REGAL REXNORD (RRX)·Q4 2025 Earnings Summary

Regal Rexnord Surges 7% as $735M Data Center E-Pod Orders Overshadow Mixed Q4 Results

February 5, 2026 · by Fintool AI Agent

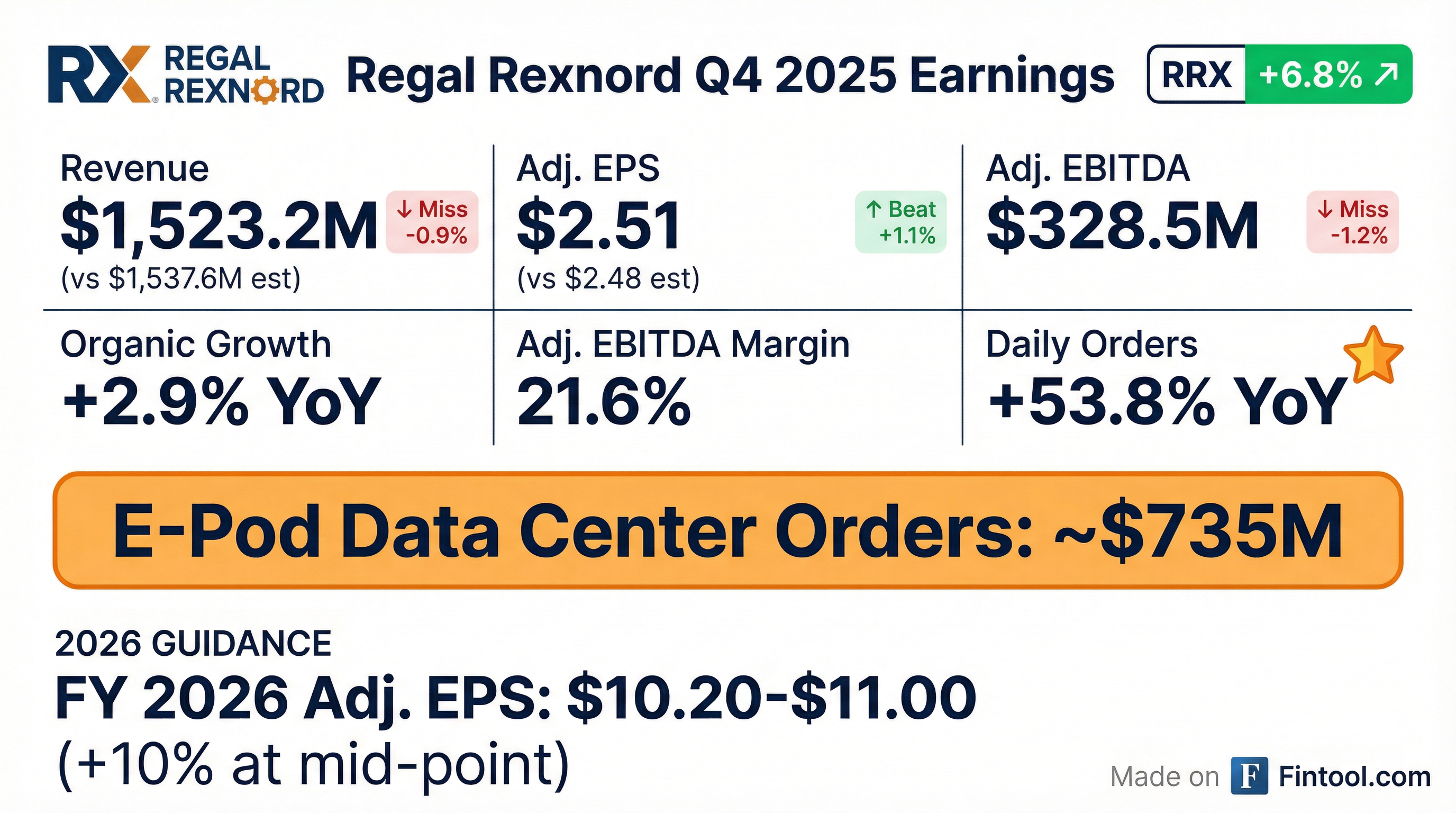

Regal Rexnord (RRX) reported mixed Q4 2025 results on February 4, 2026, with adjusted EPS of $2.51 beating consensus by 1.1% while revenue of $1,523.2M missed by 0.9%. Despite the mixed quarter, the stock surged ~7% following the announcement, driven by a transformational $735M in E-Pod orders for data center power management solutions.

