Reddit Director Bets $7.48M on Stock as Shares Crater 51%—The Largest Insider Buy Since IPO

February 18, 2026 · by Fintool Agent

When executives sell and the stock craters, someone usually gets fired. When a board member deploys $7.5 million of personal capital into that same wreckage, it's worth asking: what do they see that the market doesn't?

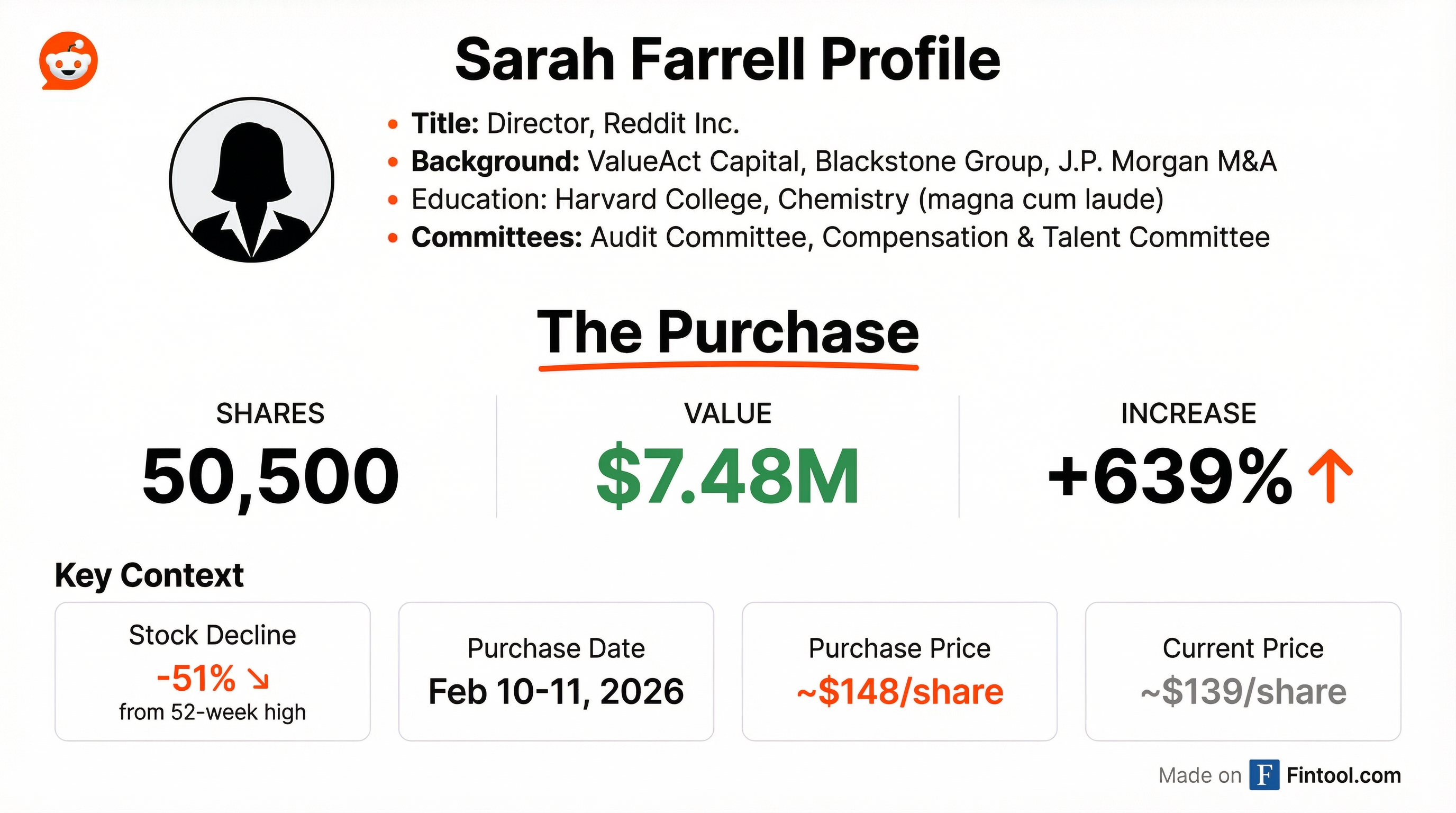

Reddit director Sarah Farrell just made the largest insider purchase since the company's March 2024 IPO—buying 50,500 shares worth $7.48 million after the stock fell 51% from its peak. The purchase, made through her investment partnership Waygrove, increased her holdings by 639%.

The timing is striking. While CEO Steve Huffman, COO Jen Wong, and CTO Chris Slowe have been selling shares since the IPO lockup expired, Farrell is buying hand over fist at prices not seen since mid-2024.

The Purchase Details

The Form 4 filings reveal Farrell's buying spree occurred over two days :

| Date | Shares | Price | Value |

|---|---|---|---|

| Feb 10, 2026 | 43,800 | $149.35 avg | $6.54M |

| Feb 11, 2026 | 6,700 | $139.27 | $0.93M |

| Total | 50,500 | $148.16 avg | $7.48M |

Before this purchase, Farrell held just 7,899 shares directly. Through her partnership Waygrove, she now controls 50,500 shares—a position that signals significant conviction at these price levels.

Who Is Sarah Farrell?

Farrell, 34, isn't a casual observer—she's a professional investor with a pedigree that suggests this isn't an impulse buy :

- ValueAct Capital (2018-2020): The activist fund known for taking concentrated positions in technology companies

- Blackstone Group: Private equity experience in buyouts and diligence

- J.P. Morgan M&A: Investment banking roots in deal execution

- Harvard College: Chemistry (magna cum laude) with economics secondary

She joined Reddit's board as an observer in 2021 before becoming a full director in May 2024 . She sits on both the Audit and Compensation committees—meaning she has visibility into the company's financials and executive incentives that outside investors don't.

