Reddit Stock Tumbles 9% as Analyst Warns of Slowing Growth and YouTube Overtakes in AI Rankings

January 27, 2026 · by Fintool Agent

Reddit shares plunged 9% Tuesday after Cleveland Research analyst Ross Walthall downgraded the stock to Neutral, warning that large US advertisers are reducing their 2026 spending forecasts and expressing less conviction about scaling their Reddit budgets. The selloff erased weeks of gains and left the stock more than 20% below its year-to-date high.

Adding to investor concerns, an Adweek report revealed that Youtube has officially overtaken Reddit as the most frequently cited social platform in AI-generated responses—a reversal that threatens a key pillar of Reddit's investment thesis.

The Analyst Warning

Walthall's research note delivered a "reality check" on the high-growth narrative that has been fueling Reddit shares since its March 2024 IPO. Key concerns include:

- Slowing new advertiser acquisition: The initial "burst" of new advertisers joining Reddit in late 2025 is normalizing

- Large US agencies reducing forecasts: Major advertising partners have less conviction about scaling up 2026 spending commitments

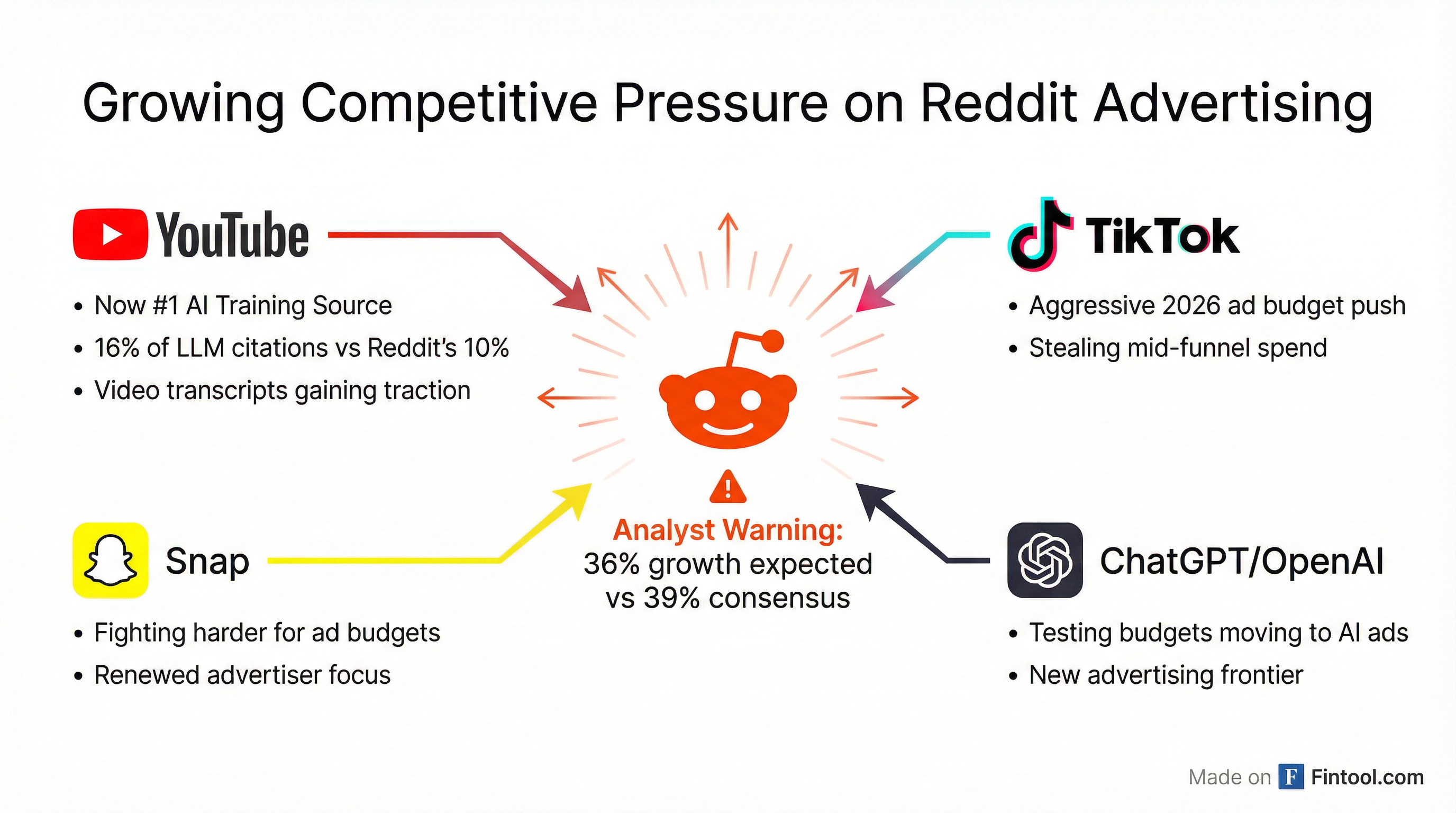

- Competition intensifying: TikTok, Snap, and even ChatGPT are fighting harder for advertising budgets