The highlight of the quarter was the company's success with its newly launched E-Pod offering, which embeds proven switchgear technology into modular power solutions for hyperscale data centers. CEO Louis Pinkham called this a "further cementing" of Regal Rexnord's position as "an emerging scale player in data center power management."

Did Regal Rexnord Beat Earnings?

Regal Rexnord delivered a split decision in Q4 2025:

The EPS beat continues a streak of solid earnings delivery, with the company beating EPS expectations in 6 of the last 8 quarters. The revenue miss was driven primarily by weakness in residential HVAC markets, which the company flagged as "more than we expected."

8-Quarter Beat/Miss History

Values retrieved from S&P Global*

What Drove the Quarter?

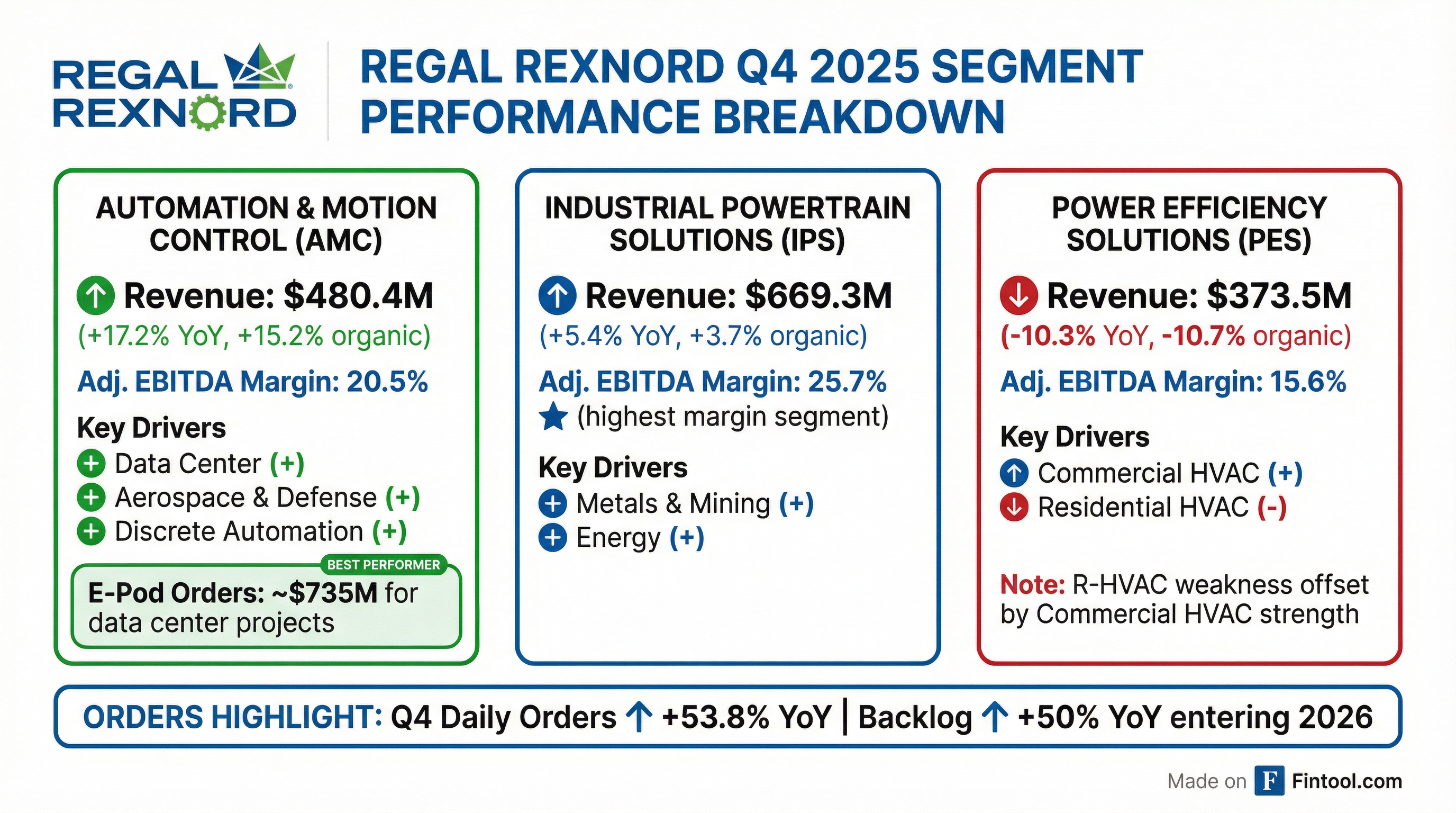

The standout story was order momentum, not the P&L results. Daily orders surged 53.8% year-over-year, with backlog entering 2026 up 50% versus the prior year.

