Earnings summaries and quarterly performance for Rexford Industrial Realty.

Executive leadership at Rexford Industrial Realty.

Board of directors at Rexford Industrial Realty.

Research analysts who have asked questions during Rexford Industrial Realty earnings calls.

Craig Mailman

Citigroup

10 questions for REXR

Blaine Heck

Wells Fargo Securities

9 questions for REXR

Greg McGinniss

Scotiabank

9 questions for REXR

John Kim

BMO Capital Markets

9 questions for REXR

Vikram Malhotra

Mizuho Financial Group, Inc.

9 questions for REXR

Brendan Lynch

Barclays

8 questions for REXR

Michael Mueller

JPMorgan Chase & Co.

8 questions for REXR

Samir Khanal

Bank of America

8 questions for REXR

Michael Griffin

Citigroup Inc.

7 questions for REXR

Nicholas Thillman

Robert W. Baird & Co.

7 questions for REXR

Omotayo Okusanya

Deutsche Bank AG

6 questions for REXR

Andrew Berger

Bank of America

3 questions for REXR

Richard Anderson

Wedbush Securities

2 questions for REXR

Anthony Hau

Truist Securities

1 question for REXR

Craig Melman

Citi

1 question for REXR

Greg McGuinness

Scotiabank

1 question for REXR

Jeffrey Spector

BofA Securities

1 question for REXR

John Peterson

Jefferies

1 question for REXR

Mike Mueller

JPMorgan Chase & Co.

1 question for REXR

Nicholas Yulico

Scotiabank

1 question for REXR

Nick Gilman

Baird

1 question for REXR

Steve Sakwa

Evercore ISI

1 question for REXR

Recent press releases and 8-K filings for REXR.

- Rexford Industrial sold two properties for an aggregate of $41.2 million year-to-date through February 25, 2026, and has approximately $185 million in dispositions under contract or accepted offer.

- In February 2026, the company repurchased 2,670,227 shares of common stock for $100.0 million at a weighted average price of $37.45 per share under a new $500 million share repurchase program, with $400 million remaining.

- Laura Clark has been named incoming Chief Executive Officer.

- The company will present at the Citi 2026 Global Property CEO Conference on March 2, 2026.

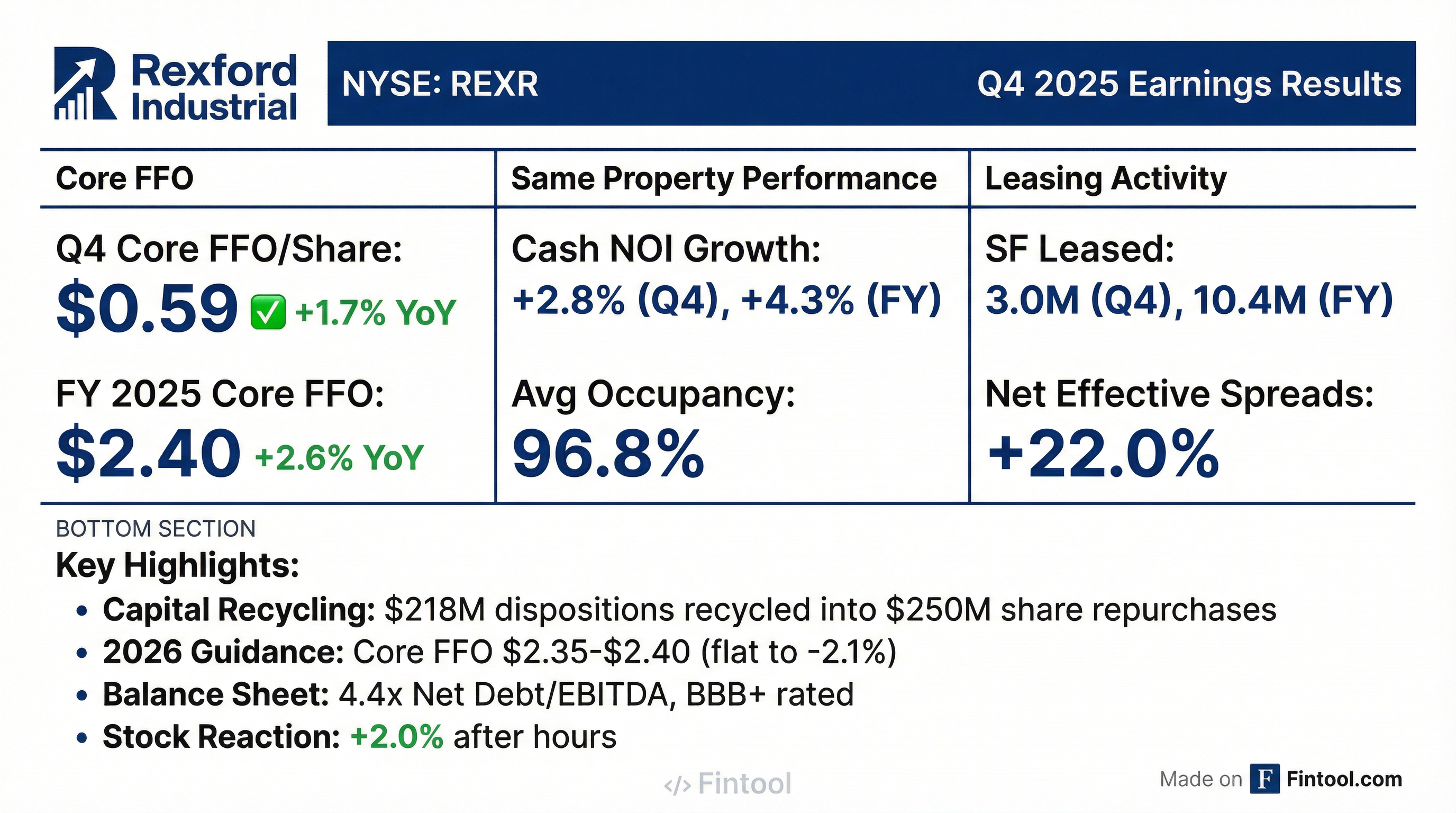

- Rexford Industrial (REXR) reported Q4 2025 Core FFO per share of $0.59, representing a 1.7% growth, and Full Year 2025 Core FFO per share of $2.40, a 2.6% growth compared to the prior year.

- For Q4 2025, Same Property Cash NOI Growth was 2.8%, and for the full year 2025, it was 4.3%.

- The company initiated its 2026 Core FFO per share guidance range at $2.35-$2.40.

- REXR maintains a strong balance sheet with 4.4x Net Debt/Adjusted EBITDAre and $1.4 billion of liquidity as of December 31, 2025.

- In 2025, $218 million of dispositions were recycled into share repurchases, and the company expects ~$450 million in dispositions for 2026.

- Rexford Industrial reported Q4 2025 Core FFO per share of $0.59 and full-year 2025 Core FFO per share of $2.40, while introducing 2026 Core FFO per share guidance of $2.35-$2.40. The company's total portfolio occupancy ended Q4 2025 at 90.2%, a 160 basis point sequential decrease, and market rents within its portfolio declined 1% in the quarter, falling 20% since early 2023.

- Co-CEOs Howard Schwimmer and Michael Frankel are departing, with Laura Clark stepping in as the new CEO.

- Rexford Industrial plans to dispose of six development projects (850,000 sq ft) and targets $400 million to $500 million in dispositions for 2026, following $218 million in property sales in 2025. This strategy led to $89 million of real estate impairments in Q4 2025.

- To enhance shareholder returns, the company repurchased $100 million of shares in Q4 2025, contributing to a full-year 2025 total of $250 million, and aims to reduce G&A as a percentage of revenue to 6% in 2026.

- Rexford's Q4 2025 Core FFO per share was $0.59, and the full-year 2025 Core FFO per share was $2.40.

- The company introduced 2026 Core FFO per share guidance of $2.35-$2.40.

- Strategic initiatives include targeting $400 million to $500 million of dispositions in 2026 and reducing development exposure by not moving forward with six projects (850,000 sq ft) intended for disposal. G&A as a percentage of revenue is targeted at 6% for 2026.

- Market conditions in infill Southern California show market rents declined 1% in Q4 2025 and 9% year-over-year, with vacancy increasing 30 basis points during the quarter and negative net absorption.

- Rexford repurchased $100 million of shares in Q4 2025, bringing the full-year 2025 total to $250 million.

- Rexford Industrial reported Core FFO per share of $0.59 for Q4 2025, with full-year 2025 Core FFO per share reaching $2.40. Total portfolio occupancy ended the quarter at 90.2%, a sequential decrease of 160 basis points.

- The company introduced 2026 Core FFO per share guidance of $2.35-$2.40 and expects Same Property Net Operating Income (NOI) growth to decline approximately 2%.

- Strategic actions include identifying six development projects (approximately 850,000 sq ft) for disposal and targeting $400 million to $500 million in dispositions for 2026. In 2025, the company sold $218 million in properties and repurchased $250 million of shares.

- Market conditions in infill Southern California showed market rents declining 10 basis points in Q4 2025 and 9% year-over-year, with vacancy increasing 30 basis points. The company indicated signs of stabilization but is "bouncing around the bottom" for market rents.

