Earnings summaries and quarterly performance for QNB.

Executive leadership at QNB.

David W. Freeman

Detailed

Chief Executive Officer and President

CEO

CS

Christina S. McDonald

Detailed

Executive Vice President, Chief Marketing Officer and Chief Retail Lending Officer

CT

Christopher T. Cattie

Detailed

Executive Vice President and Chief Operating Officer

CL

Courtney L. Covelens

Detailed

Executive Vice President, Chief Retail Officer and Chief Business Banking Officer

JL

Jeffrey Lehocky

Detailed

Executive Vice President and Chief Financial Officer

SG

Scott G. Orzehoski

Detailed

Executive Vice President and Chief Lending Officer

Board of directors at QNB.

AR

Autumn R. Bayles

Detailed

Director

GE

Gerald E. Gorski

Detailed

Director

JL

Jennifer L. Mann

Detailed

Director

KF

Kenneth F. Brown, Jr.

Detailed

Director

LA

Laurie A. Bergman

Detailed

Director

RR

Ranajoy Ray-Chauduri

Detailed

Director

RE

Randall E. Stauffer

Detailed

Director

RS

Randy S. Bimes

Detailed

Chairman of the Board

SR

Scott R. Stevenson

Detailed

Director

WR

W. Randall Stauffer

Detailed

Director

Research analysts covering QNB.

Recent press releases and 8-K filings for QNBC.

QNB Corp. Announces Q4 and Full-Year 2025 Results and Merger Update

QNBC

Earnings

M&A

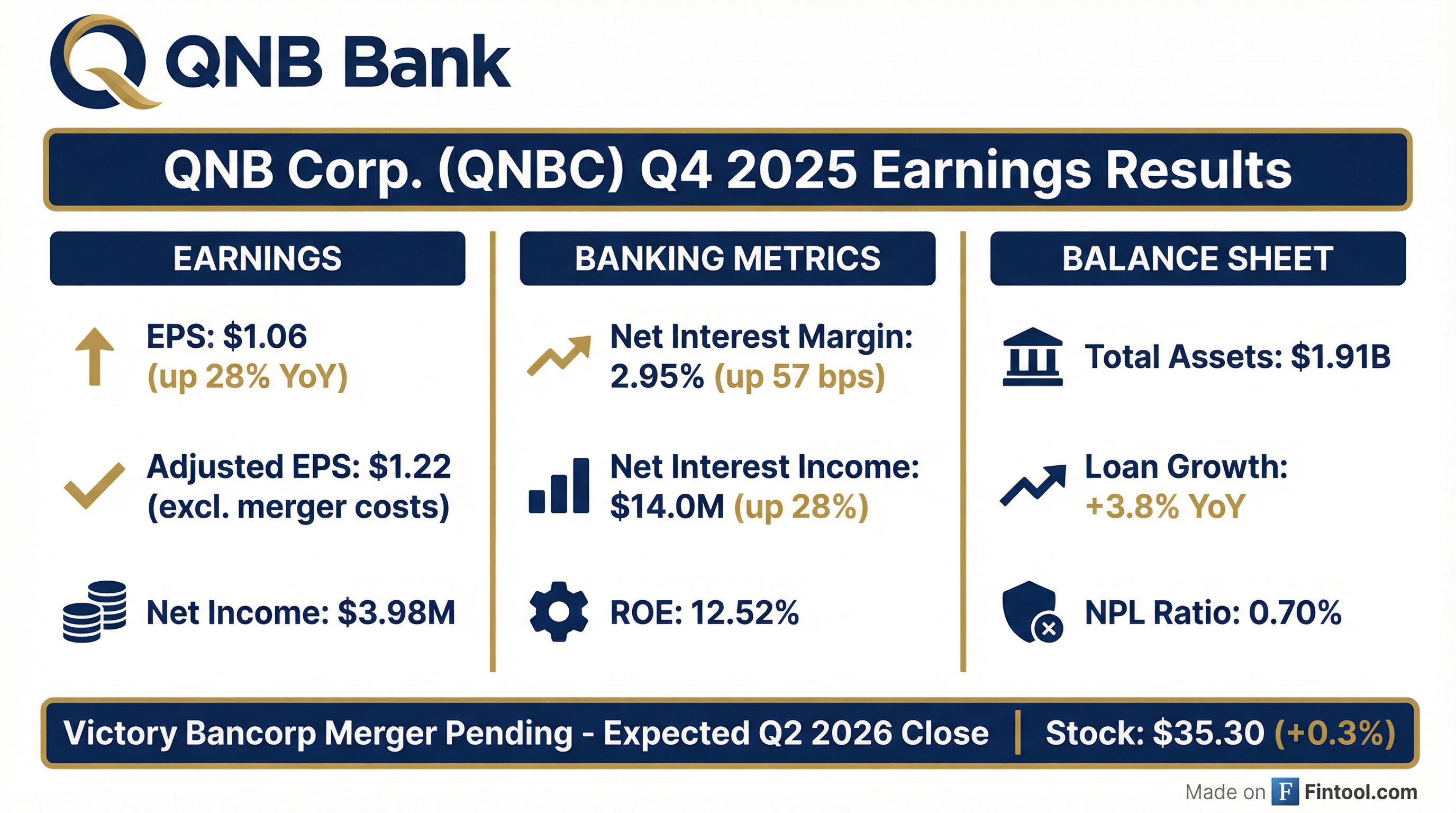

- QNB Corp. reported net income of $3,981,000 or $1.06 per diluted share for the fourth quarter of 2025, and $14,090,000 or $3.78 per diluted share for the full year 2025. Adjusted diluted EPS, excluding merger-related costs, was $1.22 for Q4 2025 and $4.08 for FY 2025.