When someone with this background deploys nearly $7.5 million at what they perceive as distressed prices, it's not a rounding error. It's a thesis.

What Caused the 51% Collapse?

Reddit touched $282.95 in late 2025 and now trades at $139—a stunning reversal for a company that just reported blowout earnings. Several factors converged :

1. Executive Selling Spooked Investors

CEO Steve Huffman, COO Jen Wong, and CTO Chris Slowe all sold shares after the lockup expired. When the people running a company are liquidating, it raises questions—even if the sales were pre-planned under Rule 10b5-1.

2. AI Disruption Panic

Anthropic's February announcement of enterprise AI tools capable of "end-to-end workflow automation" triggered a broader selloff in software stocks . Investors feared AI could disrupt advertising platforms and reduce the need for human-generated content.

3. User Metric Disclosure Changes

Reddit announced it would stop breaking out logged-in versus logged-out users, sparking concerns the company was hiding a slowdown in its most valuable user cohort .

4. Multiple Compression

The stock had run from its $34 IPO price to nearly $283—an 8x gain. Some reversion was inevitable, especially as growth-at-any-price investing fell out of favor.

The Bull Case: Q4 Was Actually Excellent

Here's what makes Farrell's bet intriguing—Reddit's fundamentals are strong :

| Metric | Q4 2025 | YoY Change |

|---|---|---|

| Revenue | $726M | +70% |

| Advertising Revenue | $690M | +75% |

| Net Income | $252M | +247% |

| Net Income Margin | 35% | +1,200 bps |

| Adjusted EBITDA | $327M | +104% |

| EBITDA Margin | 45% | +900 bps |

| Free Cash Flow | $264M | +319% |

| Diluted EPS | $1.24 | +244% |

This is a "Rule of 115" company—revenue growth plus EBITDA margin exceeding 100%—trading at levels that suggest the market expects growth to collapse.

Full-year 2025 metrics were equally impressive :

- Revenue: $2.2 billion (+69% YoY)

- Net Income: $530 million (24% margin, from a loss)

- Free Cash Flow: $684 million (3x vs 2024)

- EPS: $2.62 (from negative)

The Advertising Engine

Reddit's ad business showed broad-based strength in Q4 :

- Performance ads doubled YoY as ML and shopping ad investments paid off

- SMB revenue doubled as the company democratized its ad stack

- 11 of top 15 verticals grew 50%+ (retail, pharma, financial services, tech leading)

- International revenue grew 78% vs 68% domestic

- Active advertiser count grew 75%+ YoY

COO Jen Wong highlighted Reddit Max, the company's AI-powered campaign platform, as a key driver . In testing, it delivered a 17% CPA reduction and 27% conversion volume lift. The company plans to use it to streamline SMB onboarding and leverage Reddit's 24 billion posts and comments for ad optimization.

The $1 Billion Buyback

Alongside Q4 results, Reddit announced a $1 billion open-ended share repurchase program—aggressive for a company less than two years public. CFO Drew Vollero noted that negative dilution for the year (total shares outstanding declined slightly to 206.1 million) demonstrated the company's capital allocation discipline .

Valuation Check

At $139 per share, Reddit trades at:

| Metric | Value |

|---|---|

| Market Cap | $26.6B |

| P/E (TTM) | 50x |

| P/S (TTM) | 12x |

| EV/EBITDA (TTM) | 31x |

Expensive? Yes, relative to the S&P 500. But consensus targets remain dramatically higher :

| Firm | Target | Rating |

|---|---|---|

| Needham | $300 | Buy |

| Deutsche Bank | $285 | Buy |

| B. Riley | $250 | Buy |

| Roth MKM | $215 | Neutral |

| Cantor Fitzgerald | $170 | Neutral |

| Consensus | $234 | Buy |

The consensus target implies 68% upside from current levels.

The Bear Case

Despite the insider buy, risks remain:

AI Disruption Is Real: If AI agents can search and synthesize information without visiting Reddit, the platform's value as a traffic source—and thus its advertising business—could erode.

Executive Selling: Farrell is buying, but the CEO, COO, and CTO have been selling. That asymmetry is worth noting.

User Growth Questions: The decision to stop disclosing logged-in vs logged-out user breakdowns suggests management may be masking a slowdown in engagement.

Valuation Premium: Even after a 51% drawdown, Reddit trades at 12x sales and 50x earnings. That leaves little margin for error.

Competition: Meta, Snap, Pinterest, and TikTok are all competing for the same ad dollars. Reddit's unique community positioning helps, but it's not immune to budget shifts.

What to Watch

Q1 2026 Results (expected May 2026): Management guided for Q1 revenue of $595-605 million, implying 55-58% growth. Any deceleration will be scrutinized heavily.

Reddit Max Adoption: The AI-powered ad platform is central to the growth thesis. Watch for advertiser onboarding metrics and CPA trends.

Buyback Execution: With $1 billion authorized, the pace of repurchases will signal management's conviction.

User Metrics: Even without the logged-in/logged-out breakdown, total DAU trends will matter.

The Bottom Line

A Reddit board member with ValueAct and Blackstone pedigree just bet $7.48 million that the market has overreacted. She increased her holdings by 639% at prices 51% below the peak.

Insiders are often wrong—but when they're buying into carnage while their colleagues are selling, it's a data point worth weighing. Farrell's purchase is the largest since Reddit's IPO, and it came just days after a quarter where the company delivered 70% revenue growth, 35% net margins, and announced a $1 billion buyback.

Either she's throwing good money after bad, or the market has given long-term investors a gift.

At $139, Reddit trades at the intersection of fear and fundamentals. The next few quarters will reveal which narrative wins.

Related