REPUBLIC BANCORP INC /KY/ (RBCAA)·Q4 2025 Earnings Summary

Republic Bancorp Delivers Record Year with 20% Q4 Earnings Growth, Surpasses $1B Equity Milestone

January 30, 2026 · by Fintool AI Agent

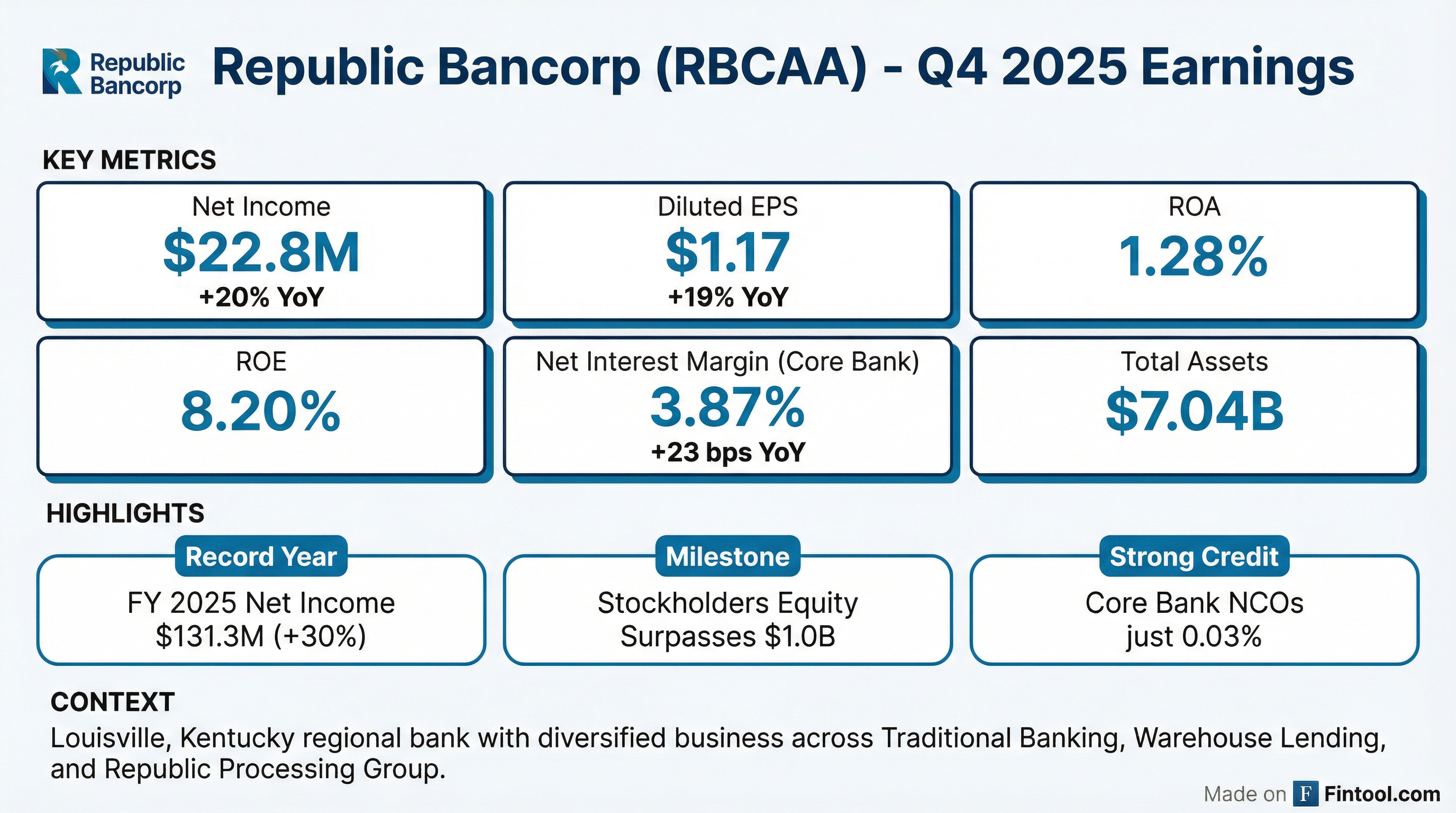

Republic Bancorp (NASDAQ: RBCAA) reported Q4 2025 net income of $22.8 million and diluted EPS of $1.17, up 20% and 19% year-over-year respectively. The Louisville-based bank capped off a record year with FY 2025 net income of $131.3 million (+30% YoY), achieving year-over-year growth across all five SEC reporting segments. Shares closed at $71.40 (+1.5%) ahead of the earnings release.