- The company announced a definitive agreement to acquire The Victory Bancorp, Inc. in an all-stock transaction, expected to close in Q2 2026, which will create a bank holding company with nearly $2.4 billion in assets.

- Net interest income for Q4 2025 increased by $3,067,000 to $14,042,000 compared to the same period in 2024, with a net interest margin of 2.95%.

- Total assets reached $1,906,005,000 as of December 31, 2025, with loans receivable increasing 3.8% to $1,262,074,000 and total deposits increasing 0.9% to $1,642,511,000.

- Non-performing loans increased to $8,793,000 or 0.70% of loans receivable at December 31, 2025, up from $1,975,000 or 0.16% at December 31, 2024, primarily due to one commercial customer relationship.

Jan 27, 2026, 5:59 PM

QNB Corp. Declares Quarterly Cash Dividend

QNBC

Dividends

- QNB Corp.'s Board of Directors declared a quarterly cash dividend of $0.38 per share on November 25, 2025.

- The cash dividend is payable on December 26, 2025, to shareholders of record on December 12, 2025.

Nov 25, 2025, 6:30 PM

Victory Bancorp Announces Third Quarter 2025 Financial Results

QNBC

Earnings

M&A

- The Victory Bancorp, Inc. reported net income of $358 thousand for the third quarter ended September 30, 2025, with basic earnings per common share at $0.18. These results were significantly impacted by $374 thousand in merger expenses related to the anticipated merger with QNB; excluding these costs, basic earnings per common share would have been $0.33.

- Total deposits grew to $436.74 million as of September 30, 2025, an increase of $38.57 million from September 30, 2024.

- Book value per common share rose to an all-time high of $15.85 as of September 30, 2025.

- Credit quality remained strong, with no nonperforming assets reported and net charge-offs at -(0.01)% for the quarter.

Nov 3, 2025, 7:04 PM

QNB Corp. Reports Q3 2025 Earnings and Announces Acquisition of Victory Bancorp

QNBC

Earnings

M&A

- QNB Corp. reported net income of $3,648,000, or $0.98 per diluted share, for the third quarter of 2025, and $10,109,000, or $2.72 per diluted share, for the nine months ended September 30, 2025. Excluding $519,000 in merger-related costs, diluted EPS was $1.09 for Q3 2025 and $2.83 for the nine-month period.

- The company announced a definitive agreement to acquire The Victory Bancorp, Inc. in an all-stock transaction, which is expected to create a bank holding company with nearly $2.4 billion in assets and close in Q4 2025 or Q1 2026.

- As of September 30, 2025, total assets were $1,903,244,000, with loans receivable at $1,246,529,000 and total deposits at $1,681,540,000.

- Net interest income for the third quarter of 2025 totaled $12,998,000, with a net interest margin of 2.72%. Non-performing loans increased to $8,947,000, or 0.72% of loans receivable, at September 30, 2025, primarily due to one commercial customer relationship.

Oct 28, 2025, 6:29 PM

QNB Group's Hong Kong Branch Secures HKD30 Billion Green Loan for MTR Corporation

QNBC

Debt Issuance

New Projects/Investments

- QNB Group's Hong Kong branch acted as a Mandated Lead Arranger, Bookrunner, Underwriter, and Green Loan Coordinator for a HKD30 billion syndicated green term loan facility for MTR Corporation.

- Finalized in September 2025, this facility is the largest unsecured international syndicated green term loan (excluding project finance) in Asia, the Middle East, and North Africa by a Hong Kong corporation with a tenor of 7 years or longer.

- The loan, which attracted HKD120 billion in demand before closing at HKD30 billion, will finance and refinance eligible green projects as outlined in MTR's Sustainable Finance Framework.

- This transaction follows an MoU signed in May 2025 between QNB Group and MTR, aligning with QNB's strategy to expand its presence in Hong Kong and the Greater China region.

Oct 9, 2025, 2:10 PM

QNB Corp. to Acquire The Victory Bancorp, Inc. in All-Stock Transaction

QNBC

M&A

Guidance Update

Board Change

- QNB Corp. announced a definitive agreement on September 23, 2025, to acquire The Victory Bancorp, Inc. in an all-stock transaction valued at approximately $40.97 million.

- Under the terms of the agreement, Victory shareholders will receive 0.5500 shares of QNB common stock for each share of Victory common stock they own.

- The merger is projected to create a bank holding company with nearly $2.4 billion in assets and is expected to be approximately 16% accretive to QNB’s 2026 estimated EPS and over 35% accretive to Victory’s 2026 projected EPS.

- The transaction is anticipated to close in the fourth quarter of 2025 or the first quarter of 2026, pending satisfaction of shareholder and regulatory approvals.

Sep 23, 2025, 8:12 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more