Earnings summaries and quarterly performance for Snap.

Research analysts who have asked questions during Snap earnings calls.

Richard Greenfield

LightShed Partners

8 questions for SNAP

Daniel Salmon

New Street Research

7 questions for SNAP

Ross Sandler

Barclays

7 questions for SNAP

Mark Shmulik

Bernstein

6 questions for SNAP

Benjamin Black

Deutsche Bank AG

5 questions for SNAP

Eric Sheridan

Goldman Sachs

4 questions for SNAP

Justin Post

Bank of America Corporation

4 questions for SNAP

Kenneth Gawrelski

Wells Fargo & Company

3 questions for SNAP

Mark Mahaney

Evercore ISI

3 questions for SNAP

Shweta Khajuria

Wolfe Research, LLC

3 questions for SNAP

Douglas Anmuth

JPMorgan Chase & Co.

2 questions for SNAP

James Heaney

Jefferies

2 questions for SNAP

Justin Patterson

KeyBanc Capital Markets

2 questions for SNAP

Ken Gawrelski

Wells Fargo

2 questions for SNAP

Deepak Mathivanan

Cantor Fitzgerald

1 question for SNAP

Michael Morris

Guggenheim Securities

1 question for SNAP

Thomas Champion

Piper Sandler

1 question for SNAP

Recent press releases and 8-K filings for SNAP.

- A December 2025 Snap Finance survey found that 66% of U.S. households delayed essential purchases of $300 or more in 2025 due to financial constraints, with this figure rising to 86% for credit-challenged consumers.

- Despite 72% of respondents reporting good financial management, 62% indicated living paycheck to paycheck in 2025, highlighting limited financial flexibility.

- 51% of respondents applied for new financing in 2025 to cover major purchases, reflecting a significant reliance on accessible payment options for essential expenses.

- For 2026, 53% of respondents expect their financial situation to improve, though 43% anticipate increased reliance on credit or financing.

- The top concerns for 2026 are inflation (67%), unexpected expenses (48%), and potential job loss (44%).

- Snapchat is launching Creator Subscriptions in an alpha test in the U.S. on February 23, allowing creators to offer subscriber-only content, priority replies, and an ad-free experience for their Stories.

- This initiative is part of Snap's broader push to build recurring, higher-margin revenue amidst advertising headwinds.

- The company highlights its 946 million daily active users and the 71% year-over-year growth of its existing paid offerings (Snapchat+ and Memories Storage Plans), which now total approximately 24 million subscribers.

- Analysts have mixed reactions, with some like Citi cutting their price target to $6 and others like Arete upgrading to Buy with a $7.30 target, reflecting differing views on the pivot from ad-led to subscription revenue.

