QUAINT OAK BANCORP (QNTO)·Q4 2025 Earnings Summary

Quaint Oak Bancorp Posts $0.07 EPS as Centennial Year Investment Phase Continues

February 2, 2026 · by Fintool AI Agent

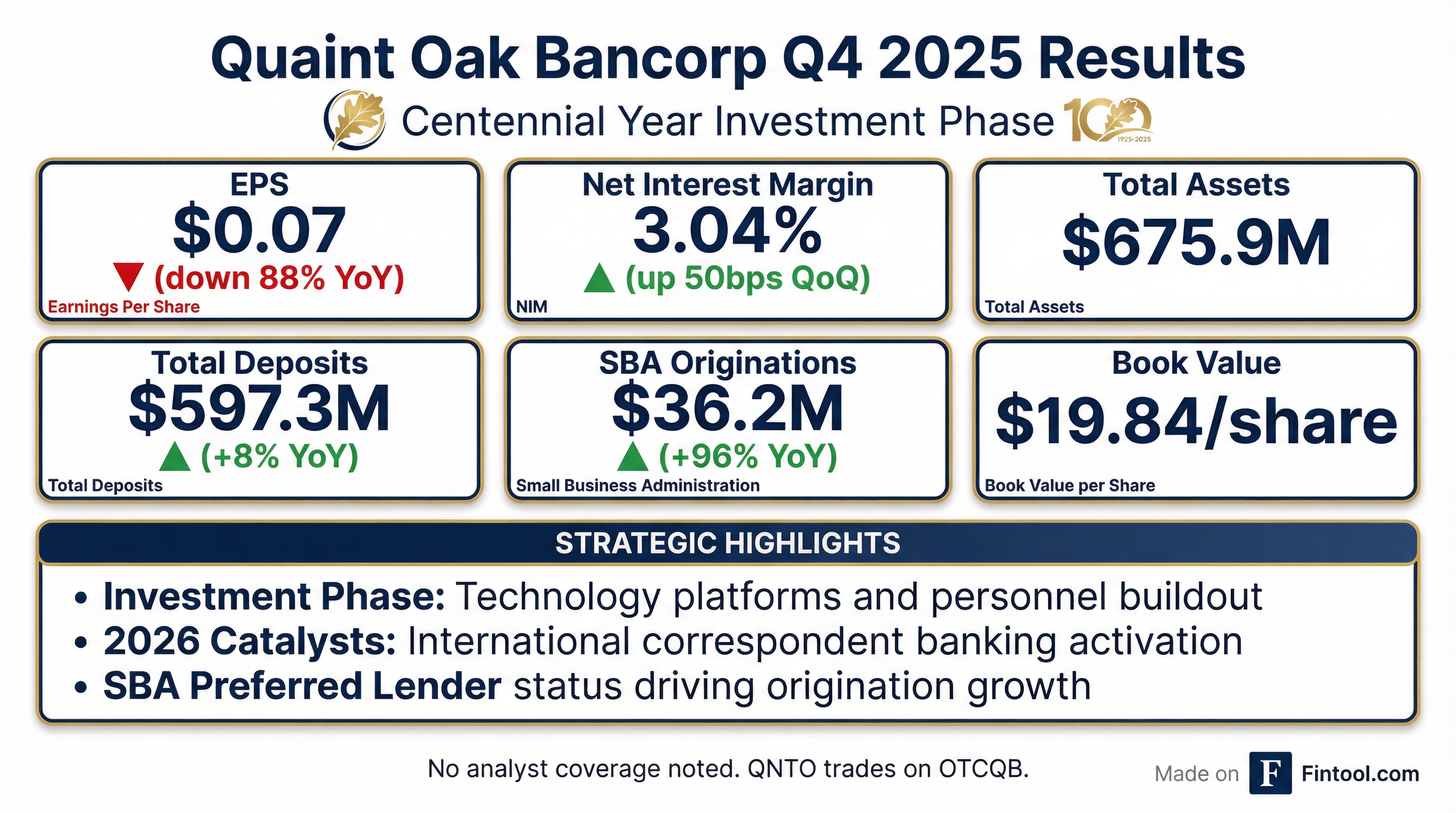

Quaint Oak Bancorp (OTCQB: QNTO) reported Q4 2025 earnings per share of $0.07, down 88% from $0.60 in the year-ago quarter, as the Southampton, Pennsylvania-based community bank continues its strategic investment phase heading into its 100th anniversary year.

The sharp earnings decline reflects a deliberate investment strategy: non-interest expense increased $2.2 million year-over-year as management built out technology platforms, personnel, and infrastructure for new business lines expected to drive growth in 2026 and beyond.

What Were the Key Q4 2025 Results?

Data from 8-K filing

Despite the earnings headwinds, underlying fundamentals showed improvement. Net interest margin expanded to 3.04% from 2.54%, driven by a 23 basis point increase in loan yields to 6.55% and successful deposit repricing that reduced interest expense by $382,000.

How Did the Stock React?

QNTO shares traded at $12.74, up approximately 4.8% from the previous close of $12.16, reaching a new 52-week high. The stock has rallied significantly from its 52-week low of $8.84, representing a 44% gain. With approximately 2.6 million shares outstanding, the market cap stands at roughly $33.6 million.*

*Values retrieved from market data

What Drove the Earnings Decline?

