Earnings summaries and quarterly performance for REGAL REXNORD.

Executive leadership at REGAL REXNORD.

Louis Pinkham

Chief Executive Officer

Hugo Dubovoy Jr.

Executive Vice President, General Counsel and Corporate Secretary

Jerrald Morton

Executive Vice President & President, Industrial Powertrain Solutions

Kevin Long

Executive Vice President & President, Automation & Motion Control

Kevin Zaba

Executive Vice President

Robert Rehard

Executive Vice President, Chief Financial Officer

Board of directors at REGAL REXNORD.

Curtis Stoelting

Director

Gerben Bakker

Director

Jan Bertsch

Director

Michael Doss

Director

Michael Hilton

Director

Rakesh Sachdev

Chairman of the Board

Rashida Hodge

Director

Robin Walker-Lee

Director

Stephen Burt

Director

Theodore Crandall

Director

Research analysts who have asked questions during REGAL REXNORD earnings calls.

Julian Mitchell

Barclays Investment Bank

6 questions for RRX

Michael Halloran

Baird

6 questions for RRX

Nigel Coe

Wolfe Research, LLC

6 questions for RRX

Christopher Glynn

Oppenheimer & Co. Inc.

5 questions for RRX

Jeffrey Hammond

KeyBanc Capital Markets

5 questions for RRX

Kyle Menges

Citigroup

4 questions for RRX

Joe Ritchie

Goldman Sachs

3 questions for RRX

Timothy Thein

Raymond James

2 questions for RRX

Tomohiko Sano

JPMorgan Chase & Co.

2 questions for RRX

Joseph Ritchie

Goldman Sachs

1 question for RRX

Mitch Moore

KeyBanc Capital Markets Inc.

1 question for RRX

Randy

Citigroup

1 question for RRX

Randy Marker

Citigroup

1 question for RRX

Saree Boroditsky

Jefferies

1 question for RRX

Tim Thein

Raymond James Financial

1 question for RRX

Vivek Shri

Goldman Sachs

1 question for RRX

Recent press releases and 8-K filings for RRX.