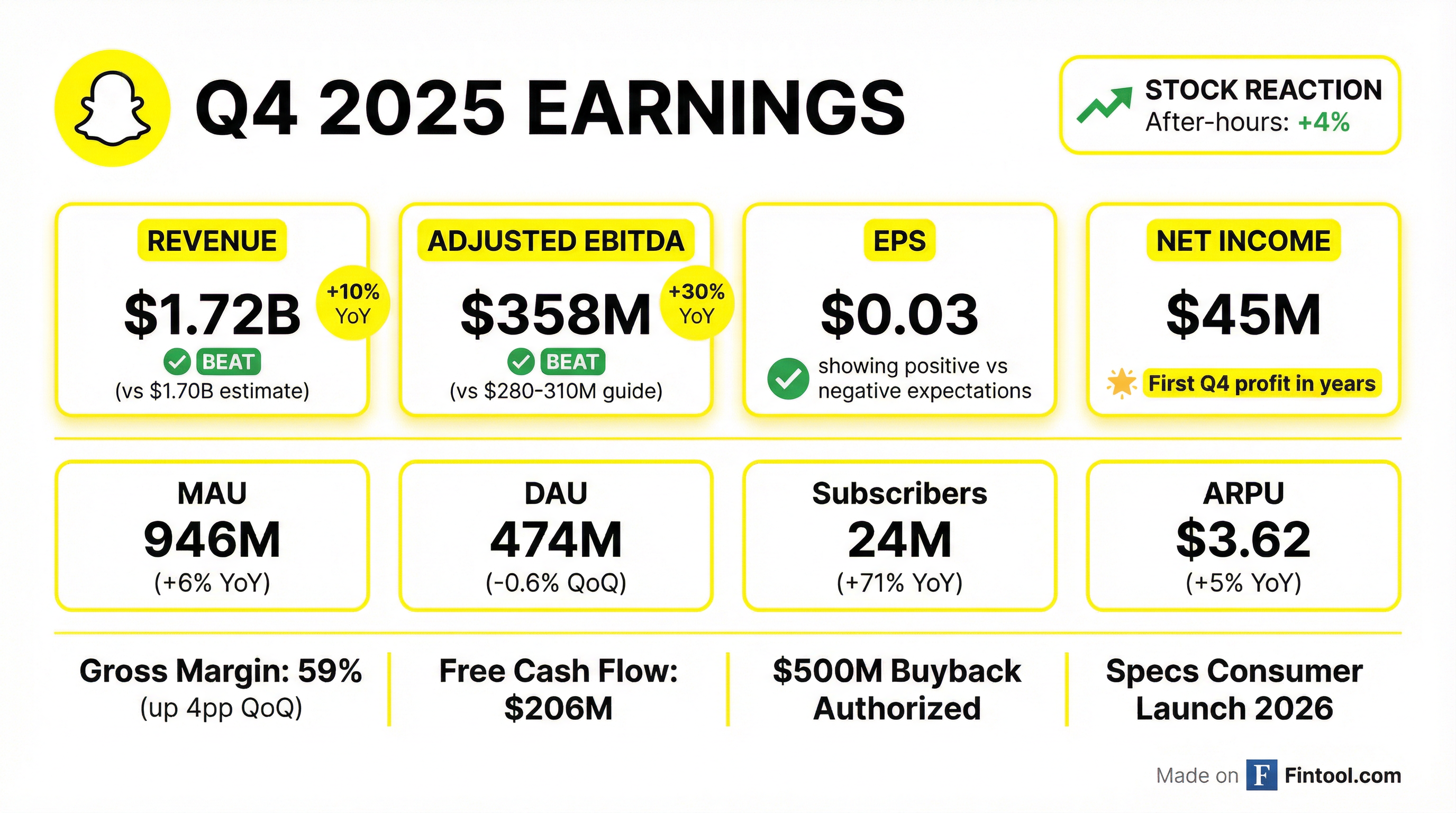

- Snap reported strong Q4 2025 financial results, with total revenue reaching $1.72 billion, a 10% year-over-year increase, driven by advertising revenue of $1.48 billion (up 5% year-over-year) and other revenue of $232 million (up 62% year-over-year). The company achieved a 59% adjusted gross margin and net income of $45 million.

- The platform's monthly active users reached 946 million, nearing its goal of 1 billion, while subscribers grew 71% year-over-year to 24 million in Q4 2025. Additionally, total active advertisers increased 28% year-over-year.

- Snap is pivoting towards profitable growth, evidenced by a new $500 million share repurchase program and a focus on the commercial launch of Specs in 2026. For Q1 2026, the company provided revenue guidance of $1.5 billion-$1.53 billion and Adjusted EBITDA guidance of $170 million-$190 million.

- Snap Inc. reported Q4 2025 total revenue of $1.72 billion, marking a 10% year-over-year increase, driven by 5% growth in advertising revenue to $1.48 billion and 62% growth in other revenue to $232 million.

- The company achieved net income of $45 million in Q4 2025, a significant improvement from $9 million in the prior year, and its adjusted gross margin reached 59%, nearing its near-term goal of 60%.

- Snapchat+ subscribers grew 71% year-over-year to 24 million in Q4 2025, contributing to the diversification of revenue streams and gross margin expansion.

- For Q1 2026, Snap Inc. provided revenue guidance of $1.5 billion-$1.53 billion and Adjusted EBITDA guidance of $170 million-$190 million.

- Snap Inc. authorized a new $500 million share repurchase program and is focused on profitable growth, including the commercial launch of Specs in 2026 and aligning infrastructure costs with monetization potential.