The $1.4 million quarterly net income decline stemmed from several factors:

Higher Non-Interest Expense (+$662K QoQ):

- Professional fees surged $482K (+108.7%) for international correspondent banking software and compliance

- Data processing up $79K (+19.6%)

- FDIC assessment increased $23K (+19.2%)

Lower Non-Interest Income (-$2.4M QoQ):

- Prior year included $1.5M gain on sale-leaseback of Allentown office building

- Net gain on loan sales decreased $1.0M (-59.3%)

Partially Offset By:

- Higher interest income (+$393K) from loan yield improvement

- Lower interest expense (-$382K) from deposit repricing

- Credit loss recovery vs. prior year provision (-$402K)

Full-year 2025 net income was $322,000 ($0.12 EPS) compared to $2.8 million ($1.08 EPS) in 2024, reflecting the sustained investment phase.

What Did Management Say About Strategic Progress?

CEO Robert T. Strong highlighted the deliberate nature of the investment cycle:

"2025 continued as a year of building out both technology platforms and personnel which largely accounted for the $2.2 million increase in non-interest expense for the year ended December 31, 2025, over calendar year 2024. During 2025, the Bank invested significant resources and capital to lay the proper foundation on which we expect to grow net income and optimize the balance sheet."

On the international correspondent banking initiative:

"As we enter 2026, we have now moved from investment to activation in our international correspondent banking business line, from which we expect to see results in 2026. We anticipate that the long-term investments we have made have positioned us for growth in this sector and will provide promising results."

What Changed From Last Quarter?

Net Interest Margin Expansion: NIM improved from 2.54% to 3.04% quarter-over-quarter, a significant expansion driven by strategic balance sheet management.

Deposit Mix Shift: The bank strategically exited a correspondent banking relationship for business checking deposits and reduced money market deposits through a deposit placement agreement. Certificates of deposit grew $71.8M (+25.4%) through competitive rate offerings.

Debt Restructuring: FHLB borrowings were completely paid down from $47.9M to zero. The company issued $10M in 11% senior unsecured notes due March 2028 and paid down $14M of subordinated debt at maturity.

How Is the SBA Lending Business Performing?

The SBA initiative showed strong momentum despite a temporary government shutdown impact in Q4:

Data from 8-K filing

Strong noted the bank's SBA Preferred Lender status has "empowered the Commercial Lending team to operate with greater efficiency, resulting in a substantial increase in production volume." Operations have normalized following the government shutdown.

What Is the Credit Quality Picture?

Asset quality metrics showed modest deterioration:

Non-performing loans totaled $7.3 million, consisting of $5.8 million on non-accrual status across 2 residential, 14 commercial real estate, and 15 commercial business loans. Management characterized all non-performing loans as "either well-collateralized or adequately reserved for."

The bank added $360,000 in OREO during the quarter from a non-performing commercial loan.

What Are the Key Risks and Concerns?

Efficiency Ratio Deterioration: The efficiency ratio spiked to 97.45% in Q4 2025 from 70.40% in Q4 2024, indicating nearly all revenue is being consumed by expenses. Full-year efficiency ratio was 92.58% vs 80.93%.

Execution Risk on New Initiatives: The international correspondent banking and SBA scaling strategies are unproven at scale. Management has committed significant capital without yet demonstrating returns.

Credit Quality Pressure: Rising NPLs and Texas Ratio warrant monitoring, though absolute levels remain manageable for a community bank focused on commercial real estate.

Limited Analyst Coverage: As an OTCQB-traded stock with $34M market cap, QNTO has no sell-side analyst coverage, limiting price discovery and institutional interest.

What Is the Balance Sheet Position?

Data from 8-K filing

The loan portfolio mix shifted toward owner-occupied residential (+$15.7M, +60.6%) and commercial real estate (+$12.1M, +4.1%), while commercial business loans declined $18.6M (-16.2%).

What Should Investors Watch in 2026?

Centennial Year Catalysts:

- International Correspondent Banking Activation — Management expects "results in 2026" from this new business line

- SBA Volume Continuation — Government operations normalized, momentum should continue

- Oakmont Commercial Pivot — Originate-and-sell model expected to increase fee income and improve capital ratios

- NIM Sustainability — Can the bank maintain 3%+ margins as rates evolve?

Key Metrics to Track:

- Efficiency ratio normalization toward 80% range

- Non-interest income growth from new initiatives

- NPL stabilization below 1.5%

- Deposit cost trends

CEO Strong concluded: "We believe we leave 2025 in a much better position as we enter our Centennial Year, having focused on progress in key sectors of our business lines. As always, our current and continued business strategy focuses on long-term profitability and maintaining healthy capital ratios, both of which reflect our strong commitment to shareholder value."

Quaint Oak Bancorp is a Pennsylvania-chartered stock savings bank headquartered in Southampton, PA, operating through three regional offices in Delaware Valley, Lehigh Valley, and Philadelphia markets. Subsidiaries include Quaint Oak Abstract, Quaint Oak Insurance Agency, Quaint Oak Mortgage, and Oakmont Commercial.