Reddit (RDDT)·Q4 2025 Earnings Summary

Reddit Crushes Q4 With 70% Revenue Growth, Announces $1B Buyback

February 5, 2026 · by Fintool AI Agent

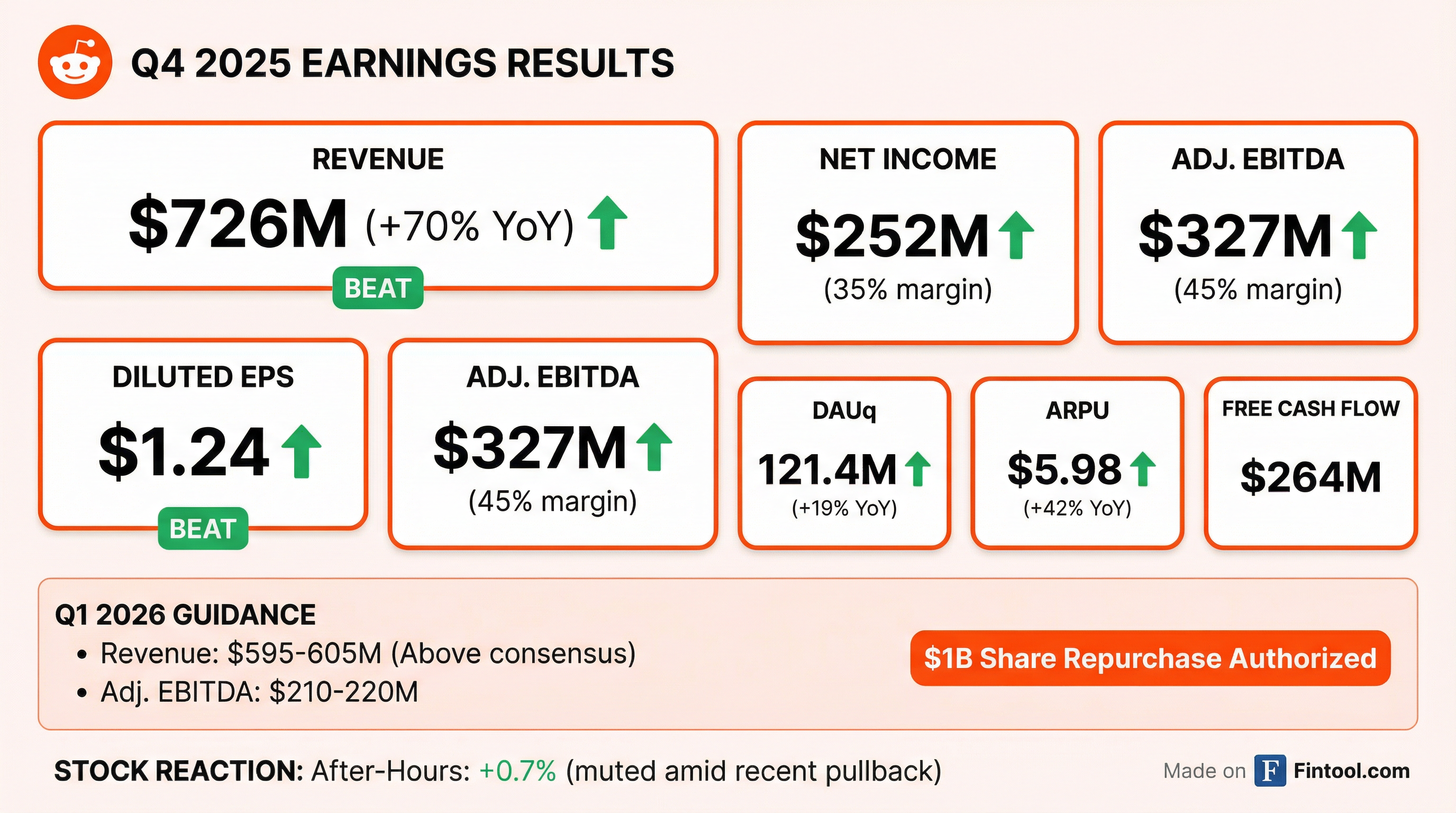

Reddit delivered another blowout quarter, posting Q4 2025 revenue of $726 million (+70% YoY) and diluted EPS of $1.24 . The company extended its perfect post-IPO earnings streak to 8 consecutive beats while announcing its first-ever $1 billion share repurchase program . Despite the strong results, shares traded roughly flat in after-hours (+0.7%) following a brutal 16% pre-earnings selloff over the prior week.

