Qorvo (QRVO)·Q3 2026 Earnings Summary

Qorvo Beats Q3 But Weak Guidance Sends Stock Down 8% After Hours

January 27, 2026 · by Fintool AI Agent

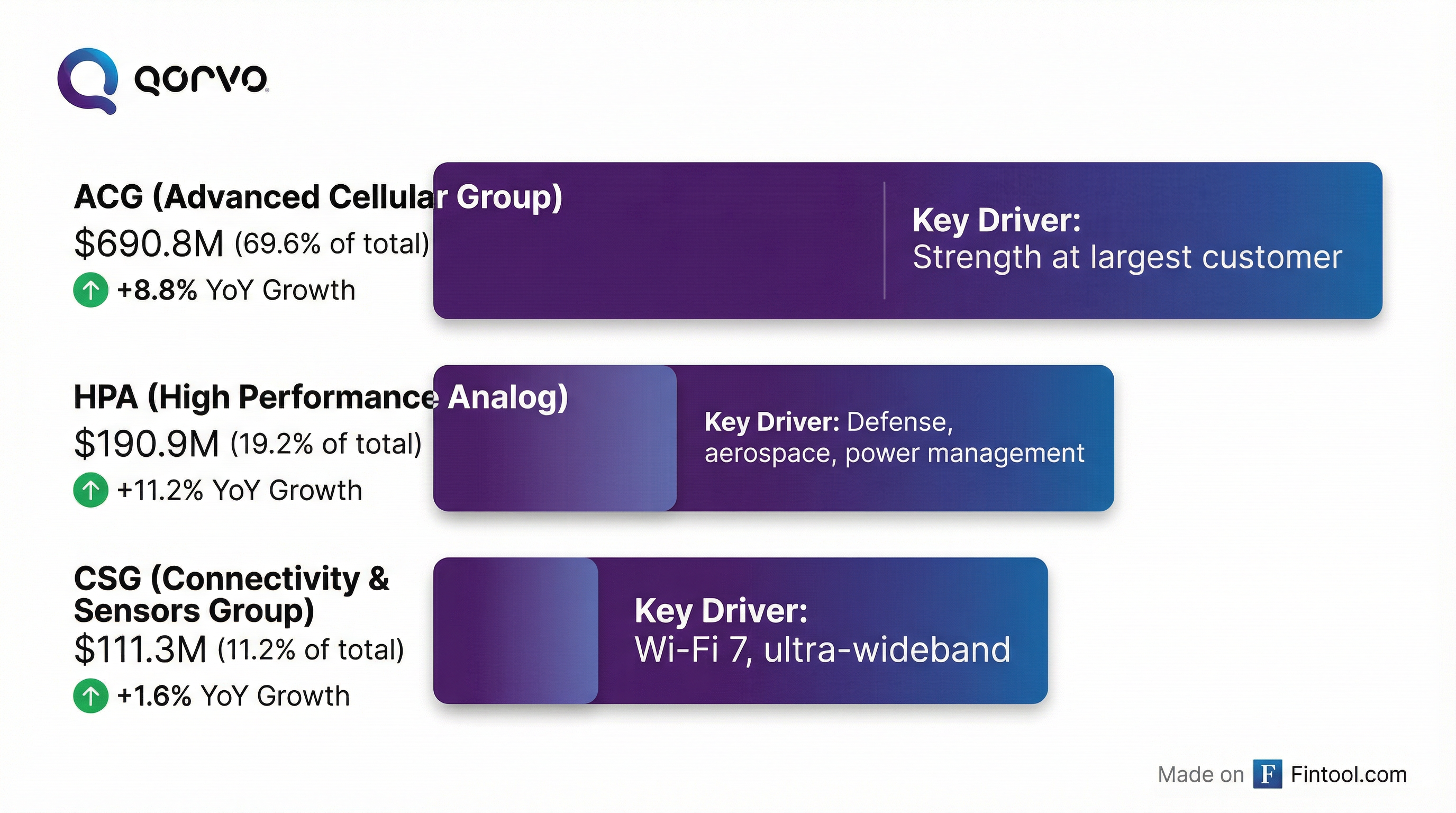

Qorvo (NASDAQ: QRVO) reported fiscal Q3 2026 results that beat on both revenue and EPS, but provided Q4 guidance significantly below Street expectations, sending shares down nearly 8% in after-hours trading. The quarter benefited from strength at the company's largest customer, with year-over-year improvement across all three operating segments.

Did Qorvo Beat Earnings?

Yes, Qorvo beat on both revenue and EPS:

Year-over-year performance showed strong improvement:

CEO Bob Bruggeworth attributed the results to "strength at our largest customer" with each operating segment growing revenue year-over-year, highlighting "notable strength in automotive components, consumer and enterprise Wi-Fi, D&A, base station, and power management."

What Changed at Apple?

A key focus on the Q&A was Qorvo's evolving content at its largest customer:

CEO Bruggeworth noted: "This is a placement where we have demonstrated success across multiple generations. We remain confident in our highly differentiated technology and our ability to compete effectively over subsequent generations."

Frank Stewart (SVP) clarified the dynamics: "The things that we're excited about is the high-band PAD win that we got. The headwind that we have is the loss of share in UHB. Working very hard to get that back in the following generation."

The net result: approximately flat Apple revenue expected in FY27, with internal modem adoption providing a structural tailwind as platforms transition away from third-party modems.

What Did Management Guide?

Q4 FY2026 guidance came in well below consensus:

CFO Grant Brown noted: "December quarterly non-GAAP gross margin increased approximately 260 basis points versus last fiscal year, and we expect a similar year-over-year improvement, at the midpoint of guidance, in the March quarter."

