Earnings summaries and quarterly performance for QUAINT OAK BANCORP.

Executive leadership at QUAINT OAK BANCORP.

Board of directors at QUAINT OAK BANCORP.

Research analysts covering QUAINT OAK BANCORP.

Recent press releases and 8-K filings for QNTO.

Quaint Oak Bancorp, Inc. Announces Fourth Quarter and Year-End 2025 Earnings

QNTO

Earnings

New Projects/Investments

Profit Warning

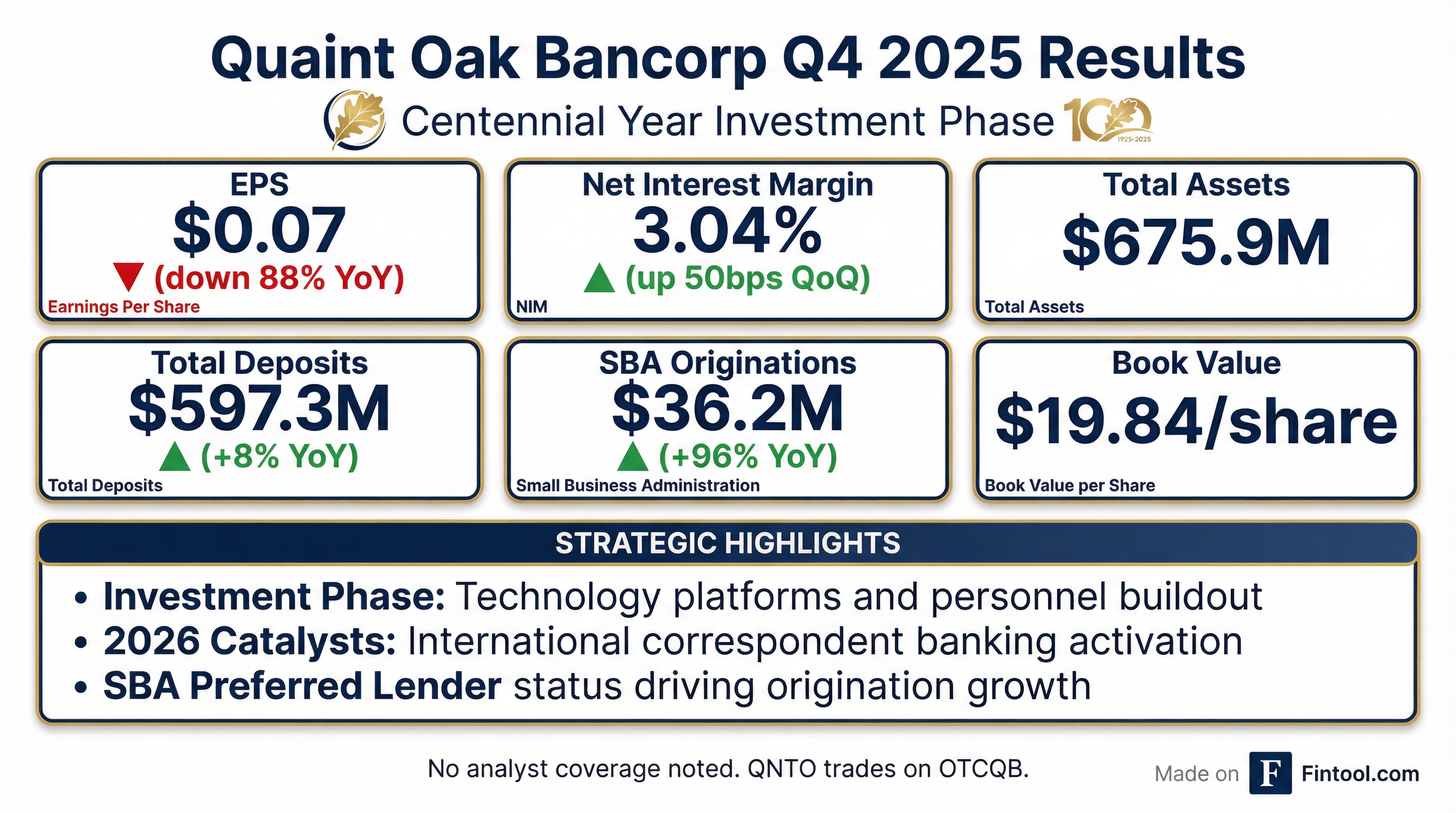

- Quaint Oak Bancorp, Inc. reported a significant decrease in net income for both the fourth quarter and full year ended December 31, 2025, with net income of $174,000 ($0.07 per share) for Q4 2025 compared to $1.6 million ($0.60 per share) in Q4 2024, and $322,000 ($0.12 per share) for FY 2025 compared to $2.8 million ($1.08 per share) in FY 2024.

