Rexford Industrial Realty (REXR)·Q4 2025 Earnings Summary

Rexford Industrial Delivers In-Line Q4 as SoCal Industrial Markets Stabilize

February 5, 2026 · by Fintool AI Agent

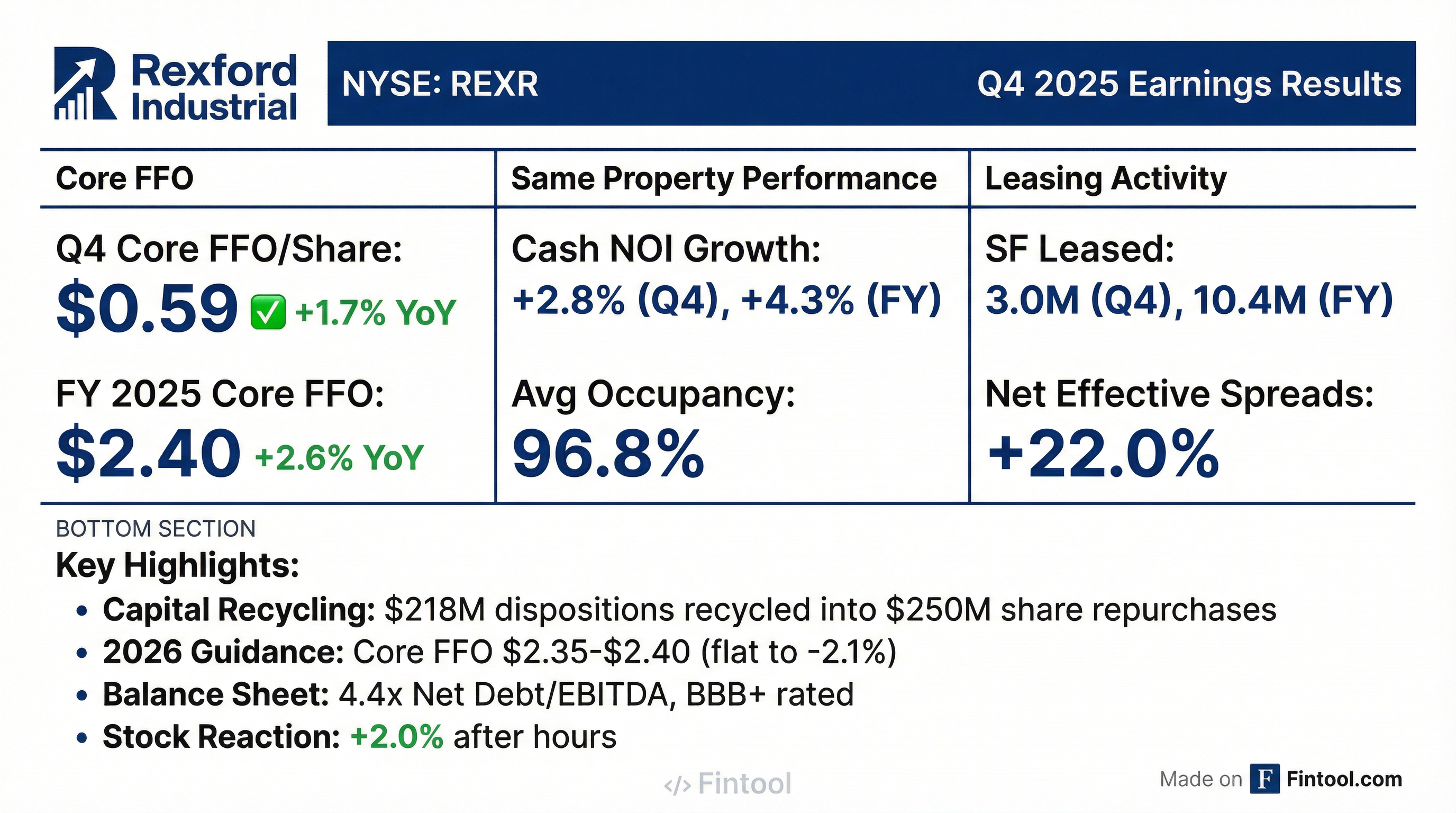

Rexford Industrial (NYSE: REXR), the Southern California-focused industrial REIT, reported Q4 2025 results that met expectations despite continued market rent pressure. Core FFO came in at $0.59 per share, up 1.7% year-over-year, while full-year Core FFO of $2.40 represented 2.6% growth. The company initiated 2026 guidance of $2.35-$2.40, reflecting headwinds from market rent normalization and anticipated occupancy declines.