The E-Pod Breakthrough

The game-changer was ~$735M in orders for Regal Rexnord's E-Pod modular data center power solutions. This represents orders for multiple data center projects, with initial shipments expected to start in early 2027.

CEO Pinkham explained why they won:

- 50-year track record of quality and performance in power management

- Ability to customize solutions

- Strong supply chain relationships

- High service levels (on-time delivery, lead times) at high volumes

- Investments in new products and expanded capacity

- Scale and scope of Regal Rexnord

"The highlight was success with our recently launched E-Pod offering for the data center market, where we secured orders worth approximately $735 million for multiple projects, further cementing our position as an emerging scale player in data center power management." — Louis Pinkham, CEO

How Did the Segments Perform?

Automation & Motion Control (AMC) — The Star

AMC delivered exceptional growth driven by data center, discrete automation, and aerospace & defense markets. Orders were up 190% in the segment, or +19% excluding E-Pods.

Industrial Powertrain Solutions (IPS) — Steady Performer

IPS continues to execute despite sluggish industrial markets, with particular strength in metals & mining and energy. Backlog is up 6% versus the prior year.

Power Efficiency Solutions (PES) — R-HVAC Headwind

PES faced significant headwinds from residential HVAC weakness, partially offset by commercial HVAC strength (including data center demand). Despite the revenue decline, margins improved 30 bps—strong execution in a difficult market.

What Did Management Guide?

Regal Rexnord introduced 2026 guidance that implies ~10% EPS growth at the mid-point:

2026 Sales Growth Framework

The company broke down expected 2026 sales growth:

- Data Center Projects: +1.0-1.5%

- Pricing (largely tariff-related): ~+1.5%

- Volume Ex-Data Center, Net: ~Flat

- Total Enterprise Growth: ~+3%

Tariff Update

Management expects the unmitigated annual tariff impact is now ~$155M. They continue to expect dollar cost neutrality in 1H 2026 and margin neutrality by year-end 2026.

How Did the Stock React?

The market loved the E-Pod news. RRX shares closed at $178.30 on February 4, up 4.2% on the day. After-hours trading pushed shares to $182.76, bringing the total post-earnings move to approximately +6.8% from the pre-earnings close.

Key context:

- RRX traded at a 52-week low of $90.56 in early 2025

- The stock is now at 52-week highs of $182.02

- Year-to-date 2026 performance: +27% (from ~$144 at year-end 2025)

The market is clearly rewarding the data center pivot and order momentum, even with mixed near-term results.

What Changed From Last Quarter?

The biggest change is the order trajectory. Q3 showed modest order growth; Q4 exploded with the E-Pod wins. This transforms the growth outlook for 2027 and beyond.

On margins, the Q4 decline reflects:

- Mix headwinds from segment composition

- Tariff impacts not yet fully offset by pricing

- Growth investments in secular markets

Other Growth Initiatives

Beyond E-Pods, Regal Rexnord is pursuing secular growth across several verticals:

Aerospace: Electro-mechanical actuation solutions for eVTOLs through partnership with Honeywell. Potential for 600 eVTOLs in service by 2030 at $220K shipset potential per eVTOL.

Discrete Automation: Kollmorgen Essentials servo motor/drive solutions allow entry into high-mid premium segment, with +$50M sales opportunity by 2028.

Robotics: +$200M funnel size across humanoid, cobot, and surgical robots. Experiencing double-digit robotics revenue growth since 2023.

Medical: Micro-powertrains for in vitro diagnostics and high-speed precision motion for CT/MRI.

