Rhinebeck Bancorp (RBKB)·Q4 2025 Earnings Summary

Rhinebeck Bancorp Completes Turnaround: FY 2025 Net Income Hits $10M After Prior Year Loss

January 29, 2026 · by Fintool AI Agent

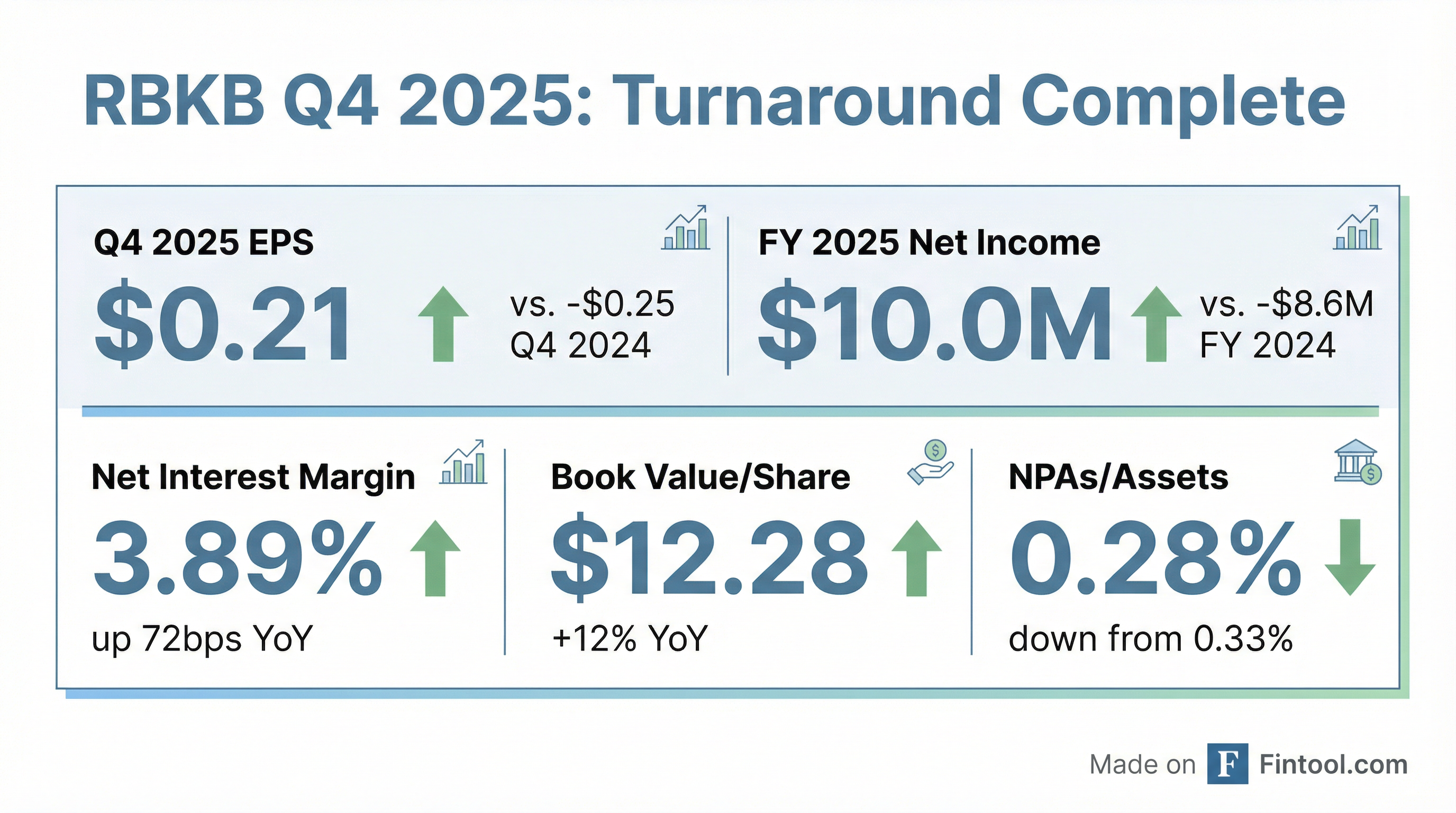

Rhinebeck Bancorp (NASDAQ: RBKB) reported Q4 2025 net income of $2.3 million, or $0.21 per diluted share, capping a full-year turnaround that saw the New York-based community bank swing from an $8.6 million loss in 2024 to $10.0 million in net income for 2025.