Did Rexford Beat Earnings?

Core FFO: $0.59/share in Q4 (+1.7% YoY) and $2.40/share for full-year 2025 (+2.6% YoY) — in-line with guidance.

Revenue: $253.2M actual vs. $251.0M consensus estimate — beat by 0.9%.*

*Values retrieved from S&P Global.

The company stabilized 7 repositioning/development projects in Q4 totaling 749K square feet with a 5.0% achieved unlevered yield, contributing $15.4M in annualized cash NOI.

GAAP Net Loss: The Q4 GAAP net loss of ($68.7M) or ($0.30)/share includes $89.1M of real estate impairments (related to near-term development properties expected to be sold in 2026) and $60.2M of Co-CEO transition costs. Excluding these non-recurring items, Core FFO was $0.59/share.

What Did Management Guide for 2026?

The 2026 outlook reflects a challenging operating environment with market rents down ~8% year-over-year across infill Southern California markets.

Key guidance drivers from the rollforward:

- Same Property NOI decline (-$0.04 to -$0.06): Net effective releasing spreads of 5-10%, 75 bps bad debt, 60 bps occupancy decline

- Repositioning/Development NOI (+$0.06-$0.07): Incremental contribution from stabilizations

- G&A savings (+$0.08): Savings from Co-CEO leadership transition

- Interest expense (-$0.03): Lower capitalized interest as projects stabilize

Same Property Cash NOI Build-Up (from CFO commentary):

- Occupancy decline (60 bps average): -100 bps

- NOI margin compression: -50 bps

- Lower term fees + Tireco reset: -75 bps

- Bad debt (incl. straight-line): -50 bps

- Concessions: -200 bps

- Contractual rent bumps: +325 bps

- Midpoint cash same property NOI: -1.5%

How Did the Stock React?

REXR shares rose approximately 2% following the earnings release, closing at $40.56 before the announcement and trading around $41.39 in after-hours. The muted positive reaction suggests investors viewed results as in-line with already-lowered expectations for SoCal industrial markets.

*Values retrieved from S&P Global.

What Changed From Last Quarter?

Improving:

- Occupancy stabilizing: Average same property occupancy improved 20 bps sequentially to 96.8%

- Leasing velocity: 3.0M SF leased in Q4, continuing strong demand for last-mile infill assets

- Capital recycling: Successfully recycled $218M of dispositions into $250M of share repurchases, adding ~$0.02 to Core FFO

Deteriorating:

- Market rents: Down 8% YoY across infill SoCal, with Greater LA down 9% and Orange County down 11%

- Mark-to-market compression: Dropped to 9% from 10% in Q3

- 2026 occupancy outlook: Guiding to 94.8%-95.3% average, down 60 bps from 2025 levels

Strategic Priorities Under New Leadership: Incoming CEO Laura Clark outlined immediate priorities from the November update:

- Re-underwrote near-term development pipeline with rigorous criteria → 6 projects (~850K SF) identified for sale

- Programmatic dispositions targeting $400M-$500M in 2026 to recycle capital

- G&A reduction to 6% of revenue (in line with peer average)

- Executive compensation recalibrated to align with shareholder priorities (per December filing)

Capital Allocation Highlights

2025 Capital Recycling:

- Dispositions: $218M total at 12.4% unlevered IRR

- Share Repurchases: $250M deployed

- Accretion: +$0.02 Core FFO per share from capital recycling

2026 Capital Plan:

- Dispositions: $400M-$500M expected, including $135M of development properties

- Dispositions Under Contract: $230M as of February 4, 2026

- Repositioning/Development Starts: 1.1M SF with $140M-$150M total investment

Dividend: The Board declared a Q1 2026 dividend of $0.435/share, a 1.2% increase from Q4 2025, payable April 15, 2026.

Balance Sheet Strength

Rexford maintains a conservative balance sheet with substantial liquidity and investment-grade ratings.

The debt maturity ladder shows minimal near-term maturities: $67M in 2026, $1.0B in 2027, with the largest unsecured notes maturing in 2030-2031.

Market Conditions: SoCal Industrial Rent Normalization

Market rents across infill Southern California have declined approximately 22% from their mid-2023 peak, following an 80% increase during the pandemic years of 2020-2022.

Despite near-term headwinds, management maintains that infill SoCal markets benefit from favorable long-term supply-demand fundamentals due to high barriers to entry, limited developable land, and ongoing conversion of industrial property to non-industrial uses.