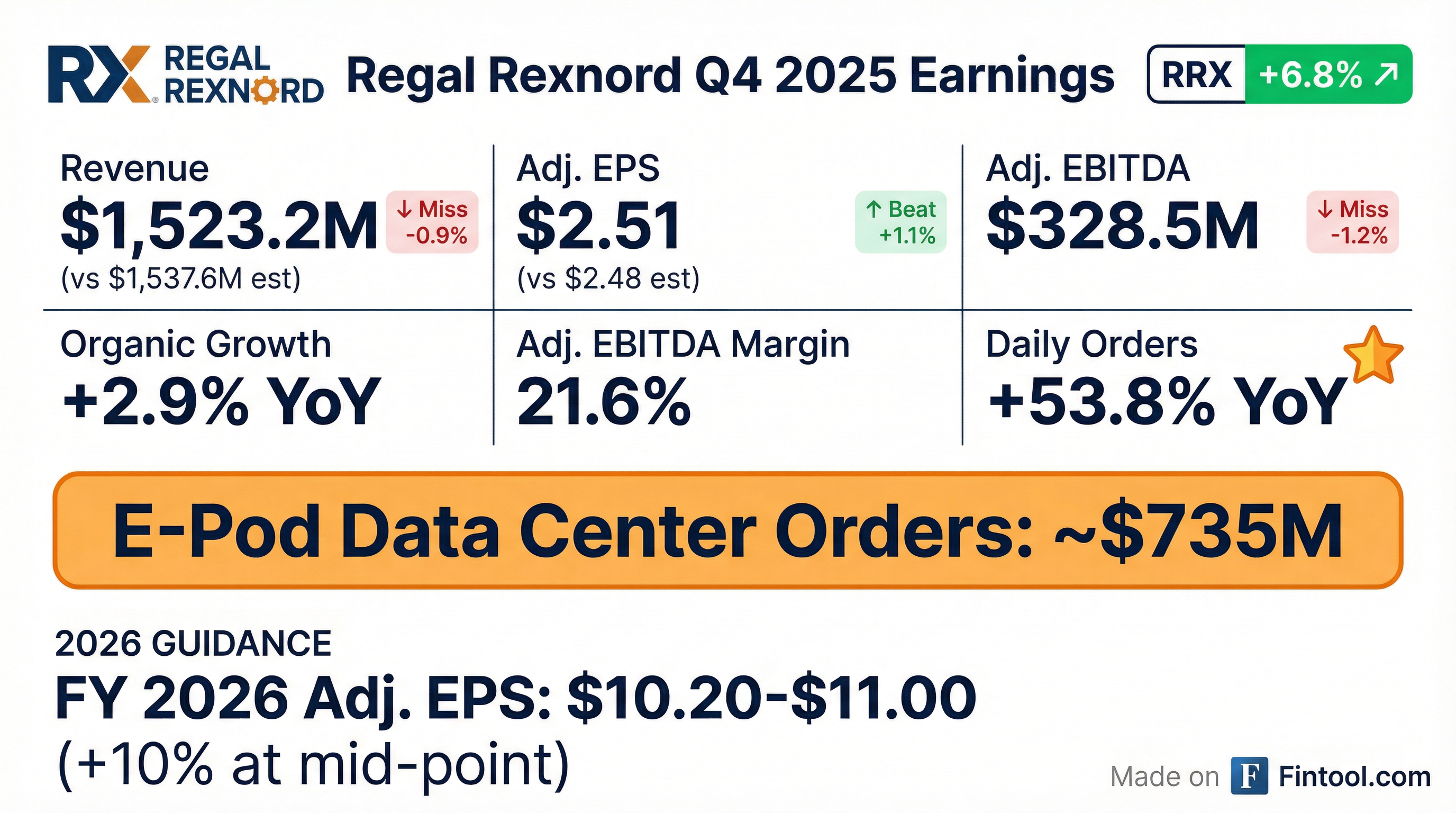

- Regal Rexnord reported strong fourth quarter 2025 results, with adjusted earnings per share of $2.51, up 7.3% year-over-year, and organic sales growth of 2.9%. The company generated $141 million in free cash flow, ending the quarter with net debt leverage at 3.1.

- The company experienced exceptionally strong orders in Q4 2025, with daily orders up 53.8% versus the prior year, and a book-to-bill ratio of 1.48. This included approximately $735 million in new E-Pod solution orders for its data center business, contributing to a 50% increase in backlog exiting 2025.

- For 2026, Regal Rexnord provided adjusted earnings per share guidance in the range of $10.20-$11.00, with a midpoint of $10.60 representing approximately 10% growth. Sales growth is projected at roughly 3%, and adjusted EBITDA margin is forecast to rise 50 basis points to 22.5%. The company also expects to generate approximately $650 million in free cash flow.

- The CEO search process is progressing as expected, with an announcement anticipated in the near future.

- Regal Rexnord reported Q4 2025 adjusted earnings per share of $2.51, a 7.3% increase year-over-year, and full-year 2025 adjusted EPS of $9.65, up nearly 6%.

- The company secured $735 million in new ePOD orders for its data center business in Q4 2025, contributing to a 53.8% increase in daily orders for the quarter and a book-to-bill ratio of 1.48. This positions the data center business for a path to approximately $1 billion in sales over the next two years.

- For 2026, Regal Rexnord provided guidance for adjusted EPS in the range of $10.20 to $11.00 (midpoint $10.60), representing approximately 10% growth, with sales growth of roughly 3% and an adjusted EBITDA margin forecast to rise 50 basis points to 22.5%.

- Free cash flow guidance for 2026 is approximately $650 million, primarily due to an anticipated $50-$100 million investment in the data center business and a more measured approach to working capital benefits.

- Segment performance in Q4 2025 saw Automation and Motion Control (AMC) sales up 15.2% organically, driven by data center, aerospace and defense, and discrete automation, while Power Efficiency Solutions (PES) sales were down 10.7% organically due to residential HVAC market weakness.

- Regal Rexnord reported Adjusted EPS of $2.51 for Q4 2025, a 7.3% increase year-over-year, and $9.65 for the full year 2025, up 5.8%. The company also achieved 2.9% organic sales growth in Q4 2025 and 0.8% for the full year.

- The company significantly reduced its gross debt by $709.4 million in 2025, ending the year with a Net Debt Leverage of 3.1x.

- Orders for the new E-Pods reached ~$735 million, contributing to a 53.8% increase in daily orders for Q4 2025 and a 50.0% increase in backlog entering 2026.

- For 2026, Regal Rexnord projects an Adjusted EPS mid-point of ~$10.60, reflecting approximately 10% growth, and anticipates sales of ~$6.10 billion.

- Regal Rexnord reported Q4 2025 adjusted earnings per share of $2.51 and full-year adjusted EPS of $9.65, with the backlog exiting 2025 up 50% versus the prior year.

- The company secured approximately $735 million in ePOD orders for its data center business in Q4 2025, driving a 53.8% increase in daily orders for the quarter and a book-to-bill ratio of 1.48.