Did Reddit Beat Earnings?

Yes, decisively. Reddit beat on both revenue and EPS for the 8th straight quarter since its March 2024 IPO.

The beat was driven by:

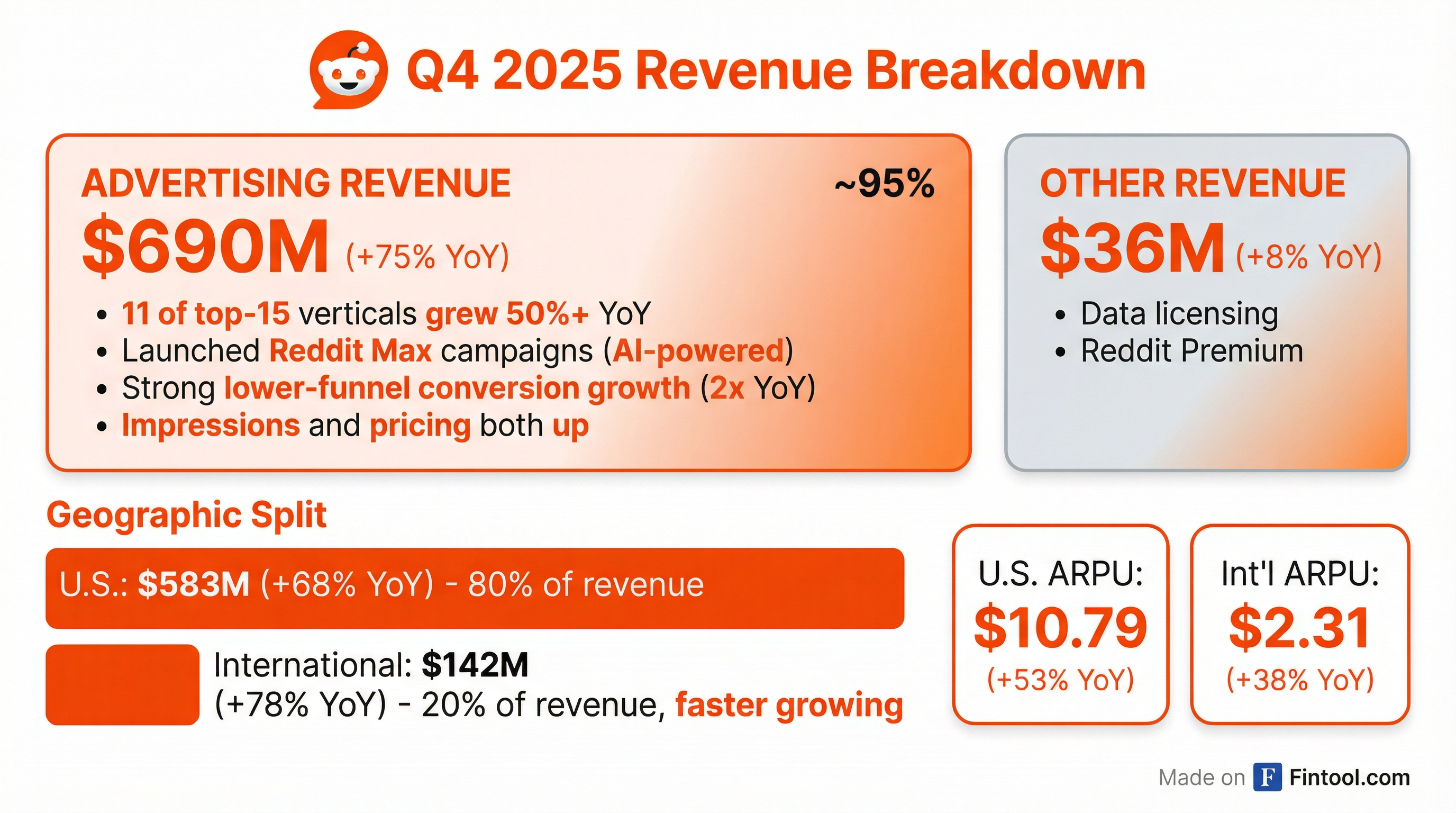

- Advertising revenue surge: +75% YoY to $690M, with 11 of the top 15 industry verticals growing 50%+