- An early 3-year renewal with the largest tenant, Tireco, resulted in a 30% roll down on the lease, which is projected to impact 2026 Same Property NOI by 50 basis points and FFO per share by $0.015.

- Rexford Industrial reported a net loss attributable to common stockholders of $(68.7) million, or $(0.30) per diluted share, for Q4 2025, primarily due to $89.1 million of impairments and $60.2 million of Co-CEO transition costs. For the full year 2025, net income was $200.2 million, or $0.86 per diluted share.

- The company's share of Core FFO increased by 9.2% to $558.6 million for the full year 2025, with Core FFO per diluted share rising 2.6% to $2.40. For Q4 2025, Core FFO per diluted share was $0.59, up 1.7%.

- For the full year 2025, Same Property Portfolio NOI increased 1.1% and Same Property Portfolio Cash NOI increased 4.3%. The company executed 10.4 million square feet of new and renewal leases, with comparable rental rates increasing by 23.4% on a net effective basis and 10.7% on a cash basis.

- Rexford Industrial repurchased $250.0 million of common stock in 2025 and authorized a new $500 million stock repurchase program subsequent to year-end. The quarterly common stock dividend was increased by 1.2% to $0.435 per share. Laura Clark is set to assume the Chief Executive Officer role effective April 1, 2026.

- Rexford Industrial Realty reported a net loss attributable to common stockholders of $68.7 million, or $0.30 per diluted share, for Q4 2025, and net income of $200.2 million, or $0.86 per diluted share, for the full year 2025. The company's share of Core FFO for the full year 2025 increased 9.2% to $558.6 million, or $2.40 per diluted share, up 2.6%.

- For the full year 2025, Total Portfolio NOI increased 5.7% to $752.7 million, and Same Property Portfolio Cash NOI increased 4.3%. Comparable rental rates on new and renewal leases increased by 23.4% on a net effective basis and 10.7% on a cash basis.

- The company repurchased 6,327,283 shares for $250.0 million in 2025 and authorized a new $500 million stock repurchase program subsequent to year-end. A quarterly common stock dividend of $0.435 per share was declared for Q1 2026, an increase of 1.2%.

- Rexford Industrial initiated full year 2026 guidance, projecting Company share of Core FFO per diluted share between $2.35 and $2.40. Laura Clark, Chief Operating Officer, will assume the Chief Executive Officer role effective April 1, 2026.

- Rexford Industrial Realty, Inc. approved its 2026 executive compensation program on December 19, 2025, which includes equity grants made on that date.

- Laura Clark has been appointed Chief Executive Officer, effective April 1, 2026, succeeding current co-CEOs Michael S. Frankel and Howard Schwimmer, who will depart on March 31, 2026.

- For 2026, Ms. Clark's annual base salary will be $850,000, and she will be eligible for an annual cash incentive opportunity with a target of 175% of her base salary.

- Ms. Clark's 2025 equity incentives include $2,465,000 in Time-Vesting LTIP Units and $3,697,500 in Performance-Vesting LTIP Units at target level. The overall equity incentive weighting for 2025 awards is 40% Time-Vesting and 60% Performance-Vesting.

- Rexford Industrial Realty is implementing a reformed capital allocation strategy focused on maximizing risk-adjusted returns, including a programmatic disposition program to recycle capital into high-yielding repositioning projects and share repurchases.

- The company is committed to improving operating margins through reduced G&A and operational efficiencies, projecting $20 million to $25 million of net G&A savings for 2026, with full year 2026 G&A expected to be between $57 million and $62 million.

- Laura Clark, current Chief Operating Officer, will transition to Chief Executive Officer effective April 1, 2026, succeeding the current Co-CEOs, and was appointed to the Board of Directors on November 17, 2025.

- The Board of Directors will add a new independent director by the end of 2025, following constructive engagement with Elliott Investment Management.

- Rexford Industrial Realty, Inc. reported Q3 2025 core FFO of $0.60 per share and raised its full-year 2025 core FFO per share midpoint guidance to $2.40, alongside an increase in same property cash NOI midpoint to 4%.

- The company executed 3.3 million square feet of leasing in Q3 2025, nearly doubling the prior quarter, which contributed to a 96.8% same property ending occupancy and leasing spreads of 26% net effective and 10% cash basis.

- Rexford disposed of three properties totaling $54 million in Q3 2025, bringing year-to-date dispositions to $188 million, and executed $150 million in share repurchases during the quarter, with a new $500 million share repurchase program authorized.

Quarterly earnings call transcripts for Rexford Industrial Realty.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more