Earnings summaries and quarterly performance for PELOTON INTERACTIVE.

Executive leadership at PELOTON INTERACTIVE.

Board of directors at PELOTON INTERACTIVE.

Research analysts who have asked questions during PELOTON INTERACTIVE earnings calls.

Shweta Khajuria

Wolfe Research, LLC

5 questions for PTON

Arpine Kocharyan

UBS

4 questions for PTON

Eric Sheridan

Goldman Sachs

4 questions for PTON

Simeon Siegel

BMO Capital Markets

3 questions for PTON

Youssef Squali

Truist Securities

3 questions for PTON

Brian Nagel

Oppenheimer & Co. Inc.

2 questions for PTON

Curtis Nagle

Bank of America

2 questions for PTON

Douglas Anmuth

JPMorgan Chase & Co.

2 questions for PTON

Andrew Boone

JMP Securities

1 question for PTON

Arpine Kocharian

UBS Group AG

1 question for PTON

Curt Nagle

Bank of America Corporation

1 question for PTON

Lee Horowitz

Deutsche Bank

1 question for PTON

Nathaniel Feather

Morgan Stanley

1 question for PTON

Yousef Squali

Truist

1 question for PTON

Recent press releases and 8-K filings for PTON.

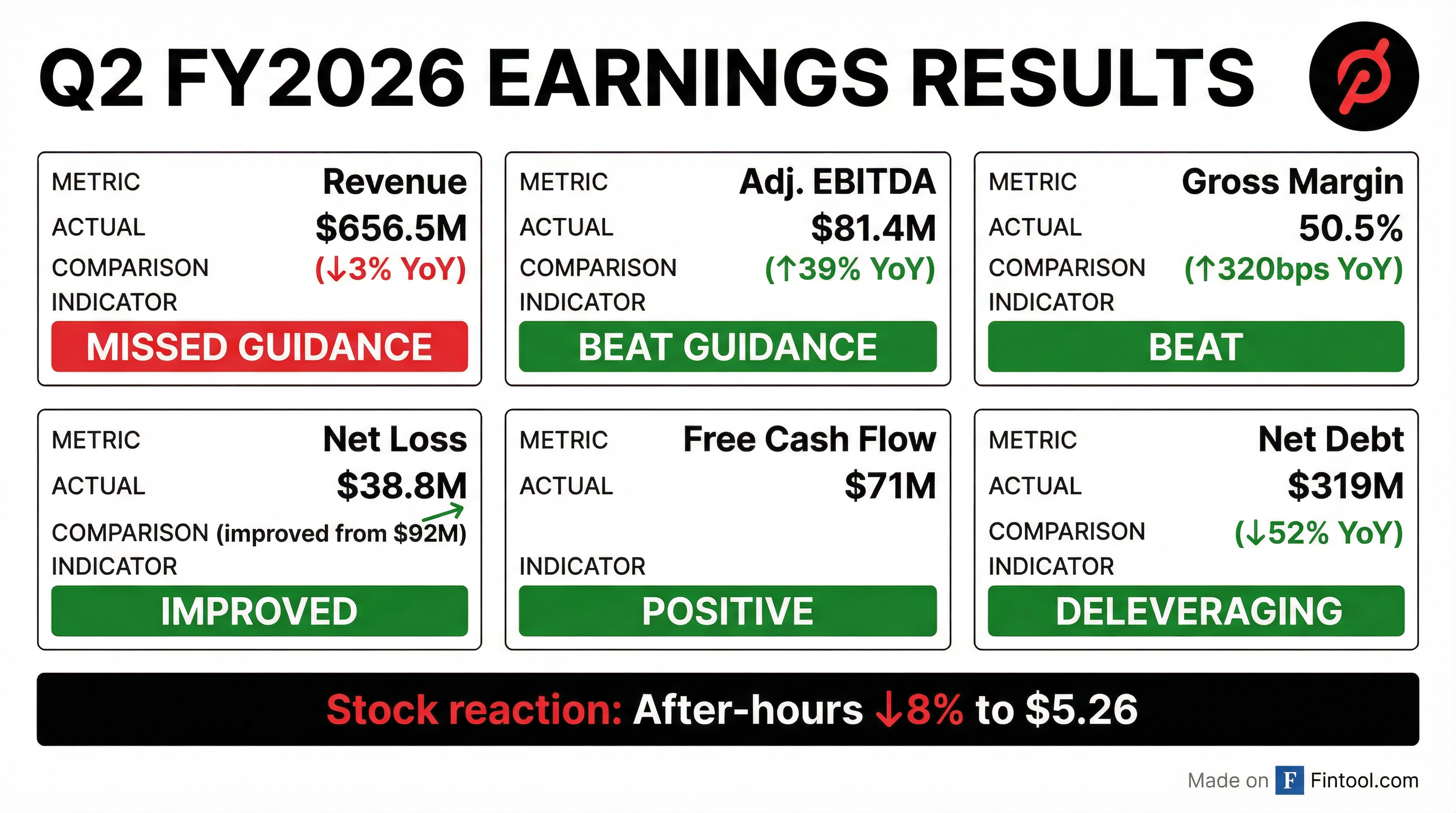

- Peloton reported Q2 2026 Adjusted EBITDA of $81 million, a 39% year-over-year increase, which was $6 million above the high end of their guidance range, and generated $71 million in free cash flow.

- The company significantly improved its balance sheet, reducing net debt by 52% year-over-year to $319 million and ending Q2 with $1,180,000 in unrestricted cash and cash equivalents.

- While Q2 2026 revenue came in below guidance, primarily due to fewer than expected equipment sales to existing members, Peloton raised its full-year fiscal 2026 Adjusted EBITDA guidance to $450 million-$500 million and its minimum free cash flow target to at least $275 million.

- Peloton is evolving from a connected fitness company to a connected wellness company, focusing on expanding its commercial business unit, which achieved 10% revenue growth year-over-year, and leveraging AI-driven personalization with Peloton IQ.

- The company remains on track to achieve its $100 million run rate savings goal by the end of Fiscal Year 2026 and expects to achieve positive operating income on a full year basis in fiscal 2026.

- Peloton reported Q2 2026 total revenue of $657 million and Adjusted EBITDA of $81 million, marking a 39% year-over-year increase.