- International acceleration: International revenue +78% YoY vs. U.S. +68%

- ARPU expansion: Global ARPU jumped 42% YoY to $5.98, with U.S. ARPU reaching $10.79 (+53%)

What Did Management Guide?

Reddit provided Q1 2026 guidance above consensus:

*Values retrieved from S&P Global

The $600M revenue midpoint implies approximately 52% YoY growth (vs. Q1 2025's $392M ), a sequential deceleration from Q4's 70% but still robust. Management expressed confidence in sustained momentum across all three sections of the ad funnel .

What Changed From Last Quarter?

Key inflections this quarter:

-

Profitability milestone: Net margin hit 35% in Q4 vs. 28% in Q3, with Adj. EBITDA margin expanding to 45%

-

Capital return program: The $1 billion buyback signals confidence in cash generation — Reddit ended Q4 with $2.48B in cash and securities

-

Leadership addition: Maria Angelidou-Smith joined as Chief Product Officer to accelerate product execution

-

AI product launch: Reddit Max campaigns (AI-powered automated ad campaigns) entered public beta, showing early outperformance

-

Search integration: Reddit Answers (AI-powered search) now serves 80M+ weekly searchers, up from 60M a year ago

How Did the Stock React?

Muted reaction despite strong results.

- After-hours: +0.7% to $152.18 (vs. close of $151.08)

- Pre-earnings selloff: Stock fell 16% in the 5 days before earnings

- From 52-week high: Down 46% from the $282.95 peak in December 2024

The subdued reaction reflects:

- The stock had already de-rated significantly from its highs

- Investors may have been looking for even stronger guidance given the pullback

- Broader tech/growth stock weakness in recent weeks

Beat/miss history since IPO:

Key User Metrics

Reddit's user engagement continues to show strong momentum, with AI-powered search gaining traction:

- Reddit Answers (AI Search): Weekly active users grew from 1M in Q1 2025 to 15M in Q4 2025

- Overall Search WAU: 80M weekly searchers, up from 60M a year ago

International growth is outpacing U.S.:

- International DAUq: +28% YoY to 68.9M

- U.S. DAUq: +9% YoY to 52.5M

Management noted they plan to phase out logged-in vs. logged-out user reporting starting Q3 2026 as product changes blur the distinction . CFO Drew Vollero explained the shift reflects a focus on growing all users rather than distinguishing between login states .

What Did Steve Huffman Say?

CEO Steve Huffman emphasized Reddit's differentiated position in the AI era:

"Reddit is at the center of a once-in-a-generation shift... We're now operating in a fundamentally different internet. One shaped by opaque algorithms, generative content, and growing distrust. And yet, amid this shift, more people are turning to Reddit... That's because Reddit is the most human place on the internet."

On the buyback announcement:

"We have a special business model that is generating a lot of cash, which is why we're excited to announce a $1 billion share repurchase program today. It's a testament to our growth and our commitment to delivering for our shareholders."

On product priorities:

"Our focus is on turning Reddit's authenticity into even more everyday utility."

Advertising Deep Dive

Advertising drove the quarter, with several notable developments:

Reddit Max Campaigns (AI-Powered)

- Launched to public beta in Q4

- Case study: Brooks Running achieved 26% higher click volume, 37% lower cost per click, 26% higher CTR

- 17% lower CPA and 27% more conversions vs. standard campaigns

Lower-funnel momentum:

- 2x YoY growth in lower-funnel conversion volume

- Enhanced ML models optimizing for advertiser objectives

Vertical strength:

- 11 of top 15 industry verticals grew 50%+ YoY

- Broad strength across brand awareness, consideration, and conversion objectives

Profitability Trends

Reddit's profitability expansion continues to accelerate:

Rule of 40 performance: Revenue growth (70%) + Adj. EBITDA margin (45%) = 115 — well above the 40 threshold for high-quality software/platform companies .