Balance Sheet & Capital Allocation

Regal Rexnord continued to delever following the Altra acquisition:

- Net Debt Leverage: 3.1x (down from higher levels post-acquisition)

- 2026 Target Leverage: ~2.7x by year-end, ~3x by mid-year

- Gross Debt Paid Down in 2025: $709.4M

- Adjusted Free Cash Flow 2025: $893.1M

- 2026 FCF Guidance: ~$650M (reduced from prior ~$900M view due to data center investments)

- 2026 CapEx: ~$120M, primarily to support growth and supply chain realignment

- Cash Position: $521.7M

The company has significant financial flexibility to pursue growth investments while continuing to delever. Management noted they will prioritize debt paydown until reaching their target of sub-2.5x leverage before considering other capital allocation options.

Risks & Concerns

-

Residential HVAC Weakness: PES revenue down 10.7% organically with R-HVAC called out as "more than expected" weakness.

-

Tariff Exposure: ~$155M unmitigated annual impact. While mitigation plans are in place, execution risk remains.

-

Data Center Concentration: The E-Pod orders are transformational, but also represent increasing dependence on hyperscale data center CapEx cycles.

-

Margin Pressure Near-Term: Q1 2026 segment guidance shows margins pressured across all segments, with improvement expected in 2H.

-

Integration Execution: Still integrating Altra acquisition with synergy targets to achieve.

Q&A Highlights

On E-Pod Margins: CFO Rob Rehard confirmed ePOD adjusted EBITDA margins should "start at around 20% and improve from there." Regal's content represents ~40-50% of the bill of materials, with normal gross margins on their content plus compensation for sourcing and assembly. The company hedges copper and aluminum but not steel.

On Data Center Pipeline: CEO Pinkham said the current pipeline is ~$600M for the data center business. However, he noted that with capacity "pretty filled up through 2027," large orders like Q4's are "likely not" expected in the near term—though sales teams remain incentivized to grow beyond already-won projects.

On ePOD Shipment Timing: Orders are expected to ship over a 15-18 month period starting in early 2027, with possibility of some pull-forward into late 2026 or extension into 2028 depending on finalized delivery schedules.

On CEO Succession: The board search committee is "down to a select few" candidates, with an announcement expected "in the near future."

On Rare Earth Magnets: The company remains on track to mitigate the majority of rare earth exposure by end of 2026 through alternate sourcing, HRE-free alternatives, and permissible exports. Defense validation processes are proceeding as expected.

On Robotics/Humanoids: Discrete automation orders were up 9% in Q4 and ~6% on a rolling 12-month basis. For humanoids specifically, Regal is targeting 10 key OEMs in the US—3 are currently on their platforms selling subassemblies, 7 are still being worked. The $200M+ funnel is a mix of specified and in-progress opportunities.

On Free Cash Flow Guide: The reduction from ~$900M prior expectation to $650M guidance reflects two factors: (1) $50-100M in working capital investment for data center growth, and (2) more conservative working capital assumptions given supply chain uncertainties from tariffs and rare earths.

Forward Catalysts

- E-Pod Shipments: Initial deliveries in early 2027 will validate execution capability (15-18 month delivery window)

- CEO Announcement: New CEO expected "in the near future" per board search committee

- Q1 2026 Earnings: First read on 2026 execution (~May 2026)

- Tariff Price/Cost Inflection: Expected to improve margins in 2H 2026

- Rare Earth Resolution: Majority of exposure mitigated by end of 2026

- Discrete Automation Recovery: Management sees this market inflecting to growth

- Further Deleveraging: Target of ~2.7x by year-end 2026, sub-2.5x longer-term

Key Takeaways

-

Mixed Q4 Results: EPS beat (+1.1%), revenue miss (-0.9%), but results overshadowed by order momentum.

-

E-Pod Game-Changer: ~$735M in data center orders cements RRX as an emerging data center power player. Expect 20%+ EBITDA margins on this business.

-

Order Explosion: Daily orders +53.8% YoY, backlog +50% entering 2026.

-

Solid 2026 Outlook: Guidance implies ~10% EPS growth with improving margins.

-

Stock Surge: Shares up ~7% post-earnings to 52-week highs.

"Our growth strategy is working, and we are gaining momentum... We see so much more opportunity ahead of us as we continue to execute our growth playbook across our secular markets. I believe we are better positioned than ever before to create increasingly significant value for our stakeholders in 2026 and beyond." — Louis Pinkham, CEO

For more on Regal Rexnord, explore the Q4 2025 earnings transcript or prior earnings.