- ROI sentiment declining: Only 59% of partners are now beating ROI targets, down from 76% in the previous quarter

Cleveland Research now projects Reddit's 2026 revenue growth at 36% year-over-year ($2.9 billion), below the consensus estimate of 39.1% ($3.0 billion).

YouTube Takes the AI Crown

Perhaps more damaging to the long-term thesis: Reddit is no longer the "king of AI training." New data from four independent sources compiled by Adweek found that YouTube now appears as a cited source in 16% of LLM answers over the past six months, compared with just 10% for Reddit.

This represents a significant reversal. Reddit's text-heavy format had made it the dominant social source for AI models because machines could easily read and process the content. But YouTube's vast library of video transcripts, explainers, and associated metadata has allowed Google's video platform to flourish as an AI data source.

The shift matters because Reddit has positioned its data licensing business as a growth driver. The company's "other revenue" segment, which includes data licensing, reached $34 million in Q1 2025, growing 66% year-over-year. If AI models increasingly prefer YouTube over Reddit for training data, this revenue stream could face pressure.

The Competitive Landscape Intensifies

The analyst note highlighted that Reddit faces competitive pressure from multiple directions:

TikTok and Snap: Both platforms are expected to fight much harder for advertising budgets in 2026. Walthall noted that these platforms are actively targeting mid-funnel spend that has been flowing to Reddit.

ChatGPT/OpenAI: Perhaps most surprisingly, ChatGPT is starting to steal test advertising budgets that might have otherwise gone to Reddit. This represents an entirely new competitive vector that didn't exist when Reddit went public in 2024.

YouTube: Beyond AI citations, YouTube's massive scale and proven advertising infrastructure continue to make it a formidable competitor for brand and performance advertising dollars.

Reddit's Fundamentals Remain Strong—For Now

Despite the selloff, Reddit's underlying business continues to perform. The company delivered strong results in Q3 2025:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $428 | $392 | $500 | $585 |

| Net Income ($M) | $71 | $26 | $89 | $163 |

| Gross Margin (%) | 92.6% | 90.5% | 90.8% | 91.0% |

| Cash Position ($M) | $562 | $636 | $734 | $912 |

Management has consistently highlighted broad-based strength across advertising objectives, channels, verticals, and geographies. In Q2 2025, advertising revenue grew 84% year-over-year to $465 million, with total active advertiser count expanding over 50% year-over-year.

However, the question investors must now grapple with is whether this growth rate is sustainable as the competitive landscape intensifies and the initial post-IPO advertiser enthusiasm normalizes.

What the Street Is Missing

Cleveland Research's downgrade focuses on near-term advertiser spending patterns, but the Conversion API (CAPI) adoption rate may be the key metric to watch. The analyst noted that broader adoption of CAPI "is needed to unlock more direct response advertising spending."

Reddit has been investing heavily in its advertising technology stack. In Q1 2025, lower funnel conversion revenue covered by CAPI tripled year-over-year, and over 90% of managed advertisers had adopted the company's Pixel. The company also launched Dynamic Product Ads (DPA) which delivered an average of over 90% higher ROAS compared to campaigns from the prior year.

If these infrastructure investments translate into better advertiser performance metrics, the current growth concerns may prove temporary. But if large advertisers continue to reduce forecasts despite improved measurement tools, it would suggest a more fundamental demand problem.

What to Watch

February 5 Earnings: Reddit reports Q4 2025 results in early February. Investors will scrutinize:

- Q4 revenue growth relative to the 56% consensus estimate

- 2026 guidance and commentary on advertiser sentiment

- Any updates on AI data licensing partnerships

- Conversion API adoption metrics

Competitive Response: How aggressively TikTok and Snap pursue Reddit's advertising clients in Q1 2026 could determine whether the current concerns are a temporary pause or the beginning of a structural deceleration.

YouTube's AI Advantage: Whether the AI citation shift accelerates or stabilizes will impact perceptions of Reddit's data licensing potential.