Full Year 2025 Summary

Reddit transformed from a loss-making company in 2024 to a highly profitable platform generating over $500M in annual net income in just one year.

Balance Sheet Strength

Reddit ended Q4 2025 with a fortress balance sheet:

- Cash & securities: $2.48B

- Total debt: $0

- Fully diluted shares: 206.1M (flat sequentially, down YoY)

The $1B buyback authorization represents ~3.5% of market cap at current prices and is the company's first return of capital since the IPO. CFO Drew Vollero outlined the capital allocation framework: "First and foremost, it's investing in the business. Second, it's M&A. Third is share repurchase where it makes sense." The company plans to maintain at least $1B in cash on the balance sheet .

Q&A Highlights

On AI Partnerships (Google, OpenAI): Steve Huffman noted Reddit's strategic position: "Reddit, per Profound, is the number one cited source in AI answers. Our relationships with both companies are very healthy. The conversation is shifting from a purely business deal to more of a product partnership."

On Agentic Commerce: COO Jen Wong positioned Reddit as well-suited for the AI commerce shift: "Reddit is the point of trusted recommendations... The human, the last point of decision-making of what to buy and allocating resources, is at the recommendation, and Reddit has the best recommendations for products and services."

On Logged-In vs. Logged-Out Monetization: Jen Wong clarified there's no impression value differential: "On an impression basis, the value of those impressions is the same. The real differential is around engagement... The opportunity is in engagement via those product improvements."

On Large Advertiser Wallet Share: Jen Wong highlighted significant headroom with enterprise accounts: "Some of these large customers have a portfolio of 100 different brands, and we still haven't penetrated all those brands. It's still in the minority percentage that we've covered."

On Search Product Evolution: Huffman indicated LLM-powered search will become the default: "The Gen AI search results, I think, will just be better for most queries... We're actually finding that the LLM search results is, in many cases, better for navigation as well."

On Shopping Ads (DPA) Progress: Jen Wong noted competitive positioning: "Our product today is competitive with tier two peers on both prospecting and retargeting. When you think about tier one, we want to do more work on ML... Shopping is a pretty numerical return exercise."

Risks and Concerns

While results were strong, investors should monitor:

-

Sequential revenue deceleration: Q1 guidance implies ~52% YoY growth vs. Q4's 70% — the law of large numbers is starting to apply

-

International monetization gap: International ARPU of $2.31 is only 21% of U.S. ARPU ($10.79) — significant runway but also uncertainty on how quickly the gap closes

-

Stock-based compensation: SBC of $343M in FY 2025 remains elevated, though down from $802M in FY 2024

-

Platform authenticity threats: Management acknowledged active work on bot verification and labeling to preserve conversation quality in the AI era

-

Stock volatility: Shares are down 46% from highs despite strong fundamentals — valuation has reset significantly

Forward Catalysts

Key events to watch:

- Reddit Max campaigns — Full launch and adoption metrics

- Bot verification launch — Weeks away per management

- AI search expansion — New languages and agentic search features

- Buyback execution — Timing and pace of share repurchases

- Feed relevancy improvements — AI/ML investments to improve personalization

- Q1 2026 earnings — Whether guidance proves conservative (as prior quarters have)

The Bottom Line

Reddit delivered another exceptional quarter with 70% revenue growth, 35% net margins, and its first buyback announcement. The 8-quarter beat streak since IPO is remarkable. However, the stock's muted reaction suggests the market may be looking for even more clarity on the growth trajectory as the company scales past $2B in annual revenue.

At current prices (~$151), Reddit trades at roughly 10x forward revenue — a significant compression from its peak multiples. The fundamental story remains intact, but investors appear more cautious on high-growth names broadly.

Report generated by Fintool AI Agent on February 5, 2026. Data sourced from Reddit's Q4 2025 8-K filing, earnings call transcript, and S&P Global.

Related Links: