Earnings summaries and quarterly performance for SAP.

Research analysts who have asked questions during SAP earnings calls.

Adam Wood

Morgan Stanley

8 questions for SAP

Frederic Boulan

Bank of America

8 questions for SAP

Mark Moerdler

Bernstein Research

8 questions for SAP

Mohammed Moawalla

Goldman Sachs

8 questions for SAP

Charles Brennan

Jefferies

7 questions for SAP

Toby Ogg

JPMorgan Chase & Co.

7 questions for SAP

Jackson Ader

KeyBanc Capital Markets

6 questions for SAP

Michael Briest

UBS Limited

6 questions for SAP

Ben Castillo-Bernaus

Exane BNP Paribas

4 questions for SAP

Johannes Schaller

Deutsche Bank

4 questions for SAP

Michael Turrin

Wells Fargo

3 questions for SAP

Sven Merkt

Barclays Capital

3 questions for SAP

Ben Bernaus

BNP Paribas

2 questions for SAP

Balajee Tirupati

Citigroup Inc.

1 question for SAP

Ben Castillo

BNP Paribas

1 question for SAP

Keith Bachman

BMO Capital Markets

1 question for SAP

Recent press releases and 8-K filings for SAP.

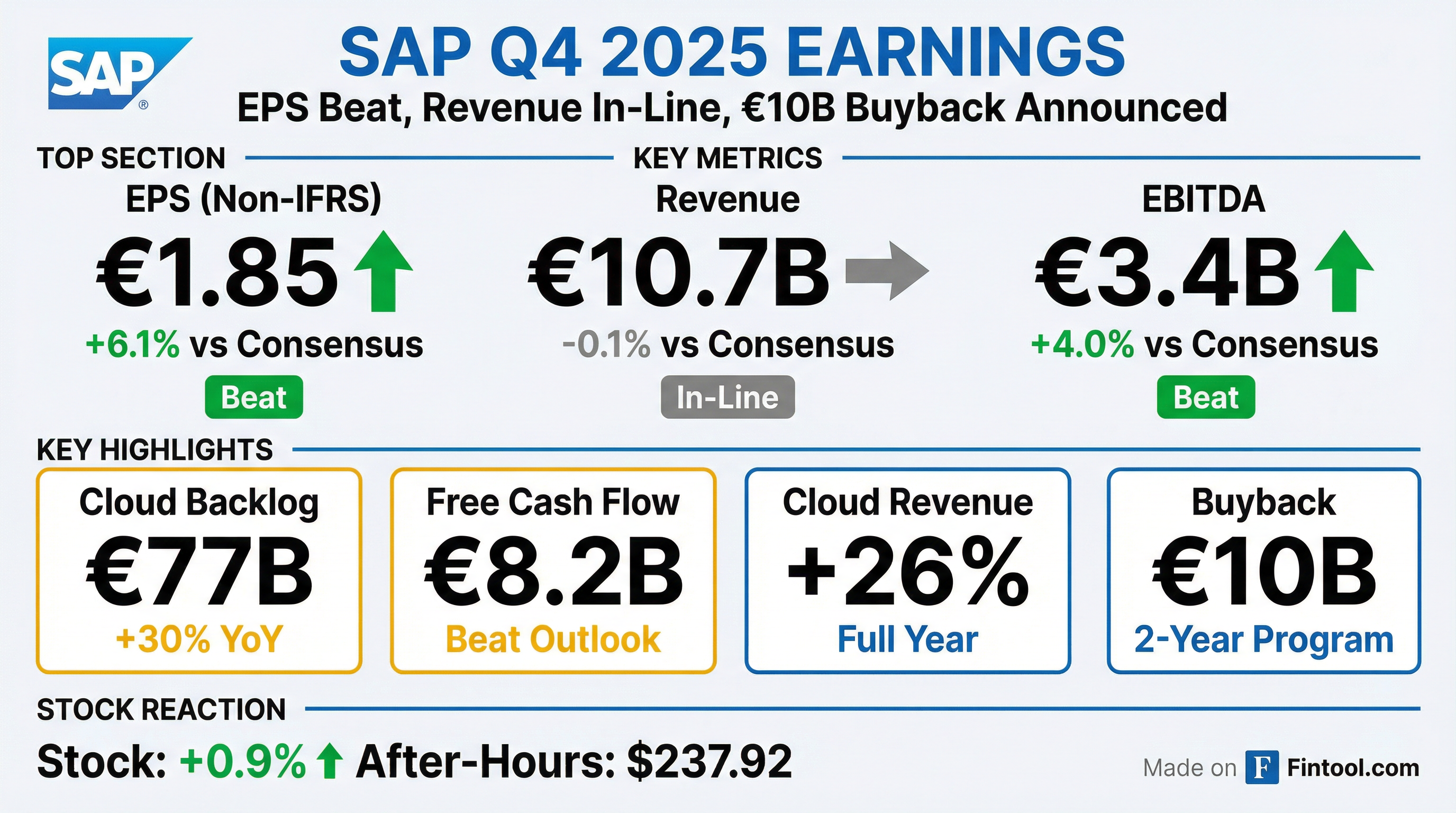

- SAP SE reported total revenue of €36,800 million and operating profit of €9,617 million for 2025, with basic earnings per share of €6.14 from continuing operations, significantly up from 2024 figures.

- The company completed a €5 billion share repurchase program in August 2025 and announced a new €10 billion program on January 29, 2026, slated for completion by the end of 2027.

- Operating profit in 2025 was positively impacted by a decline in restructuring expenses from €3,144 million in 2024 to €3 million in 2025, but was negatively affected by €191 million in workforce transformation expenses and a €387 million provision for Teradata litigation.

- Current cloud backlog grew to €21,052 million in 2025 from €18,078 million in 2024, and the cloud margin increased by 1.1 percentage points to 73.9%.

- Muhammad Alam, SAP's executive board member responsible for product and engineering, will not renew his contract next year when it expires due to personal reasons, though he has more than a year remaining.

- SAP views its core applications as the "operating system of a business" for mission-critical functions like financial management and supply chain, creating a significant moat against GenAI disruption. The company is focused on leveraging GenAI to create incremental value and autonomous experiences on top of this core.

- The Business Data Cloud (BDC), launched less than a year ago, has been phenomenally successful, allowing customers to utilize data engineering tools while preserving data gravity and semantic richness within SAP's framework, and supports zero-copy sharing with non-SAP data through partnerships.

- SAP is actively evolving its monetization models to adapt to industry changes, exploring embedded value, per-user-per-month, and consumption-based measures, with a focus on demonstrating value.

- Muhammad Alam, SAP's Executive Board Member for Product and Engineering, will not renew his contract next year due to personal reasons, though he has over a year remaining.

- SAP believes its mission-critical applications act as the "operating system of a business," making them less prone to GenAI disruption compared to other SaaS applications.

- The company emphasizes its strong competitive moats, including 50 years of embedded business processes, deep industry capabilities, enterprise readiness, security, privacy, and global localization.

- SAP's Business Data Cloud (BDC), launched less than a year ago, has been "phenomenally successful" with over half of its customers in usage today and a very quick time to value.

- SAP is focused on developing "agentic experiences" and autonomous applications, leveraging its core systems and data context to provide out-of-the-box agents for functions like finance and supply chain.

- SAP has rapidly scaled its generative AI offerings, releasing 130 generative AI features in 2025 and 30 agents. The Joule AI assistant now incorporates 1,400 skills and leverages a massive internal knowledge graph for ERP systems.

- AI is a significant driver in SAP's sales cycle, with two-thirds of order entry volume including AI and 90% of the largest deals incorporating AI and Business Data Cloud. Customer adoption of Joule has seen a 9x increase.

- SAP's AI solutions are delivering substantial productivity benefits, exemplified by Joule for Consultants saving approximately 10 hours per week per consultant (a 25% boost) for clients like Siemens.

- The commercial model for SAP's embedded AI is consumption-based, selling "AI units" that account for business value beyond just token costs, and the company partners broadly with various Frontier model providers for cost arbitrage.

- SAP has rapidly expanded its generative AI offerings, growing from 10 use cases in 2024 to 130 features last year, and enhancing Joule with 1,400 skills and 30 agents.

- Key AI innovations include a knowledge graph linking SAP's complex ERP data and the RPT-1 foundation model for tabular data predictions, which is now productive and recognized with a Spotlight Award.

- Joule has achieved a 9x increase in customer adoption, demonstrating substantial productivity gains, such as 10 hours saved per week per consultant for Siemens using "Joule for Consultants".

