Earnings summaries and quarterly performance for Reddit.

Executive leadership at Reddit.

Board of directors at Reddit.

Research analysts who have asked questions during Reddit earnings calls.

Benjamin Black

Deutsche Bank AG

7 questions for RDDT

Richard Greenfield

LightShed Partners

7 questions for RDDT

Andrew Boone

JMP Securities

6 questions for RDDT

Jason Helfstein

Oppenheimer & Co. Inc.

5 questions for RDDT

Ronald Josey

Citigroup Inc.

5 questions for RDDT

Brian Nowak

Morgan Stanley

4 questions for RDDT

John Colantuoni

Jefferies

4 questions for RDDT

Thomas Champion

Piper Sandler

4 questions for RDDT

Eric Sheridan

Goldman Sachs

3 questions for RDDT

Justin Post

Bank of America Corporation

3 questions for RDDT

Naved Khan

B. Riley Securities

3 questions for RDDT

Alan Gould

Loop Capital

2 questions for RDDT

Brad Erickson

RBC Capital Markets

2 questions for RDDT

Colin Sebastian

Baird

2 questions for RDDT

Daniel Salmon

New Street Research

2 questions for RDDT

Josh Beck

Raymond James

2 questions for RDDT

Kenneth Gawrelski

Wells Fargo & Company

2 questions for RDDT

Maggie Hoffman

JPMorgan Chase & Co.

2 questions for RDDT

Mark Shmulik

Bernstein

2 questions for RDDT

Ron Josey

Citi

2 questions for RDDT

Tom Champion

Piper Sandler Companies

2 questions for RDDT

Vasily Karasyov

Cannonball Research

2 questions for RDDT

Douglas Anmuth

JPMorgan Chase & Co.

1 question for RDDT

Laura Martin

Needham & Company, LLC

1 question for RDDT

Rohit Kulkarni

ROTH Capital Partners, LLC

1 question for RDDT

Recent press releases and 8-K filings for RDDT.