- For 2026, Regal Rexnord provided guidance anticipating approximately 3% sales growth, an adjusted EBITDA margin forecast to rise 50 basis points to 22.5%, and adjusted earnings per share in the range of $10.20 to $11.00.

- Regal Rexnord Corporation reported strong fourth quarter 2025 financial results, with sales of $1,523.2 million, up 4.3% year-over-year, and GAAP net income of $63.8 million, up 51.9% year-over-year.

- The company secured ~$735 million in orders for its Data Center E-Pod Solution in Q4 2025, contributing to a 53.8% increase in daily orders versus the prior year.

- For the full year 2025, sales were $5,934.5 million, and Adjusted Diluted EPS was $9.65, up 5.8% from the prior year.

- Regal Rexnord paid down $709.4 million of gross debt in 2025 and ended the year with a net debt/Adjusted EBITDA (including synergies) of ~3.1x.

- The company introduced Full Year 2026 guidance for Adjusted Diluted EPS in a range of $10.20 to $11.00, representing growth of ~10% at the mid-point.

- Regal Rexnord reported Q4 2025 sales of $1,523.2 million, an increase of 4.3% year-over-year, and diluted EPS of $0.95, up 53.2%.

- The company experienced significant order momentum in Q4 2025, with daily orders up 53.8% and securing ~$735 million in orders for its Data Center E-Pod solution.

- For the full year 2025, Regal Rexnord generated $893.1 million in adjusted free cash flow and paid down $709.4 million of gross debt, ending the year with a net debt/adjusted EBITDA ratio of ~3.1x.

- Regal Rexnord introduced full-year 2026 guidance for adjusted diluted EPS in a range of $10.20 to $11.00, representing approximately 10% growth at the mid-point.

- Regal Rexnord Corporation entered into a Third Amended and Restated Credit Agreement on November 21, 2025, which includes an unsecured Delayed Draw Term Loan of up to $850,000,000 maturing on February 21, 2029, and an unsecured revolving line of credit of up to $1,500,000,000 maturing on November 21, 2030.

- The facilities will be used to refinance the existing credit agreement and 6.050% Senior Notes due 2026, fund working capital, capital expenditures, and for general corporate purposes.

- The agreement establishes financial covenants, including a Funded Debt to EBITDA Ratio not greater than 4.00 to 1.00 for the first two fiscal quarters after the closing date, and 3.75 to 1.00 thereafter. This ratio may increase to 4.25 to 1.00 for any four fiscal quarter period following an acquisition of at least $150,000,000, subject to certain restrictions.

- Additionally, the Interest Coverage Ratio must not be less than 3.00 to 1.00 as of the last day of any fiscal quarter.

- Regal Rexnord's CEO, Louis Pinkham, announced his transition, stating it was a personal decision made in partnership with the board.

- The company is experiencing strong demand, with 10% overall order growth. The data center business is on track for $130 million this year, with a $1 billion pipeline , and the company has booked $30 million in humanoid-related orders with a $100 million bid pipeline.

- Regal Rexnord anticipates free cash flow to increase from $625 million this year to $900 million next year.

- Updated financial aspirations include achieving 40% gross margins by the end of 2026 and 25% EBITDA margins by the end of 2027, both approximately one year later than initially projected.

- Regal Rexnord (RRX) reported ~$5.9 billion in total revenue, an adjusted gross margin of ~38%, and an adjusted EBITDA margin of ~22% for 2024.

- The company is making targeted investments in high-potential growth verticals, including Discrete Automation, Aerospace, Data Center, and Medical, which collectively represented ~32% of 2024 sales.

- Regal Rexnord is gaining momentum in the Data Center market with recent orders totaling $195 million and an E-POD bid pipeline exceeding $400 million, while also pursuing Robotics opportunities with recent wins worth ~$30 million and an opportunity funnel of ~$100 million.

- The company emphasizes its strong financial position, including accelerating organic growth, significant margin progress, and a trading free cash flow yield of ~7%.

- Regal Rexnord Corporation (RRX) announced on October 29, 2025, that it has initiated a Chief Executive Officer (CEO) succession process.

- Louis Pinkham will step down as CEO upon the appointment of his successor and will then serve as an advisor to the company until March 31, 2026.

- His departure is being treated as a termination without cause, entitling him to a $6,000,000 lump sum cash payment, a full annual bonus for 2025, and continued health benefits for up to 24 months.

- Mr. Pinkham's departure is not the result of any dispute or disagreement with the company.

Quarterly earnings call transcripts for REGAL REXNORD.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more