Replimune Group (REPL)·Q3 2026 Earnings Summary

Replimune Beats EPS as RP1 FDA Decision Nears April 10

February 3, 2026 · by Fintool AI Agent

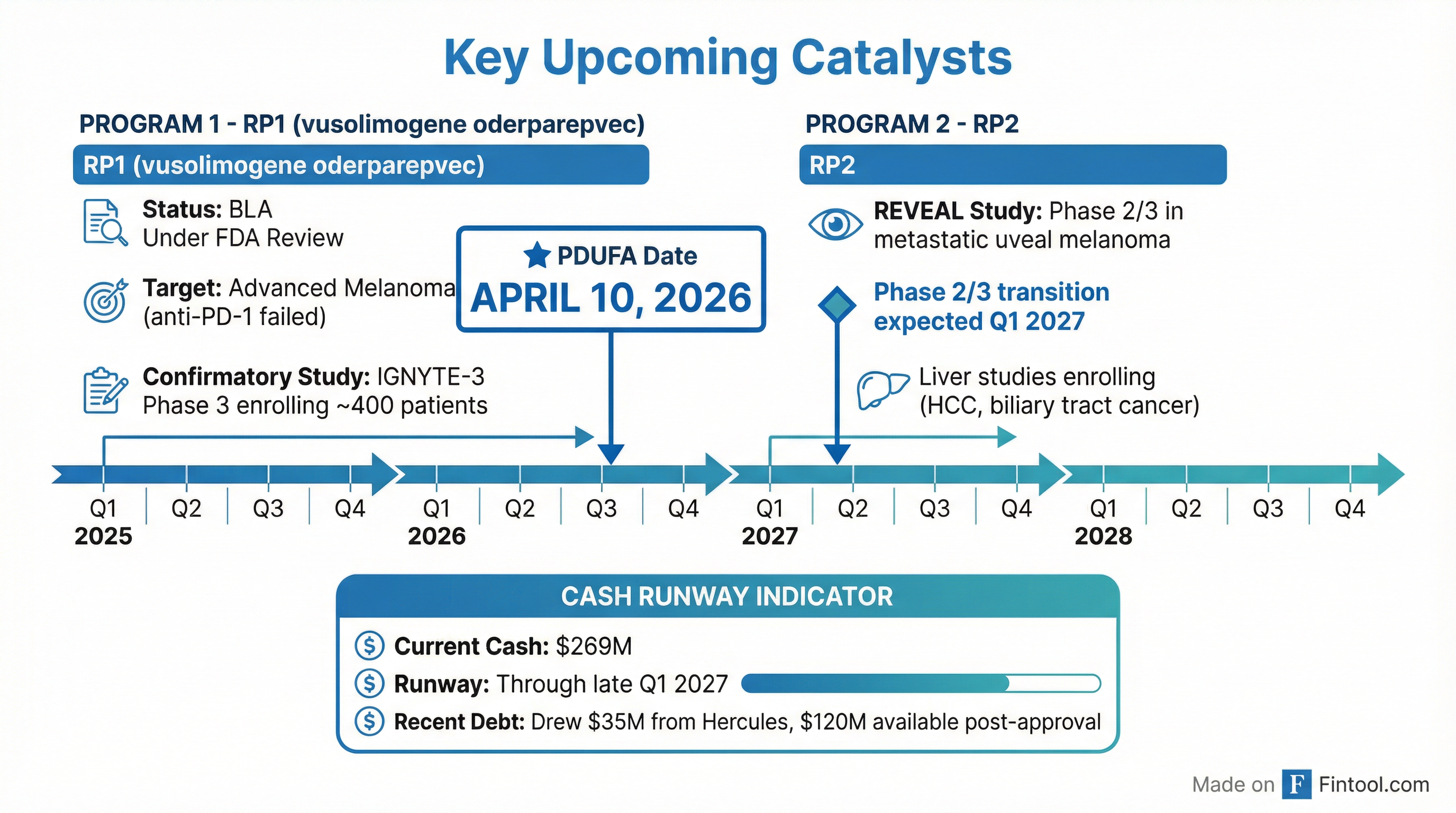

Replimune Group (NASDAQ: REPL) reported fiscal Q3 2026 results that beat EPS estimates while the company's lead drug candidate RP1 approaches its April 10, 2026 FDA decision date. The pre-commercial biotech posted a net loss of $70.9 million ($0.77 per share) versus consensus expectations of -$0.85, representing a 9.4% beat. With $269 million in cash and a freshly amended debt facility with Hercules Capital, Replimune has extended its runway to fund operations through late Q1 2027—crucially covering the RP1 approval decision and potential launch.

