Earnings summaries and quarterly performance for REPUBLIC BANCORP INC /KY/.

Executive leadership at REPUBLIC BANCORP INC /KY/.

Steven E. Trager

Executive Chair and Chief Executive Officer

A. Scott Trager

President, Republic Bancorp, Inc.; Vice Chair, Republic Bank & Trust Company

Andrew Trager-Kusman

Senior Vice President, Chief Strategy Officer, Republic Bank & Trust Company

Anthony T. Powell

Executive Vice President, Chief Credit Officer

Cheryl M. VanAllen

Executive Vice President, Chief People Officer

Christy A. Ames

Executive Vice President, General Counsel; Secretary of the Company and the Bank

Jeffrey A. Starke

Executive Vice President, Chief Information and Operating Officer

John T. Rippy

Executive Vice President, Chief Risk Officer; Assistant Secretary

Juan M. Montano

Executive Vice President, Chief Mortgage Banking Officer

Kevin D. Sipes

Executive Vice President, Chief Financial Officer and Chief Accounting Officer

Logan M. Pichel

President and Chief Executive Officer, Republic Bank & Trust Company

Margaret S. Wendler

Executive Vice President, Chief Human Resources Officer

Steven E. DeWeese

Executive Vice President, Managing Director of Commercial and Private Banking

William R. Nelson

President, Republic Processing Group

Board of directors at REPUBLIC BANCORP INC /KY/.

Alejandro M. Sanchez

Director

David P. Feaster

Director

Ernest W. Marshall, Jr.

Director

Heather V. Howell

Director

Jennifer N. Green

Director

Mark A. Vogt

Lead Independent Director

Timothy S. Huval

Director

Vidya Ravichandran

Director

W. Kennett Oyler, III

Director

W. Patrick Mulloy, II

Director

Yoania Cannon

Director

Research analysts covering REPUBLIC BANCORP INC /KY/.

Recent press releases and 8-K filings for RBCAA.

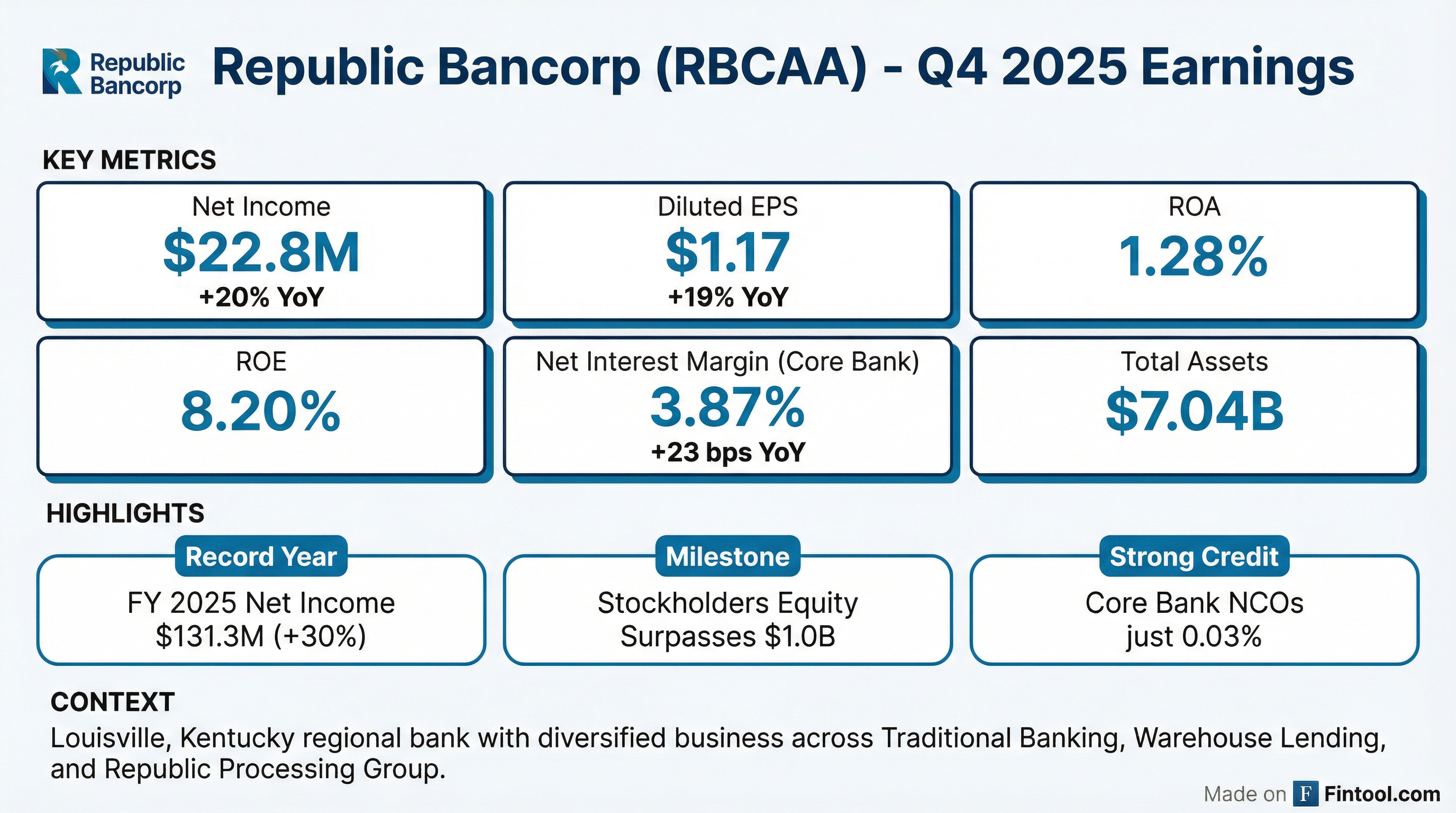

- Republic Bancorp reported a 20% increase in fourth quarter 2025 net income to $22.8 million and $1.17 per share in Diluted EPS, contributing to record net income of $131.3 million and $6.72 Diluted EPS for the full year 2025.

- For Q4 2025, the company achieved a return on average assets (ROA) of 1.28% and a return on average equity (ROE) of 8.20%.

- The company's total assets reached approximately $7.04 billion as of December 31, 2025, with Total Stockholders' Equity surpassing $1.0 billion during the year.

- Strategic actions included an agreement to sell its St. Louis-based RBF operations, expected to close in Q1 2026 with an approximate $6 million gain, and the company maintained solid credit quality metrics, with net charge-offs to average loans at 0.03% and nonperforming loans at 0.45% of total loans as of December 31, 2025.

- Republic Bancorp, Inc. announced a 10% increase in its quarterly cash dividends, marking the 28th consecutive year of dividend increases.

- The new quarterly cash dividend will be $0.495 per share for Class A Common Stock and $0.45 per share for Class B Common Stock.

- These dividends are payable on April 17, 2026, to shareholders of record as of March 20, 2026.

- The increased cash dividend results in an annualized dividend yield for the Class A Common stock of 2.77%, based on the stock's closing price on January 20, 2026.

- As of September 30, 2025, the company had approximately $7.01 billion in total assets.

- Republic Bancorp reported strong Q3 2025 earnings, with earnings per share (EPS) of $1.52 and revenue of $93.54 million, both surpassing analyst estimates.

- The company achieved a net interest margin (NIM) expansion of 16 basis points year-over-year, increasing from 3.22% in Q3 2024 to 3.38% in Q3 2025.

- Despite this solid performance, the stock has declined approximately 8.5% over the past three months and underperformed the S&P 500 year-to-date.

- Republic Bancorp's total shareholder return over the past five years exceeds 128%, highlighting strong long-term growth despite recent short-term share price declines.

- The company maintained strong balance sheet liquidity with deposit growth of 5% in Q3 2025, while the total loan portfolio slightly declined by 2% due to disciplined management.

- Republic Bancorp reported net income of $29.7 million and Diluted Earnings per Class A Common Share of $1.52 for the third quarter of 2025, representing increases of 12% and 11% respectively, over the third quarter of 2024.

- For the third quarter of 2025, the company achieved a return on average assets (ROA) of 1.69% and a return on average equity (ROE) of 10.91%. The Total Company Net Interest Margin (NIM) expanded 16 basis points to 4.65% from the third quarter of 2024.

- Core Bank net income increased by 15% to $19.8 million for the third quarter of 2025, driven by a 12% increase in net interest income. Deposits grew by $21 million from June 30, 2025, to September 30, 2025.

- Credit quality for the Core Bank remained solid, with net charge-offs to average loans at 0.02% and period-end nonperforming loans to total loans at 0.42% for the third quarter of 2025.

- Republic Bancorp reported net income of $29.7 million and Diluted EPS of $1.52 per share for the third quarter of 2025, representing increases of 12% and 11% respectively, over the third quarter of 2024.

- For the third quarter of 2025, the company achieved a return on average assets (ROA) of 1.69% and a return on average equity (ROE) of 10.91%.

- The Total Company Net Interest Margin (NIM) expanded by 16 basis points to 4.65% in the third quarter of 2025, up from 4.49% in the third quarter of 2024.

- Core Bank net income increased by 15% to $19.8 million for the third quarter of 2025, compared to $17.2 million in the prior year period.

- The company recently received two accolades, being ranked among Bank Director's Top 25 publicly traded banks and awarded the 2024 Raymond James Community Bankers Cup.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more