Earnings summaries and quarterly performance for REGAL REXNORD.

Executive leadership at REGAL REXNORD.

Louis Pinkham

Chief Executive Officer

Hugo Dubovoy Jr.

Executive Vice President, General Counsel and Corporate Secretary

Jerrald Morton

Executive Vice President & President, Industrial Powertrain Solutions

Kevin Long

Executive Vice President & President, Automation & Motion Control

Kevin Zaba

Executive Vice President

Robert Rehard

Executive Vice President, Chief Financial Officer

Board of directors at REGAL REXNORD.

Curtis Stoelting

Director

Gerben Bakker

Director

Jan Bertsch

Director

Michael Doss

Director

Michael Hilton

Director

Rakesh Sachdev

Chairman of the Board

Rashida Hodge

Director

Robin Walker-Lee

Director

Stephen Burt

Director

Theodore Crandall

Director

Research analysts who have asked questions during REGAL REXNORD earnings calls.

Julian Mitchell

Barclays Investment Bank

6 questions for RRX

Michael Halloran

Baird

6 questions for RRX

Nigel Coe

Wolfe Research, LLC

6 questions for RRX

Christopher Glynn

Oppenheimer & Co. Inc.

5 questions for RRX

Jeffrey Hammond

KeyBanc Capital Markets

5 questions for RRX

Kyle Menges

Citigroup

4 questions for RRX

Joe Ritchie

Goldman Sachs

3 questions for RRX

Timothy Thein

Raymond James

2 questions for RRX

Tomohiko Sano

JPMorgan Chase & Co.

2 questions for RRX

Joseph Ritchie

Goldman Sachs

1 question for RRX

Mitch Moore

KeyBanc Capital Markets Inc.

1 question for RRX

Randy

Citigroup

1 question for RRX

Randy Marker

Citigroup

1 question for RRX

Saree Boroditsky

Jefferies

1 question for RRX

Tim Thein

Raymond James Financial

1 question for RRX

Vivek Shri

Goldman Sachs

1 question for RRX

Recent press releases and 8-K filings for RRX.

- Louis Pinkham is concluding his 7-year tenure, during which gross margins increased from 26% to 38% (with a path to 40%), transforming the company into a technology-driven solutions provider.

- The company achieved $325 million in synergies from the Rexnord and Altra acquisitions, with $210 million in cross-sell in 2025 towards a $250 million target by 2028.

- Regal Rexnord received $1 billion in data center orders in 2025 and has a current funnel of $600 million for the data center market, with the majority of current orders expected to ship in 2027. EPODs specifically have a 20%+ EBITDA margin profile.

- For 2026, the company guides for 3% organic growth, driven by 1.5 points from price and 1.5 points from the data center market, while expecting the residential HVAC market (within PES) to be down high single digits.

- Regal Rexnord has undergone significant transformation, with gross margins improving from 26% to 38% over seven years, targeting 40%. This includes a strategic shift from a component supplier to a solutions provider, driven by a decentralized 80/20 model.

- The company successfully integrated Rexnord and Altra acquisitions, achieving $325 million in synergies , and aims to double solution sales by 2027 from high single-digit growth in 2024.

- Regal Rexnord secured $1 billion in data center orders in 2025, with the majority of shipments anticipated in 2027, and expects a 20%+ EBITDA margin profile for its EPOD data center product.

- For 2026, the company projects 3% organic growth, attributing 1.5 points to price (tariff-related) and 1.5 points to data center , while anticipating a high single-digit decline in residential HVAC.

- New growth areas include $40 million in humanoid orders in 2025 and the recently launched Kollmorgen Essentials product line, targeting $50 million by 2028.

- Regal Rexnord has undergone significant transformation, with gross margins improving from 26% to 38% over the past seven years and a path to 40%. The company is strategically shifting from a component supplier to a solutions provider, aiming to double solution sales from high single digits in 2024 by 2027.

- The company forecasts 3% organic growth for 2026, with 1.5 points from price (tariff-related) and 1.5 points from the data center market. However, the residential HVAC market is expected to be down high single digits for the year.

- The data center market presents a substantial growth opportunity, with $1 billion in orders received in 2025 and a current funnel of $600 million. Most of these orders are projected to ship in 2027, and E-Pod products are expected to achieve a 20%+ EBITDA margin.

- Past acquisitions of Rexnord and Altra have yielded $325 million in synergies. For 2026, $40 million in cost synergies are anticipated, which are being used as a de-risker for the annual guidance.

- The automation segment shows promising growth, including $40 million in orders in 2025 for humanoid offerings and the launch of Kollmorgen Essentials, which targets $50 million in revenue by 2028. The company is also positioned in the eVTOL market with a shipset value of over $200,000.

- Regal Rexnord projects low single-digit growth for 2026, with Q1 EBITA margins around 21% expected to improve by 200-250 basis points sequentially, driven by data center expansion and pricing.