- The company significantly improved its balance sheet, reducing net debt by 52% year-over-year to $319 million and generating $71 million in free cash flow in Q2.

- Q2 revenue came in below guidance, primarily due to lower-than-expected equipment sales of the new Cross Training Series to existing members, though sales to new members were in line with expectations.

- Peloton raised its full-year fiscal 2026 Adjusted EBITDA guidance to $450 million-$500 million and its minimum Free Cash Flow target to at least $275 million, while slightly lowering the total revenue outlook to $2.40 billion-$2.44 billion.

- The company continues its strategy of evolving into a connected wellness company, launching new products like the Cross Training Series and AI-powered Peloton IQ, and reported 10% year-over-year revenue growth in its commercial business unit.

- Peloton reported Q2 2026 total revenue of $657 million, which was below guidance primarily due to lower equipment sales to existing members, but achieved strong profitability with Adjusted EBITDA growing 39% year-over-year to $81 million and a total gross margin of 50.5%.

- The company significantly improved its financial foundation, reducing net debt by 52% year-over-year to $319 million and ending Q2 with $1.18 billion in unrestricted cash and cash equivalents.

- Peloton raised its full-year fiscal 2026 guidance, with Adjusted EBITDA now projected at $450 million-$500 million and a minimum Free Cash Flow target of at least $275 million, reflecting continued cost discipline and progress towards its $100 million run rate savings goal.

- Strategically, Peloton is evolving into a connected wellness company, having launched new offerings like the Cross Training Series and AI-powered Peloton IQ, while also expecting to achieve positive operating income on a full year basis in fiscal 2026.

- Peloton reported Q2 FY2026 total revenue of $657 million, a 3% decrease year-over-year, alongside a 39% increase in Adjusted EBITDA to $81 million.

- The company recorded a GAAP Net loss of $39 million and saw Ending Paid Connected Fitness Subscriptions decrease by 7% year-over-year to 2.661 million.

- Peloton raised its Full Year FY2026 Adjusted EBITDA guidance to a range of $450 million to $500 million.

- Chief Financial Officer Liz Coddington will step down from her position, effective March 27, 2026, to pursue an external opportunity.

