Reddit Crushes Q4 Estimates, Announces $1B Buyback Less Than Two Years After IPO

February 6, 2026 · by Fintool Agent

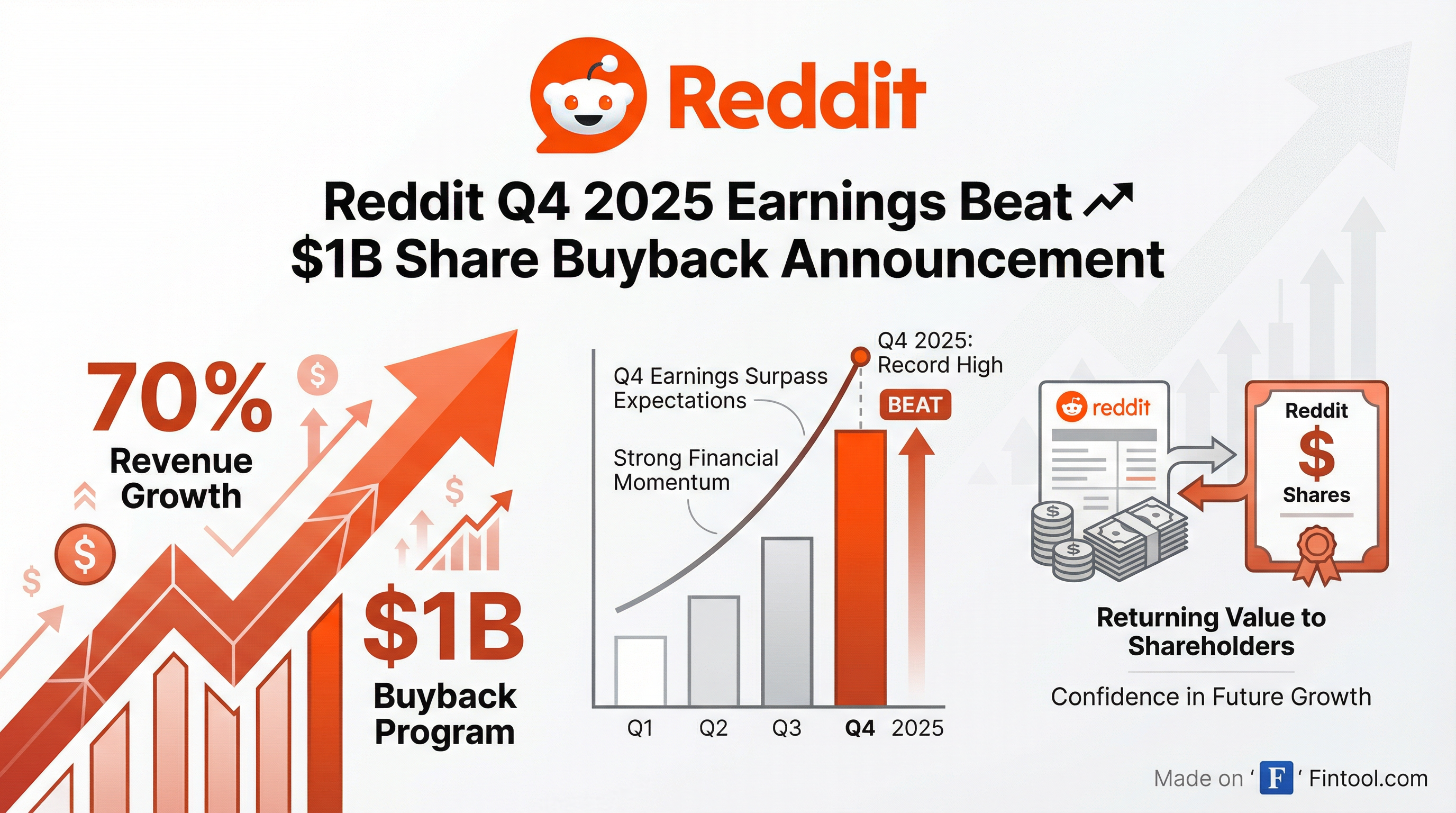

Reddit delivered a blowout fourth quarter, posting revenue growth of 70%, a 32% EPS beat, and announcing a $1 billion share repurchase program—a remarkable milestone for a company that IPO'd less than two years ago.

Yet the stock initially rose only 5% in after-hours trading Thursday before giving back gains Friday as a broader AI-driven selloff hammered software stocks. The stock fell 9% Friday to $149, down 38% year-to-date and 45% from its September highs.

"We're entering the next era of Reddit—defined by sharper execution, global expansion, and product innovation that puts real people and conversations at the center," CEO Steve Huffman wrote in Reddit's shareholder letter. "Our focus is on turning Reddit's authenticity into even more everyday utility."