- The company secured nearly $1 billion in data center orders in 2025, including a $735 million EPOD solution order for 2027 delivery, anticipating data center revenue to become a low teens percentage of total revenue by 2027 with profitability above 20%.

- Net leverage is expected to be around 2.7x by the end of 2026, with a target of below 2x by the end of 2027, as free cash flow normalizes after a $150 million capital investment in data center capacity.

- Market conditions are mixed, with IPS orders down 50 basis points in January (up 3% in Q4) and residential HVAC projected to be down high single digits for 2026, while automation orders are strong, particularly in the defense sector.

- Regal Rexnord reports mixed demand indicators in short-cycle industrial activity, with IPS orders down 50 basis points in January but automation orders up 9% in Q4, driven by the defense vertical.

- The company secured nearly $1 billion in data center orders in 2025, including a $735 million ePOD solution order for 2027 delivery, expecting data centers to contribute a low teens percentage of Regal's revenue by 2027. The current funnel of data center business is about $600 million.

- For 2026, Regal Rexnord anticipates low single-digit growth, with Q1 EBITDA margins expected around 21% and progressive improvement throughout the year, targeting 30%-35% operating leverage and a 39% gross margin.

- The company plans a $150 million capital investment for data center capacity, expects free cash flow to normalize in 2027, and projects net leverage to end 2026 at approximately 2.7x, aiming to be below 2x by the end of 2027. Management is prioritizing debt paydown and focusing on Lean initiatives in its factories.

- Regal Rexnord anticipates low single-digit growth for 2026, with 1.5 points from data centers and 1-1.5 points from pricing.

- The company secured nearly $1 billion in data center orders in 2025, including a $735 million EPOD order for 2027 delivery, projecting data centers to become a low teens percentage of Regal's revenue by 2027.

- EBITA margins are expected to begin at 21% in Q1 2026 and improve by 200-250 basis points quarter-over-quarter throughout the year, driven by resolving rare earth magnet supply issues, tariff pricing, and a mix shift towards higher-margin businesses.

- Net leverage is projected to be around 2.7x by the end of 2026 and below 2x by the end of 2027, with a priority on debt paydown, and potential for opportunistic share buybacks or dividend increases once leverage is below 2.5x.

- While short-cycle industrial activity shows mixed indicators, automation orders were up 9% in Q4 2025, primarily driven by the defense vertical in Europe.

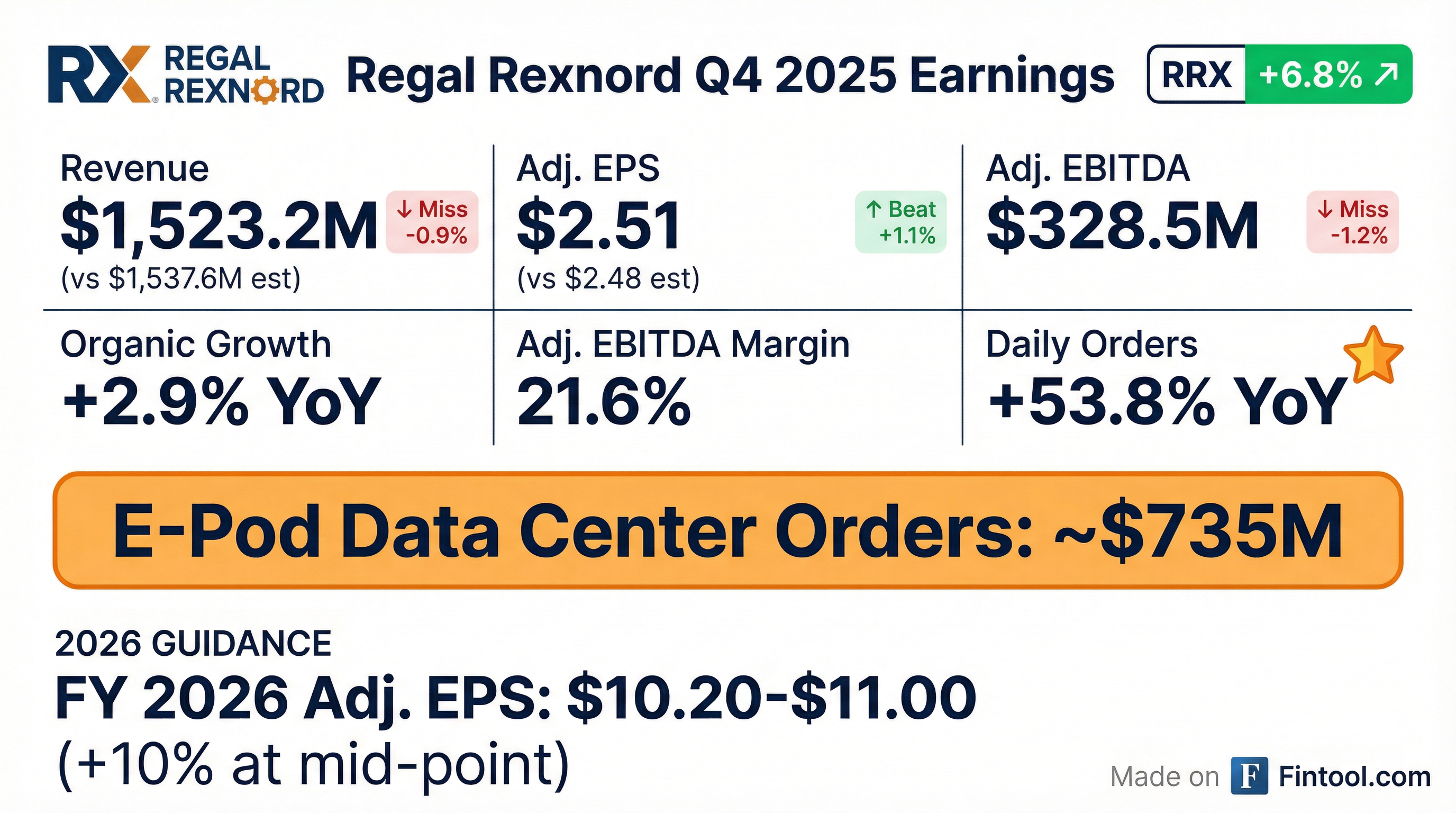

- Regal Rexnord reported strong fourth quarter 2025 results, with adjusted earnings per share of $2.51, up 7.3% year-over-year, and organic sales growth of 2.9%. The company generated $141 million in free cash flow, ending the quarter with net debt leverage at 3.1.

- The company experienced exceptionally strong orders in Q4 2025, with daily orders up 53.8% versus the prior year, and a book-to-bill ratio of 1.48. This included approximately $735 million in new E-Pod solution orders for its data center business, contributing to a 50% increase in backlog exiting 2025.

- For 2026, Regal Rexnord provided adjusted earnings per share guidance in the range of $10.20-$11.00, with a midpoint of $10.60 representing approximately 10% growth. Sales growth is projected at roughly 3%, and adjusted EBITDA margin is forecast to rise 50 basis points to 22.5%. The company also expects to generate approximately $650 million in free cash flow.

- The CEO search process is progressing as expected, with an announcement anticipated in the near future.

- Regal Rexnord reported Q4 2025 adjusted earnings per share of $2.51, a 7.3% increase year-over-year, and full-year 2025 adjusted EPS of $9.65, up nearly 6%.

- The company secured $735 million in new ePOD orders for its data center business in Q4 2025, contributing to a 53.8% increase in daily orders for the quarter and a book-to-bill ratio of 1.48. This positions the data center business for a path to approximately $1 billion in sales over the next two years.

- For 2026, Regal Rexnord provided guidance for adjusted EPS in the range of $10.20 to $11.00 (midpoint $10.60), representing approximately 10% growth, with sales growth of roughly 3% and an adjusted EBITDA margin forecast to rise 50 basis points to 22.5%.

- Free cash flow guidance for 2026 is approximately $650 million, primarily due to an anticipated $50-$100 million investment in the data center business and a more measured approach to working capital benefits.

- Segment performance in Q4 2025 saw Automation and Motion Control (AMC) sales up 15.2% organically, driven by data center, aerospace and defense, and discrete automation, while Power Efficiency Solutions (PES) sales were down 10.7% organically due to residential HVAC market weakness.

- Regal Rexnord reported Adjusted EPS of $2.51 for Q4 2025, a 7.3% increase year-over-year, and $9.65 for the full year 2025, up 5.8%. The company also achieved 2.9% organic sales growth in Q4 2025 and 0.8% for the full year.

- The company significantly reduced its gross debt by $709.4 million in 2025, ending the year with a Net Debt Leverage of 3.1x.

- Orders for the new E-Pods reached ~$735 million, contributing to a 53.8% increase in daily orders for Q4 2025 and a 50.0% increase in backlog entering 2026.

- For 2026, Regal Rexnord projects an Adjusted EPS mid-point of ~$10.60, reflecting approximately 10% growth, and anticipates sales of ~$6.10 billion.

- Regal Rexnord reported Q4 2025 adjusted earnings per share of $2.51 and full-year adjusted EPS of $9.65, with the backlog exiting 2025 up 50% versus the prior year.

- The company secured approximately $735 million in ePOD orders for its data center business in Q4 2025, driving a 53.8% increase in daily orders for the quarter and a book-to-bill ratio of 1.48.

- For 2026, Regal Rexnord provided guidance anticipating approximately 3% sales growth, an adjusted EBITDA margin forecast to rise 50 basis points to 22.5%, and adjusted earnings per share in the range of $10.20 to $11.00.

Quarterly earnings call transcripts for REGAL REXNORD.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more