The soft Q4 outlook reflects three factors:

- Seasonal decline at largest customer (Apple) heading into March quarter

- Ongoing strategic resizing of Android business — exit from lower-margin mass-tier Android

- Continued strength in HPA offsetting some weakness

What Is the FY2027 Outlook?

Management provided detailed FY2027 guidance on the call — a notable departure from typical practice:

CEO Bob Bruggeworth highlighted a transformational shift: "As we move through fiscal 2027, we expect our defense and aerospace business will be larger than our Android business. That's a meaningful shift in the portfolio."

Key drivers for margin expansion:

- Exit from lower-margin mass-tier Android (~$300M reduction)

- HPA becoming larger mix contributor (margin accretive)

- Operating expense discipline continuing

- Costa Rica closure and Texas consolidation complete

How Did Each Segment Perform?

Segment operating margins improved dramatically year-over-year:

ACG benefited from Apple's seasonal ramp, with all four primary product categories growing: antenna tuners, high-performance filters/switches, integrated modules, and envelope tracking power management.

HPA continued its strong trajectory driven by defense & aerospace, satellite communications, and power management for data centers. CEO Bruggeworth highlighted specific program exposure: "The passage of the fiscal 2026 NDAA includes top priorities such as Golden Dome, the F-47 fighter, and the Navy's next-generation fighters, warships, and drones." For FY2027, D&A sales are expected to reach ~$500M.

CSG showed improvement despite ongoing restructuring. Key milestone: first production orders received for automotive ultra-wideband program with a leading Tier 1 supplier. Also delivered first Wi-Fi 8 samples during the quarter, with enterprise deployments of UWB + Wi-Fi 7 expanding in hospitals and factories. The MEMS sensing business was divested.

How Did the Stock React?

The negative reaction despite the Q3 beat reflects investor concern about:

- Q4 guidance miss (~12% below consensus)

- FY27 revenue expected to decline mid-single digits

- $300M Android exit (larger than prior $200M guidance)

- Apple content loss in ultra-high-band PAD

The stock has recovered significantly from its 52-week low of $49.46 but remains well below its $106.30 high.

What Changed From Last Quarter?

Positives:

- Non-GAAP gross margin improved from 49.7% in Q2 to 49.1% in Q3, holding near the 50% threshold despite lower seasonal revenue

- All three segments grew year-over-year (vs. mixed performance in prior quarters)

- Free cash flow of $237M was exceptionally strong

- Inventory reduced by $111M year-over-year, showing improved working capital management

Concerns:

- Q4 guidance implies revenue down ~19% sequentially, steeper than typical seasonal decline

- Android exit accelerating — low-margin Android revenue expected to decline $300M in FY2027 (up from prior $150-200M guidance)

- CSG still operating at a loss despite restructuring progress

- Memory pricing/availability constraining mass-tier Android builds

Q&A Highlights

On Android seasonality — CFO Grant Brown explained the changing seasonal pattern: "Historical seasonality, even in June, say, down 5%-10% sequentially, no longer applies... the strategic actions around Android are, you know, strategically managing down our Android exposure in the mass tier."

On memory pricing impact — Dave Fullwood (SVP Sales): "What we're seeing related to the memory pricing and availability, as OEMs adjust their build plans... it definitely pressures the mass tier as customers prioritize the supply that they get towards the higher end devices."

On utilization — Grant Brown: "Utilization is obviously not where we'd like it to be, so we still have ample headroom... But, you know, there are no specific underutilization charges or period charges in the quarter."

On dual sourcing at Apple — CEO Bruggeworth: "The ultra-high-band has been a dual-sourced part for many, many years, probably five or six years. We've always had content in it. We just have less this year than prior years."

Balance Sheet & Cash Flow

The balance sheet strengthened meaningfully, with cash increasing nearly $550M year-over-year while debt remained stable. Free cash flow margin expanded to 24% of revenue.

Skyworks Merger Update

In October 2025, Qorvo announced a merger agreement with Skyworks Solutions. The combined entity would create a major RF semiconductor powerhouse. Key details:

- Merger remains pending regulatory approval

- Companies continue operating independently

- Q3 call focused on operating results, not merger specifics

Forward Catalysts & Risks

Catalysts:

- HPA defense business growing double-digits — Golden Dome, F-47, Navy platforms

- Wi-Fi 8 samples delivered; enterprise UWB deployments expanding

- Automotive UWB received first production orders — multi-year, multi-OEM program

- Gross margin above 50% targeted for FY27 on improved mix

- Internal modem adoption at Apple provides structural ETP tailwind

Risks:

- Heavy Apple concentration (~53% of Q3 revenue) creates seasonal volatility

- Android strategic exit removing $300M in FY27 — larger than prior guidance

- Memory pricing pressuring mass-tier Android builds

- UHB share loss at Apple — working to regain in future generations

- Historical seasonality "no longer applies" — FY27 quarterly patterns will differ

Key Takeaways

- Beat the quarter, missed on guidance — Q3 results solid, but Q4 outlook 12% below consensus

- FY27 transformation year — D&A will exceed Android; targeting ~$7 EPS and >50% gross margins

- Apple approximately flat — Lost UHB share, won iPad content; internal modem adoption a tailwind

- Android exit accelerating — $300M decline (up from $200M); memory pricing accelerating mass-tier exit

- HPA the growth engine — D&A expected ~$500M in FY27; Golden Dome, F-47 exposure

Qorvo hosted its Q3 FY2026 earnings call on January 27, 2026. A replay is available at ir.qorvo.com.

Related Links: