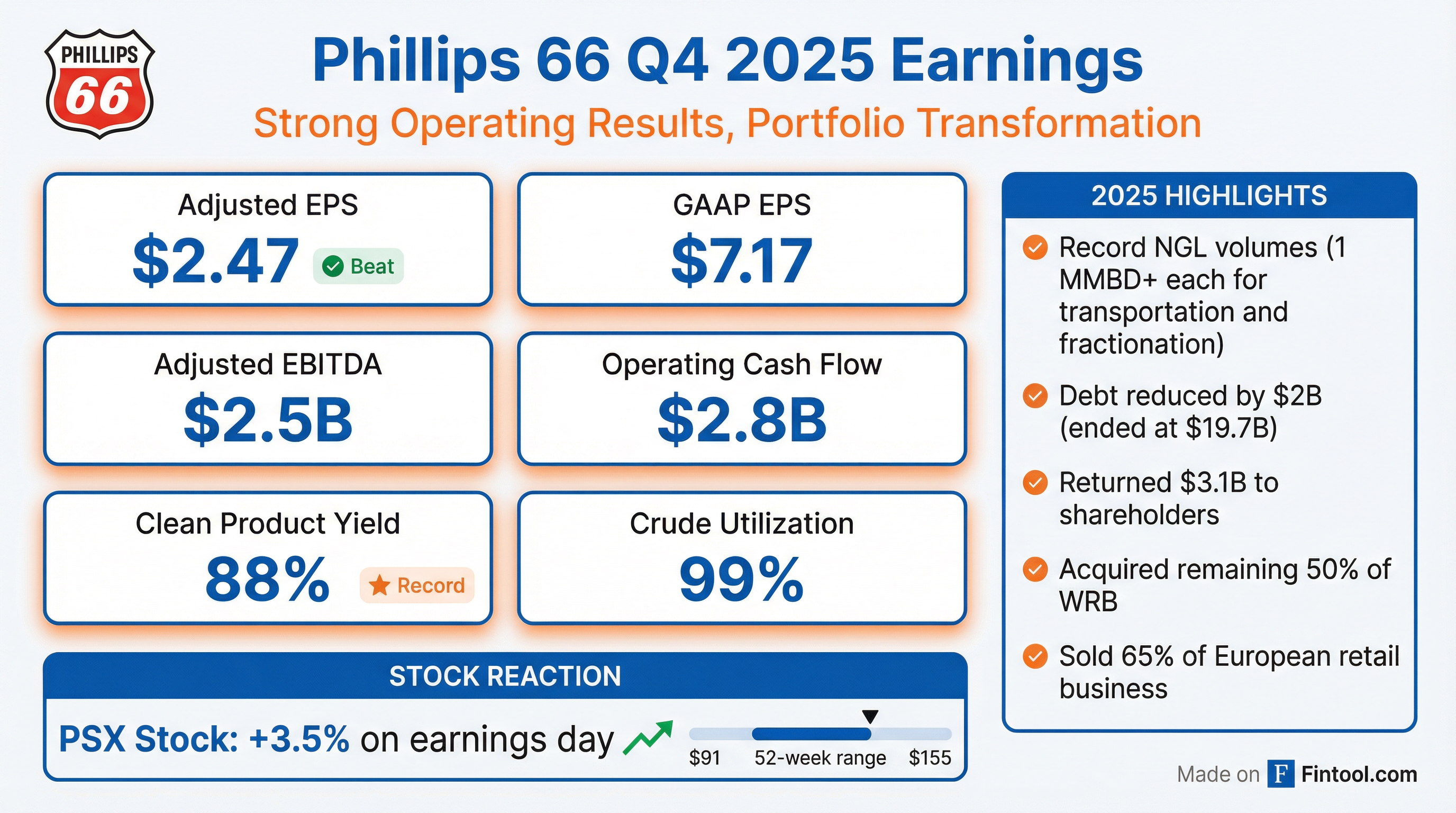

- Reported Q4 earnings of $2.9 billion ($7.17/share) and adjusted earnings of $1.0 billion ($2.47/share); generated $2.8 billion of operating cash flow, spent $682 million of capital, repaid over $2 billion of debt, and returned $756 million to shareholders (including $274 million of share buybacks); net debt to capital ended at 38%.

- Operational & portfolio highlights: best-ever safety performance; record clean product yields and high utilization across refining; record NGL transportation and fractionation volumes with ~$1 billion of midstream adjusted EBITDA; completed acquisition of the remaining 50% of WRB JV, sold 65% of Germany/Austria retail business, and idled the Los Angeles refinery.

- 2026 guidance: Q1 global refining/utilization mid-90s%; corporate & other costs of $400–420 million (Q1) and $1.5–1.6 billion (FY); depreciation & amortization of $2.1–2.3 billion; turnaround expenses of $170–190 million (Q1) and $550–600 million (FY).

- Refining cost reduction target: Q4 controllable cost of $5.96/barrel (or $5.50–5.57 ex-Los Angeles idling) against a goal of $5.50/barrel by end-2027, with a $0.30 annual tailwind in 2026 from LA idling and an additional $0.15/barrel expected from continuous improvement initiatives.

- Delivered strong Q4 results with high refining utilization rates, record clean product yields, and best-ever safety performance; optimization initiatives target $5.50 controllable cost per barrel by end of 2027

- Executed strategic portfolio actions: acquired remaining 50% of WRB JV, sold 65% of Germany/Austria retail business, idled Los Angeles refinery; expanded NGL volumes via Coastal Bend and Dos Picos II

- Midstream segment achieved ~$1 billion adjusted EBITDA in Q4 2025 (up 40% since 2022); projects on track for $4.5 billion run-rate EBITDA by year-end 2027 with gas plants every 12–18 months and 125 kbpd pipeline expansion

- Q4 reported earnings of $2.9 billion ($7.17/share) and adjusted earnings of $1 billion ($2.47/share); generated $2.8 billion operating cash flow, spent $682 million on capex, returned $756 million to shareholders, and net debt/capital at 38%

- 2026 outlook includes Q1 global utilization in mid-90s, corporate costs of $400–420 million in Q1 and $1.5–1.6 billion full-year, D&A of $2.1–2.3 billion, and $550–600 million of full-year turnaround expenses

- Phillips 66 reported Q4 earnings of $2.9 billion ($7.17/share) and adjusted earnings of $1.0 billion ($2.47/share), including $239 million of pre-tax accelerated depreciation at its Los Angeles Refinery.

- The company generated $2.8 billion of net operating cash flow ($2.0 billion ex-working capital) and reduced debt by $2.0 billion, ending 2025 with $19.7 billion of debt.

- Operationally, Refining achieved a record clean product yield of 88% and 99% crude capacity utilization, while Midstream set new records with NGL transportation and fractionation volumes each exceeding 1 MMBD.

- For full-year 2025, Phillips 66 earned $4.4 billion ($10.79/share) and adjusted $2.6 billion ($6.44/share), generated $5.0 billion of operating cash flow ($6.1 billion ex-working capital) and returned $3.1 billion to shareholders (>50% of cash flow).

- Strategic portfolio actions included selling the majority of its European retail business, acquiring the remaining 50% interest in WRB Refining LP, and enhancing its Midstream position through the Coastal Bend acquisition and Dos Picos II expansion.

- Phillips 66 delivered fourth-quarter earnings of $2.9 billion (or $7.17 per share) and adjusted earnings of $1.0 billion (or $2.47 per share), including $239 million of pre-tax accelerated depreciation on the Los Angeles Refinery.

- Achieved record NGL transportation and fractionation volumes of over 1 million barrels per day, an 88% clean product yield and 99% crude capacity utilization in refining.

- Generated $2.8 billion of net operating cash flow ($2.0 billion excluding working capital) and reduced debt by $2.0 billion, ending the year with $19.7 billion of debt.

- Enhanced portfolio through sale of its European retail business, acquisition of the remaining 50% of WRB Refining and midstream expansions including Coastal Bend and Dos Picos II.

- The Trust has drawn the full $1 million letter of credit and, including loans under promissory notes and accrued interest, owes PCEC approximately $12.5 million as of the current month.