- Snap reported Q4 2025 total revenue of $1.72 billion, an increase of 10% year-over-year, with advertising revenue growing 5% to $1.48 billion and other revenue surging 62% to $232 million.

- The company achieved net income of $45 million and Adjusted EBITDA of $358 million in Q4 2025, while adjusted gross margin reached 59%.

- Snap is focused on profitable growth, aiming to exceed 60% gross margins in 2026, and plans the commercial launch of its augmented reality product, Specs, in 2026.

- For Q1 2026, Snap anticipates revenue between $1.5 billion and $1.53 billion and Adjusted EBITDA between $170 million and $190 million.

- A new $500 million share repurchase program has been authorized.

- SNAP reported Q4 2025 revenue of $1,716 million, an increase of 10% year-over-year, with net income of $45 million and Adjusted EBITDA of $358 million.

- Global monthly active users (MAU) grew 6% year-over-year to 946 million in Q4 2025, with average revenue per user (ARPU) reaching $3.62.

- The company generated operating cash flow of $270 million and Free Cash Flow of $206 million in Q4 2025, ending the period with $2.9 billion in cash, cash equivalents, and marketable securities.

- Key growth drivers included an 89% year-over-year increase in revenue from In-App Optimizations and a 62% increase in Other Revenue to $232 million, supported by a 71% rise in subscribers to 24 million.

- SNAP repurchased 29.4 million shares in Q4 2025.

- Snap Inc. reported Q4 2025 revenue of $1,716 million, a 10% increase year-over-year, contributing to full-year 2025 revenue of $5,931 million, up 11% year-over-year.

- In Q4 2025, the company achieved net income of $45 million and Adjusted EBITDA of $358 million, with a gross margin of 59%. For the full year 2025, Adjusted EBITDA was $689 million.

- The board of directors authorized a stock repurchase program of up to $500 million of its Class A common stock, supported by $2.9 billion in cash, cash equivalents, and marketable securities as of December 31, 2025.

- Global monthly active users (MAU) reached 946 million in Q4 2025, a 6% increase year-over-year. The company provided Q1 2026 revenue guidance of $1.50 billion to $1.53 billion and plans for the public launch of Specs in 2026.

- Snap Inc. reported Q4 2025 revenue of $1,716 million, marking a 10% year-over-year increase, and full-year 2025 revenue of $5,931 million, an 11% increase year-over-year.

- For Q4 2025, the company achieved net income of $45 million and Adjusted EBITDA of $358 million, with Free Cash Flow of $206 million. Full-year 2025 results included a net loss of $460 million, Adjusted EBITDA of $689 million, and Free Cash Flow of $437 million.

- The board of directors authorized a stock repurchase program of up to $500 million of its Class A common stock, which will be funded from existing cash and cash equivalents. As of December 31, 2025, Snap had $2.9 billion in cash, cash equivalents, and marketable securities.

- Snap is spinning off its smart-glasses business as Specs Inc., a wholly-owned subsidiary, to gain operational focus, enable partnerships, and create a clearer valuation and distinct brand.

- This strategic move precedes the public launch of its next-generation Spectacles later this year, which are currently offered as a $99-per-month subscription aimed at developers and creators.

- Specs are designed with see-through lenses to overlay 3D digital objects onto the real world, featuring an "Intelligence System" to assist users while prioritizing privacy.

- Snap will face intense competition in the smart-glasses market, where Meta Platforms currently commands approximately 73%.

- SNAP households spend 23% more per household on CPG food and beverages than non-SNAP households, accounting for $336 billion in total CPG food and beverage spending.

- These households make 29% more shopping trips compared to non-SNAP households.

- 75% of SNAP food and beverage spending is on name brands.

- Food retailers account for the largest share of SNAP channel dollar spend at 46%.

Fintool News

In-depth analysis and coverage of Snap.

Snap Hits $1 Billion Subscription Milestone as Snapchat+ Tops 25 Million

Snap Posts First Quarterly Net Profit in Years as 'Crucible Moment' Strategy Pays Off

Snap's Pivot to Profitability: Q4 Earnings Beat as Company Sacrifices User Growth for Margins

Snap Spins Out Spectacles Into Specs Inc., Betting on AR Glasses to Challenge Meta

Quarterly earnings call transcripts for Snap.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more