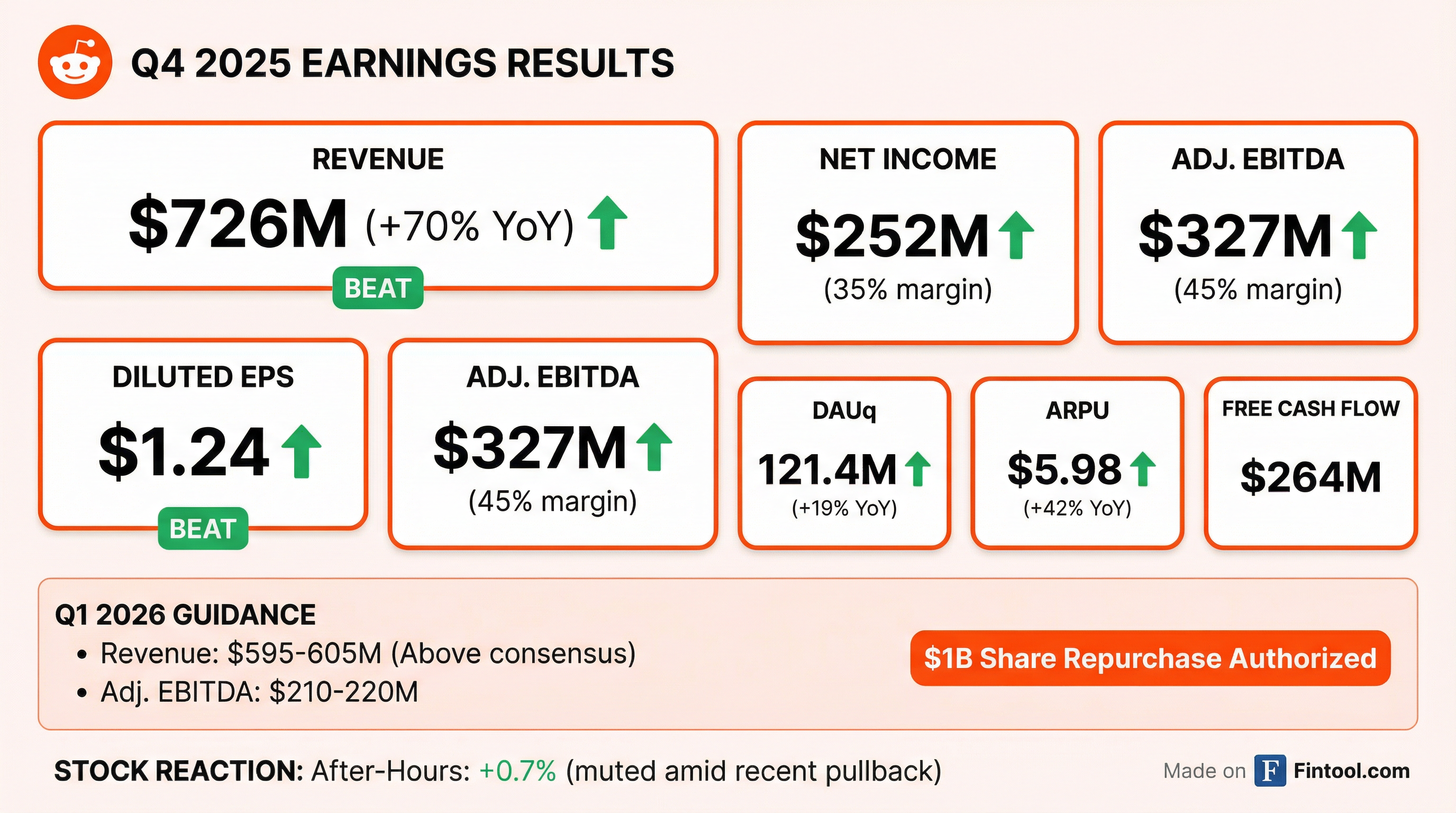

- Reddit reported strong Q4 results, with revenue of approximately $726 million (up ~70% year-over-year) and adjusted EBITDA of about $327 million.

- The company's non-GAAP EPS for the quarter was $1.72, representing a 99% year-over-year increase.

- Key operational highlights include a 75% year-over-year growth in advertising revenue and a 44% increase in average revenue per user.

- Analysts reacted heterogeneously, with some firms like Needham and Raymond James maintaining bullish ratings and high price targets, while others such as Bank of America and Cantor Fitzgerald trimmed targets citing sector multiple compression and capital-allocation risks.

- Management's guidance points to continued high growth and margin expansion.

- Reddit posted strong Q4 and full-year 2025 results, with Q4 revenue reaching $726 million and full-year 2025 revenue at $2.2 billion. The company also reported full-year net income of $530 million and adjusted EBITDA of $845 million, with gross margins of 91.2%.

- The company announced a $1 billion share repurchase program, marking its first major buyback since going public, which management views as a significant capital-allocation signal.

- Reddit's management outlined a "tuck-in first" M&A strategy, focusing on acquiring adtech and complementary capabilities to accelerate monetization and grow its user base.

- Reddit issued Q1 guidance above consensus and identified longer-term revenue opportunities in AI-powered search and data licensing.

- Analysts from Citi and Needham maintained Buy ratings and raised price targets, citing factors such as faster user growth, expanding margins, and stronger monetization.

- Reddit reported a strong Q4 2025, with total revenue growing 70% year-over-year to $726 million and advertising revenue increasing 75% to $690 million. For the full year 2025, revenue reached $2.2 billion, up 69% year-over-year, with net income of $530 million and diluted EPS of $2.62.

- The company achieved significant user growth in Q4 2025, with over 121 million daily active users (up 19% year-over-year) and over 471 million weekly active users (up 24%). Average revenue per user (ARPU) grew 42% year-over-year to $5.98.

- Reddit's ad platform saw robust expansion, with the total active advertiser count growing over 75% year-over-year in Q4 2025. Key drivers included performance ads, which doubled year-over-year for lower funnel objectives, and the public beta launch of Reddit Max Campaigns, an AI-powered platform that delivered an average 17% CPA reduction and 27% conversion volume lift in testing.

- Strategic initiatives for 2026 include scaling automation through Ads Manager and Reddit Max, delivering more advertiser value across the full funnel, and expanding the Reddit for Business ecosystem. The company also highlighted evolving product partnerships with Google and OpenAI, aiming to integrate users into Reddit's community features.

- Reddit reported a breakout year in 2025, with full-year revenue of $2.2 billion, up 69% year-over-year, and net income of $530 million. In Q4 2025, total revenue grew 70% year-over-year to $726 million, with net income reaching $252 million and diluted EPS of $1.24.

- The company announced a $1 billion share repurchase program with no set expiration date, reflecting its growth and commitment to shareholder returns.

- User growth continued strongly in Q4 2025, with 121 million daily active users (up 19% year-over-year) and 471 million weekly active users (up 24%).

- The advertising business was a key driver, growing 75% year-over-year to $690 million in Q4, with the total active advertiser count increasing by over 75% year-over-year.

- For Q1 2026, Reddit estimates revenue between $595 million and $605 million, representing 52%-54% year-over-year growth, and Adjusted EBITDA between $210 million and $220 million.