The results reflect the payoff from the bank's 2024 balance sheet restructuring, which involved taking $16 million in securities losses to reposition the investment portfolio at higher yields.

Did Rhinebeck Bancorp Beat Earnings?

No analyst coverage available. Rhinebeck Bancorp is a small-cap community bank (~$133M market cap) with limited analyst following. There is no consensus estimate against which to measure a beat or miss.

However, the results demonstrate clear operational improvement:

What Drove the Margin Expansion?

The story of 2025 is margin expansion. Net interest margin expanded 72 basis points year-over-year to 3.89%, driven by:

- Higher asset yields: Average yield on interest-earning assets improved 46bps to 5.77%

- Lower liability costs: Cost of interest-bearing liabilities declined 33bps to 2.54%

- Reduced FHLB advances: Average borrowings declined $42.8M as deposit growth allowed paydown of higher-cost wholesale funding

CEO Matthew Smith highlighted the success: "Net interest margin increased to 3.89% for the year, driven by prudent pricing strategies and stable funding costs, while our efficiency ratio improved meaningfully to 73.12%."

How Did the Stock React?

The stock closed at $11.90 on the day of the announcement, essentially flat:

The stock is trading at a 3% discount to book value ($12.28) and a modest discount to tangible book value ($12.07).

What Changed From Last Quarter?

Sequential Decline in EPS: Q4 EPS of $0.21 was down from $0.25 in Q3 2025, primarily due to:

- Lower net interest income ($11.8M vs $12.0M) as NIM contracted 6bps

- Lower non-interest income ($1.7M vs $1.9M)

- Higher non-interest expense ($10.1M vs $9.7M) driven by compensation

Credit Quality Remained Stable:

- Non-performing assets: 0.28% of total assets (unchanged QoQ)

- Provision for credit losses: $503K (down from $904K in Q3)

- Net charge-offs: $371K vs $971K in Q4 2024

Balance Sheet Highlights

Strategic Loan Mix Shift: The bank intentionally reduced indirect automobile loans by $81.9M while growing commercial real estate (+$52.1M) and residential mortgages (+$13.4M).

Capital Position

The bank's capital ratios improved significantly:

All ratios are well above regulatory "well-capitalized" thresholds.

Key Risks and Concerns

Management's forward-looking statements highlighted several risks:

- Interest rate sensitivity: Margin expansion could reverse if rates change unfavorably

- Deposit concentration: Uninsured deposits were 27.9% of total deposits (up from 26.9%)

- Geographic concentration: All branches in Dutchess, Ulster, Orange, and Albany counties

- Economic uncertainty: Potential tariffs, recession risks, and real estate value fluctuations

What to Watch Going Forward

- NIM sustainability: Can the bank maintain ~3.9% NIM in a potentially changing rate environment?

- Loan growth: Deposits grew 7.5% but loans declined 1.9% — need to see loan demand pick up

- Expense management: Non-interest expense rose 5.9% YoY; efficiency ratio needs to hold

- Credit quality: Indirect auto exposure declining, but watch CRE concentration

About Rhinebeck Bancorp

Rhinebeck Bancorp, Inc. is a Maryland corporation and the holding company of Rhinebeck Bank, a New York chartered stock savings bank. The bank operates 13 branches and 2 representative offices in Dutchess, Ulster, Orange, and Albany counties in New York's Hudson Valley region.

View the Q4 2025 8-K filing for complete financial statements and disclosures.