Leadership Transition Update

Laura Clark, currently Chief Operating Officer, will assume the CEO role effective April 1, 2026, as part of the Company's planned leadership succession. Co-CEOs Howard Schwimmer and Michael Frankel will depart March 31, 2026, continuing as Board directors until the 2026 Annual Meeting.

Co-founder Howard Schwimmer shared on the call: "Building Rexford from a startup into a leading industrial real estate company has been an extraordinary journey. What we've achieved reflects the talent, discipline, and commitment of a remarkable team, as well as the trust and support of our partners and shareholders."

Co-founder Michael Frankel added: "I'm deeply grateful to everyone who contributed to Rexford's growth and success, and I'm proud of what the team has accomplished. Looking forward, I'm also excited for Rexford's opportunity to create significant shareholder value through its next phase of growth."

The transition resulted in $60.2M of non-recurring costs in Q4, including accelerated stock-based compensation for transition-related awards and pre-existing awards. These costs were fully recognized in Q4 and will not impact 2026 Core FFO.

David Stockert was appointed to the Board of Directors and Audit Committee effective January 1, 2026.

Post-Quarter Events

Tireco Lease Extension: Subsequent to year-end, Rexford executed a 3-year early renewal with its largest tenant, Tireco, Inc., which occupies 1.1 million SF at the Production Avenue property in the Inland Empire West submarket. The lease was expiring January 2027, and Tireco initially sought a 5+ year term, but Rexford strategically negotiated a shorter 3-year term to reset to market sooner. The above-market rent reset results in approximately 30% rent roll-down, converting from triple-net to gross lease structure.

New Stock Repurchase Authorization: The Board authorized a new $500M stock repurchase program, superseding the prior program. Full availability remains under the current program.

Q&A Highlights

On Tireco Lease Renewal: Incoming CEO Laura Clark explained the strategic early renewal of the company's largest tenant, Tireco (1.1M SF): "Given the significant cash flow impacts from the downtime of that space, especially considering the capital investment that would be required to position that space for lease, we did engage in discussions around an early renewal. Although they were seeking a longer lease term [5+ years], we strategically negotiated a 3-year lease, which allows us to reset at market rent sooner." The roll-down is approximately 30%, impacting same property NOI by ~50 bps and Core FFO by ~$0.015/share.

On Market Stabilization Signals: Clark provided a nuanced view of market conditions. "We're certainly seeing some signs of stabilization, while there's other indicators that show some continued challenge... I think those are indicating that we're still bouncing around the bottom here."

Positive signals include:

- Q3/Q4 leasing activity levels steady

- Tenants entering the market sooner to lock in current rents

- Sub-50K SF spaces showing stabilization

- Concessions and TIs steady quarter-over-quarter

- Rent decline moderated to -1% QoQ (vs. more elevated declines in H1)

Challenges remaining:

- Leasing activity moderated as 2026 began (75% activity on vacant spaces vs. 80% last quarter)

- Net absorption still negative

- Leasing taking longer as tenants shop the market

On Development Asset Sales: Management identified 6 near-term development projects (~850K SF) to sell, all under contract or accepted offer at ~$135M ($80/land SF). These were projected to yield only 4% upon stabilization. "These projects no longer meet our investment hurdles, and selling these assets allows us to redirect $285 million of capital into higher-yielding uses."

On Watch List Concentration: John Nahas (MD of Operations) noted the watch list has "some concentration in logistics" with tenants "contending with changing rates from their customers." The company assumes 75 bps of bad debt for 2026 (vs. 50 bps in 2025).

On 2026 Capital Availability: CFO Fitz provided the sources/uses math: "At year-end, we'd have $166 million of cash, including dispositions at the midpoint of $450 million. That puts us at $616 million of sources. The development and repositioning spend is expected to be about $203 million in 2026. So that leaves about $413 million of available cash to deploy to the highest risk-adjusted returns, and that can include share repurchases or future repositioning/development."

On Buyer Pool for Dispositions: Development sites attracted local SoCal developers, while operating assets sold primarily to users at ~4% cap rates.

Forward Catalysts to Watch

- Q1 2026 leasing activity: Will tenant demand hold amid tariff and macro uncertainty?

- Disposition execution: $400M-$500M target represents 2x+ 2025 levels

- Market rent stabilization: When will SoCal industrial rents bottom?

- Development stabilizations: $19M-$21M annualized NOI expected in 2026

- Share repurchase activity: Will management continue buybacks at current valuations?

For more on Rexford Industrial, see the company page or read the Q4 2025 earnings transcript.