Did Replimune Beat Earnings?

Yes — EPS beat by 9.4%. Replimune reported a net loss of $0.77 per share versus the consensus estimate of $0.85, narrowing losses more than expected.

As a pre-commercial biotech focused on oncolytic immunotherapies, Replimune has no product revenue. The 9% increase in operating expenses year-over-year reflects higher R&D spending on the IGNYTE-3 confirmatory study for RP1 and preparations for a potential commercial launch.

What Is the Key Catalyst?

RP1 BLA PDUFA date: April 10, 2026. This is the defining event for Replimune's near-term trajectory.

The FDA accepted Replimune's BLA resubmission for RP1 (vusolimogene oderparepvec) in anti-PD-1 failed melanoma in October 2025, setting an April 10, 2026 target action date. CEO Sushil Patel stated the company has been "engaged with the FDA in the review of the BLA resubmission" and emphasized that "advanced melanoma patients can progress quickly and are in urgent need of safe and effective treatment options."

Commercial readiness activities are "well underway" with:

- Commercial supply already produced

- Commercial organization prepared to engage target accounts rapidly

How Is the Cash Position?

$269.1 million with runway through late Q1 2027. Replimune strengthened its financial position through an amended debt facility with Hercules Capital.

Debt Facility Amendment (January 29, 2026):

- Drew $35 million third tranche upon closing

- Fourth tranche: $30 million available until September 30, 2026

- Fifth tranche: $50 million tied to revenue milestone, available until December 2027

- Sixth tranche: Increased to $40 million (from $25M)

- Total potential additional funding: $120 million at post-approval milestones

- Interest rate: Greater of 8.50% or Prime + 1.75%

- Amortization pushed from October 2026 to October 2027

The runway extension to late Q1 2027 is critical—it covers the RP1 PDUFA date and provides 9-10 months of post-decision runway to execute a commercial launch if approved.

What About the Clinical Pipeline?

RP1 confirmatory trial enrolling; RP2 advancing toward Phase 2/3 transition.

RP1 (vusolimogene oderparepvec)

RP2

How Did the Stock React?

Muted reaction ahead of FDA catalyst. REPL closed at $6.98 on February 2, 2026, down slightly from $7.03 prior. The stock is trading near the bottom of its 52-week range ($2.68-$14.80) as investors await the April FDA decision.

The stock has faced significant pressure over the past year, declining ~48% from 52-week highs despite the advancing RP1 regulatory timeline. This likely reflects broader biotech sector headwinds and the binary nature of the April FDA decision.

Analyst Views:

- Average Price Target: $12.57 (80% upside)

- Range: $10.00 - $18.00

- Recent upgrade: BMO Capital raised target to $11 (November 2025) with Market Perform rating

What Changed From Last Quarter?

Runway extended, commercial readiness emphasized, debt restructured.

*Values retrieved from S&P Global

Key narrative shifts:

- Commercial supply confirmed produced — removing a key execution risk for launch

- Debt facility restructured — trading higher interest rate for extended runway and milestone-linked capital

- NMSC enrollment stopped — focusing resources on melanoma programs

What Are the Key Risks?

-

Binary FDA outcome (April 10): An approval would transform the company; a rejection or CRL could be devastating given the cash position and debt load.

-

Cash runway tight: Late Q1 2027 provides limited cushion beyond the PDUFA date, particularly if additional clinical work is required.

-

Commercial execution: Even if approved, Replimune must execute against established competitors in advanced melanoma with a novel oncolytic virus platform.

-

IGNYTE-3 confirmatory trial: The Phase 3 confirmatory study is required for full approval; interim data or enrollment issues could impact the regulatory path.

-

Debt covenants: The amended Hercules facility includes milestone-linked tranches that depend on approval and revenue achievement.

Forward Catalysts

Summary

Replimune delivered a modest EPS beat while all eyes remain fixed on April 10, 2026. The company has done what it can to prepare: commercial supply is ready, the sales team is in place, and the balance sheet has been fortified with the Hercules amendment. The stock's ~80% discount to analyst targets reflects the binary nature of the FDA decision. For investors, the Q3 results are a sideshow—the main event arrives in 66 days.

Related Links: