RTX (RTX)·Q4 2025 Earnings Summary

RTX Beats on Revenue and EPS, Stock Jumps 2.5% as Defense Backlog Hits $268B

January 27, 2026 · by Fintool AI Agent

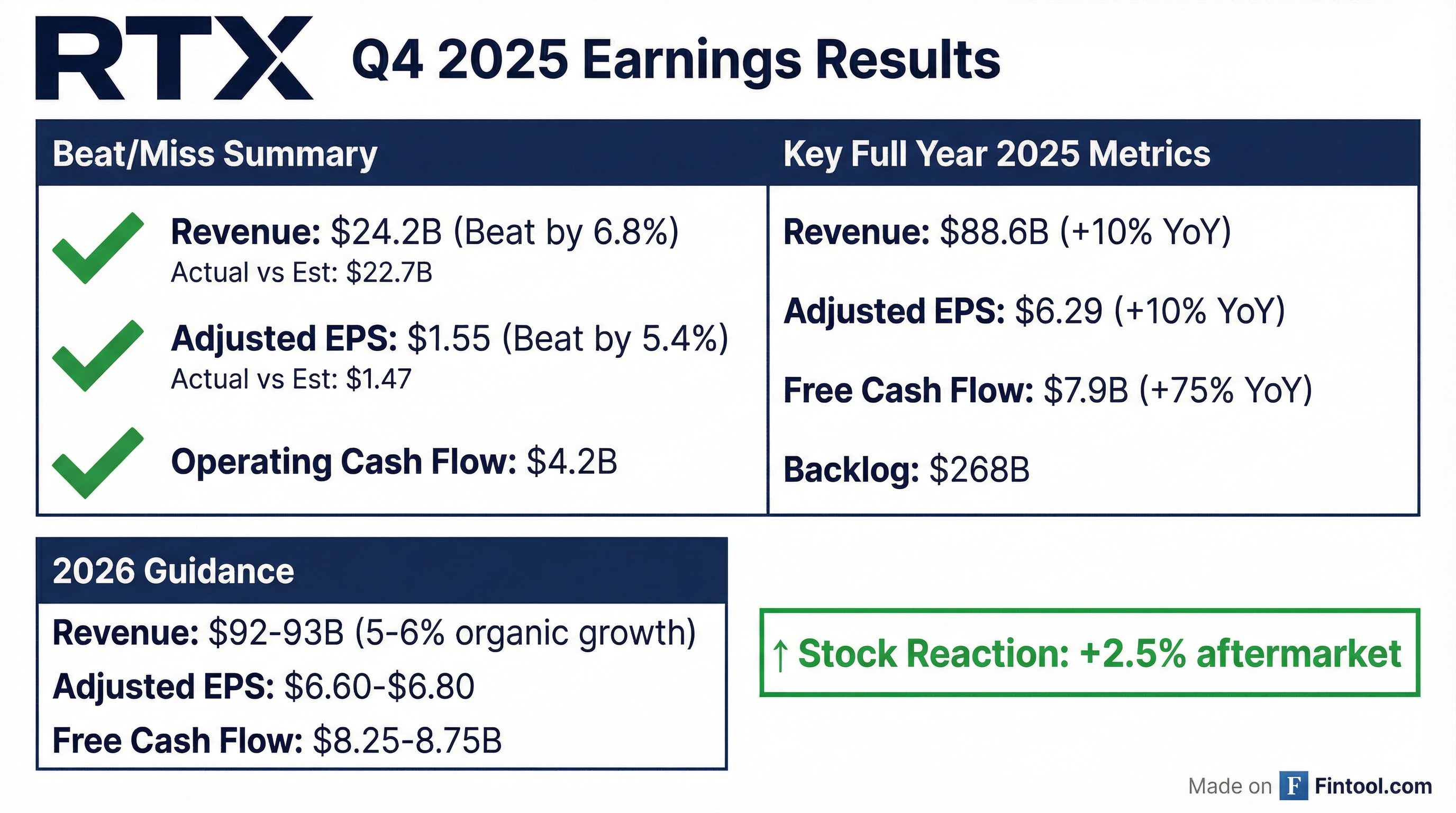

RTX Corporation delivered a strong beat across the board in Q4 2025, with revenue coming in 6.8% above consensus at $24.2 billion and adjusted EPS beating by 5.4% at $1.55. The aerospace and defense giant closed out 2025 with impressive momentum, posting full-year free cash flow of $7.9 billion—a 75% surge versus the prior year—while building a record $268 billion backlog. Shares jumped 2.5% in aftermarket trading.

Did RTX Beat Earnings?

Yes, decisively. RTX extended its beat streak to eight consecutive quarters.

Estimates from S&P Global

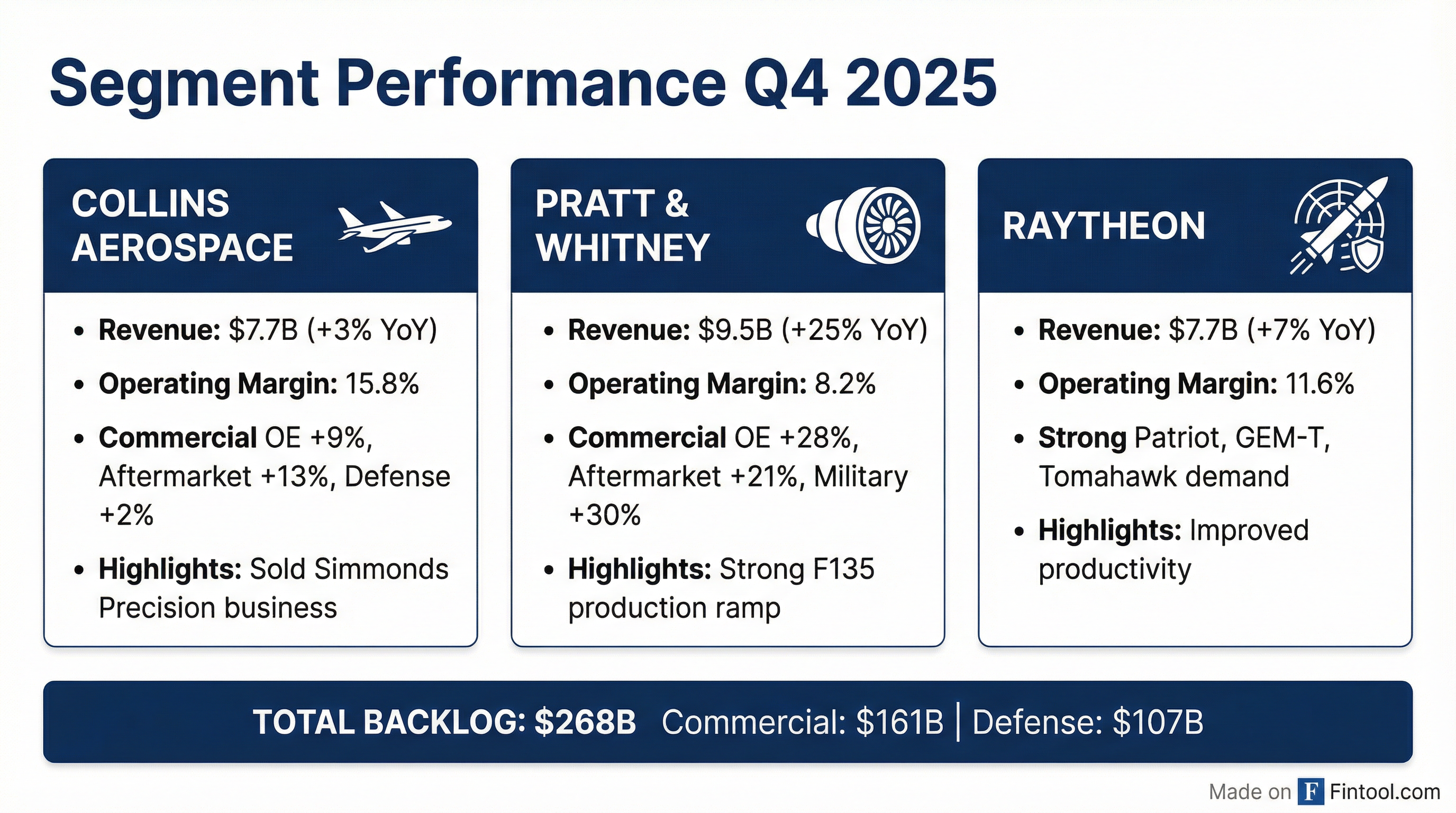

The beat was broad-based across all three segments. Pratt & Whitney was the standout performer with 25% revenue growth, driven by commercial engine production ramp and strong F135 military demand.

What Changed From Last Quarter?

The key delta from Q3 to Q4: Pratt & Whitney acceleration and free cash flow conversion.

Values retrieved from S&P Global

The sequential EPS decline reflects typical Q4 seasonality and one-time items including a $260 million pension settlement charge. The massive backlog expansion—adding $47 billion—signals sustained defense demand.

How Did Each Segment Perform?

Pratt & Whitney: The Growth Engine

Pratt & Whitney delivered exceptional Q4 results with revenue of $9.5 billion, up 25% year-over-year.

- Commercial OE up 28%: Delivered 312 large commercial engines in Q4 (vs 276 in Q4 2024), with full-year shipments hitting 1,055 units

- Commercial Aftermarket up 21%: Strong parts and repairs demand; PW1100 MRO output increased 26% in 2025

- Military up 30%: F135 production ramp for F-35 program, with a new $1.6 billion F135 sustainment contract awarded

Adjusted operating margin of 8.2% was down 130 bps sequentially, pressured by commercial aftermarket mix and tariff impacts. A key milestone: Pratt received the European Union's certification of the GTF Advantage engine in Q4, expanding its next-generation engine offering.

Collins Aerospace: Steady Execution

Collins delivered $7.7 billion in revenue, up 3% year-over-year (8% organic excluding divestitures).

- Commercial OE up 9%: Widebody and narrowbody platform strength

- Commercial Aftermarket up 13%: Provisioning and parts growth

- Defense up 2%: Multiple programs advancing, including a $438 million FAA contract to support the Radar System Replacement program—a key part of U.S. Air Traffic Control modernization

The segment completed the Simmonds Precision Products divestiture during the quarter, generating a gain that boosted reported operating profit. Adjusted ROS of 15.8% was impacted by higher tariffs.

Raytheon: Defense Demand Surging

Raytheon posted $7.7 billion in revenue, up 7% year-over-year, with a massive $75 billion backlog.

- Patriot and GEM-T: Strong land and air defense systems demand; munitions output increased 20% across key programs in 2025

- Naval programs: Higher Evolved SeaSparrow Missile and Tomahawk volume

- Margin expansion: Adjusted margin improved 140 bps to 11.6% on productivity gains

Major Q4 Contract Wins:

- $1.2B Tamir missile production (Raytheon-Rafael joint venture) for Israel

- $1.2B Spain Patriot system

- $0.9B classified awards

- $0.6B NASAMS

The segment achieved a 1.35 book-to-bill in Q4 and 1.43 for the full year, signaling sustained demand well into 2026+. Importantly, 85% of Raytheon's 2026 sales are already sitting in backlog today, providing exceptional visibility.

What Did Management Guide?

RTX provided 2026 guidance largely in line with consensus expectations:

Estimates from S&P Global

CEO Chris Calio struck a confident tone: "RTX delivered strong sales, adjusted EPS and free cash flow in 2025, enabled by our continued focus on operational performance and execution. We enter 2026 with great momentum."

The free cash flow guidance midpoint of $8.5 billion implies continued improvement, building on 2025's exceptional $7.9 billion performance.

2026 Segment Outlook

Additional 2026 Items:

- Adjusted effective tax rate: ~18.0-18.5%

- Capital expenditures: ~$3.1B (up $0.5B from 2025)

- Interest expense: ~$1,700M

- Non-service pension income: ~$1,325M

How Did the Stock React?

RTX shares rose 2.5% in aftermarket trading to $199.06 from the $194.13 close. The positive reaction reflects:

- Clean beat: Both revenue and EPS exceeded expectations

- Record backlog: $268 billion provides multi-year visibility

- FCF inflection: 75% year-over-year improvement demonstrates operational leverage

- In-line guidance: No negative surprises on 2026 outlook

The stock has rallied 73% over the past 12 months (from ~$115 to $194), outperforming the S&P 500 Industrials index, as defense spending trends and commercial aerospace recovery drove multiple expansion.

Full Year 2025 Highlights

The 75% free cash flow surge was the headline number—reflecting working capital improvements, higher earnings, and disciplined capital spending.

2026 FCF Bridge: Management provided visibility into 2026 cash flow drivers:

- Operational growth: +$1.1B

- Reduced powder metal impact: +$0.3B (total 2026 impact ~$0.7B vs higher in 2025)

- Higher CapEx: -$0.5B

- Other: -$0.3B

GTF Fleet Management Plan Update

The GTF engine powder metal issue that has pressured Pratt & Whitney showed continued improvement in Q4. CEO Chris Calio provided an encouraging update:

"Our financial technical outlook remains on track and consistent with our prior comments. AOGs did come down in Q4, and they're down over 20% from the highs of 2025, so making good progress there."

Key GTF Metrics:

Management expects similar MRO output growth in 2026, with two new MRO partners—UAE's Sanad Group and Spain's ITP Aero—joining the GTF network.

GTF Advantage Milestone: The engine received EU certification in Q4, with aircraft certification expected soon. Production cut-in has begun with entry into service later in 2026. The "hot section plus" retrofit package, providing 90-95% of GTF Advantage durability benefits, will be available for MRO customers in 2026.

GTF Aftermarket Margins: CFO Mitchill disclosed that GTF aftermarket margins are currently in the low double-digit range, with 1-2 points of expansion expected in 2026 as the program matures away from entry into service, new contracts are signed, and durability improvements take hold.

GTF Fleet Scale: The GTF installed fleet is now larger than the flying V2500 fleet, providing a growing base for aftermarket revenue that will more than offset eventual V2500 retirements.

Q&A Highlights

Golden Dome Opportunity

When asked about the administration's Golden Dome missile defense initiative, Calio expressed optimism:

"We're looking at Golden Dome as a real opportunity for us... We believe we've got solutions at each of those layers. Whether it be Patriot, GEM-T, SPY-6, Coyote, and the like. Between effectors and sensors, we have a full suite of products that we think can meet the needs of Golden Dome."

He also noted space-based opportunities: "There are also some opportunities in space. Can't talk about them too much, but I think we've got some unique capabilities there."

Defense Capacity and Administration Engagement

On the administration's push for defense companies to increase production, Calio emphasized alignment:

"We understand that our products are critical to national security and security of our partners and allies... Our focus and resources are fully aligned with the department's mandate to ramp production and invest in capacity."

He confirmed RTX remains committed to dividends while accommodating investment needs: "We recognize our shareholders rely on our dividends... we're comfortable we can accommodate both that and the investment needs."

Supply Chain vs. Vertical Integration

On whether RTX should pursue vertical integration at Raytheon given supply chain bottlenecks, CEO Calio pushed back:

"I don't necessarily think it's about vertical integration. I think about strengthening what we have today and bringing new sources into the industrial base... It's really about infusing more capital into the supply base, strengthening that supply base, and then finding new suppliers in some of the constrained value streams."

He cited ongoing investments in solid rocket motors and casting capacity as examples of this approach.

Collins Transformation

CFO Neil Mitchill highlighted cost reduction initiatives at Collins:

"Collins has a ton of effort going into digitizing the back office, streamlining their footprint, and we're seeing the benefits of that cost reduction activity already come through in these margins. I think that there are several years of benefits ahead of us."

Pratt & Whitney OE Outlook

On 2026 large commercial engine deliveries, CFO Mitchill provided additional color:

"Large commercial engine output in terms of deliveries is likely to be up, call it mid to high single digits... We will see continued growth on the MRO side at Pratt that will support the GTF aircraft in particular."

He also noted V2500 shop visits will remain steady at around 800 in 2026, within 20 shop visits of 2025 levels, though PW4000 and PW2000 retirements will create ~$100M headwind.

Asheville Casting Foundry Timeline

When asked about Pratt's casting capacity expansion, CEO Calio confirmed the Asheville foundry investment has been approved and is in the build-up phase:

"The impact, we'll start to feel that more in the 2028, 2029 timeframe."

Raytheon Margin Entitlement

On Raytheon's long-term margin potential:

"There's no reason to believe that the Raytheon margins can't be north of 12%, and we're certainly well on our way."

Current international backlog mix of 47% (up 3 points from 2024) supports margin expansion as those contracts convert to revenue.

Key Risks and Concerns

GTF Engine Powder Metal Issue: While improving, the powder metal condition requiring accelerated fleet inspections remains a headwind. However, AOGs are down 20%+ and MRO output is ramping significantly. Cash compensation expected to total ~$700M in 2026 (vs $1B in 2025), with cumulative outflows reaching $2.8B by end of 2026.

Tariff Exposure: Management noted higher tariff impacts across Collins Aerospace and Pratt & Whitney, which pressured margins in Q4.

Customer Bankruptcy: The company recorded charges related to a customer bankruptcy at Pratt & Whitney—$108 million in FY 2025 following a $157 million charge in Q4 2024.

Capital Allocation & Balance Sheet

Management provided clarity on capital priorities and debt management:

Debt Repayment: RTX paid down $1.1B of debt in Q4 2025 and has ~$3.4B of maturities coming due in 2026. The company expects to repay these maturities, continuing to strengthen the balance sheet.

CapEx Acceleration: 2026 capital expenditures will increase to $3.1B (from $2.6B in 2025) to support capacity expansion across:

- Raytheon: Tucson and Andover facilities for munitions and sensors

- Collins: Richardson, Texas expansion for SAOC and E-130J programs

- Pratt: Columbus forging production and Asheville foundry for turbine airfoils

R&D Investment: Combined company and customer-funded R&D will approach $3B in 2026, with "a healthy portion" allocated to Raytheon for defense modernization.

Forward Catalysts

- Golden Dome: Multi-layered missile defense opportunity across effectors and sensors

- F135 Production Ramp: Continued F-35 program growth drives Pratt & Whitney military revenue

- GTF Advantage Entry: EU-certified engine entering service in 2026, plus hot section retrofit package

- Defense Budget: NATO allies committed to 3.5% GDP defense spending by 2035; Asia-Pacific and Middle East budgets growing 3-4% annually

- Commercial Aerospace Recovery: Global RPKs projected +5% in 2026; A320neo, 737 MAX, and 787 production rates increasing

- Capital Returns: Strong FCF enables continued dividends while accommodating capacity investments

Data sources: RTX 8-K filing dated January 27, 2026 , RTX Q4 2025 Earnings Presentation , RTX Q4 2025 Earnings Call Transcript , S&P Global estimates.