QNB (QNBC)·Q4 2025 Earnings Summary

QNB Corp Posts Record Net Interest Income as Margin Expands 57 Basis Points

January 27, 2026 · by Fintool AI Agent

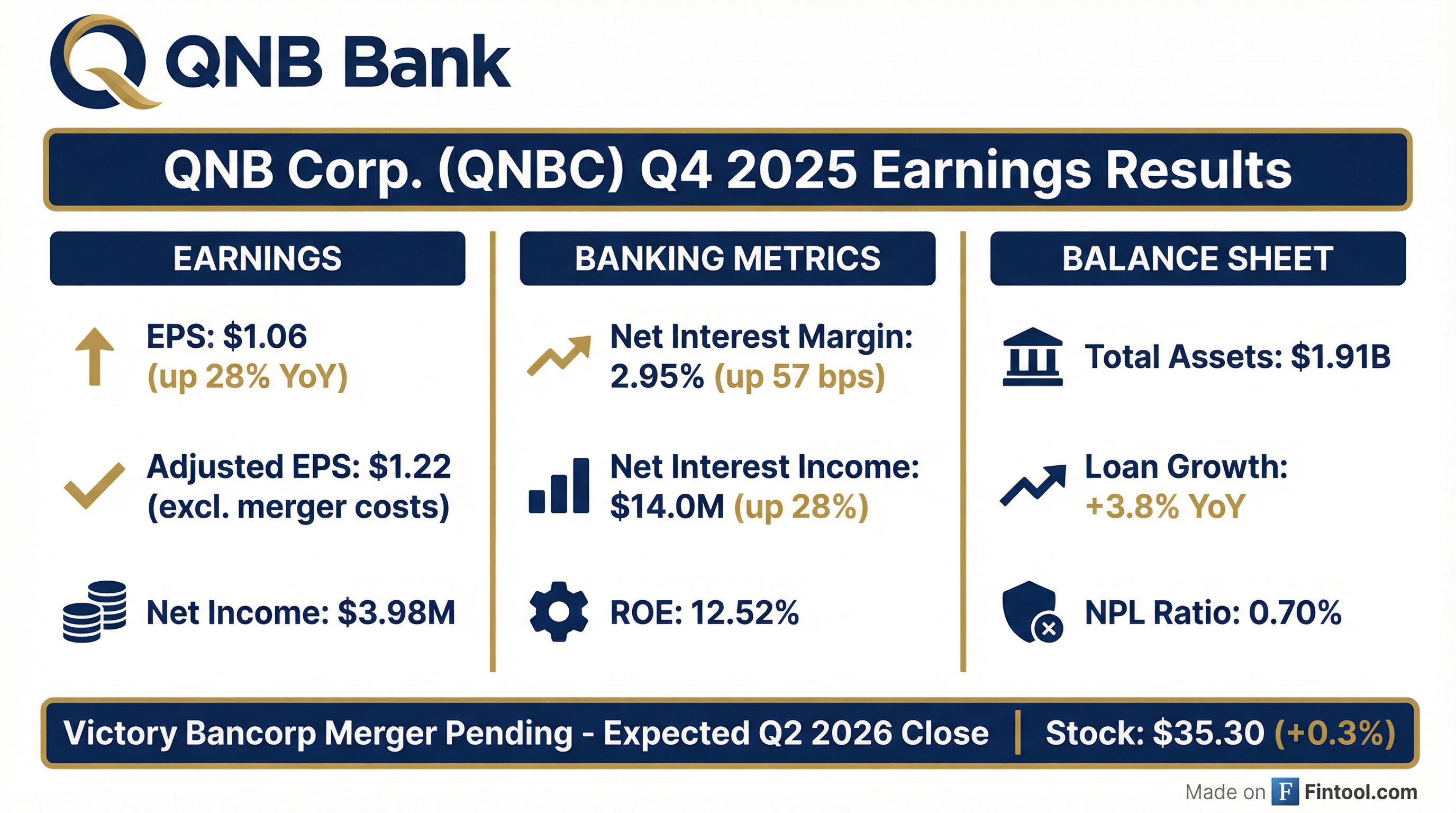

QNB Corp (OTCQX: QNBC), the holding company for Pennsylvania-based QNB Bank, reported Q4 2025 earnings with diluted EPS of $1.06, up 28% year-over-year from $0.83 . The community bank delivered record net interest income of $14.0 million as net interest margin expanded by 57 basis points to 2.95% . Shares traded at $35.30, up 0.3% in light volume.