- Peloton Interactive reported Q2 FY2026 Total Revenue of $657 million, a 3% decrease year-over-year, and a GAAP Net loss of $39 million.

- Adjusted EBITDA for Q2 FY2026 increased by 39% year-over-year to $81 million.

- Ending Paid Connected Fitness Subscriptions for Q2 FY2026 were 2.661 million, representing a 7% decrease year-over-year.

- The company raised its Full Year FY2026 Adjusted EBITDA guidance to $450 - $500 million.

- Peloton implemented a workforce reduction of approximately 11% of its global staff on January 30, 2026, with cuts concentrated among engineering and enterprise-focused teams.

- These layoffs are part of a previously announced effort to save roughly $100 million and follow an earlier 6% workforce reduction in August.

- The decision comes after lackluster sales of last year’s upgraded, Peloton IQ AI-enabled hardware and a recall of about 877,800 units of a prior high-end Bike model in late 2025.

- Peloton has launched a new growth strategy, including the Peloton Cross Training Series and the first-ever commercial line, Peloton Pro Series, expanding its product lineup from five to nine items. It also introduced Peloton IQ, an AI-powered personal coach, which was rolled out to millions of members.

- The company has reduced its net debt by half over the last year and aims to save an additional $100 million in FY26 on a run rate basis, having already achieved half of this target.

- Despite a recent price increase, Peloton expects churn to remain flat for the full year, driven by a tenure effect, increased member workouts, and a rapid moderation in cancellations post-price hike.

- Peloton is expanding its distribution footprint through micro-stores and a partnership with 100 Johnson Fitness and Wellness stores across the U.S.. The company also plans to refinance its $1 billion term loan around May, aiming for a lower cost of capital and increased flexibility for potential share buybacks or M&A.

- Executive compensation has been shifted towards performance-based stock units, and stock ownership requirements have been implemented for top executives to align with shareholder interests and reduce dilution.

- Peloton launched a new growth strategy including the Peloton Cross Training Series (nine new residential products), the Peloton Pro Series (first commercial line), and Peloton IQ, an AI-powered personal coach, which has led to a 4% increase in workouts per member in October.

- The company reduced its net debt by half over the last year and plans to refinance a $1 billion term loan around May to lower the cost of capital and gain flexibility for potential share buybacks or M&A. A $200 million zero-coupon debt is due in February.

- Peloton exceeded its FY25 target of $200 million in run-rate savings and is halfway to achieving another $100 million in savings for FY26. Connected Fitness gross margins are expected to improve in Q2 compared to Q1.

- Despite a recent subscription price increase, churn is flat for the year, attributed to a tenure effect, increased member engagement from new software, and a rapid moderation in churn post-price increase.

- Peloton has implemented a new multi-year growth strategy, launching the Peloton Cross Training Series and Peloton Pro Series products, alongside the AI-powered Peloton IQ software, which has led to a 4% increase in workouts per member in October.

- The company has reduced its net debt by half over the past year and is on track to achieve $100 million in savings for FY 2026.

- Peloton plans to refinance a $1 billion term loan around May to reduce the cost of capital and gain financial flexibility for potential buybacks or M&A.

- The company is expanding its distribution through micro-stores and a partnership with Johnson Fitness & Wellness, while maintaining a flat churn rate for the year despite a price increase.

- Peloton reported Q1 2026 total revenue of $551 million and Adjusted EBITDA of $118 million, exceeding guidance on most key financial metrics. The company also generated $67 million in free cash flow.

- The company announced a voluntary recall of approximately 833,000 Bike Plus units in the US and 44,800 in Canada due to a seat post issue, with a $13.5 million accrual impacting Q1 gross margin.

- Peloton launched a new equipment lineup (Cross Training Series, Pro Series) and Peloton IQ, an AI-powered personalized coaching feature, on October 1st.

- Management raised its full-year fiscal 2026 guidance for total gross margin to 52%, adjusted EBITDA to $425 million-$475 million, and the minimum free cash flow target to at least $250 million.

- The company continued to strengthen its balance sheet, with net debt decreasing by 49% year-over-year to $395 million and a net leverage ratio of 1.1.

Fintool News

In-depth analysis and coverage of PELOTON INTERACTIVE.

Quarterly earnings call transcripts for PELOTON INTERACTIVE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more