- PCEC’s estimated Asset Retirement Obligations were $45.7 million as of December 31, 2019, with subsequent quarterly re-evaluations adding $5.1 million net to the Trust’s interest and a $455,000 accretion adjustment for Developed Properties in the current month.

- Arbitration awards permit PCEC to deduct its own and the Trustee’s legal fees (approximately $6.1 million total to date) from net profits, and a federal whistleblower suit against PCEC will proceed after denial of a dismissal motion.

- The September 2022 cancellation of the Phillips 66 pipeline agreement has constrained Orcutt production, leading to a 17% drop (9,364 Bbls) in November 2025 versus December 2022, and PCEC is incurring higher transportation costs under new short-term sales arrangements.

- Phillips 66 and Kinder Morgan opened a second open season for the Western Gateway Pipeline from January 16 to March 31, 2026, to secure commitments for remaining capacity.

- The offering adds new origin points and expanded destinations, including Los Angeles access via reversal of Kinder Morgan’s SFPP line, enhancing supply diversification and optionality.

- The project combines a new-build segment from Borger, Texas to Phoenix, Arizona, reversed SFPP and Gold Pipeline flows, and connectivity to Phoenix, Las Vegas, and California markets.

- Phillips 66 aims to deliver durable through-cycle cash flow and a rateable dividend via its integrated downstream platform, targeting $4.5 billion of midstream EBITDA by late 2027 through organic projects (Dos Picos, Iron Mesa, Coastal Bend expansion) and contract escalations.

- Refining capacity remains structurally tight, with net additions of ~500 mbpd annually to the end of the decade against stable product demand, underpinning a constructive refining outlook and potential WCS heavy-crude differential widening into the teens over time.

- The company will recycle capital from non-core asset sales (e.g., European retail) and opportunistic M&A (e.g., WRB acquisition) to fund a low-$2 billion annual capex, $2 billion of dividends, $2 billion of buybacks, and reduce net debt from $21.8 billion to $17 billion by end-2027.

- CP Chem remains cash-generative in the current downturn and is about to start up two world-scale, low-cost ethylene assets, supporting strong long-term returns and premium valuation optionality.

- Phillips 66 will deliver durable through-cycle cash flow with a rateable dividend via integrated downstream operations (midstream, refining, marketing, chemicals) focused on safe, reliable, efficient hydrocarbon processing

- Management is monitoring the potential return of Venezuelan supply, noting Gulf Coast refineries’ capacity (~200 kbd) for Venezuelan crude and implications for Western Canadian Select differentials and NAFTA trade

- The company forecasts structurally tight refining capacity through the late 2020s, with net additions of ~500 kbd annually offset by ongoing rationalizations supporting margin capture

- Midstream aims for $4.5 billion EBITDA by 2027, driven by organic projects (Dos Picos, Iron Mesa, Coastal Bend expansion), contract renewals, and escalations

- Targets debt reduction from $21.8 billion to $17 billion by end-2027 via ~$8 billion annual cash flow, $2 billion dividends, $2 billion buybacks, $2 billion capex, and selective non-core asset sales

- PSX CEO Mark Lashier emphasized durable cash flow via downstream-only focus with complementary refining, midstream, marketing, and chemicals assets, targeting $5.50/boe refining cost run rate by end-2026 through continuous safety and reliability improvements.

- PSX CFO Kevin Mitchell detailed midstream growth to $4.5 billion EBITDA by late 2027, driven by Permian gas processing expansions (Dos Picos, Iron Mesa) and transportation projects (Coastal Bend), funded within a ~$1 billion annual midstream capex.

- PSX plans to reduce net debt from $21.8 billion (end-Q3 2025) to ~$17 billion by end-2027, supported by $8 billion annual operating cash flow, $2 billion dividends, $2 billion share repurchases, and low-$2 billion capex, plus proceeds from asset dispositions.

- PSX is pursuing M&A and portfolio optimization—acquired Wood River/Borger refineries for integration synergies, sold European retail assets (closed Dec 1, 2025) and plans to divest non-core assets to redeploy capital for growth and shareholder returns.

Quarterly earnings call transcripts for Phillips 66.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more