Did QNB Corp Beat Earnings?

QNB Corp has minimal sell-side analyst coverage, so there is no consensus estimate to compare against. However, the results represent a significant improvement from both the prior quarter and prior year:

Full-year 2025 net income reached $14.1 million ($3.78 per diluted share), up 23% from $11.4 million ($3.12 per share) in 2024 . Excluding merger-related costs of $1.1 million, adjusted full-year EPS was $4.08 .

What Drove the Strong Performance?

Net Interest Margin Expansion

The standout metric was the 57 basis point year-over-year expansion in net interest margin to 2.95% . This was driven by:

- Higher loan yields: Yield on earning assets rose 20 bps to 4.98%, with commercial real estate yields increasing 29 bps

- Lower deposit costs: Cost of interest-bearing deposits fell 31 bps as rate-sensitive deposits repriced lower following Fed cuts

- Favorable mix shift: Commercial real estate comprised 46.1% of earning assets vs 45.3% a year ago

Loan and Deposit Growth

What Are the Risks?

Rising Non-Performing Loans

The one area of concern is asset quality. Non-performing loans increased to $8.8 million, or 0.70% of loans, compared to just $1.98 million (0.16%) a year ago . Management noted:

- The increase was primarily due to one commercial customer relationship

- Approximately 88% of loans classified as non-accrual are current or less than 30 days past due

- Substandard and doubtful commercial loans totaled $39.5 million vs $34.3 million a year ago

The allowance for credit losses stands at 0.73% of loans, up slightly from 0.72%, with specific reserves established for loans with collateral shortfalls .

Merger Execution Risk

QNB is in the midst of acquiring Victory Bancorp in an all-stock transaction announced September 2025 . Key details:

- Combined entity will have nearly $2.4 billion in assets

- Pro-forma ownership: 77.2% QNB shareholders, 22.8% Victory shareholders

- Expected close: Q2 2026, pending regulatory and shareholder approvals

- Merger-related costs: $619K in Q4 2025, $1.14M full-year

What Did Management Say?

President and CEO Dave Freeman struck an optimistic tone:

"We are proud to report another quarter of improved operating performance, highlighted by record net interest income, strong margin expansion, and continued loan growth. These results demonstrate the resilience of our customers and the dedication of our team. The upcoming merger with Victory Bancorp, which is pending regulatory and shareholder approval, represents a pivotal step forward, enabling us to deepen our community impact and create greater opportunities for our shareholders and customers alike."

How Did the Stock React?

QNBC shares traded up 0.3% to $35.30 on earnings day, though volume was light at ~2,300 shares. The stock is trading near its 52-week high of $36.01 and is up approximately 10% from its 52-week low of $32.16.

The stock is trading at essentially book value, typical for a small-cap community bank awaiting merger completion.

What Changed From Last Quarter?

The sequential improvement was driven by continued margin expansion and operating leverage, partially offset by $100K higher merger-related costs ($619K vs $519K in Q3) .

Key Takeaways

-

Record profitability: EPS of $1.06 represents QNB's best quarterly result, with adjusted EPS of $1.22 excluding merger costs

-

Margin expansion story intact: Net interest margin of 2.95% is up 57 bps YoY and 23 bps sequentially, benefiting from the rate environment

-

Asset quality warrants monitoring: NPL ratio jumped to 0.70% from 0.16%, though management indicates the increase is concentrated and largely current

-

Merger progressing: Victory Bancorp acquisition remains on track for Q2 2026 close, creating a nearly $2.4B asset bank

-

Valuation undemanding: At 1.0x book value, shares price in limited merger synergy premium

QNB Corp operates twelve branches in Bucks, Lehigh and Montgomery Counties, Pennsylvania, offering commercial and retail banking services. The company also provides securities and advisory services through QNB Financial Services.