- This decline was primarily attributed to a $2.2 million increase in non-interest expense for the year, driven by investments in technology and personnel, and a $2.8 million decrease in interest and dividend income.

- The company highlighted strategic investments in its international correspondent banking business and a substantial increase in SBA loan originations to $36.2 million in 2025 from $18.5 million in 2024.

- As of December 31, 2025, total assets were $675.9 million and total deposits were $597.3 million, while non-performing loans increased to $7.3 million (1.36% of total loans) from $6.3 million (1.18%) in the prior year.

4 days ago

Quaint Oak Bancorp Announces Q4 and Full Year 2025 Earnings

QNTO

Earnings

New Projects/Investments

Guidance Update

- Quaint Oak Bancorp, Inc. reported a significant decline in net income for both the fourth quarter and full year ended December 31, 2025. Net income for Q4 2025 was $174,000 ($0.07 per basic and diluted share), down from $1.6 million ($0.60 per share) in Q4 2024. For the full year 2025, net income was $322,000 ($0.12 per share), a decrease from $2.8 million ($1.08 per share) in 2024.

- The decrease in full-year net income was primarily attributed to a $2.2 million increase in non-interest expense, driven by investments in technology platforms and personnel, and a $2.8 million decrease in interest and dividend income.

- For Q4 2025, non-interest income decreased by $2.4 million (58.0%) due to the absence of a $1.5 million gain from a 2024 sale-leaseback transaction and a $1.0 million decrease in net gain on sale of mortgage and Oakmont Commercial loans. Non-interest expense for the quarter increased by $662,000 (11.6%), mainly due to higher professional fees for international correspondent banking activities.

- The company's total deposits increased by 8.0% to $597.3 million at December 31, 2025, while total assets decreased by 1.4% to $675.9 million.

- Quaint Oak Bancorp highlighted strategic investments in its international correspondent banking business line and significant progress in its SBA initiative, with originations increasing to $36.2 million in 2025 from $18.5 million in 2024, expecting promising results from these investments in 2026.

4 days ago

Quaint Oak Bancorp, Inc. Announces Third Quarter Earnings

QNTO

Earnings

New Projects/Investments

Profit Warning

- Quaint Oak Bancorp, Inc. reported a net loss of $41,000, or $0.02 per basic and diluted share, for the third quarter ended September 30, 2025, compared to net income of $243,000, or $0.09 per basic and diluted share, for the same period in 2024.

- The decline in net income was primarily attributed to a strategic investment in building a new international correspondent banking business line, which significantly increased non-interest expenses.

- Despite the net loss, the company experienced a 44.5% rise in non-interest income and an improvement in its net interest margin to 2.77% for the three months ended September 30, 2025.

- As of September 30, 2025, non-performing loans were 1.16% of total loans receivable, net, and the Texas Ratio was 9.80%.

Oct 30, 2025, 9:52 PM

Quaint Oak Bancorp, Inc. Reports Q3 2025 Net Loss Amid Strategic Investments

QNTO

Earnings

New Projects/Investments

Debt Issuance

- Quaint Oak Bancorp, Inc. reported a net loss of $41,000, or $0.02 per basic and diluted share, for the third quarter ended September 30, 2025, compared to net income of $243,000, or $0.09 per basic and diluted share, for the same period in 2024.

- For the nine months ended September 30, 2025, net income was $148,000, or $0.06 per basic and diluted share, a decrease from $1.2 million, or $0.47 per basic and diluted share, for the same period in 2024.

- The decline in earnings is primarily attributed to a strategic investment in building a new international correspondent banking business line, which led to a 16.3% increase in non-interest expense for the three months ended September 30, 2025, compared to the prior year.

- Despite the short-term impact, the company saw positive signs with non-interest income rising 44.5% quarter-over-quarter and the net interest margin improving to 2.77% for the three months ended September 30, 2025.

- At September 30, 2025, non-performing loans were 1.16% of total loans receivable, net, and the Texas Ratio was 9.80%, which, although slightly increased, remain at manageable levels.

Oct 30, 2025, 9:49 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more