- AI is significantly impacting SAP's sales, with two-thirds of order entry volume and 90% of the largest deals including AI components, and the company monetizes embedded AI through "AI units".

- SAP has significantly expanded its AI portfolio, releasing 130 generative AI features last year and 30 AI agents this year, including Joule Agent Builder and AI Agent Hub.

- The company's AI copilot, Joule, is experiencing rapid adoption, with 9 times the number of customers. Joule for Consultants has demonstrated a 25% productivity boost for users like Siemens, saving 10 hours per consultant per week.

- SAP's AI commercial model is consumption-based , and AI offerings are driving sales, with two-thirds of order entry volume having AI attached and 90% of top deals including AI and Business Data Cloud (BDC), contributing to an incremental EUR 1 billion revenue opportunity.

- SAP has developed a proprietary Relational Pre-trained Transformer (RPT-1) for tabular data predictions, which is now productive and can replace numerous narrow machine learning models, as evidenced by a chemicals company.

- SAP met its revenue outlook and exceeded its non-IFRS operating profit and free cash flow outlook for fiscal year 2025.

- For FY2025, cloud revenue increased by 23% (26% at constant currencies) to €21.02 billion, and the total cloud backlog grew by 22% (30% at constant currencies) to a record €77.29 billion as of December 31, 2025.

- The company announced a new two-year share repurchase program with a volume of up to €10 billion, scheduled to start in February 2026 and expected to be completed by the end of 2027.

- For 2026, SAP expects cloud revenue of €25.8 – 26.2 billion at constant currencies and approximately €10 billion in free cash flow at actual currencies.

- SAP reported strong financial results for fiscal year 2025, with total revenue approaching EUR 37 billion, up 11%, and cloud revenue growing 26% year-on-year. Non-IFRS basic earnings per share increased by 36% to EUR 6.15, and free cash flow reached EUR 8.2 billion, exceeding outlooks for operating profit and cash flow.

- The company's total cloud backlog grew 30% to a record EUR 77 billion, while the current cloud backlog reached EUR 21 billion, up 25%. This current cloud backlog growth was a more pronounced slowdown than anticipated, attributed to a deal mix with larger transformations, longer ramp periods, and geopolitical tensions affecting complex transactions.

- For 2026, SAP expects total revenue growth to accelerate and projects a record free cash flow of approximately EUR 10 billion.

- SAP announced a new two-year share repurchase program of up to EUR 10 billion, scheduled to begin in February. The company also highlighted the commercial impact of AI and the Business Data Cloud, with the latter generating over EUR 2 billion in order entry since its launch.

- SAP reported a strong close to 2025, with total revenue approaching EUR 37 billion, up 11%, and non-IFRS basic earnings per share increasing by 36% to €6.15. The company overachieved its outlook for operating profit and cash flow.

- Cloud revenue grew 26% year-on-year in 2025, primarily driven by the Cloud ERP Suite which grew 32% and accounted for 86% of total cloud revenue. The total cloud backlog reached a record EUR 77 billion, up 30%.

- AI is emerging as a meaningful contributor to customer decisions and deal activity, with two-thirds of deals in Q4 2025 involving AI. SAP also announced a new two-year share repurchase program of up to EUR 10 billion, scheduled to start in February.

- For 2026, SAP expects total revenue growth to accelerate and projects a record free cash flow of approximately EUR 10 billion.

- SAP reported a strong close to 2025, achieving its cloud and software outlook and overachieving operating profit and cash flow outlooks. Full-year total revenue reached EUR 37 billion, up 11%, driven by 26% cloud revenue growth and a 32% increase in Cloud ERP Suite. Non-IFRS basic earnings per share rose 36% to EUR 6.15.

- The total cloud backlog grew 30% to a record EUR 77 billion in 2025. However, current cloud backlog (CCB) growth of 25% was a more significant slowdown than expected, primarily due to larger deals with longer ramp periods and geopolitical tensions.

- For 2026, SAP anticipates accelerated total revenue growth and expects to generate a record free cash flow of approximately EUR 10 billion.

- The company announced a new two-year share repurchase program of up to EUR 10 billion, set to begin in February, demonstrating confidence in its business and commitment to shareholder returns.

- AI and the Business Data Cloud (BDC) are becoming significant commercial contributors, with BDC generating over EUR 2 billion in order entry since its launch.

Fintool News

In-depth analysis and coverage of SAP.

Quarterly earnings call transcripts for SAP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more