- Reddit reported strong financial performance for Q4 2025, with revenue growing 70% year-over-year to $726 million and net income reaching $252 million. For the full year 2025, revenue was $2.2 billion (up 69% year-over-year) and net income was $530 million.

- The company's board of directors authorized a $1 billion share repurchase program.

- User engagement continued to grow, with 121 million daily active users (up 19% year-over-year) and 471 million weekly active users (up 24%) in Q4 2025.

- Reddit is advancing its AI integration, launching verified profiles in Q4 and the public beta of Reddit Max Campaigns, an AI-powered platform for advertisers.

- Starting in Q3 2026, Reddit will no longer report logged-in and logged-out user metrics, shifting focus to overall user engagement and growth.

- Reddit reported strong financial results for Q4 2025, with revenue increasing 70% year-over-year to $726 million and net income reaching $252 million. For the full year 2025, revenue grew 69% to $2.2 billion, with net income of $530 million.

- Daily Active Uniques (DAUq) increased 19% year-over-year to 121.4 million in Q4 2025.

- Reddit's Board of Directors authorized a share repurchase program of up to $1 billion of Class A common stock.

- For the first quarter of 2026, Reddit estimates revenue to be in the range of $595 million to $605 million and Adjusted EBITDA in the range of $210 million to $220 million.

- Reddit reported Q4 2025 revenue of $726 million, a 70% year-over-year increase, and full-year 2025 revenue of $2.2 billion, up 69% year-over-year. Net income for Q4 2025 was $252 million and $530 million for the full year 2025.

- Daily Active Uniques (DAUq) increased 19% year-over-year to 121.4 million in Q4 2025.

- Reddit's Board of Directors authorized a share repurchase program of up to $1 billion of Class A common stock.

- For the first quarter of 2026, Reddit estimates revenue in the range of $595 million to $605 million and Adjusted EBITDA in the range of $210 million to $220 million.

- Tianrong Internet Products and Services Inc. (TIPS) has announced the launch of an AI Inference Marketplace, designed to provide affordable, scalable, and decentralized access to GPU compute for artificial intelligence applications.

- This strategic initiative aims to address the accelerating demand for AI inference and training compute, as well as the rising costs and supply constraints faced by centralized cloud providers.

- The marketplace will enable individuals and organizations to rent out idle GPUs, with TIPS projecting a 50–80% reduction in inference costs compared to centralized providers.

- TIPS intends to generate revenue by taking a 5–10% transaction fee from the marketplace, with optional premium tiers available.

- The company notes a significant market opportunity, with the global AI inference market expected to grow from approximately $106 billion in 2025 to $255 billion by 2030.

- Needham & Company has named Reddit its top stock pick for 2026, reiterating a Buy rating and a $300 price target.

- The bullish case is centered on Reddit's improving ad platform, which is rolling out AI-powered tools, and a growing data-licensing business that reportedly generates over $100 million annually from existing deals.

- Needham projects 2026 revenue potential near $2.95 billion, with management guiding Q4 2025 revenue around $655–$665 million.

- As of December 24, 2025, Reddit's stock was indicated around $225.82, with a market capitalization near $43.0 billion.

- The European ETF industry is projected to grow significantly, with assets expected to reach €6 trillion by 2030, driven by innovations in product offerings and technology.

- Defined Outcome ETFs\u2122 are anticipated to experience rapid growth, potentially quadrupling assets to over $334 billion by 2030, appealing to pre-retirement investors seeking predictable, downside-protected investment strategies.

- In November 2025, BlackRock's Target Allocation model portfolio team strategically shifted allocations from quality to momentum and increased value exposure, leading to record inflows into the iShares S&P 500 Value ETF (IVE) and MSCI USA Momentum Factor ETF (MTUM).

- Globally, ETF inflows remain robust, with over $1.2 trillion year-to-date, despite more money exiting mutual funds than entering ETFs, which is driving the launch of new ETF share classes.

Fintool News

In-depth analysis and coverage of Reddit.

Reddit Director Bets $7.48M on Stock as Shares Crater 51%—The Largest Insider Buy Since IPO

Reddit Crushes Q4 Estimates, Announces $1B Buyback Less Than Two Years After IPO

Reddit Announces First-Ever $1B Buyback After Q4 Blowout: Revenue Beats by 9%, Margins Hit 35%

Reddit Stock Tumbles 9% as Analyst Warns of Slowing Growth and YouTube Overtakes in AI Rankings

Reddit Stock Plunges 9% as SMB Ad Concerns Mount and Co-Founder's Digg Challenges from Within

Quarterly earnings call transcripts for Reddit.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more