Did Republic Bancorp Beat Earnings?

Yes — Republic delivered solid growth across all profitability metrics:

The full-year 2025 results were equally impressive:

What Drove the Strong Quarter?

Net Interest Margin Expansion

Core Bank NIM expanded 23 basis points YoY to 3.87%, driven by:

- Lower deposit costs — Weighted-average cost of interest-bearing deposits fell from 2.43% to 2.12% (-31 bps)

- Asset reallocation — Company deployed excess cash into higher-yielding investments, with average investments rising from $595M to $901M (+51%) at a 4.09% yield vs 3.16% prior year

- Traditional Bank loan growth — Average loans increased $32M with weighted-average yield expanding 15 bps to 5.72%

Warehouse Lending Strength

Warehouse lending showed significant growth:

- Average outstanding lines increased $72M (+13%) to $625M

- Average committed lines rose from $942M to $1.17B

- Period-end Warehouse balances surged 37% YoY to $754M

Republic Processing Group Turnaround

RPG reported net income of $6.9 million for Q4 2025, a $5.5 million improvement over Q4 2024's $1.4 million. The primary driver was Tax Refund Solutions (TRS), which narrowed its seasonal Q4 loss to $1.4M from $6.4M, benefiting from the non-renewal of a large tax preparer contract that had generated high provisioning costs in the prior year.

How Did the Stock React?

RBCAA shares have performed well, trading near their 52-week high:

The stock is trading at a modest premium to tangible book value, reflecting the bank's consistent profitability and strong capital position.

What Changed From Last Quarter?

Notable developments:

- Provision expense increased — Total Company provision of $10.1M vs $2.0M in Q3, primarily due to a $4.8M specific allocation on a $16M C&I participation loan and growth in Warehouse balances

- RBF divestiture announced — The company agreed to sell its St. Louis-based Republic Bank Finance operations, with an expected gain of ~$6M upon closing in Q1 2026

- Salaries expense increased — Salaries and benefits rose $3.1M QoQ due to higher health insurance claims and bonus accruals

Credit Quality and Capital

Credit Metrics Remain Strong

Republic's Core Bank credit quality ratios are among the industry's best:

CEO Logan Pichel emphasized the credit strength: "For the year, the Core Bank's net charge-offs to average loans was 0.03%, while nonperforming loans and delinquent loans represented just 0.45% and 0.26% of total loans as of December 31, 2025. These ratios remain among the best in the industry."

Capital Position

The company reached a significant milestone with Total Stockholders' Equity exceeding $1.0 billion:

Segment Performance

Full-year segment highlights:

- Traditional Banking contributed $63.7M (+13% YoY)

- Republic Credit Solutions delivered $28.0M (+19% YoY)

- TRS achieved $22.0M (+244% YoY), benefiting from lower provisioning

What's the Outlook?

Management did not provide explicit guidance but highlighted several positive factors:

- Balance sheet liquidity — "One of the best liquidity positions in the history of our Company"

- Strategic flexibility — RBF divestiture proceeds (~$82M) to be recycled into other lending opportunities

- Core system conversion complete — New core operating system implemented in just eight months

- Dividend increases — Class A quarterly dividend of $0.451 per share, up 11% from $0.407 in Q4 2024

CEO Pichel's outlook: "We enter 2026 with industry-strong credit quality and capital ratios, along with one of the best liquidity positions in the history of our Company. As such, we believe we are well-positioned for another strong year ahead, as we remain focused on disciplined growth, operational excellence and efficiency."

Key Takeaways

- Record profitability — FY 2025 net income of $131.3M (+30%) and ROA of 1.84% demonstrate strong execution across all segments

- NIM expansion continues — Core Bank NIM at 3.87% (+23 bps YoY) with Traditional Bank NIM reaching 3.99%

- Equity milestone — Total stockholders' equity surpassed $1.0B, up from $992M a year ago

- Diversified earnings — All five reporting segments delivered YoY net income growth for FY 2025

- Credit quality exceptional — Core Bank net charge-offs of just 0.03% are among the best in the industry

- Strategic moves — RBF divestiture to close in Q1 2026 with ~$6M gain, improving capital allocation

The quarter caps off a transformational year for Republic Bancorp, demonstrating the strength of its diversified business model.

Earnings release: January 30, 2026

Related: RBCAA Company Profile | Q3 2025 Earnings | 8-K Filing