Earnings summaries and quarterly performance for Rhinebeck Bancorp.

Executive leadership at Rhinebeck Bancorp.

Board of directors at Rhinebeck Bancorp.

Research analysts covering Rhinebeck Bancorp.

Recent press releases and 8-K filings for RBKB.

Rhinebeck Bancorp, Inc. Announces Q4 and Full-Year 2025 Results

RBKB

Earnings

Revenue Acceleration/Inflection

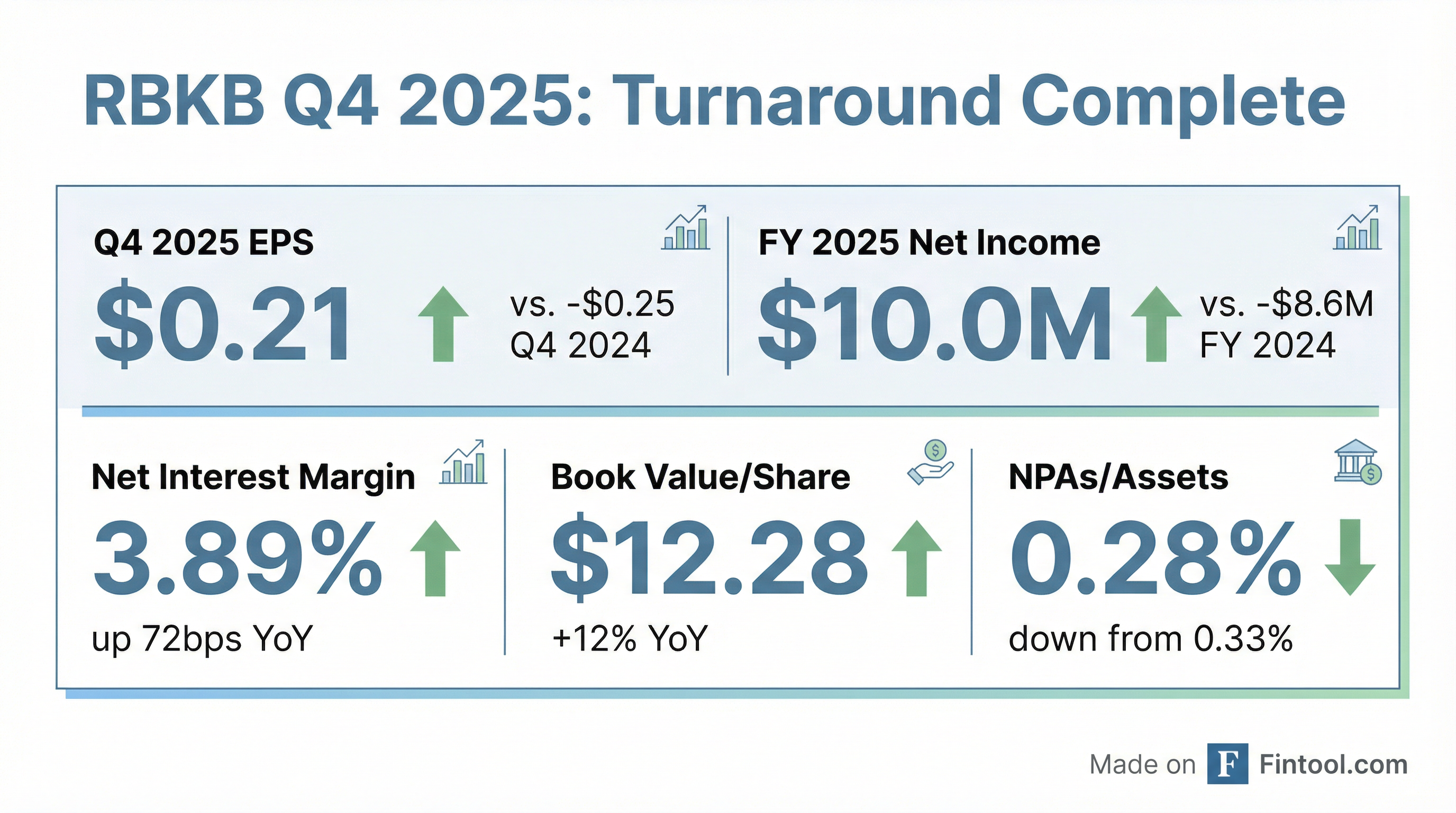

- Rhinebeck Bancorp, Inc. reported net income of $2.3 million and diluted earnings per share of $0.21 for the fourth quarter of 2025, an improvement from a net loss of $2.7 million and diluted loss per share of $0.25 in the same quarter of 2024.

- For the full year ended December 31, 2025, the company achieved a net income of $10.0 million and diluted earnings per share of $0.92, marking a significant turnaround from a net loss of $8.6 million and diluted loss per share of $0.80 in 2024.

- Net interest income for Q4 2025 increased to $11.8 million from $10.2 million in Q4 2024, with the net interest margin rising to 3.87% from 3.50%. For the full year 2025, net interest income was $46.4 million and the net interest margin was 3.89%.

- Total assets increased by 3.7% to $1.30 billion and stockholders' equity grew by 12.3% to $136.9 million as of December 31, 2025.

- The company's efficiency ratio improved to 73.12% and non-performing assets stood at 0.28% of total assets for the year ended December 31, 2025.

Jan 29, 2026, 9:40 PM

Rhinebeck Bancorp, Inc. Reports Q3 2025 Net Income and CEO Change

RBKB

Earnings

CEO Change

Revenue Acceleration/Inflection

- Rhinebeck Bancorp, Inc. reported a net income of $2.7 million for the third quarter of 2025, or $0.25 earnings per share, a significant turnaround from a net loss of $8.1 million, or $0.75 diluted loss per share, in the third quarter of 2024. For the first nine months of 2025, net income totaled $7.7 million, or $0.70 earnings per share, compared to a net loss of $6.0 million in the prior year period.

- Net interest income for Q3 2025 increased by $2.4 million, or 24.5%, to $12.0 million, primarily due to higher yields on interest-earning assets and lower costs on interest-bearing liabilities. This improved earnings stream follows a balance sheet restructuring in Q3 2024 that resulted in a $12.0 million pre-tax loss.

- Total assets increased by $60.2 million, or 4.8%, to $1.32 billion as of September 30, 2025. This growth was supported by a $95.0 million, or 9.3%, increase in deposits and a $11.2 million, or 9.2%, increase in stockholders' equity to $133.0 million.

- Matthew Smith has assumed the role of President and Chief Executive Officer, with a focus on sustainable growth, deepening client relationships, and driving innovation.

Oct 28, 2025, 8:36 PM

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more