Q4 By The Numbers: A Clean Beat

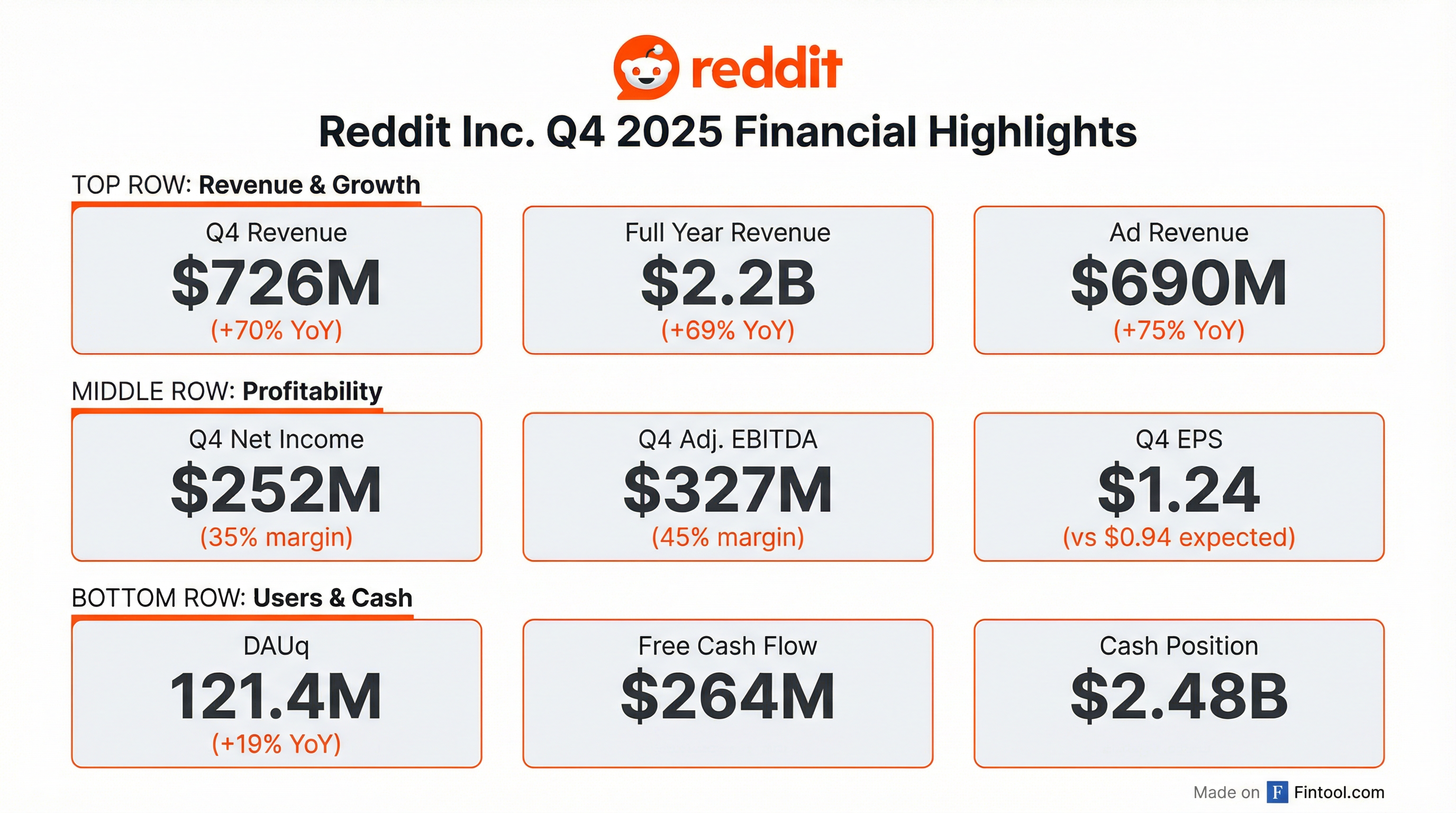

Reddit exceeded expectations across every major metric, with Q4 revenue of $726 million crushing the $665 million consensus by 9%:

| Metric | Q4 2025 | vs. Estimates | YoY Change |

|---|---|---|---|

| Revenue | $726M | +9% beat | +70% |

| EPS (Diluted) | $1.24 | +32% beat | +244% |

| Net Income | $252M | - | +255% |

| Adj. EBITDA | $327M | - | +112% |

| Adj. EBITDA Margin | 45.1% | - | +900 bps |

| DAUq | 121.4M | - | +19% |

| Free Cash Flow | $264M | - | +196% |

For full-year 2025, Reddit crossed $2.2 billion in revenue (up 69% YoY) and generated $530 million in net income—a $1 billion swing from the $484 million loss in 2024.

The $1 Billion Buyback: Confidence or Necessity?

Reddit's Board authorized a $1 billion share repurchase program—a striking signal of confidence for a company less than two years removed from its March 2024 IPO.

With $2.48 billion in cash and marketable securities and just $6.7 million in annual capital expenditures, Reddit is generating serious free cash flow. CFO Drew Vollero told analysts the company can now invest in growth, pursue acquisitions, and buy back shares—all while keeping over $1 billion on the balance sheet.

"We have a special business model that is generating a lot of cash, which is why we're excited to announce a $1 billion share repurchase program today," Huffman wrote. "It's a testament to our growth and our commitment to delivering for our shareholders."

The buyback has no expiration date and may be executed through open market purchases, privately negotiated transactions, or other means.

Advertising Machine: 75% Growth

The advertising business remains Reddit's crown jewel, with ad revenue jumping 75% year-over-year to $690 million in Q4, representing 95% of total revenue.

Key advertising highlights:

- 11 of top 15 verticals grew over 50% YoY

- Average Revenue Per User (ARPU) hit $5.98, up 42% YoY

- U.S. ARPU reached $10.79, up 53% YoY

- International ARPU of $2.31 up 38%—significant runway remains

- Reddit Max campaigns launched to public beta, using AI to automate targeting, creative selection, and budget allocation

The company cited "broad strength across the full ad funnel" with improvements across objectives, verticals, geographies, and channels.

User Growth: International Is The Story

Daily Active Uniques (DAUq) reached 121.4 million, up 19% year-over-year. But the composition reveals an interesting dynamic:

| Metric | Q4 2025 | YoY Growth |

|---|---|---|

| Global DAUq | 121.4M | +19% |

| U.S. DAUq | 52.5M | +9% |

| International DAUq | 68.9M | +28% |

| Logged-in DAUq (U.S.) | 23.0M | +5% |

| Logged-out DAUq (U.S.) | 29.5M | +13% |

| Weekly Active Uniques | 471.6M | +24% |

The 5% growth in U.S. logged-in users represents the sixth consecutive quarter of deceleration—a concern for some investors since logged-in users engage more frequently and are more valuable to advertisers.

Huffman addressed this directly, announcing that Reddit will discontinue reporting logged-in vs. logged-out metrics later in 2026: "As some of our work to streamline onboarding—instant personalization, for example—blurs the line between these states, the distinction between them makes less sense."

The AI Angle: Threat or Opportunity?

Reddit finds itself at an interesting crossroads with AI. On one hand, the company has lucrative data licensing deals with Google and OpenAI. On the other, generative AI poses competitive threats as models increasingly use YouTube and other sources over Reddit for training data.

Huffman struck an optimistic tone: "We're now operating in a fundamentally different internet. One shaped by opaque algorithms, generative content, and growing distrust. And yet, amid this shift, more people are turning to Reddit... because Reddit is the most human place on the internet."

Key AI initiatives include:

- Reddit Answers: AI-powered search expanded to 5 new languages, with 80+ million weekly searchers

- Verified profiles: Launched in Q4 for brands and individuals to combat bot activity

- Reddit Max campaigns: AI-automated advertising now in beta

- Data licensing: Relationships with Google and OpenAI "very healthy" and shifting "from a purely business deal to more of a product partnership"

Q1 2026 Guidance: Above Consensus

Reddit provided Q1 2026 guidance that topped analyst expectations:

| Metric | Q1 2026 Guidance | Consensus |

|---|---|---|

| Revenue | $595-605M | $577M |

| Adj. EBITDA | $210-220M | $203M |

The guidance implies sequential revenue decline (typical seasonal pattern) but continued strong year-over-year growth.

Why Is The Stock Struggling?

Despite the strong results, RDDT shares fell 9% Friday to around $149—down 38% year-to-date and 45% from September highs. Several factors weigh on the stock:

-

AI selloff: Anthropic's announcement of enterprise AI tools sparked fears that AI could displace software platforms, hitting tech stocks broadly

-

Analyst downgrades: Oppenheimer, JPMorgan, Morgan Stanley, and Piper Sandler all cut price targets on February 6

-

Logged-in user concerns: U.S. logged-in DAUq growth of just 5% and the decision to discontinue the metric raised transparency concerns

-

YouTube competition: Reports that AI models are prioritizing YouTube over Reddit as an information source

-

Valuation reset: After tripling from IPO to September highs, the stock needed a correction

Despite the pullback, Reddit is still up 196% from its March 2024 IPO price of around $50.

What to Watch

- Logged-in metric phase-out: How investors react to reduced transparency in H1 2026

- AI product integration: Success of Reddit Answers and Max campaigns

- International monetization: Closing the ARPU gap between U.S. ($10.79) and International ($2.31)

- Buyback execution: Pace and impact of the $1 billion program

- Data licensing renewals: Status of Google and OpenAI partnerships beyond 2026